Explore how conversational AI in banking streamlines customer service, boosts security, and delivers personalized financial insights through real-world use cases.

Akshat Mandloi

Updated on

January 27, 2026 at 4:59 PM

The way banks communicate with customers is undergoing a major transformation. What began as basic chatbot support has evolved into sophisticated, AI-powered conversations that can process loan applications, offer real-time financial guidance, and detect fraud, across voice, chat, and messaging platforms.

This evolution is being driven by rising expectations for speed, personalization, and 24/7 service. Customers today expect their bank to respond instantly, understand their needs, and offer solutions without requiring a branch visit or a phone queue. The market reflects this shift: conversational AI in banking is projected to grow from $9.9 billion in 2023 to over $57 billion by 2032.

For financial institutions, this isn't just about improving efficiency, it's about reimagining the entire customer experience. In this guide, we explore how conversational AI is reshaping banking in 2025: the technologies powering it, the real-world use cases delivering value, and how leading banks are adopting it to stay ahead.

TL;DR: Key Takeaways

Real Conversations: Conversational AI now handles complex, multi-step requests, moving beyond scripted chatbots to natural, context-aware interactions.

Faster Operations: AI automates loan processing, onboarding, and compliance, slashing turnaround times from days to minutes and reducing manual errors.

Fraud Smarts: Advanced AI detects suspicious activity in real time, proactively flagging risks and reducing false positives.

Personalized Banking: AI delivers tailored financial advice, product recommendations, and proactive alerts based on real customer data.

Global Reach: Multilingual AI assistants enable banks to serve diverse customers smoothly, breaking down language barriers and expanding access.

What is Conversational AI in Banking? How It Works Across Channels

Conversational AI in banking refers to advanced systems that interpret and respond to human language through channels such as chat, voice, and messaging platforms. These systems rely on natural language processing (NLP), machine learning, and large language models to automate a broad range of customer and operational interactions.

AI in banking now powers everything from virtual assistants to fraud detection, loan origination, and complex customer service workflows.

Key Ways Conversational AI Powers Banking Operations

Here are the main ways conversational AI drives banking operations:

Automated Customer Interactions: AI-driven chatbots and voice assistants handle inquiries, process transactions, and resolve issues without human intervention. These systems can authenticate users, retrieve account information, and even process payments or transfers through secure conversational flows.

Personalized Recommendations: AI models analyze transaction histories and behavioral data to deliver customized product suggestions, spending insights, and proactive alerts. This personalization is grounded in real-time data analysis, not manual scripting.

Fraud Detection and Risk Management: Conversational AI can flag suspicious activity by monitoring conversations and transaction patterns, triggering alerts or additional verification steps when anomalies are detected.

Operational Automation: AI automates repetitive back-office tasks, such as compliance checks, loan processing, and document verification, reducing manual workload and turnaround times.

Now that you know what conversational AI in banking is, it’s worth looking at why banks are choosing to use it in their daily operations. This helps explain the shift toward smarter, more responsive customer service.

Read more: Top 11 Conversational AI Platforms In 2025

Why Banks Are Adopting Conversational AI in Their Processes

Banks face growing demands for faster, more reliable service without increasing costs. Conversational AI in banking helps meet these needs by handling more requests, reducing repetitive tasks, and providing support around the clock.

Here’s why banks are adopting conversational AI and what it means for customer experience:

Handling More Requests Without Extra Staff: Conversational AI in banking lets banks respond to many customers at once, so people don’t have to wait on hold or repeat themselves.

Cutting Down Routine Costs: By automating simple questions like checking balances or resetting passwords, banks reduce the need for large support teams focused on repetitive tasks.

Always-On Support: Customers can get help anytime, day or night, whether it’s checking a transaction or getting answers outside regular business hours.

Keeping Compliance Straight: Automated systems follow rules consistently, reducing mistakes that can happen when humans handle complex regulations.

Smarter Customer Conversations: AI uses past transactions and habits to offer relevant advice or alerts, making interactions feel more personal and helpful.

Spotting Fraud Faster: AI watches for unusual activity during conversations, helping banks catch fraud sooner without slowing down service.

Speeding Up Approvals: Banks process loans and onboard new customers quicker by automating document checks and decision steps, cutting down waiting times.

The reasons banks are adopting conversational AI are closely tied to the technologies behind it. Exploring these technologies reveals how AI meets the demands for faster, safer, and more personalized banking services.

What Technologies Drive Conversational AI in Banking Today?

Conversational AI in banking depends on a mix of advanced tools that make real conversations possible and secure. These technologies work behind the scenes to help banks answer questions, process requests, and protect customer data. Here are the key technologies that drive conversational AI in banking:

Natural Language Processing (NLP): Understands and interprets customer queries, enabling chatbots and voice assistants to respond accurately to banking-specific questions.

Machine Learning (ML): Learns from data patterns to improve personalization, detect fraud, and refine responses over time.

Speech Recognition and Voice Biometrics: Converts speech to text and verifies user identity through voice, supporting secure voice-based banking.

Generative AI: Produces human-like, context-aware replies for tasks such as customer support and financial guidance.

Sentiment Analysis: Detects customer emotions to prioritize urgent issues and improve service quality.

Document Automation: Extracts and processes information from forms and contracts, speeding up tasks like loan approvals and compliance checks.

Security Technologies: Includes encryption, multi-factor authentication, and regulatory compliance measures to protect data and transactions.

Omnichannel Connectivity: Ensures consistent customer experience across apps, websites, messaging platforms, and call centers.

The real value of these technologies comes through in how banks use them with customers and staff. Here’s how conversational AI shows up in everyday banking tasks and services.

Here’s an interesting read: AI Agents in Banking: Automating Fraud Detection & Account Services

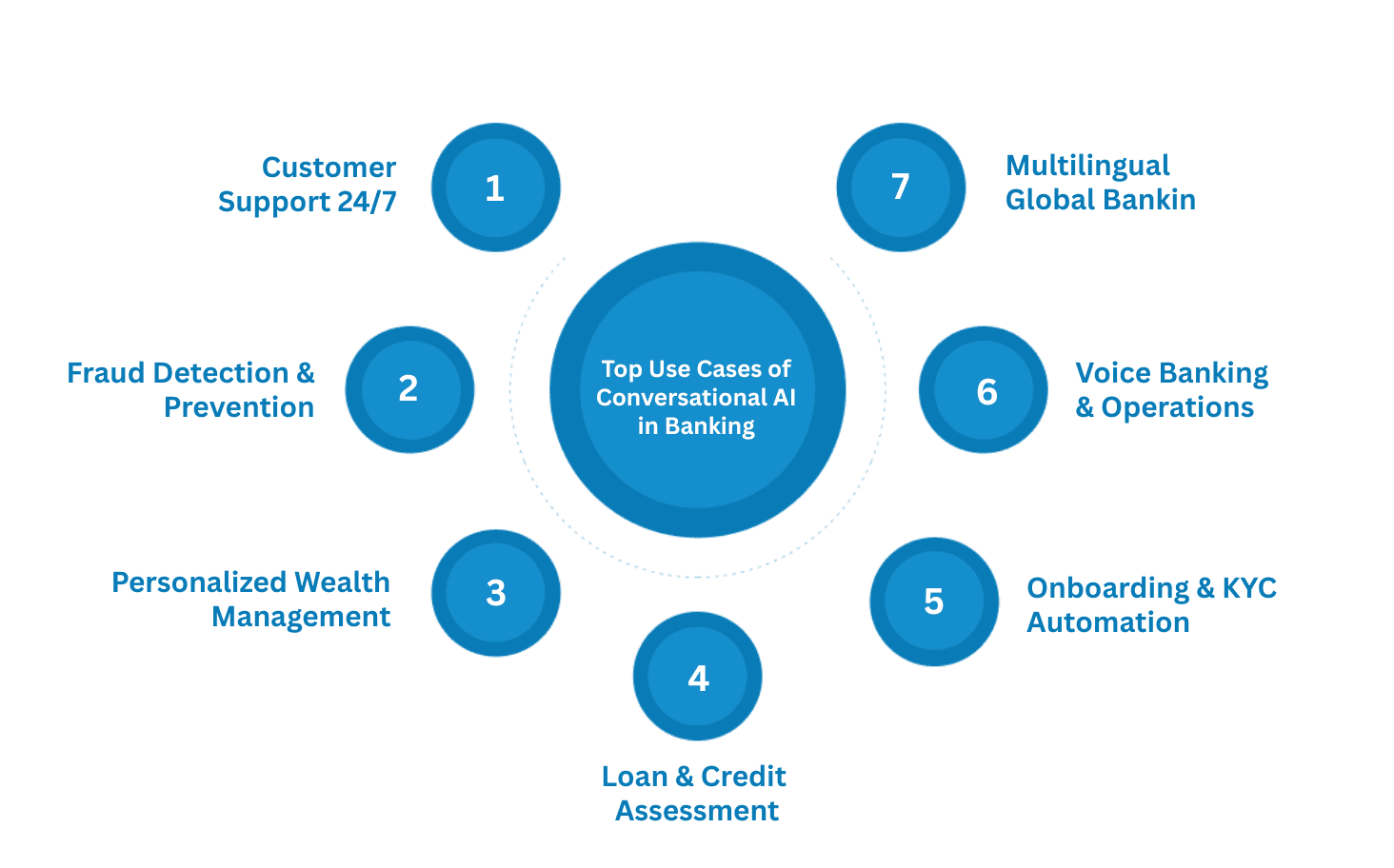

Top Use Cases of Conversational AI in Banking (With Real Examples)

Conversational AI is becoming part of everyday banking, handling everything from simple questions to complex tasks. It helps banks serve customers faster and frees up staff for more important work. Knowing where and how it’s used gives a clearer picture of its real benefits. Here are key examples of conversational AI in banking at work.

1. Customer Service and 24/7 Support

AI-powered chatbots and virtual assistants provide round-the-clock customer support, handling routine inquiries and complex requests without human intervention. These systems can understand natural language, process context, and deliver accurate responses across multiple channels including websites, mobile apps, and messaging platforms.

What has it improved for banks:

Reduced Wait Times: Customers receive instant responses instead of waiting in phone queues, as conversational AI automates a wide range of banking interactions.

Cost Reduction: Banks lower support costs by automating repetitive customer service tasks, freeing up human agents for more complex issues.

Scalability: Systems handle thousands of simultaneous conversations, enabling banks to manage high volumes without additional staffing.

Real life example: Bank of America's virtual assistant Erica has processed over 1 billion customer interactions since launch, helping nearly 32 million customers with everyday tasks ranging from account balance checks to transaction disputes. The assistant provides proactive insights about spending patterns and upcoming bills, making it a central part of the bank's customer experience strategy.

2. Fraud Detection and Prevention

Conversational AI systems monitor customer interactions and transaction patterns in real-time to identify suspicious activities and potential fraud. These solutions can detect anomalies in communication patterns, flag unusual requests, and provide immediate alerts to both customers and bank security teams.

What has it improved for banks:

Real-time Protection: AI systems detect and prevent fraudulent activities before they cause financial damage, reducing false positives by up to 67%.

Proactive Security: Customers receive instant notifications about suspicious account activity in their preferred language and communication channel.

Risk Assessment: Advanced analytics identify potential risks by analyzing voice patterns, behavioral biometrics, and transaction contexts.

Real life example: DBS Bank uses AI-powered virtual assistants to monitor customer transactions and flag suspicious activity in real-time. This system has helped the bank detect and prevent fraud, saving millions of dollars annually while reducing the time between threat identification and response.

3. Personalized Financial Advice and Wealth Management

AI-driven financial advisors analyze customer data, spending patterns, and financial goals to provide personalized investment recommendations and financial planning assistance. These systems can adapt to individual risk tolerance and provide 24/7 guidance without traditional advisor fees.

What has it improved for banks:

Personalized Recommendations: AI analyzes transaction history and behavioral patterns to suggest relevant financial products based on individual customer profiles.

Democratized Access: Advanced financial advice becomes available to customers regardless of account size, expanding wealth management services to underserved segments.

Real-time Insights: Customers receive immediate financial guidance and portfolio updates, improving engagement and investment outcomes.

Real life example: Capital One's Eno virtual assistant analyzes customer spending patterns and provides personalized financial insights and recommendations. The system helps customers track expenses, set budgets, and offers investment suggestions based on their financial behavior and goals.

4. Loan Processing and Credit Assessment

Conversational AI streamlines the loan application process by automating document verification, credit assessment, and approval workflows. These systems can guide customers through applications, collect required documentation, and provide real-time status updates while ensuring regulatory compliance.

What has it improved for banks:

Processing Speed: AI reduces loan approval times from weeks to under one hour, increasing customer satisfaction and reducing abandonment rates.

Accuracy: Automated systems improve approval accuracy by reducing human errors and standardizing decision processes, resulting in more reliable outcomes.

Operational Efficiency: Banks process significantly more loan applications using the same resources, all while maintaining compliance standards.

Real life example: KPMG developed a customized Gen AI solution for loan processing that automates document extraction and verification. The system reduced loan processing time from days to under one hour while improving accuracy and reducing operational costs for banking clients.

5. Customer Onboarding and KYC Automation

AI-powered onboarding systems guide new customers through account setup, identity verification, and Know Your Customer (KYC) processes using conversational interfaces. These solutions can handle document uploads, biometric verification, and compliance checks in multiple languages.

What has it improved for banks:

Onboarding Speed: Digital KYC processes are completed in minutes instead of days, significantly reducing customer drop-off rates.

Compliance Automation: AI ensures all regulatory requirements are met consistently, reducing manual errors and audit risks.

Global Accessibility: Multilingual support enables banks to onboard customers from diverse linguistic backgrounds without language barriers.

Real life example: JPMorgan Chase, one of the world’s largest banks, employs AI-powered onboarding tools that automate KYC verification and document processing. This has significantly reduced customer onboarding time and operational costs while maintaining strict compliance with regulatory requirements, supporting its global customer base efficiently.

6. Voice Banking and Hands-free Operations

Voice-enabled AI assistants allow customers to perform banking tasks through natural speech commands, including checking balances, transferring funds, and paying bills. These systems integrate with mobile apps and smart devices to provide accessible, convenient banking experiences.

What has it improved for banks:

Accessibility Enhancement: Voice banking provides equal access for visually impaired customers and those with mobility limitations.

User Convenience: Customers can complete transactions without typing or navigating complex menus, reducing interaction time.

Multi-language Support: Advanced voice systems support regional dialects and multiple languages, improving customer inclusion.

Real life example: YES Bank's YES ROBOT voice assistant enables customers to apply for over 65 banking products, check loan eligibility, and book deposits using only voice commands and OTP authentication. In its early years, the system had handled over 8.3 million customer interactions with 90% intent recognition accuracy, facilitating ₹5.2 billion in deposits.

7. Multilingual Support and Global Banking

Advanced conversational AI systems provide real-time language translation and cultural adaptation, enabling banks to serve diverse global customer bases in their native languages. These solutions maintain context and banking terminology accuracy across multiple languages and dialects.

What has it improved for banks:

Market Expansion: Banks can serve customers in regions with different languages without establishing local support teams.

Customer Satisfaction: Consumers are more likely to make repeat purchases when post-sale support is available in their native language.

Operational Cost Reduction: Multilingual AI chatbots reduce the need for hiring specialized language support staff while handling high-volume inquiries.

Real life example: smallest.ai offers lifelike voice interactions in 16 global languages, including English, Hindi, Tamil, Marathi, Spanish, French, and German, enabling banks to engage customers worldwide with natural-sounding, localized voice support. This capability allows banks to deliver consistent, high-quality service and break down language barriers for a truly global customer base.

How Smallest.ai Improves Conversational AI for Enterprise Banking

Manual processes in banking often slow down customer service, create bottlenecks with repetitive tasks, and make it tough to scale support during peak times. Smallest.ai steps in with conversational AI in banking, automating voice interactions and complex workflows so banks can handle high volumes without sacrificing accuracy or compliance.

Enterprise-Ready Voice Agents: Deploy voice agents that manage thousands of calls daily, built to handle complex banking scenarios and strict compliance needs.

Brand Voice Customization and Voice Cloning: Banks can customize the AI’s voice to reflect their brand or clone specific voices, creating a consistent and recognizable customer experience that builds trust and sets their service apart.

Custom Training on Your Data: Agents are trained on your institution’s data, with guarantees for handling edge cases and maintaining predictable performance.

On-Premises and Cloud Flexibility: Run AI models on your own hardware or in the cloud, giving you control over data and inference.

Handles Complex Numbers and Scenarios: The voice AI accurately processes sensitive information, like credit card and account numbers, even in challenging call conditions such as background noise, poor audio quality, heavy accents, or call interruptions, minimizing errors and maintaining customer trust.

Multi-Language Support: Serve customers across four continents with lifelike voices in over 16 languages, making your bank accessible to a global audience.

Real-Time Analytics and Insights: Monitor every interaction and extract actionable insights through a customizable analytics dashboard.

Developer-Friendly Integration: Integrate with Python, Node.js, and REST APIs, connecting conversation AI in banking directly to your existing systems.

Enterprise-Grade Security: Data is protected with SOC 2 Type II, HIPAA, PCI, and ISO compliance, meeting the highest security standards in banking.

Best Practices for Successful Conversational AI in Banking

Conversational AI in banking is becoming a key part of how institutions improve service and manage operations. Understanding how to get the most from this technology matters for delivering better customer experiences and meeting business goals. The following best practices highlight what banks should focus on to optimize their use of conversational AI.

Design for Real Conversations: Build conversation flows that reflect how customers actually speak and ask questions. Use NLP models trained on real banking interactions to handle slang, typos, and multi-step requests.

Prioritize Security and Privacy: Encrypt all interactions and use multi-factor authentication for sensitive transactions. Regularly audit your AI in banking systems for compliance with regulations like GDPR and GLBA.

Keep Humans in the Loop: Route complex or sensitive requests to human agents when the AI hits a confidence threshold or detects customer frustration. This avoids dead ends and builds trust.

Continuous Model Training: Update your models with new data from customer interactions to improve intent recognition, accuracy, and fraud detection. Monitor for drift and retrain as banking products and regulations change.

Personalize Interactions: Use transaction history and customer preferences to offer relevant recommendations, alerts, and proactive support. This makes every interaction more meaningful and increases engagement.

Monitor and Measure Performance: Track metrics like response accuracy, resolution rates, and customer satisfaction. Use this data to spot gaps, refine your AI, and report real business impact.

Test Across Channels: Deploy and test your conversational AI in banking across web, mobile, messaging, and voice channels for a consistent experience everywhere customers interact.

Conclusion

Conversational AI in banking demands more than just automation, it calls for solutions that can handle real-world complexity, scale with demand, and protect sensitive data. smallest.ai delivers on these needs with enterprise-ready voice agents that are custom-trained on your data, ensuring every interaction matches your bank’s unique requirements.

These agents manage thousands of calls a day, support over 16 languages, and excel at handling complex workflows, from compliance checks to secure transactions. With flexible deployment options and top-tier security certifications, smallest.ai gives banks the control and reliability they need to move forward with confidence.

Discover how smallest.ai can help you set a new standard for customer experience in banking. Get a free demo!

FAQs About Conversational AI in Banking

1. Can conversational AI in banking handle legacy system integration?

Integrating conversational AI with legacy banking infrastructure is challenging due to outdated, on-premise software. Banks often need to invest in APIs and cloud infrastructure to bridge these systems, and ongoing monitoring is required to maintain stability and security.

2. How does conversational AI address data privacy concerns?

Banks must implement strict encryption, access controls, and activity logging to protect sensitive customer data within conversational AI systems. Dialog logs and personal information require enterprise-grade storage solutions, data masking, and regular audits to prevent exposure.

3. What risks exist around bias in conversational AI?

AI models trained on historical banking data can unintentionally reinforce demographic biases, impacting decision-making and customer experience. Banks need continuous monitoring and periodic algorithm updates to identify and correct bias in AI-driven interactions.

4. Are conversational AI systems in banking always accurate?

Accuracy depends on the quality of the training data and ongoing model updates. Conversational AI may struggle with slang, jargon, or complex context, leading to irrelevant or incomplete responses. Regular performance reviews and retraining are essential to maintain reliability.

5. What are the regulatory challenges for conversational AI in banking?

Conversational AI must comply with strict financial regulations like GDPR and CCPA. Automated interactions need to be transparent, fair, and auditable, which adds complexity to system design and ongoing governance.