Explore how voice AI is redefining banking: from fraud detection and account queries to payments via voice. Learn architecture, challenges, and evaluation criteria for enterprise adoption.

Akshat Mandloi

Updated on

December 26, 2025 at 11:27 AM

Banking has always been about trust, speed, and accessibility. Today, those expectations are shifting toward more natural and seamless customer interactions. While mobile apps and chat remain dominant, voice is rapidly emerging as the next interface in financial services — offering customers the ability to check balances, transfer funds, or verify their identity by simply speaking.

For financial institutions, voice AI is more than a convenience layer. It is a strategic capability that can reduce call center load, enhance fraud prevention, and improve accessibility for a diverse customer base. Yet, deploying voice in banking isn’t the same as adding a voice assistant to retail or hospitality. Strict regulations, the need for precise authentication, and the complexity of financial data integrations mean that banks must approach voice AI with enterprise-grade rigor.

In this article, we’ll explore the most relevant use cases of voice in banking, the architectural patterns that make it viable, and the risks and evaluation criteria every financial institution should know before adoption.

Key Takeaways

Voice AI is moving beyond IVR: In banking, it now powers fraud alerts, identity verification, and even payments — not just balance checks.

Voice AI in banks now covers fraud alerts, KYC, payments, and account management, not just balance checks.

Sub-second latency and multi-factor authentication are critical for maintaining customer trust.

Enterprise-ready solutions must support PCI-DSS, SOC 2, GDPR, and local regulator compliance, plus on-prem or hybrid deployments.

Future-ready banks are piloting speech-native LLMs and proactive voice agents today to gain an early advantage.

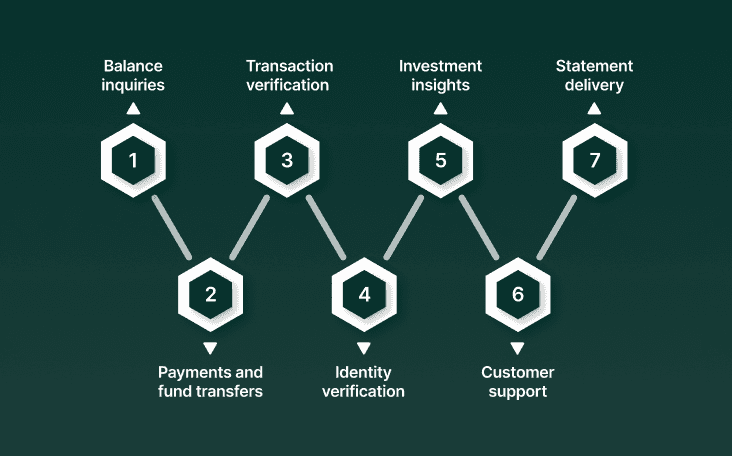

Key use cases in banking & finance

Voice AI in financial services goes well beyond replacing IVR menus. Banks and fintechs are deploying it in high-impact workflows where efficiency, security, and customer experience converge.

1. Balance inquiries and account management

Routine queries such as “What’s my current balance?” or “Show my last three transactions” are the bread-and-butter of call centers. Automating them with voice agents reduces call volumes while giving customers immediate answers.

2. Payments and fund transfers

Voice assistants can initiate transfers (“Send ₹5,000 to my savings account”) or bill payments once authentication is completed. For security, this is typically paired with multi-factor verification — such as OTPs, biometrics, or session tokens.

3. Fraud alerts and transaction verification

Banks are already using voice bots for real-time fraud alerts: when unusual activity is detected, a voice agent can call the customer to confirm or block a transaction. This shortens the response window and reduces fraud losses.

4. KYC and identity verification

Voice biometrics and conversational flows can streamline Know Your Customer (KYC) checks. Instead of filling forms or visiting branches, customers verify identity via structured voice prompts, with data cross-checked against compliance databases.

5. Investment insights and portfolio updates

Premium customers often need quick access to portfolio summaries, stock alerts, or investment advice. Voice AI can provide updates on holdings, returns, or even read analyst insights, reducing dependency on human advisors for routine updates.

6. Customer support routing & escalation

Instead of navigating complex IVR menus, customers can explain their issue in natural language. Voice AI then classifies the intent and routes the call to the right department or agent — improving first-call resolution.

7. Document and statement delivery

Voice agents can help customers request account statements or loan documents, trigger secure delivery via email or app, and confirm completion — closing the loop in one conversation.

Also read:

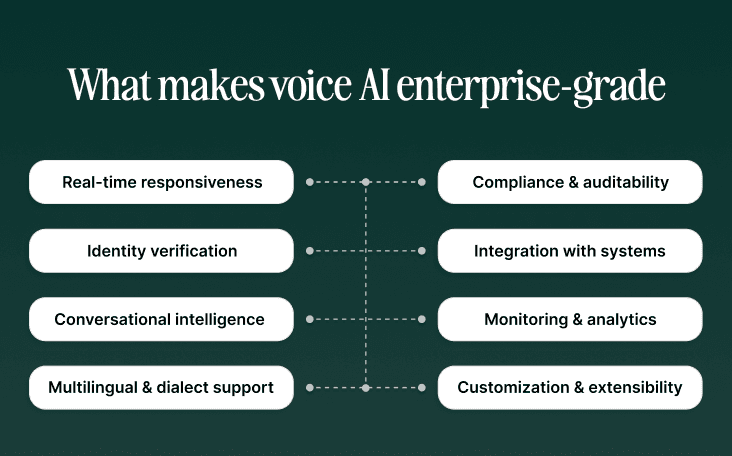

What makes voice AI enterprise-grade in finance

Not all voice technologies are suited for the rigor of financial services. Unlike retail or hospitality, banks deal with sensitive data, strict regulations, and real-time risk. Here’s what separates an enterprise-grade banking deployment from a consumer-grade voice assistant:

1. Real-time responsiveness

In fraud alerts, loan inquiries, or payments, latency kills trust. Banking voice agents must deliver sub-second response times (<100 ms round-trip) to keep conversations natural and prevent drop-offs.

2. Security, compliance & auditability

Banks face strict requirements: PCI DSS, SOC 2, GDPR, HIPAA (for health-linked products), and local financial regulators. Voice systems must provide:

Encryption for audio streams and transcripts

Secure session management

Full audit trails for compliance checks

Options for on-premises or hybrid deployment to meet data residency laws

3. Identity verification & anti-spoofing

Voice biometrics can streamline authentication, but they are also vulnerable to deepfake voice spoofing. Enterprise systems must combine voice biometrics with multi-factor verification (OTP, device fingerprint, behavioral analytics) to harden defenses.

4. Integration with core banking systems

Financial services rely on core banking platforms, CRMs, fraud detection engines, and payment networks. Voice AI must integrate seamlessly through APIs, middleware, or event buses — without adding friction or risk.

5. Conversational intelligence in financial context

Banking language is filled with acronyms, domain terms, and compliance disclaimers. Voice agents must:

Recognize domain-specific vocabulary (e.g., ACH, UPI, FDIC, NEFT)

Handle long dialogues (loan applications, KYC interviews)

Support interruptions and clarifications without losing context

6. Monitoring & analytics

Enterprises need dashboards for:

Call containment rate

Fraud false positives / false negatives

Average handle time (AHT)

Escalation percentage & CSAT

This data not only improves AI performance but also strengthens compliance reporting.

7. Multilingual & dialect support

Banks often serve diverse populations. Enterprise-ready systems must support 10+ languages and dialects, with robustness for accents and code-mixing (e.g., Hindi-English, Spanish-English).

8. Customization & extensibility

Every bank has its own brand voice and regulatory context. Systems must allow fine-tuning of voices, flows, and compliance logic to match customer expectations and brand guidelines.

Also read:

Evaluation Criteria for Banks Choosing Voice AI

Selecting a voice AI vendor isn’t just about features—it’s about fit. Below are the essential criteria banks and financial institutions must evaluate before committing:

1. End-to-end latency & call responsiveness

Demand real-world performance metrics under load (not just lab demos).

Vendors should support streaming speech models with barge-in and hold conversational continuity even with interruptions.

2. Security, compliance & auditability

Confirm certifications relevant to banking: PCI-DSS, SOC 2, ISO 27001, GDPR, and local financial regulator requirements.

Ensure full audit trails, PII redaction, session logging, and real-time anomaly alerts.

3. Authentication & anti-spoof defenses

Voice biometrics must be hardened with anti-spoofing, challenge-response prompts, and multi-factor checks (OTP, device fingerprinting).

Be wary: new attacks like SyntheticPop show spoofing systems can degrade biometric accuracy drastically.

4. Integration depth & domain context

The vendor must support secure, low-latency connectors to core banking systems, risk engines, CRMs.

The AI should handle domain-specific vocabulary (SWIFT, NEFT, ACH) and long multi-turn dialogues.

5. Deployment flexibility & data residency

Verify whether the solution can run on-prem, hybrid, or in regulated environments to meet data residency or local regulator mandates.

Public cloud–only solutions may violate compliance in many jurisdictions.

6. Observability & operations

Real-time dashboards tracking containment, false positives, call drop rate, latency, escalation rates.

Ability to export logs, generate reports for audits, and monitor for fraud or anomalies.

7. Scalability, reliability & redundancy

Providers should guarantee high availability (e.g. >99.9% uptime) and global redundancy (multiple PoPs).

Ability to scale to peak banking volumes (e.g. month-end spikes) without degradation.

8. Customization, extensibility & vendor lock-in

The bank should be able to customize voice personas, flows, and compliance logic.

Prefer architectures or vendors that allow gradual migration or fallback (avoid total lock-in).

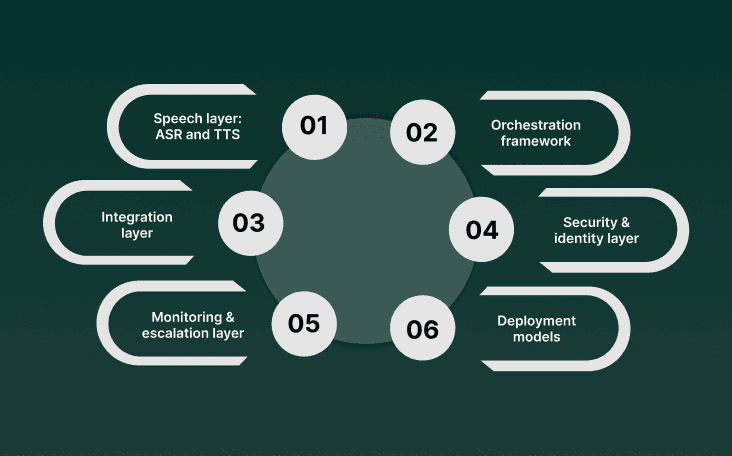

Architectural patterns & technology stack

Building voice AI for banking isn’t just about adding speech recognition to a chatbot. It requires a layered architecture that balances performance, security, and integration with existing financial systems.

1. Speech layer: ASR and TTS

Automatic Speech Recognition (ASR): Converts speech to text in real time, with custom vocabularies for financial terms (e.g., “SWIFT,” “NEFT,” “ACH”).

Text-to-Speech (TTS): Generates natural, human-like responses with expressive tone, ensuring customer trust.

Streaming pipelines: Needed for <100 ms latency in live calls.

2. Agent & orchestration framework

Frameworks such as LangChain, Semantic Kernel, or AutoGen handle reasoning, memory, and task orchestration.

In banking, orchestration must support:

Multi-step workflows (fraud alerts, loan applications)

Context retention across long calls

Tool usage for database lookups, transaction validation, and risk scoring

3. Integration layer

Middleware and APIs connect the voice agent to core banking systems, CRMs, fraud engines, and payment networks.

Event-driven architectures (Kafka, Pub/Sub) ensure scalability and reliability.

Secure connectors enforce least-privilege access and transaction logging for compliance.

4. Security & identity layer

Encryption of all audio and text data in transit and at rest.

Identity verification via biometrics, OTP, device fingerprinting, or multi-factor authentication.

Anti-spoofing measures to detect deepfake voices before granting access.

5. Monitoring & escalation layer

Continuous monitoring of latency, fraud detection accuracy, containment rates, and CSAT.

Seamless escalation to human agents with full transcript + metadata handoff.

Compliance dashboards for audit and reporting.

6. Deployment models

Cloud-native: fast to deploy but may raise compliance concerns.

Hybrid: voice processing in cloud, sensitive data on-prem.

On-premises: critical for banks in tightly regulated geographies. See Enterprise Voice AI On-Premises Deployment Guide.

Related:

Conclusion

Voice AI is no longer an experiment for banks — it is becoming a strategic capability for customer service, fraud prevention, and even transactions. But unlike retail or hospitality, financial services operate under strict regulations and high stakes. That means banks must demand enterprise-grade voice AI: systems with sub-second latency, layered authentication, regulatory compliance, and deep integration into core banking infrastructure.

The early movers in banking are already piloting fraud alerts, identity verification, and payments via voice. Over the next few years, speech-native LLMs, multilingual voice agents, and edge deployments will set the new standard.

At Smallest.ai, we help banks and financial institutions deploy secure, real-time voice AI with enterprise-ready compliance and integration. From on-prem deployments to sub-100 ms response times, our APIs and frameworks are designed to meet the demands of regulated industries. Talk to our team to explore how voice AI can reshape your customer experience.

FAQs

1. How is voice AI different from traditional IVR in banking?

Traditional IVR uses static menus (“Press 1 for balance”). Voice AI uses speech recognition + NLU to understand intent, answer queries directly, and escalate contextually — creating a more natural, human-like experience.

2. What are the top use cases for voice AI in banks?

Key workflows include balance inquiries, payments, fraud alerts, KYC verification, portfolio updates, and support routing. These reduce call center load while enhancing customer trust.

3. Is voice biometric authentication safe enough for banking?

On its own, no. Modern fraudsters can spoof voices using AI. Banks must pair voice biometrics with MFA — OTPs, device fingerprints, or challenge-response prompts — plus anti-spoofing checks.

4. Can banks deploy voice AI on-premises for compliance?

Yes. Many vendors, including Smallest, support on-prem or VPC deployments, which are often required for compliance with PCI-DSS, HIPAA, and data residency laws.

5. What KPIs should banks track when deploying voice AI?

Focus on containment rate, fraud false positives/negatives, latency, escalation rates, AHT, and CSAT. These show both security and customer impact.

6. What’s next for voice AI in finance?

Expect speech-native LLMs, multilingual robustness, and proactive voice agents that initiate fraud checks or reminders — all running closer to the edge for lower latency.

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now