Discover how conversational AI for finance streamlines customer service, automates compliance, and improves risk management with real-world industry results.

Akshat Mandloi

Updated on

January 27, 2026 at 4:59 PM

Conversational AI in finance is no longer a side project, it’s now a core driver of how financial companies connect with customers, manage risk, and stay ahead in a crowded market. As the industry faces pressure to deliver faster, smarter, and more secure service, AI-powered chatbots, voice assistants, and virtual agents are stepping up to handle everything from onboarding and account management to fraud alerts and investment advice. The results speak for themselves, in 2024, nearly 70 percent of financial services companies reported AI-driven revenue increases.

Banks and fintechs are using conversational AI in finance to automate routine interactions, personalize advice, and give customers 24/7 access to support, while freeing up teams to focus on complex, high-value work. These systems rely on advanced natural language processing and real-time analytics to deliver accurate, compliant, and context-aware responses across every channel, including apps, web, and messaging platforms.

In this guide, you’ll see how conversational AI in finance is changing customer experience, driving growth, and setting new standards for security and performance in the financial sector.

TL;DR/ Key Takeaways

Operational Efficiency: AI handles thousands of daily interactions, reduces fraud response times by up to 99%, and cuts onboarding from days to minutes, freeing teams for higher-value work.

Customer Experience: Conversational AI delivers 24/7 personalized support, achieves up to 90% first call resolution, and reduces customer wait times from hours to seconds.

Risk and Compliance: Real-time fraud detection with 96% accuracy and automated compliance monitoring reduce errors and build customer trust without slowing operations.

Scalable Advisory Services: AI democratizes financial advice, improving loan approvals by 15%, reducing defaults by 25%, and offering personalized portfolio management to millions simultaneously.

What is Conversational AI in Finance?

Conversational AI in finance refers to advanced systems that interpret, process, and respond to human language across digital channels, chat, voice, and messaging, using a combination of natural language processing (NLP), machine learning, and large language models.

These platforms automate a wide range of financial interactions, from routine customer service to complex advisory and compliance workflows, all while maintaining strict security and regulatory standards.

Core Technologies of Conversational AI in Finance:

Conversational AI in finance depends on a mix of advanced technologies that make secure, real-time conversations possible across channels. Here’s a look at the core components driving this shift:

Natural Language Processing (NLP): Breaks down and understands customer queries, allowing chatbots and voice assistants to respond accurately to finance-specific questions and requests.

Machine Learning (ML): Learns from transaction data and conversation patterns to refine how the system responds, flag suspicious activity, and personalize interactions.

Speech Recognition & Voice Biometrics: Converts spoken language into text, verifies user identity, and enables secure voice-based transactions.

Generative AI: Produces context-aware, human-like responses for tasks such as customer support, investment guidance, and regulatory disclosures.

Sentiment Analysis: Detects emotion and urgency within conversations, helping prioritize issues and improve service outcomes.

Document Automation: Extracts data from forms and contracts, speeding up processes like loan approvals and compliance checks.

Security Protocols: Includes encryption, multi-factor authentication, and compliance with regulations such as GDPR, CCPA, and PCI DSS to protect sensitive financial data.

How Conversational AI in Finance Works in Practice

Conversational AI in finance powers both customer-facing and back-office processes. For example, AI-driven chatbots can authenticate users, answer account questions, process payments, and flag suspicious transactions in real time. In wealth management, AI analyzes spending and investment patterns to offer personalized advice or portfolio suggestions, adapting to each user’s risk profile and goals.

Banks and financial firms deploy these systems across web platforms, mobile apps, call centers, and messaging apps. The technology supports multilingual interactions, handles regulatory disclosures, and automates compliance checks, reducing manual workload and turnaround times.

When you see conversational AI in finance working day-to-day, the difference is personal, customers get answers without frustration, teams spend less time on repetitive calls, and problems get solved faster. These improvements aren’t just technical; they build trust, save time, and let people focus on what matters most in their financial lives.

Here’s an interesting read: Beyond Voiceflow: Discovering Superior Conversational AI Platforms in 2025

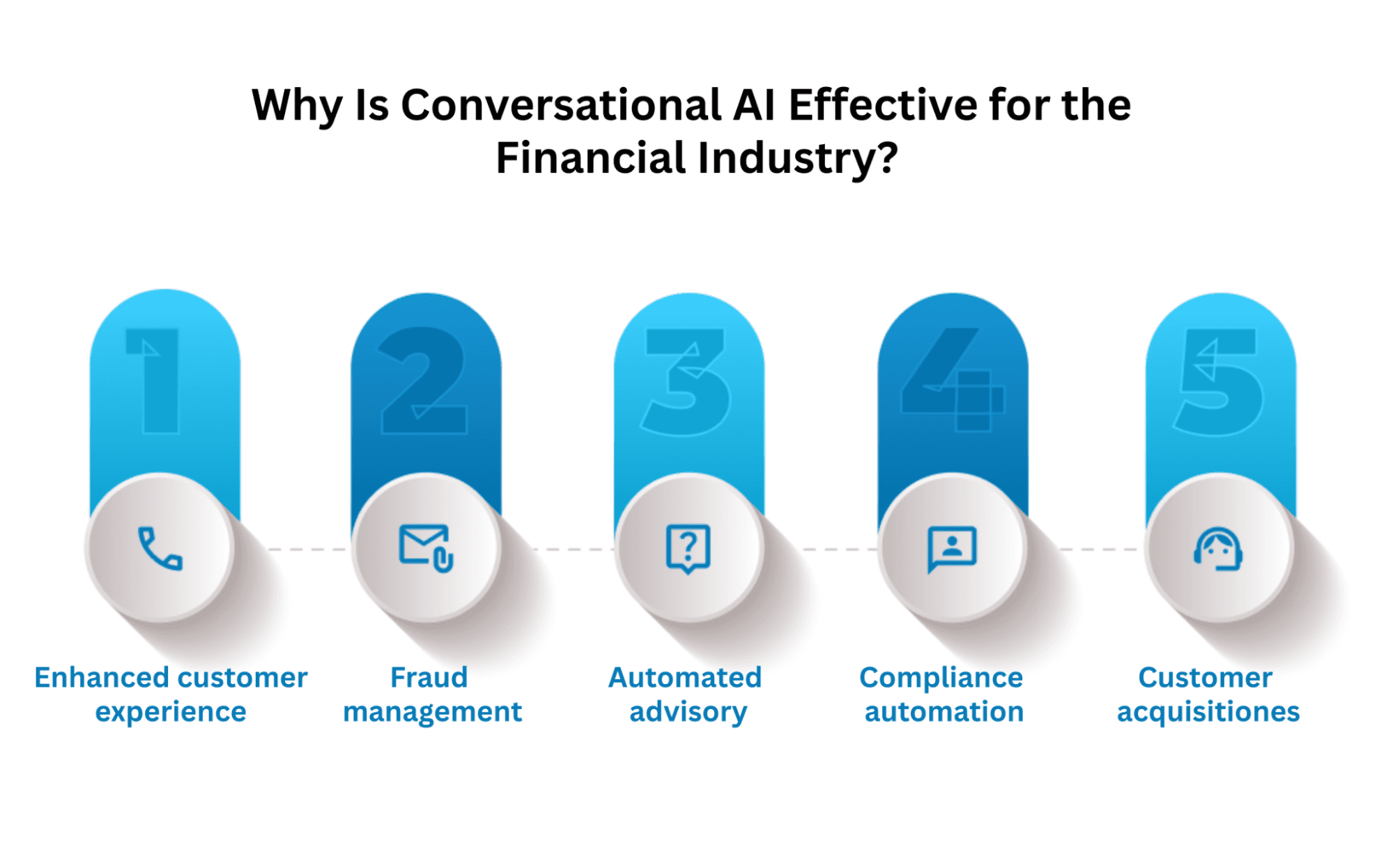

Why Is Conversational AI Effective for the Financial Industry?

Conversational AI in finance delivers measurable results, streamlining service, reducing risk, and opening new channels for customer engagement. Here’s how these benefits play out across the industry.

1. Improved Customer Experience and Availability

Conversational AI has changed customer service in financial services by providing instant, personalized support around the clock. Banks using AI-powered chatbots can handle up to 80% of routine customer service questions, while AI voice assistants achieve 90% accuracy in customer interactions.

Impact on Financial Operations:

Operational Efficiency: Banks report handling 10,000+ fully automated daily customer interactions, with AI systems processing customer inquiries in minutes rather than hours. AI chatbots can handle up to 50% of customer inquiries, significantly reducing the burden on human agents.

Cost Reduction: Financial institutions implementing conversational AI achieve 36% reporting that AI decreased their company's annual costs by more than 10%. Banks save approximately $35 million in fraud prevention over 18 months while reducing mean time to respond to fraud by 99%.

24/7 Service Delivery: AI-powered systems provide continuous support, with 91% of US banks currently using AI for fraud detection and customer service. This eliminates traditional banking hours constraints and provides immediate assistance for urgent financial needs.

Impact on Customer Relationships:

First Call Resolution: AI-powered systems achieve up to 80% first call resolution rates, with some institutions reporting FCR rates as high as 90%. This directly correlates with improved customer satisfaction scores.

Response Time Optimization: AI reduces customer service handling time by 50% while improving satisfaction ratings by 45% within six months. Response times drop from hours to seconds for routine inquiries.

Personalized Interactions: AI analyzes customer data to provide tailored financial advice and product recommendations, with 72% of consumers preferring businesses offering personalized experiences. This creates stronger emotional connections between customers and financial institutions.

2. Fraud Detection and Risk Management

Conversational AI has transformed fraud detection from reactive to proactive, with AI systems capable of analyzing transaction patterns in real-time to identify suspicious activities. Machine learning systems can reduce fraud detection time by up to 70% while increasing accuracy by 60% compared to traditional methods. Financial institutions now prevent $40 billion in potential losses annually through AI-driven fraud detection.

Impact on Financial Operations:

Real-time Monitoring: AI systems monitor transactions continuously, identifying unusual patterns and flagging suspicious behavior instantly. Banks achieve 96% accuracy in fraud detection with only 0.8% false positives, dramatically improving operational efficiency.

Automated Risk Assessment: AI processes vast amounts of data to evaluate creditworthiness and risk profiles automatically. This reduces loan processing time from weeks to hours while maintaining accuracy rates above 95%.

Compliance Automation: AI-driven compliance systems ensure continuous monitoring of regulatory requirements, reducing compliance costs by automating routine checks and reporting processes.

Impact on Customer Relationships:

Proactive Protection: AI systems alert customers to potential fraud before significant damage occurs, with Mastercard reporting a 300% boost in fraud detection rates. This proactive approach builds trust and demonstrates the bank's commitment to customer security.

Reduced False Positives: Advanced AI algorithms minimize incorrect fraud flags, reducing customer frustration from declined legitimate transactions. This improves customer experience while maintaining security standards.

Voice Biometric Authentication: AI-powered voice recognition provides secure, convenient authentication methods that customers prefer over traditional security questions or passwords.

3. Automated Financial Advisory and Decision Making

Conversational AI has democratized financial advisory services, making personalized financial guidance accessible to all customer segments. AI-powered financial advisors can analyze customer spending patterns, income, and investment preferences to provide tailored recommendations.

Impact on Financial Operations:

Scalable Advisory Services: AI systems can provide personalized financial advice to millions of customers simultaneously, something impossible with human advisors alone. Banks report 25% improvement in customer engagement through AI-driven personalization.

Automated Portfolio Management: AI analyzes market conditions and customer preferences to optimize investment portfolios automatically. This reduces management costs while improving investment outcomes through data-driven decision making.

Credit Assessment: AI-enhanced credit scoring models reduce default rates by 25% while increasing loan approval rates by 15%. This improves both profitability and financial inclusion.

Impact on Customer Relationships:

Personalized Financial Guidance: AI provides customized budgeting advice, investment suggestions, and savings recommendations based on individual financial goals and behaviors. Customers using AI-powered financial management tools experience significant improvements in their savings rates.

Educational Support: AI assistants help customers understand complex financial products and services, improving financial literacy through interactive, conversational education.

Predictive Insights: AI anticipates customer needs and provides proactive financial advice, such as suggesting budget adjustments before overspending or recommending investment opportunities based on market conditions.

4. Regulatory Compliance and Automation

Conversational AI has changed regulatory compliance in financial services by automating complex monitoring and reporting processes. AI systems can process regulatory requirements in real-time, ensuring continuous compliance while reducing manual workload.

Impact on Financial Operations:

Automated Compliance Monitoring: AI systems continuously monitor transactions and activities for regulatory violations, providing instant alerts when issues are detected. This reduces compliance-related errors and ensures timely responses to regulatory requirements.

Document Processing: AI can automatically analyze and process regulatory documents, extracting relevant information and ensuring proper categorization. This reduces processing time by up to 40% while improving accuracy.

Audit Trail Generation: AI systems automatically generate comprehensive audit trails, making regulatory examinations more efficient and reducing the time required for compliance reviews.

Impact on Customer Relationships:

Transparent Processes: AI-powered compliance systems provide customers with clear explanations of regulatory requirements and how they affect their accounts or transactions. This transparency builds trust and reduces customer confusion.

Faster Approvals: Automated compliance checks significantly reduce the time required for account openings, loan approvals, and other regulatory processes. Customers experience faster service delivery without compromising compliance standards.

Consistent Service: AI ensures that all customers receive consistent treatment regarding regulatory requirements, eliminating human bias and ensuring fair application of policies across all customer segments.

5. Customer Onboarding and Acquisition

Conversational AI has transformed customer onboarding from a lengthy, manual process into a streamlined, digital experience. AI-powered onboarding systems can reduce onboarding time from days to minutes while improving completion rates. Traditional onboarding processes see 18% of applicants abandon the process, while AI-driven systems significantly reduce these drop-off rates.

Impact on Financial Operations:

Accelerated Processing: AI automation reduces onboarding time from over 11 minutes to under 8 minutes per digital check.

Automated Verification: AI systems can automatically verify customer identities, and process documents. This reduces manual review requirements while maintaining security standards.

Workflow Optimization: AI guides customers through onboarding processes step-by-step, providing real-time assistance and reducing completion times.

Impact on Customer Relationships:

Personalized Onboarding: AI customizes the onboarding experience based on customer preferences and needs, creating a more engaging and relevant process. This personalization improves customer satisfaction from the first interaction.

Immediate Support: AI-powered onboarding assistants provide instant answers to customer questions during the application process, reducing confusion and abandonment rates.

Smooth Experience: AI creates a cohesive onboarding journey across all channels, whether customers start on mobile, web, or in-branch. This consistency improves customer confidence and reduces friction in the process.

The benefits of conversational AI in finance are clear, but the challenge lies in applying them without compromising security or customer trust. smallest.ai addresses this by combining advanced voice technology with strict compliance, making it a practical choice for financial organizations that need reliable, human-like interactions at scale.

How smallest.ai Transforms Financial Services with Conversational AI

Financial industries deal with strict regulations, high call volumes, and the need for secure, accurate service at scale. Manual processes and legacy systems often slow down response times and increase the risk of errors. Conversational AI in finance from smallest.ai addresses these challenges by automating both customer-facing and back-office workflows, letting banks and financial firms deliver reliable service, meet compliance standards, and reach customers worldwide.

Enterprise-Ready Voice Agents: smallest.ai’s voice agents are designed to handle thousands of daily calls, supporting everything from account inquiries to compliance checks. They adapt to complex banking protocols and regulatory requirements, making them suitable for large-scale deployments.

Flexible Deployment: You can deploy smallest.ai models on your own hardware or in the cloud. This gives you control over sensitive data and lets you meet strict regulatory and security requirements without sacrificing performance.

Workflow Automation: Agents manage hundreds of process variations, from routine transactions to complex standard operating procedures (SOPs). This reduces manual workload and ensures predictable, rule-based handling of every customer request.

High-Volume Call Handling: The platform supports multiple parallel calls, whether you use smallest.ai’s system or integrate with your own. This means you can scale up during peak times without delays or dropped calls.

Custom Analytics: A customizable dashboard lets you monitor agent performance, review call logs, and extract actionable insights. This helps you refine workflows, improve customer experience, and meet reporting requirements.

Multilingual Capabilities: smallest.ai supports over 16 languages, allowing you to serve customers across continents with natural-sounding, localized voices. This breaks down language barriers and expands your reach to new markets.

Developer-Ready Integration: SDKs and APIs for Python, Node.js, and REST make it easy to connect smallest.ai agents to your existing systems, telephony, and apps. This speeds up deployment and reduces IT overhead.

Enterprise-Grade Security: Data is protected with SOC 2 Type II, HIPAA, PCI, and ISO compliance, both in the cloud and on-premises. Regular audits and strict internal controls help keep sensitive financial information safe.

smallest.ai shows what’s possible when conversational AI in finance is built for real-world demands, handling multilingual support, regulatory compliance, and high call volumes with accuracy and speed. To keep these systems reliable and secure, it’s important to follow proven best practices that address both technical and operational challenges.

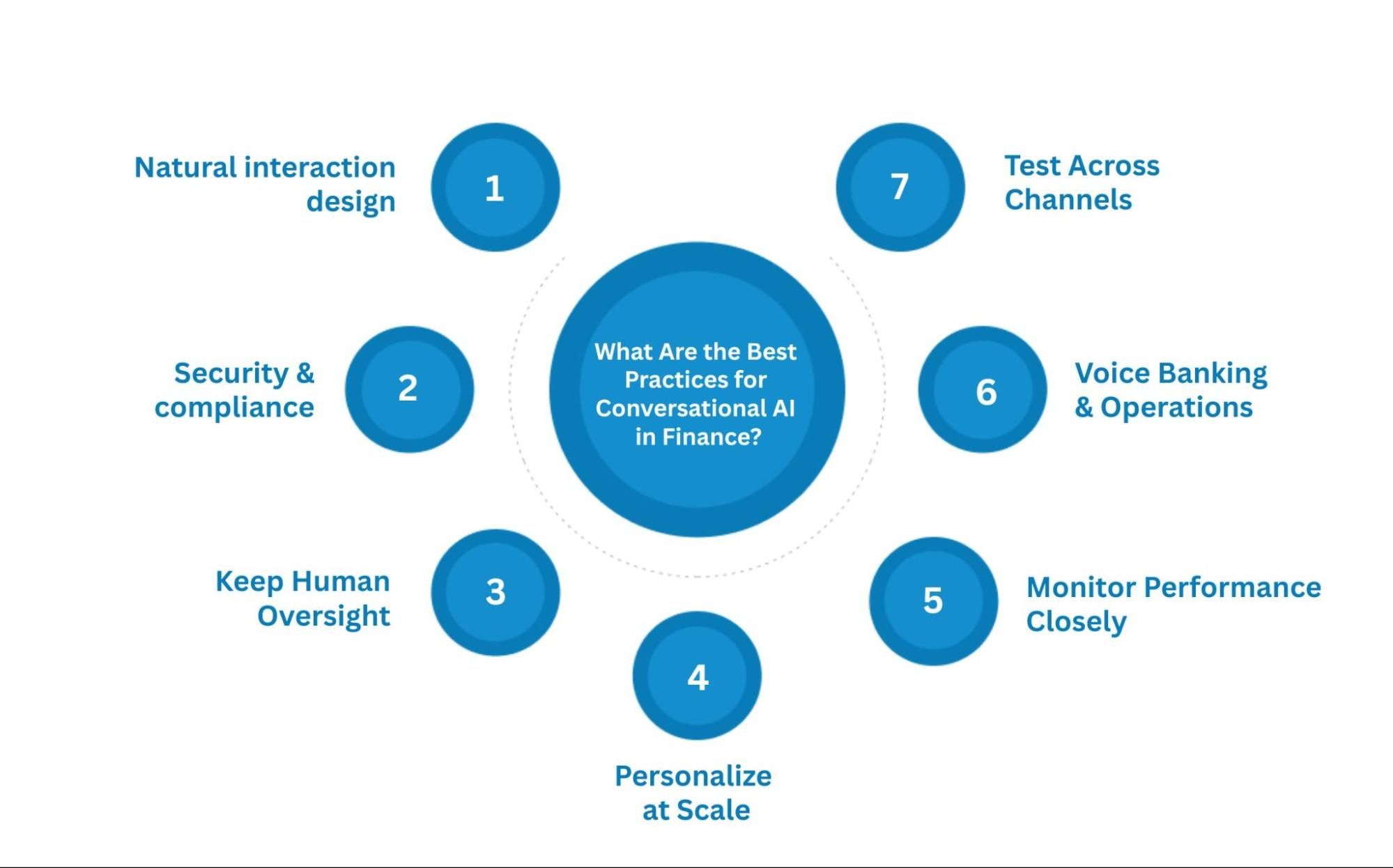

What Are the Best Practices for Conversational AI in Finance?

Conversational AI in finance works best when built on practical strategies that address real-world risks and user needs. Here are the practices that set high-performing systems apart from the rest.

Design for Natural Interactions: Build conversation flows that reflect how people actually speak, including slang, abbreviations, and multi-step requests. Use NLP models trained on real financial conversations to improve accuracy and relevance.

Prioritize Security and Compliance: Encrypt all exchanges and use multi-factor authentication for sensitive actions. Regularly audit your systems for compliance with regulations like GDPR, PCI DSS, and GLBA to protect customer data and maintain trust.

Keep Human Oversight: Route complex, high-risk, or sensitive requests to human agents when the AI’s confidence drops or customer frustration is detected. This prevents dead ends and helps maintain a positive experience.

Continuous Model Training: Update your AI with new data from live interactions to improve intent recognition, fraud detection, and response quality. Monitor for data drift and retrain as financial products or regulations change.

Personalize at Scale: Use transaction history and customer preferences to offer relevant alerts, advice, and product suggestions. Personalization should be rooted in real-time analytics, not static rules.

Monitor Performance Closely: Track resolution rates, customer satisfaction, and error rates. Use this data to refine your models and workflows, closing gaps before they impact customers.

Test Across Channels: Deploy and test your conversational AI in finance across web, mobile, messaging, and voice to deliver a consistent, reliable experience everywhere your customers interact.

Conclusion

Conversational AI in finance has moved well beyond scripted responses, now powering secure, multilingual, and highly contextual interactions that drive measurable results for financial firms. The difference comes down to precision, compliance, and the ability to scale complex workflows without sacrificing customer experience or data security.

smallest.ai stands out by delivering enterprise-grade voice agents that handle thousands of calls per day, adapt to your data, and meet the strictest regulatory standards. With support for over 16 languages, custom analytics, and flexible deployment options, including on-premises, smallest.ai gives financial organizations real control over their AI strategy. Teams can automate everything from onboarding to fraud alerts, all while maintaining transparency and reliability at every touchpoint.

For financial companies ready to move beyond generic automation and build smarter, more resilient operations, smallest.ai brings the technical depth and practical features needed to lead in a competitive market. Get a free demo!

FAQs About Conversational AI in Finance

1. How does conversational AI in finance handle integration with legacy banking systems?

Most financial firms still rely on legacy infrastructure, which often lacks direct compatibility with modern AI tools. Successful deployments use custom APIs and cloud connectors to bridge these gaps, but ongoing technical support is needed to keep data flowing smoothly between old and new systems.

2. What steps are taken to address bias in AI-driven financial decisions?

AI models can reinforce existing biases in training data, potentially leading to unfair outcomes. Financial institutions use regular audits, diverse data sources, and algorithm updates to detect and correct bias, ensuring fairer decision-making in areas like loan approvals and fraud detection.

3. Can conversational AI in finance fully replace human agents for complex or emotional issues?

No. While AI can automate routine interactions, it struggles with complex queries, non-standard accents, and situations that require empathy or nuanced judgment. Leading banks use hybrid models, where AI handles the initial contact and escalates sensitive or complicated cases to human agents.

4. How do financial firms keep conversational AI models current with changing regulations?

Regulatory requirements in finance shift frequently. Firms must monitor legal updates, retrain AI models, and update conversation flows to reflect new rules, such as KYC, AML, and data privacy laws, so the AI remains compliant and avoids costly penalties.

5. What mechanisms exist for real-time user feedback and continuous improvement?

Some platforms now integrate feedback channels directly into chat and voice interfaces, allowing customers to report issues or suggest improvements on the spot. This feedback is used to retrain models, correct errors, and adapt responses, making the AI more responsive and accurate over time.

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now