Learn how Digital Transformation in Banking powers AI, cloud, and automation to deliver measurable benefits, improved customer experiences, and efficiency.

Akshat Mandloi

Updated on

January 19, 2026 at 8:39 AM

Every missed customer call or delayed approval costs more than money; it costs trust. Digital transformation in banking is rewriting how institutions connect with people, using voice AI, conversational AI, voice agents, and voice cloning to make interactions feel natural, fast, and reliable.

The digital transformation in banking industry is projected to expand at a CAGR of 13.7% from 2025 to 2033, reaching an estimated USD 752.9 billion by 2033. These technologies don’t just automate; they let banks anticipate needs, resolve queries instantly, and reduce repetitive work across operations.

In this guide, we break down the drivers, benefits, tools, and real-world use cases shaping digital transformation in banking.

Key Takeaways

Invisible Forces Drive Change: Digital transformation is shaped by regulatory shifts, evolving customer expectations, and distributed finance, not just tech upgrades.

Voice AI Reduces Manual Work: AI voice agents handle routine queries, speeding responses, cutting errors, and freeing human teams for high-value tasks.

Real-Time Data Powers Personalization: Continuous behavioral insights allow banks to anticipate needs, offer timely solutions, and increase retention.

Automation Strengthens Compliance: AI-driven workflows and automated KYC, fraud detection, and reporting reduce errors while maintaining regulatory alignment.

Team Preparedness Determines Success: Upskilling, role redefinition, and cross-functional collaboration are critical to sustain digital transformation initiatives.

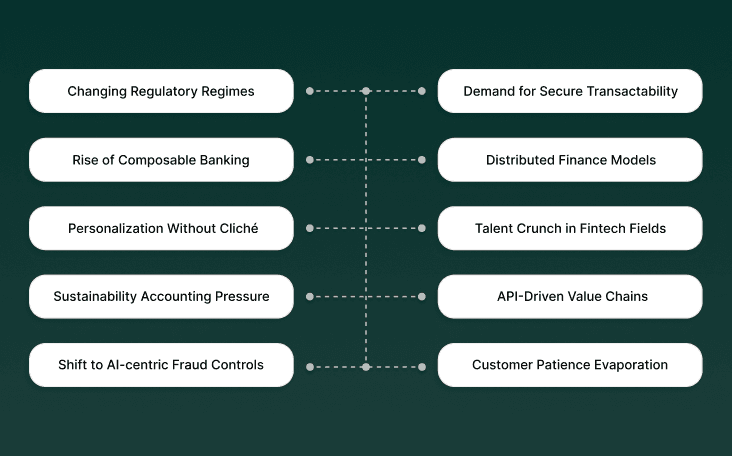

What Drives Digital Transformation in Banking Today

Digital transformation in the banking industry is now heavily shaped by forces that are both less visible and far more impactful than first impressions suggest.

Far from just software rollouts or tech upgrades, it’s about how banks accelerate relevant value delivery, respond to sector-specific pressures, and capitalize on changing user attitudes that weren’t on the radar just a year ago.

Challenges that Banks Face Without Digital Transformation:

Changing regulatory regimes: Compliance demands shift, requiring banks to rethink how data flows and customer authentication work in real-time.

Demand for secure transactability: Customers expect frictionless security, pushing banks to rethink identity checks and zero-trust models beyond passwords.

Rise of composable banking: Modular tech stacks mean future-proofing is proactive, not reactive, as plug-and-play services gain ground.

Distributed finance models: Banking is transitioning from legacy mainframes to distributed architectures, including cloud-native databases and event-driven workflows.

Personalization without cliché: Real-time insights from behavioral data shape offerings users didn't know they wanted, before they realize it themselves.

Talent crunch in fintech fields: Shortages in niche talent pools cue banks to automate back office work and prioritize scalable upskilling.

Sustainability accounting pressure: Boards now measure digital spend not just in dollars, but in ESG compliance; digital projects face new scorecards.

API-driven value chains: APIs unlock “bank as a service” – turning commoditized operations into revenue drivers, not just plumbing.

Shift to AI-centric fraud controls: Rule-based screening is replaced by dynamic AI risk engines that update models continuously with new threat signals.

Customer patience evaporation: If platforms lag or glitch, loyalty flips fast; speed is now a baseline, not a differentiator.

Why Digital Transformation in Banking Matters More Than Ever

Digital transformation in banking industry matters because the foundation of value delivery has shifted. Profitability, trust, and growth now depend on how well a bank connects intelligence, speed, and human understanding.

Digital transformation goes beyond digitizing old systems, targeting hidden inefficiencies that delay decisions, compromise compliance, and frustrate customers.

Benefits of Digital Transformation in Banking:

Smarter Customer Experiences that Drive Retention: Banks win loyalty by predicting customer intent, personalizing offers, and resolving issues before they escalate, all powered by real-time data updates.

Operational Agility with Measurable Impact: Digital systems help banks roll out products faster, handle KYC and onboarding with minimal friction, and scale operations without proportional cost increases.

Risk and Compliance Made Predictive: Automated monitoring identifies irregularities before they become liabilities, while built-in compliance tracking minimizes manual errors and reduces audit pressure.

Data as a Revenue Multiplier: Behavioral insights open new income streams, from micro-credit to embedded finance, helping banks serve diverse segments with precision.

Trust Through Transparency and Security: Consistent communication, secure transactions, and real-time visibility create confidence that strengthens every customer relationship.

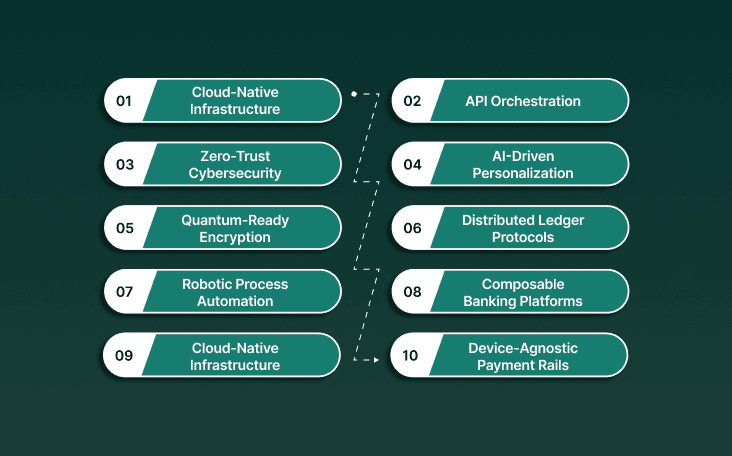

Key Technologies Powering Digital Transformation in Banking

Digital transformation in banking industry depends on how well technology connects insight with action. The focus has shifted from replacing manual tasks to building intelligent systems that learn, adapt, and respond across every customer and operational touchpoint. The real change comes from combining these technologies to make digital banking transformation smarter, faster, and more transparent.

Cloud-native infrastructure: Banks push workloads and sensitive operations to multi-cloud and hybrid platforms, moving agility from theory into practice.

API orchestration: Digital services increasingly depend on strong API frameworks for sharing data, quickly onboarding partners, and launching new offerings.

Real-time data streaming: Banks ingest, analyze, and act on transaction flows as the split-second events occur, fraud checks included.

Zero-trust cybersecurity: Identity and access controls shift from static credentials to continuous verification, even inside the perimeter.

AI-driven personalization: Machine learning models surface granular insights from behavioral signals, driving timely, context-aware interactions.

Quantum-ready encryption: Forward-looking institutions deploy post-quantum cryptography, watching for threats that bypass traditional encryption.

Distributed ledger protocols: Smart contract platforms power settlement and KYC without needing manual reconciliation or intermediaries.

Robotic process automation: Routine back office tasks, account opening, and loan origination run hands-free, freeing up teams for exception handling.

Composable banking platforms: Legacy product silos give way to stackable modules, supporting fast testing and pivots for new services.

Device-agnostic payment rails: Mobile, wearable, and connected device payments get universal support with tokenization and multi-factor authentication.

These technologies set the stage for practical applications, showing how banks can transform day-to-day operations and deliver measurable impact to customers.

Discover how your institution can modernize customer interactions and operational workflows, see real-world applications in our guide on Voice AI for Banks & Financial Services: Use Cases, Architecture & Best Practices.

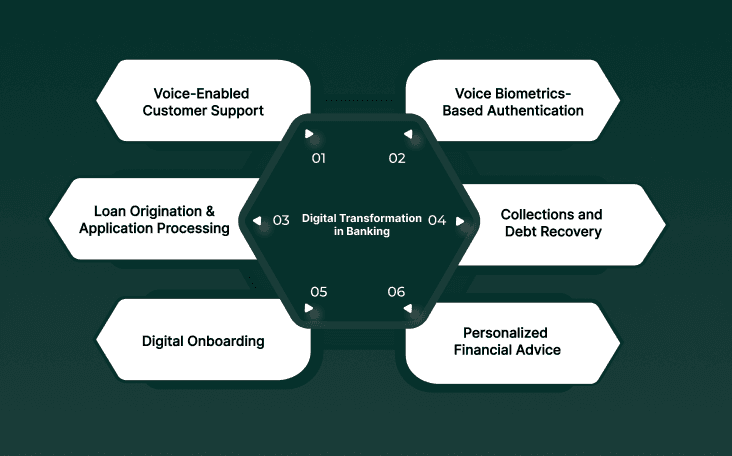

Real-World Use Cases of Digital Transformation in Banking

Digital transformation in banking industry is redefining how financial institutions serve, secure, and scale customer interactions. Voice AI and automation are now central to this shift, reducing manual effort, improving compliance, and unlocking revenue opportunities once limited by human bandwidth.

Below are six high-impact examples showing how these technologies are driving measurable outcomes.

Use Case 1: Voice-Enabled Customer Support and Account Management

Banks are using voice agents to handle routine customer inquiries 24/7. Customers speak naturally to AI systems that understand intent, access real-time data, and resolve issues within seconds.

24/7 Availability Without Labor Scaling: Voice agents manage calls during nights, weekends, and holidays, providing round-the-clock support without the need for additional staffing.

Real-Time Account Data Access: Voice agents pull data from core systems to answer questions like “What’s my balance?” within seconds, using secure authentication via voice biometrics or OTP.

Reduction in Repetitive Manual Work: Many inbound calls cover routine queries like payment dates or cheque status. AI handles these autonomously, allowing human agents to focus on high-value interactions.

Use Case 2: Voice Biometrics-Based Authentication and Fraud Prevention

Banks are replacing PINs and passwords with voice authentication that verifies identity through pitch, tone, and cadence, strengthening security without adding friction.

Passive Authentication During Conversation: Voice biometrics confirm identity mid-conversation without interrupting the flow, reducing call times and minimizing the risk of fraud.

Compliance and Regulatory Alignment: Each authentication event creates a verifiable audit trail for PSD2 and GDPR, simplifying compliance reporting and risk management.

Adaptive Multi-Factor Security: Systems apply added verification for high-value transactions or low-confidence scores, balancing security rigor with user convenience.

Use Case 3: Loan Origination and Application Processing

Voice AI accelerates lending cycles from weeks to hours by automating application intake, verification, and approval through guided conversational AI workflows.

Guided Application Support: Borrowers get real-time guidance on loan eligibility, product options, and required documents, reducing drop-offs and improving completion rates.

Automated KYC and Document Collection: AI collects KYC information, prompts document uploads, and sends reminders, cutting delays caused by manual follow-ups.

Faster Approvals and Disbursements: Automated processing allows same-day or next-day loan approvals, driving higher throughput during peak demand periods.

Use Case 4: Collections and Debt Recovery

AI voice agents transform debt collections into predictive, customer-aware processes that recover more debt while preserving relationships.

Intelligent Segmentation and Messaging: AI adjusts outreach tone and timing based on repayment patterns, improving recovery effectiveness and reducing collection costs.

Scalable Outreach at Lower Cost: Voice agents can engage thousands of borrowers simultaneously with personalized reminders and restructuring offers.

Emotion and Sentiment Recognition: AI detects distress or frustration during calls and adjusts tone or escalates to human agents for empathetic resolution.

Use Case 5: Digital Onboarding and Customer Acquisition

Conversational AI simplifies onboarding by guiding customers through account setup anytime, across devices, with fewer drop-offs.

Multi-Channel, Guided Onboarding: Customers start on one channel and finish on another without repeating steps, improving completion rates and satisfaction.

Proactive Support and Clarification: AI answers onboarding questions instantly and helps resolve missing-document or form issues before they cause delays.

Built-In Compliance and Risk Checks: Automated KYC and AML screening happen alongside interaction, cutting onboarding time from days to minutes while maintaining control.

Use Case 6: Personalized Financial Advice and Cross-Sell

Banks use AI-driven voice assistants to offer customized guidance and product recommendations based on real customer data.

Spending Insights and Savings Suggestions: AI identifies unnecessary spending, unused subscriptions, and saving opportunities through real-time analysis of transaction data.

Proactive Cross-Selling: When a deposit matures or a balance nears its limit, AI suggests relevant products like reinvestments or credit upgrades.

Continuous, Low-Cost Engagement: Voice agents deliver ongoing advice and alerts at scale, improving wallet share and retention without expanding service teams.

With these technologies in place, banks can move from theoretical capabilities to actionable solutions that reshape customer interactions and operational workflows.

Transform customer experiences and drive Digital Transformation in Banking and Finance with Smallest.ai’s conversational voice agents. Get started with a demo today!

Inside the Digital Transformation in Banking and Finance Process

Digital transformation in banking is not a single project; it’s an operational reframe. Banks that succeed approach it as a coordinated system upgrade across people, processes, and platforms. The real progress comes from aligning internal goals with customer expectations, replacing manual dependencies with intelligent automation, and building trust through measurable transparency.

Assess and Prioritize Core Frictions: Banks begin by mapping where delays, data silos, or manual tasks slow customer or operational outcomes. Fixing high-impact areas first drives visible results early.

Modernize Infrastructure and Data Flow: Legacy systems are upgraded or connected through APIs, allowing real-time access to customer data, transaction status, and compliance metrics across departments.

Embed AI and Automation in Daily Operations: From customer service to credit risk, AI systems take on repetitive, time-sensitive processes while teams focus on high-value analysis and decision oversight.

Build Secure and Compliant Frameworks: Data governance, encryption, and automated reporting become built-in standards, not separate layers, reducing the effort of meeting regulatory requirements.

Measure and Adapt Through Continuous Feedback: Banks track process speed, service accuracy, and customer sentiment, using this data to refine workflows and roll out improvements at scale.

As teams prepare to embrace digital tools and AI-driven workflows, understanding the hurdles that can slow adoption becomes critical to sustaining meaningful progress.

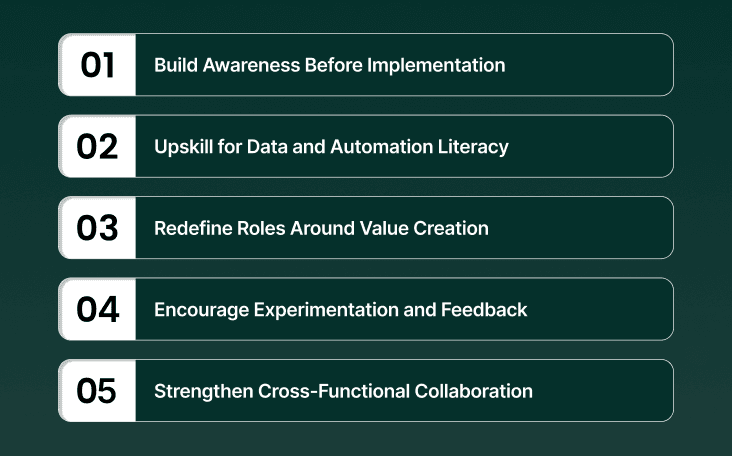

Preparing Your Banking Services Team for Digital Transformation

Digital transformation in banking succeeds only when teams shift from process execution to problem-solving. The technology matters, but the mindset shift matters more. Preparing teams means connecting strategy with skill, helping every employee understand how automation, AI, and data insight change their daily work and long-term value.

Build Awareness Before Implementation: Start with conversations, not software. Teams need clarity on why the change matters, what problems it solves, and how it supports their roles.

Upskill for Data and Automation Literacy: Training should move beyond tool usage to practical understanding, how to read data signals, manage exceptions, and collaborate with AI-driven systems.

Redefine Roles Around Value Creation: Freeing teams from repetitive work lets them focus on advisory, compliance oversight, and relationship building, creating visible impact for customers and management.

Encourage Experimentation and Feedback: Small pilot projects let teams see success firsthand, refine workflows, and share lessons before wider rollout, increasing ownership across departments.

Strengthen Cross-Functional Collaboration: Technology change only sticks when operations, IT, and compliance teams plan and execute together, reducing silos and keeping transformation goals consistent.

Discover how cutting-edge automation is reshaping financial security and efficiency with our deep look into AI Agents in Banking: Automating Fraud Detection & Account Services.

Common Challenges in Digital Transformation for Banking Services

Digital transformation in banking and finance often looks smooth on paper, but the real hurdles appear once teams start execution. The challenge isn’t in adopting technology, it’s in aligning people, systems, and priorities under changing regulatory and customer pressures. Recognizing these friction points early can help banks plan smarter rollouts and sustain long-term progress.

Challenge | Description |

|---|---|

Legacy Systems That Slow Down New Tech | Outdated infrastructure limits integration, leading to data gaps and slower customer responses. Modernization often requires rebuilding workflows, not just replacing tools. |

Data Fragmentation Across Departments | Customer data lives in silos, making real-time insight difficult. Without unified visibility, personalization and compliance both take a hit. |

Change Fatigue Within Teams | Frequent tool rollouts and shifting priorities can cause resistance or burnout. Clear communication and small wins help maintain trust and adoption. |

Regulatory Constraints and Compliance Pressure | Balancing automation with strict oversight remains complex. Even minor process changes need approval cycles that delay transformation timelines. |

Unclear Ownership of Digital Projects | Without defined accountability, initiatives lose momentum. Assigning cross-functional leaders prevents duplication and keeps outcomes measurable. |

How Smallest.ai Accelerates Digital Transformation in Banking

True digital transformation in banking now means creating real conversations, not just digital touchpoints. Smallest.ai brings voice intelligence to the center of customer interactions, helping financial institutions connect faster, act smarter, and operate at scale through natural speech automation.

Voice Agents That Work Like Real Bank Representatives: AI voice agents handle day-to-day customer interactions, from account inquiries to payment reminders, while understanding intent and responding instantly, 24/7.

Voice Cloning for Familiar, Human Connections: Smallest.ai’s voice cloning tech recreates brand-approved voices that sound natural and trustworthy, improving engagement across languages and regions.

Lightning Voice AI for Faster Live Conversations: Powered by speech models trained on real call data, Lightning Voice AI allows instant understanding and response during live customer interactions, cutting average handling time.

Electron Intelligence for Complex Use Cases: Electron SLMs analyze live speech to handle multi-step digital banking transformation tasks like fraud checks, balance confirmations, or credit card activations with precision and contextual understanding.

Secure, On-Premise Deployments for Compliance-Driven Banking: Banks can deploy voice AI within their infrastructure while staying compliant with SOC 2 Type II, HIPAA, and PCI standards, keeping every interaction private and protected.

Smallest.ai empowers banks to turn every customer interaction into a smart, secure, and human conversation; driving speed, trust, and true digital transformation.

Conclusion

Digital transformation in banking is growing into a measure of how intuitively banks respond to human needs, not merely a collection of technology upgrades. From anticipating customer queries to simplifying complex operations, this shift is about creating experiences that feel personal, proactive, and precise. Banks embracing digital transformation in banking today are redefining what efficiency, engagement, and reliability mean for every interaction.

Smallest.ai accelerates this shift by putting voice AI, conversational AI, voice agents, and voice cloning at the center of banking operations. Teams can handle high volumes of customer interactions naturally, reduce repetitive tasks, maintain compliance, and scale services with real-time intelligence, making each conversation meaningful and productive.

Unlock smarter customer interactions and operational ease with Smallest.ai. Book a demo today.

FAQs About Digital Transformation in Banking

1. How does digital transformation in banking differ from general automation?

Digital transformation in banking goes beyond automation; it’s about creating responsive, data-driven systems that connect customers, agents, and core operations in real time through technologies like conversational and voice AI.

2. What are the biggest overlooked challenges in digital transformation for banks?

Many banks underestimate the cultural shift required. Legacy processes, fragmented data, and a lack of AI-ready infrastructure often slow real progress despite large tech investments.

3. How is corporate banking approaching digital transformation differently?

Corporate banking focuses on intelligent workflows, automating loan processing, compliance checks, and treasury operations using voice and data-driven AI models for accuracy and speed.

4. What are real-world examples of digital transformation in banking?

Examples include AI-driven voice agents managing inbound loan queries, predictive analytics for fraud prevention, and virtual account assistants handling multilingual customer interactions in real time.

5. What measurable benefits come from digital banking transformation?

Banks adopting full-stack AI see faster query resolution, improved compliance accuracy, higher customer satisfaction, and lower operational costs through reduced human intervention in repetitive processes.