See how generative AI in financial services is driving measurable ROI through better risk visibility, faster claims, and real-time customer intelligence.

Prithvi Bharadwaj

Updated on

January 19, 2026 at 8:38 AM

Every missed call, delayed claim, or slow approval costs money, and trust. Financial leaders know that timing defines outcomes, yet most systems still react after the fact. Generative AI in financial services is changing that rhythm by giving underwriters and service teams real-time context inside every interaction.

With voice AI, conversational AI, and voice agents, financial institutions can interpret data as it’s spoken, not hours later. Voice cloning keeps communication consistent across products and regions while preserving compliance tone. What once required days of manual review now happens in seconds, with accuracy that supports both growth and oversight.

Generative AI in financial services is turning communication into intelligence and intelligence into measurable performance.

In this guide, we’ll show how financial organizations use it to accelerate decisions, strengthen compliance, and power growth across operations.

Key Takeaways

AI Turns Conversations Into Actionable Insight: Voice AI and conversational AI convert live interactions into structured data, allowing underwriters and compliance teams to make decisions during the call itself.

Underwriting Speed and Precision Are Increasing: Generative AI in financial services reduces review times, refines pricing accuracy, and helps analysts focus on exceptions instead of repetitive verification.

Regulatory Trust Is Built Through Transparency: Natural-language audit trails record every reasoning step, helping institutions maintain explainability and compliance without slowing down approvals.

Synthetic and Federated Data Improve Model Reliability: Financial teams use synthetic data to test pricing and credit risk safely, improving fairness and avoiding exposure of sensitive customer information.

Voice Agents Are Defining Real-Time Financial Growth: Smallest.ai’s voice agents, voice cloning, and conversational AI connect live communication with measurable ROI, giving financial institutions a competitive edge in 2025.

Why Generative AI is Becoming a Strategic Priority for Financial Leaders

Underwriting was built for predictable risk and slower information cycles. Financial institutions now face real-time data, fluctuating markets, and customer expectations that demand instant clarity.

The traditional model strains under these conditions, leaving underwriters managing rising complexity with outdated tools. Generative AI in financial services is stepping in to address that imbalance by giving decision teams context, scale, and precision across every risk touchpoint.

Data Growth Without Data Understanding: Underwriters have more data than ever, but most of it remains unstructured and unusable for risk insight or predictive analysis.

One-Size-Fits-All Risk Models: Conventional scoring methods apply uniform logic across diverse portfolios, missing micro-patterns unique to each client or region.

Fragmented View of Customer Behavior: Traditional systems separate financial, transactional, and behavioral data, preventing a holistic understanding of customer intent and risk.

Lag Between Market Change and Model Update: Economic or environmental changes take months to reflect in legacy underwriting models, reducing pricing accuracy during volatile periods.

Human Fatigue in High-Volume Review: Underwriters handle repetitive document checks and cross-references that limit time for deeper risk evaluation and portfolio strategy.

Limited Scenario Imagination: Historic data drives most models, but emerging risks like digital fraud or climate-linked losses require scenario generation beyond past trends.

Documentation Gaps Affecting Compliance: Legacy workflows often record outcomes but not reasoning, creating exposure during audits or disputes.

To see how voice agents and real-time dialog models are creating measurable business outcomes, read Conversational AI in Finance: Key Applications and Industry Impact.

How Generative AI Is Quietly Rewriting Decision-Making in Finance

Financial decisions depend on timing, accuracy, and trust. Yet most underwriting and risk systems still react to data instead of interpreting it in real time.

Generative AI in financial services changes that rhythm by reading patterns as they form, not after they appear. It allows institutions to combine transactional logic with narrative reasoning, helping underwriters, analysts, and compliance teams see why something matters, not just what happened.

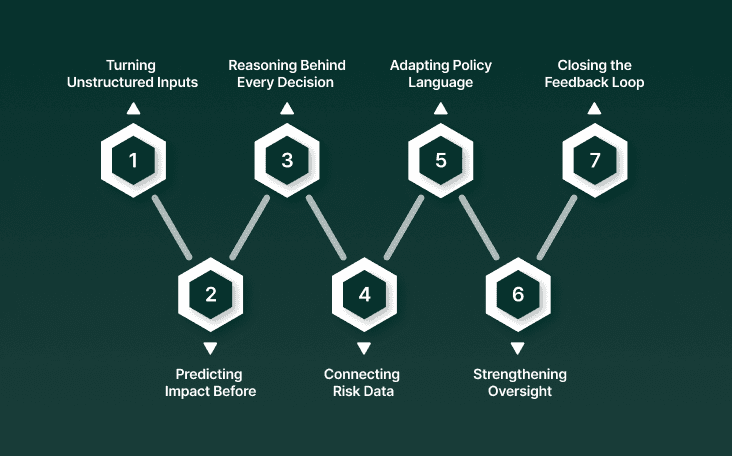

Turning Unstructured Inputs Into Clarity: Emails, claims notes, and voice transcripts become usable data that highlight context around intent, exceptions, and behavioral triggers.

Predicting Impact Before It Hits the Books: Generative models simulate how credit, market, or policy shifts might influence future exposure rather than waiting for historical proof.

Capturing the Reasoning Behind Every Decision: AI-generated summaries preserve the “why” behind approvals, declines, and adjustments, creating transparency for both auditors and customers.

Connecting Risk Data Across Departments: Information once siloed between underwriting, claims, and compliance becomes a shared signal chain that reduces duplicated reviews.

Adapting Policy Language in Real Time: Generative AI systems can adjust documentation or pricing language as new data enters, keeping coverage terms aligned with current risk.

Strengthening Oversight Without Slowing Work: Supervisors can review condensed AI summaries instead of full files, keeping human oversight strong while maintaining decision speed.

Closing the Feedback Loop: Every outcome feeds new context back into the model, teaching it to recognize subtle patterns tied to profit, loss, or fraud.

To understand how real-time voice agents are transforming compliance, risk assessment, and customer communication, explore Voice AI for Banks & Financial Services: Use Cases, Architecture & Best Practices.

The change is already visible at the structural level. What began as faster data analysis is now reshaping compliance visibility, audit confidence, and accountability itself.

The Real Impact of Generative AI in Financial Services

Compliance teams are used to governing models built on fixed rules and linear data. Generative AI in financial services changes that equation by introducing systems that learn context, create outputs, and explain their reasoning. The opportunity is significant, but so is the oversight required.

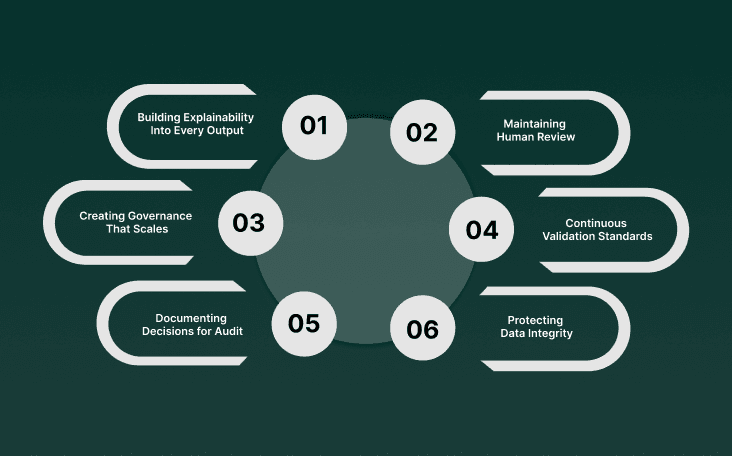

1. Building Explainability Into Every Output

AI insights must be traceable, not just accurate. Generative AI in financial services introduces transparency that lets compliance teams see how every conclusion is formed.

Metadata as Evidence: Each output carries its data source, reasoning chain, and confidence level for audit-ready validation.

Real-Time Traceability: Regulators and internal auditors can review reasoning behind underwriting or claim decisions instantly.

Customer Trust Through Clarity: Transparent AI decisions reduce disputes and strengthen client confidence in approvals or denials.

2. Maintaining Human Review for High-Risk Decisions

Automation accelerates workflows, but oversight remains the anchor of compliance. Human validation protects institutions from errors in complex or high-value financial cases.

Hybrid Oversight Model: AI screens standard cases while analysts focus on exceptions requiring professional judgment.

Human Sign-Off Protocols: Final approval steps preserve accountability for sensitive policies or claim payouts.

Operational Safety Net: Ongoing manual reviews help identify early model drift or bias before large-scale impact.

3. Creating Governance That Scales with AI

Clear ownership and version tracking prevent AI governance from becoming an afterthought. Each generative model should have defined accountability and audit visibility.

Defined Ownership: Assign responsibility for model training, testing, and approval within cross-functional risk teams.

Version Transparency: Track all parameter updates, retraining events, and performance shifts over time.

Compliance Confidence: Structured governance builds regulator trust in how AI models are managed across departments.

Experience how Smallest.ai connects every call, claim, and customer insight to measurable ROI. Book a demo.

4. Adopting Continuous Validation Standards

Generative AI for finance and banking performs best when tested against new conditions. Validation must evolve with markets, regulations, and customer behavior.

Live Testing Protocols: Compare model predictions with recent financial and regional data for ongoing reliability.

Adaptive Performance Checks: Frequent recalibration keeps risk scoring and pricing models responsive to market volatility.

Regulatory Alignment: Continuous validation guarantees compliance with emerging AI guidelines from OCC and CFPB.

5. Documenting Decisions for Audit and Accountability

AI-generated summaries can record both outcome and reasoning, creating transparent, text-based audit trails for regulators and internal teams.

Natural-Language Records: Automated logs capture how data, reasoning, and outcomes connect.

Faster Audit Response: Teams can locate model outputs and supporting logic instantly during reviews.

Internal Learning Loop: Documentation helps retrain models and improve team understanding of AI-driven insights.

6. Protecting Data Integrity and Model Reliability

AI systems are only as strong as the data they learn from. Generative AI in financial services must prevent contamination at every level.

Controlled Data Pipelines: Train models only on verified, compliant internal and anonymized external data.

Bias Prevention Practices: Continuous screening detects and removes skewed patterns in data inputs.

Secure Data Handling: Encrypted storage and access logs keep sensitive financial data compliant with industry standards.

When compliance and oversight reach real-time parity with data flow, financial leaders start to see measurable results, clarity that translates directly into financial outcomes.

Measuring ROI from Generative AI in Financial Services

Return on investment in generative AI is not measured by cost savings alone. For financial institutions, value comes from accuracy, compliance confidence, and measurable customer outcomes.

Underwriters and risk leaders are using generative AI in financial services to quantify how better data interpretation translates into profitability, trust, and operational control. The focus has shifted from adoption metrics to tangible performance indicators tied directly to business outcomes.

Faster Underwriting and Policy Turnaround: Cycle times drop when document reviews, summaries, and pricing recommendations are generated automatically with supporting context.

Reduction in Manual Review Hours: AI-generated insights cut repetitive data checks, freeing analysts and underwriters to focus on exception handling and risk strategy.

Improved Pricing Precision: Generative AI for finance and banking refines risk models, producing more accurate pricing that protects margins and strengthens customer retention.

Lower Compliance Rework: Automated audit trails reduce errors that trigger re-submissions, fines, or additional scrutiny from regulators.

Measurable Fraud Prevention Gains: Synthetic scenario modeling spots emerging fraud patterns early, cutting financial losses and investigation costs.

Higher Customer Retention: Personalized, consistent responses during claims or lending interactions create faster resolutions and build long-term trust.

Better Portfolio Profitability: By capturing small risk shifts sooner, teams can reprice or rebalance portfolios before losses compound.

Shorter Onboarding for New Analysts: Generative AI for financial services and banking trains new underwriters with real-world cases, reducing time to independent productivity.

How to Implement Generative AI Responsibly: A Practical Roadmap

Most financial institutions are eager to adopt generative AI, but rushing without structure leads to uneven results and compliance gaps. Responsible rollout means balancing experimentation with accountability.

The most successful teams approach it as a phased program, testing on measurable use cases, building governance around every model, and training staff to interpret AI output correctly. This keeps generative AI in financial services accurate, auditable, and aligned with business goals.

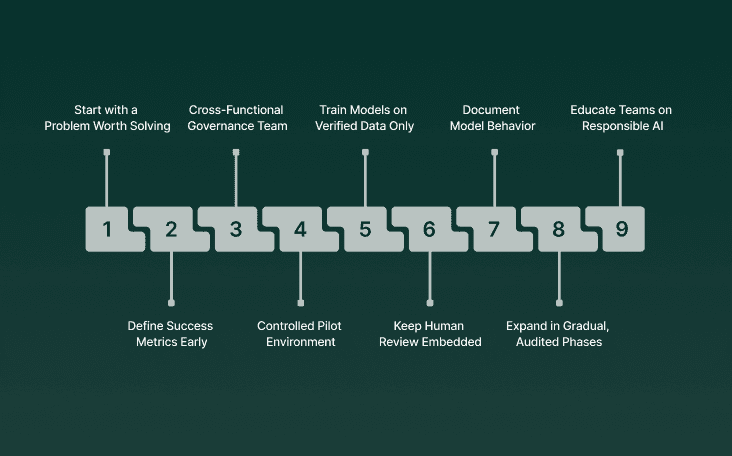

Start with a Problem Worth Solving: Select one area where AI can close a clear gap, such as underwriting documentation or customer response accuracy.

Define Success Metrics Early: Track measurable outcomes like turnaround time, accuracy rates, and audit exceptions before scaling to other use cases.

Build a Cross-Functional Governance Team: Include underwriting, risk, compliance, and technology leaders who can jointly review and approve AI model use.

Create a Controlled Pilot Environment: Deploy generative AI for finance and banking in a limited production setting with restricted data access and live supervision.

Train Models on Verified Data Only: Feed systems clean, regulated information to reduce the risk of bias or misinformation in model-generated insights.

Keep Human Review Embedded: Assign review checkpoints where underwriters or compliance staff validate AI-generated outputs before final approval.

Document Model Behavior and Changes: Maintain clear records of model inputs, parameter updates, and retraining events for internal and regulatory audits.

Expand in Gradual, Audited Phases: Scale from pilot to enterprise use once the AI meets accuracy and compliance thresholds across departments.

Educate Teams on Responsible AI Practices: Train underwriters, analysts, and supervisors to question model outputs and identify early warning signs of bias or drift.

Top Use Cases of Generative AI Impact in Financial Services

Financial firms are adopting generative AI where decisions depend on accuracy, timing, and context. The most measurable value appears when human judgment is supported by AI systems capable of interpreting complex data and producing transparent reasoning. Below is how generative AI in financial services is creating impact across underwriting, compliance, and customer operations.

Use Case | Purpose | Primary Impact |

|---|---|---|

Underwriting Summaries | Converts long reports into concise risk briefs. | Cuts review time and improves consistency. |

Policy Drafting | Generates policy language from structured data. | Speeds up issuance and reduces admin work. |

Claims Analysis | Creates clear summaries from notes and images. | Shortens claim cycles and supports audits. |

Customer Interactions | Powers AI voice and chat responses. | Improves response time and customer satisfaction. |

Fraud Simulation | Builds synthetic data to test fraud systems. | Detects new patterns before real losses occur. |

Credit Risk Monitoring | Predicts defaults using real-time indicators. | Enables proactive portfolio adjustments. |

Knowledge Retrieval | Answers staff queries using internal data. | Cuts research time and improves accuracy. |

Regulation Summaries | Condenses new rules into actionable briefs. | Speeds compliance updates and reporting. |

Client Communication | Writes personalized financial messages. | Increases engagement and retention. |

What’s Next for Generative AI in Financial Services

The first phase of generative AI in financial services focused on improving efficiency and documentation. The next wave will center on decision trust, contextual reasoning, and real-time adaptability. Financial leaders are asking sharper questions, how to verify what AI creates, how to keep it compliant, and how to measure its contribution to growth.

The coming shift will redefine how underwriting, compliance, and customer engagement operate together under one continuous intelligence loop.

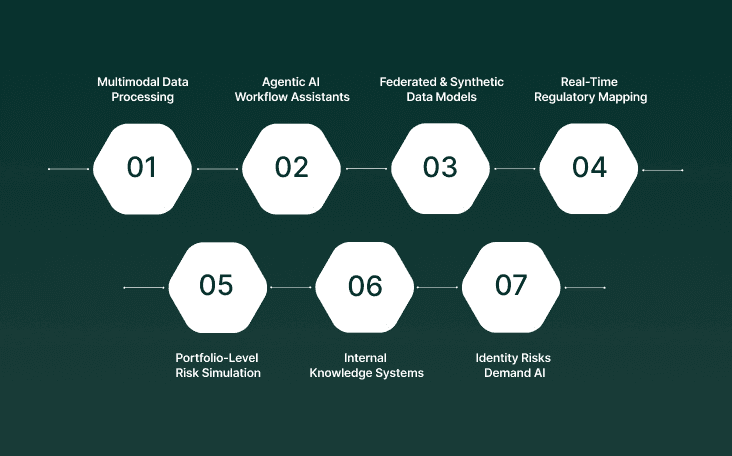

Multimodal Data Processing Becomes the Norm: Generative AI for finance and banking will combine text, voice, image, and structured data into unified workflows, underwriters will see claims notes, audio logs and market signals in one context.

Agentic AI Workflow Assistants Go Live: More institutions will deploy AI agents that initiate and manage multi-step tasks, for example, gathering supporting documents, updating pricing models, and generating audit trails, elevating human underwriters to oversight roles.

Federated and Synthetic Data Models Mitigate Privacy Risk: Financial firms will adopt synthetic data generation and federated learning to train models without exposing customer data, widening access to high-quality datasets while managing regulator concerns.

Real-Time Regulatory Mapping and Audit Logging: Generative AI in financial services will support live tracking of rule changes (e.g., U.S., EU) and generate traceable documentation for each decision-path, helping underwriters and compliance teams stay audit-ready.

Portfolio-Level Risk Simulation using Generative Scenarios: Teams will move from historical stress tests to generative simulation of unprecedented events (climate, geopolitical, supply chain) to estimate portfolio exposures proactively.

Internal Knowledge Systems with Conversational Interface: Underwriters, risk analysts, and compliance officers will query internal policy, claim precedents, or regulatory guidance via conversational AI, reducing time spent hunting documents and increasing consistency.

Growing Fraud and Identity Risks Demand AI Countermeasures: As fraudsters use generative AI (deepfakes, synthetic identities), financial services must deploy counter-agents and forensic AI capable of identifying AI-enabled attacks in real time.

How Smallest.ai Turns Generative AI Strategy into Real-Time Financial Impact

Financial institutions are shifting toward real-time communication and instant decision feedback. Yet most still rely on delayed, text-heavy systems that separate customer interaction from data insight. Smallest.ai bridges that gap through its Voice AI and Conversational AI platforms, helping underwriters, risk teams, and service operations act in real time, where timing directly affects accuracy, compliance, and customer trust.

Real-Time Voice Agents for Financial Operations: Voice agents manage live conversations across lending, insurance, and collections, reducing human handoffs while keeping every exchange recorded and verifiable.

Voice Cloning for Brand Consistency: Branded voice profiles create uniform communication across regional and product lines without losing personalization or compliance tone.

Conversational AI for Customer and Risk Interaction: AI-driven agents engage customers, confirm identities, gather claims details, and answer coverage or credit questions instantly.

Sub-100-ms Latency for Immediate Decision Support: Responses occur in real time, allowing teams to use AI insights while a call or transaction is still active.

Electron SLMs Trained on Financial Dialogues: In-house small language models interpret industry-specific vocabulary, policy terms, claim codes, and loan triggers with accuracy that general models miss.

Lightning Voice AI for Natural Speech Flow: Human-like cadence and emotion modeling make financial discussions feel authentic, building customer confidence during sensitive interactions.

Secure On-Premise and Cloud Deployment: Financial data stays protected under SOC 2 Type 2, HIPAA, PCI, and ISO standards, suitable for banks and insurers with strict compliance requirements.

Integrated Telephony and Analytics Stack: Smallest.ai connects directly with systems like Salesforce, Zendesk, and WhatsApp to analyze voice data and report key interaction metrics instantly.

Multilingual Communication Capability: Supports 16 global languages, allowing cross-border financial operations to maintain accuracy in both conversation and documentation.

Developer-Ready SDKs for Quick Deployment: Python and Node SDKs let internal tech teams build, test, and deploy new voice workflows within days.

The result is a connected financial system where accuracy, compliance, and customer trust work together in real time, powered by Smallest.ai.

Conclusion

Financial institutions that once measured progress by efficiency are now measuring it by responsiveness. Generative AI in financial services is not replacing human expertise; it is amplifying it with context that moves as fast as the market itself. The shift toward real-time intelligence is redefining what accuracy, compliance, and customer value look like in 2025. Underwriters and risk leaders who use data to act in the moment are the ones setting the new standard for profitability and trust.

That is where Smallest.ai changes what is possible. Its voice AI, conversational AI, and voice agents bring live intelligence to underwriting, claims, and collections, helping teams hear patterns before they become risks. Through voice cloning, financial brands can maintain consistent, compliant communication across products and languages while keeping every interaction measurable. With sub-100ms latency and secure deployment, Smallest.ai connects real-time insight with real financial impact.

Financial leaders ready to connect communication with performance are already acting. Experience how Smallest.ai turns every conversation into ROI, book a demo.

FAQs About Generative AI in Financial Services

1. How does generative AI in financial services handle unstructured risk data like voice logs or claims notes?

Generative AI for financial services and banking can read and summarize audio, text, and image data together. This allows underwriters and claims analysts to interpret customer calls, field notes, or scanned forms as structured insights, improving both accuracy and documentation speed.

2. Can generative AI for finance and banking improve pricing transparency without exposing sensitive data?

Yes. By using synthetic data modeling and federated learning, generative AI systems can test pricing and credit scenarios safely. Financial teams get clear explanations of rate changes while keeping client data private and compliant with regulatory standards.

3. What role does voice AI play in implementing generative AI for financial services and banking?

Voice AI connects the data layer with customer experience. Real-time voice agents use generative models to answer inquiries, verify identity, and record reasoning behind each interaction, turning every call into a usable data point for future risk and compliance reviews.

4. How are regulators viewing the use of generative AI in financial services for decision support?

Regulatory bodies are focusing on explainability and audit trails rather than restricting AI outright. They expect institutions to show how outputs are generated and validated, making transparent reasoning a key compliance requirement for any generative AI model used in finance.

5. What is the biggest operational advantage of deploying generative AI for finance and banking inside call and claims centers?

Generative AI eliminates the lag between data capture and decision action. When voice agents and conversational AI handle live calls, insights are generated instantly, allowing financial institutions to adjust risk scoring, claim validation, or policy terms during the same interaction.

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now