Explore the impact of AI in banking, from enhanced security to personalized services, and learn how financial institutions are transforming with cutting-edge technology.

Akshat Mandloi

Updated on

January 27, 2026 at 4:59 PM

AI in banking is moving from concept to daily reality, setting new standards for customer experience, security, and financial products. Banks are no longer just experimenting with chatbots or automating routine tasks, they are using AI to spot fraud in real time, deliver financial advice that actually fits each customer’s needs, and streamline complex processes that once took days. This shift is backed by hard numbers, the global market for AI in banking was valued at $26.23 billion in 2024 and is projected to grow to $34.58 billion in 2025, with forecasts reaching $379.41 billion by 2034.

This constant growth signals a clear change in how banks operate and serve people. AI is now central to everything from risk assessment to customer support, and the pace of adoption is only picking up. In this guide, you’ll see how AI in banking is setting new benchmarks for security, convenience, and service, and what that means for anyone building, marketing, or supporting financial services.

TL,DR/Key Takeaways:

Responsible AI Governance: AI governance frameworks are essential for responsible deployment, ensuring fairness, transparency, and regulatory compliance.

Improved Fraud Detection Accuracy: Real-time AI monitoring can reduce false positives in fraud detection by up to 60%, improving accuracy and trust.

Back-Office Automation Benefits: Expanding AI use beyond customer-facing tasks to back-office automation drives significant cost savings and operational speed.

Credit Access Through Alternative Data: Alternative data sources powered by AI enable credit access for customers traditionally overlooked by standard scoring models.

Scalable, Secure AI Solutions: Platforms like smallest.ai offer customizable, secure AI solutions that scale across languages and complex workflows without compromising data privacy.

What is AI in Banking?

Artificial intelligence in banking refers to the use of machine learning, natural language processing, computer vision, and related technologies to automate, personalize, and secure a wide range of financial services.

These systems process vast amounts of data, transactions, customer interactions, risk signals, and more, to make predictions, flag anomalies, and provide insights that would be impossible to achieve with manual methods alone.

AI in banking combines specific technologies to overcome real challenges:

Machine Learning spots subtle shifts in customer behavior or credit risk by analyzing complex data patterns beyond simple rules.

Natural Language Processing reads contracts and regulatory texts to extract relevant details without manual review.

Computer Vision verifies identities by matching faces or extracting data from handwritten forms.

Robotic Process Automation handles repetitive tasks like verifying documents but can also make conditional decisions when paired with AI.

Predictive Analytics anticipates loan defaults or fraud by connecting dots across diverse data sources.

Speech Recognition powers secure voice commands for banking services.

Anomaly Detection catches unusual transactions that don’t fit normal patterns, flagging potential fraud early.

AI in banking covers a wide range of technology, but its real value shows up in day-to-day results. To see how this technology moves from theory to practice, it helps to look at the areas where banks are already seeing clear benefits.

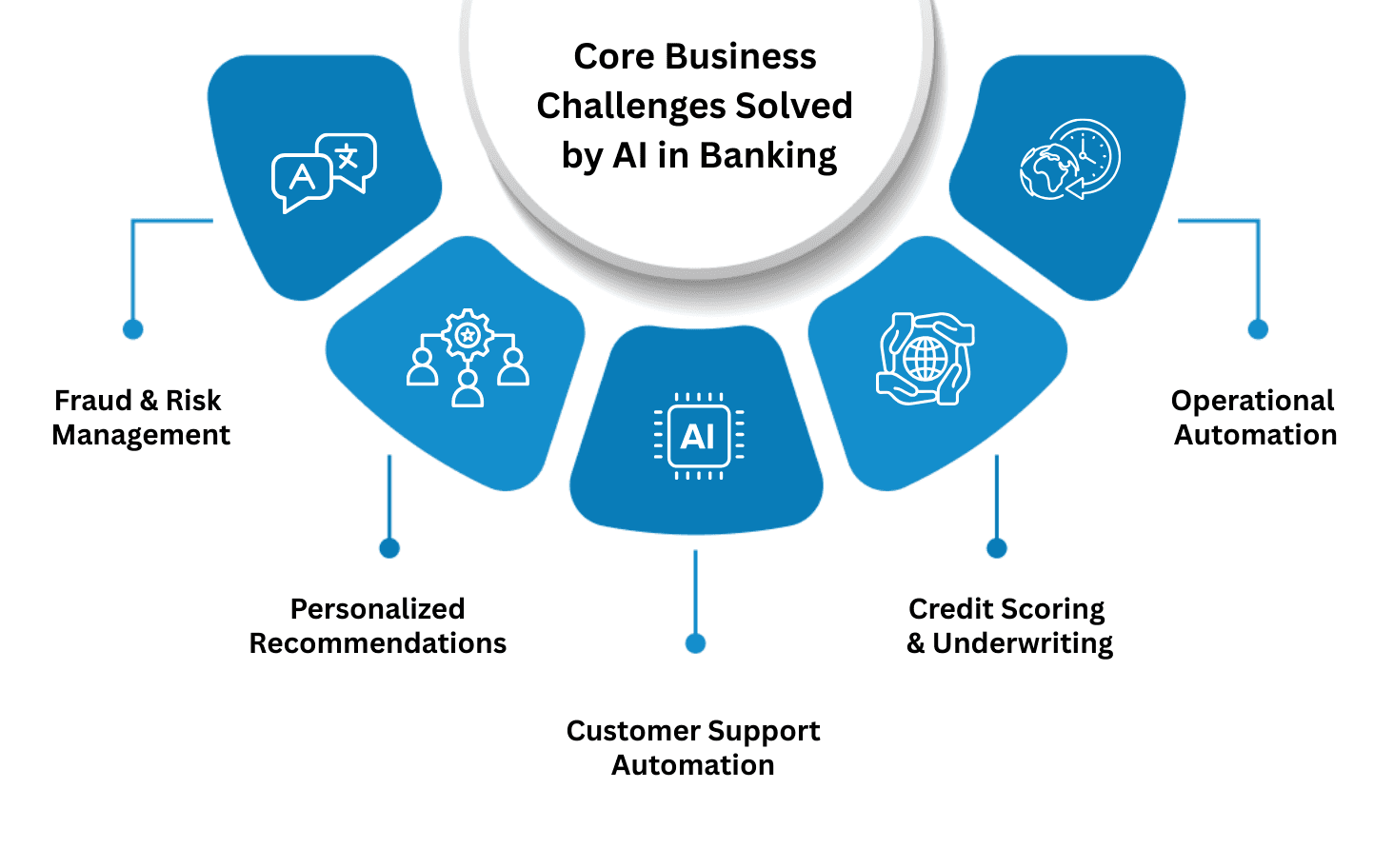

Core Business Challenges Solved by AI in Banking

Banks deal with a lot behind the scenes, protecting customers from fraud, helping people find the right products, and trying to keep things simple even when the work is complex. AI steps in where people and old systems hit their limits.

It helps banks spot problems faster, answer questions any time of day, and make smarter decisions with less guesswork. Here’s how AI is making a real difference where it matters most:

Fraud Detection & Risk Management: Banks deploy AI to spot suspicious transactions in real time. Algorithms sift through millions of data points, identifying unusual patterns that signal fraud or money laundering. This approach has changed how financial crime is detected, moving from rules-based systems to models that learn and adapt as threats shift.

Personalized Recommendations: AI analyzes customer behavior, spending habits, and life events to suggest relevant products, like loans, credit cards, or investment options, at the right moment. These recommendations are based on predictive analytics, not generic marketing blasts, which helps banks connect with customers on a more individual level.

Customer Support Automation: Virtual assistants and chatbots powered by natural language processing handle routine queries, resolve issues, and even guide users through complex processes. They operate around the clock, reducing wait times and freeing up human agents for more complicated requests.

Credit Scoring and Underwriting: Traditional credit scoring relies on a narrow set of data points. AI expands this view, incorporating alternative data (such as transaction histories, utility payments, or even social signals) to assess creditworthiness, especially for those with limited credit history.

Operational Automation: Banks use AI to automate repetitive processes, such as document verification, compliance checks, and data entry. This reduces manual errors and speeds up back-office operations, which translates into cost savings and improved accuracy.

AI is making a real difference in banking, from spotting fraud to helping customers get answers faster. These results come from the way AI systems actually work behind the scenes. To see why banks are investing in this technology, we should look at how these systems process data, learn from patterns, and support daily operations.

How AI Systems Work in Banking

AI systems in banking are trained on historical and real-time data. For example, a fraud detection model learns from past fraudulent and legitimate transactions, adjusting its predictions as new data comes in. These systems often use a combination of supervised and unsupervised learning, adapting to new patterns without explicit programming.

Natural language models, used in chatbots or document analysis, are trained to understand context, intent, and sentiment. This allows them to respond to customer inquiries with a level of nuance that mimics human conversation.

AI systems in banking handle tasks like fraud detection and customer support by analyzing data and automating processes. To fully benefit, banks need a clear plan that links AI efforts to business goals and builds a solid foundation for growth. A strategic framework moves banks beyond isolated projects toward lasting impact.

Here’s an interesting read: AI Agents in Banking: Automating Fraud Detection & Account Services

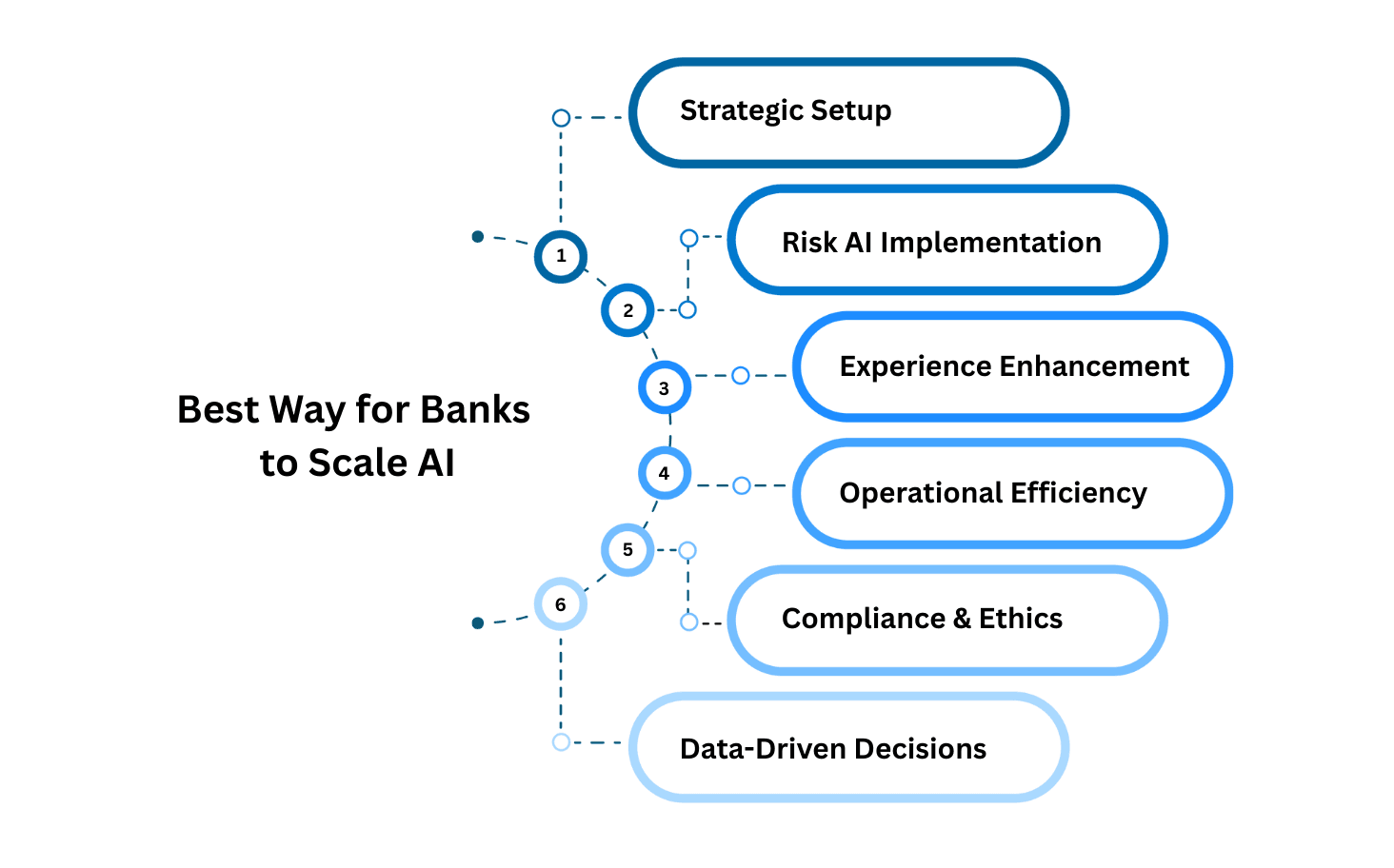

What’s the Best Way for Banks to Scale AI Successfully?

Launching AI in banking isn’t about quick fixes or isolated experiments. Banks that see real results approach AI with a clear plan, making sure every step supports their bigger goals. A strategic framework helps banks move past scattered pilots and build AI into the core of their business.

Here are some different approaches that give banks the structure to scale AI confidently and responsibly:

1. Strategic Foundation Setting

Banks must establish clear AI governance frameworks that align with business objectives while addressing regulatory requirements. This foundational approach involves creating dedicated AI committees, defining ethical principles, and establishing measurable success metrics across all AI initiatives.

Action:

Establish AI Governance Committee: Form interdisciplinary teams including risk management, compliance, IT, and business stakeholders to oversee AI strategy and implementation.

Define Responsible AI Principles: Develop clear guidelines for fairness, transparency, accountability, and explainability that guide all AI initiatives.

Create AI Risk Management Framework: Implement structured risk assessment processes using existing three lines of defense models adapted for AI-specific risks.

Real Life Example: DBS Bank has deployed over 1,500 AI models across 370 use cases, projected to bring SGD 1 billion in economic value by 2025, built on their structured responsible AI framework established in 2014.

2. Risk-Centric AI Implementation

Banks must adopt a risk-first approach to AI deployment, focusing on fraud detection, cybersecurity, and regulatory compliance as primary use cases. This approach allows institutions to build confidence and demonstrate value while maintaining strict oversight of AI systems.

Action:

Prioritize High-Impact, Low-Risk Use Cases: Begin with internal operations like compliance monitoring and fraud detection before expanding to customer-facing applications.

Implement Real-Time Monitoring Systems: Deploy AI-powered tools that analyze transaction patterns and identify anomalies instantly, reducing false positives by up to 60%.

Establish Model Validation Protocols: Create comprehensive testing and validation processes for AI models, including bias detection and performance monitoring.

Real Life Example: HSBC uses AI-powered systems to monitor credit card transactions and improve AML compliance, automatically analyzing vast amounts of customer data and transaction history to detect suspicious activities in real-time.

3. Customer Experience Enhancement

Banks should use AI to provide personalized, proactive customer service while maintaining human oversight. This approach focuses on creating 24/7 support capabilities and delivering tailored financial advice that builds customer trust and loyalty.

Action:

Deploy AI-Powered Virtual Assistants: Implement chatbots and virtual assistants that handle routine inquiries while escalating complex issues to human agents.

Create Personalized Financial Insights: Use AI to analyze customer data and provide tailored recommendations for budgeting, investments, and financial planning.

Establish Omnichannel AI Integration: Smoothly connect AI capabilities across mobile apps, websites, and physical branches for consistent customer experiences.

Real Life Example: Bank of America's Erica virtual assistant has facilitated over 2.5 billion customer interactions since 2018, serving 20 million active users with personalized financial insights and 24/7 support, leading to a 50% reduction in IT service desk calls.

4. Operational Efficiency Optimization

Financial institutions should focus on automating routine processes, reducing manual errors, and improving operational productivity through AI-driven solutions. This approach enables staff to focus on higher-value activities while reducing operational costs.

Action:

Automate Document Processing: Implement AI systems for contract analysis, loan processing, and regulatory documentation to reduce processing time by 60% or more.

Automate Document Processing: Apply AI systems to handle contract analysis, loan processing, and regulatory documentation, minimizing manual work and accelerating turnaround times.

Streamline Compliance Operations: Use AI to automate regulatory reporting, transaction monitoring, and audit processes, simplifying compliance workflows and reducing manual intervention.

Real Life Example: JPMorgan Chase's COiN (Contract Intelligence) platform analyzes 12,000 commercial credit agreements annually, reducing legal review time by 360,000 hours per year and saving $150 million through improved fraud detection and operational efficiency.

5. Regulatory Compliance and Ethics

Banks must embed compliance considerations into every AI initiative from the design phase, ensuring transparency, auditability, and adherence to evolving regulatory requirements. This proactive approach prevents costly penalties while building stakeholder trust.

Action:

Implement Compliance-by-Design: Integrate regulatory requirements into AI development processes from the outset, ensuring all systems meet current and anticipated regulations.

Establish Continuous Monitoring: Deploy AI systems that automatically track regulatory changes and adjust compliance protocols in real-time.

Create Audit Trail Documentation: Maintain comprehensive records of AI decision-making processes, model training data, and system changes to support regulatory examinations.

Real Life Example: Standard Chartered Bank uses AI-powered transaction monitoring systems that adapt to new AML regulations automatically, reducing false positives while maintaining compliance with global financial crime prevention standards across multiple jurisdictions.

6. Data-Driven Decision Making

Banks should establish strong data governance frameworks that enable AI systems to access high-quality, unbiased data while maintaining privacy and security standards. This foundation supports accurate AI models and reduces risks associated with poor data quality.

Action:

Implement Data Quality Management: Establish processes for data validation, cleansing, and bias detection to ensure AI models receive accurate input data.

Create Data Privacy Safeguards: Deploy privacy-preserving techniques like federated learning and differential privacy to protect customer information while enabling AI training.

Establish Data Lineage Tracking: Implement comprehensive tracking of data sources, transformations, and usage to support model explainability and compliance requirements.

Real Life Example: Wells Fargo uses AI-driven mortgage underwriting systems that analyze borrower creditworthiness through automated income and property appraisal verification, improving processing speed while maintaining data accuracy and regulatory compliance.

Having a clear strategy in place sets the direction for AI initiatives, but timing the move to full adoption is just as important. Understanding when to make the switch ensures banks can turn plans into action and capture real benefits.

When Should Banks Make the Switch to AI?

Banks should consider making the switch to AI when they recognize the need to move beyond traditional methods and are ready to improve speed, accuracy, and customer experience through smarter automation. This decision marks a shift toward embracing technology that can handle complexity and scale more effectively.

Regulatory complexity grows: Manual compliance checks struggle to keep up with shifting rules across regions, increasing the risk of errors and delays. AI can track changes and flag issues automatically.

Data volume overwhelms analysis: Traditional systems miss subtle fraud or credit risk signals hidden in large datasets. AI models can analyze diverse data sources quickly and accurately.

Customer demands exceed capacity: When customers expect instant loan approvals or 24/7 support, legacy processes cause delays. AI automation and chatbots handle routine tasks, freeing staff for complex cases.

Rising operational costs: Back-office tasks like document review and transaction monitoring consume too many resources with slow results. AI reduces manual work and improves precision, lowering costs.

Limited product innovation: Outdated systems and slow data processing hinder personalized offers. AI enables faster, data-driven product development.

Once banks decide when the time is right to move to AI, the next focus is on choosing the right tools and partners to meet rising customer expectations. Platforms like smallest.ai offer practical ways for banks to put AI into action, helping them respond faster, personalize services, and keep up with what customers want.

Read more: Exploring Intelligent Agents in Artificial Intelligence

How Smallest.ai Helps Banks Automate Collections and Improve Voice AI ROI

Smallest.ai’s AI voice agents handle high-volume banking interactions, from collections and payment disputes to routine support, with measurable impact. In real deployments, banks have seen up to 45% higher call pick-up rates and 50% faster resolution times, helping reduce agent load while improving customer experience.

Here’s how smallest.ai delivers value:

Fast and Accurate Voice Models: With sub-100ms response time, their voice agents can handle acronyms, long numbers (like credit cards), and varied caller intents, all with natural pacing and intonation.

Custom Deployment & Data Privacy: Whether on-premise or in the cloud, smallest.ai ensures data never leaves the designated inference hardware. They’re certified across SOC 2 Type II, HIPAA, PCI, and ISO standards.

No-Code, Rapid Setup: Build, test, and deploy AI voice agents in minutes using your brand’s voice and knowledge base, no ML expertise required.

Seamless Legacy Integration: Easily connect to CRMs, payment platforms, and legacy tools common in banking and debt collection.

Transparent, Scalable Pricing: Pay only for usage with voice minutes as low as $0.05, supporting up to 10,000 concurrent calls across 16+ languages.

By combining customizable workflows, scalable infrastructure, and industry-grade security, smallest.ai equips banks to handle large call volumes, improve repayment success, and deliver better customer experiences, all while keeping control over sensitive data.

Book a demo to see how smallest.ai can help you modernize your collections and voice workflows.

Top Challenges in AI Adoption for Banks (and their Solutions)

Banks face a unique set of technical, regulatory, and operational challenges when bringing AI into their operations. Here’s a look at the main hurdles and effective solutions, backed by current industry research:

Challenge | Description | Solution |

|---|---|---|

Data Quality and Bias | Incomplete, inconsistent, or biased data skews AI in banking outcomes and risks regulatory breaches. | Deploy data validation, cleansing, and bias detection pipelines before model training. |

Model Explainability | Black-box models make it difficult to justify decisions to regulators and customers. | Use explainable AI (XAI) frameworks and model-agnostic interpretability tools like LIME/SHAP. |

Regulatory Compliance | AI in banking must meet strict, evolving requirements for transparency and accountability. | Integrate compliance-by-design, automated documentation, and audit trails into AI workflows. |

Cybersecurity Risks | AI systems can introduce new attack surfaces and vulnerabilities. | Apply adversarial testing, continuous monitoring, and multi-factor authentication for AI systems. |

Talent Shortage | Demand for AI specialists outpaces supply, slowing project delivery and quality. | Upskill internal teams and partner with academic institutions for talent pipelines. |

Integration with Legacy Systems | Outdated infrastructure resists AI adoption and limits scalability. | Use APIs, microservices, and phased migration strategies to bridge legacy and modern platforms. |

Model Drift and Performance Decay | AI models degrade over time as data patterns shift, reducing accuracy. | Schedule regular model retraining, validation, and performance monitoring. |

Customer Trust and Adoption | Customers may distrust automated decisions or digital-only service channels. | Combine AI with human oversight, clear communication, and opt-in features for sensitive tasks. |

Solving challenges such as data quality, compliance, and legacy system integration clears the way for the future of AI in banking. These solutions help banks adopt new technologies and trends that improve efficiency, personalization, and security.

Future of AI in Banking: Key Technologies & Trends

AI is changing banking by making services faster, smarter, and more personal. New tools and trends are helping banks spot problems early, offer better advice, and work more efficiently. Here’s what to watch for:

AI-Driven Risk Management: Real-time analysis of vast data sets improves credit scoring and fraud detection accuracy; JPMorgan’s AI reduced false positives by 15-20%.

Generative AI for Customer Interaction: Advanced NLP enables personalized financial advice and automates document processing, cutting loan approval times drastically.

Quantum Computing: Promises exponential speed-ups in portfolio optimization and risk simulations; HSBC investing in quantum-secure communications.

Blockchain & CBDCs: Blockchain accelerates cross-border payments; over 130 countries exploring Central Bank Digital Currencies, reshaping monetary systems.

Biometric Security: Multi-modal biometrics (face, voice, fingerprint) improve authentication and fraud prevention in mobile banking.

AutoML & RPA: Automated machine learning accelerates model deployment; robotic process automation streamlines compliance and back-office operations.

Edge Computing: Enables low-latency fraud detection by processing data near the source, improving transaction security.

AI for ESG & Sustainable Finance: AI analyzes unstructured data to assess climate and social risks, aiding banks in sustainable lending and investment.

Open Banking APIs: Facilitate secure data sharing with fintechs, expanding service offerings and customer reach.

Graph Neural Networks: Advanced analytics detect hidden fraud patterns and improve credit risk models by analyzing complex relational data.

Conclusion

AI banking is setting a new standard for how financial services operate, raising expectations for accuracy, security, and relevance across every customer interaction. As banks move from early pilots to broader adoption, the focus is shifting to tools that can deliver reliable results at scale without adding complexity.

Banks and financial institutions looking to modernize collections, reduce operational costs, and protect sensitive data at scale are turning to smallest.ai, a platform purpose-built for secure, high-performance voice automation. With voice agents that are trained to navigate complex financial conversations, smallest.ai offers a reliable, real-time AI solution that integrates seamlessly with legacy systems.

Book a demo today to see how smallest.ai can power your next phase of AI transformation.

FAQs About AI in Banking

1. How does AI improve liquidity management for banks?

AI is now used to predict cash flow needs and optimize liquidity, helping banks manage reserves more accurately and reduce costs related to holding excess capital.

2. Can AI help banks with regulatory compliance?

AI systems automate compliance reporting and even run regulatory stress tests, making it easier for banks to keep up with changing rules and avoid penalties.

3. What role does AI play in expanding credit access to the underbanked?

AI-powered credit decisioning analyzes alternative data, like rent payments and utility bills, so banks can offer loans to people without traditional credit histories, opening up new markets.

4. How is AI used in behavioral biometrics for security?

Banks use AI to monitor unique patterns in how customers interact with their devices (such as typing speed or touch gestures), adding an extra layer of fraud detection beyond passwords.

5. Can generative AI create new financial products?

Generative AI models are being used to design custom financial products and marketing messages by analyzing customer data and simulating different market conditions, which speeds up product development and personalization.