Discover the top AI collection tools for debt recovery in 2025, comparing platform features, industry fit, and key performance outcomes.

Akshat Mandloi

Updated on

January 27, 2026 at 4:58 PM

Organizations managing receivables face growing pressure to accelerate collections, reduce operational costs, and meet compliance requirements. AI collection solutions are becoming central to this effort, enabling teams to automate manual tasks, engage debtors proactively, and use data more effectively to improve recovery performance.

The scale of this shift is reflected in the numbers: the Global AI for Debt Collection Market is expected to reach around USD 15.9 billion by 2034, up from USD 3.34 billion in 2024. This projection highlights the increasing demand for AI collection tools that support measurable results.

In this guide, you'll find a detailed overview of the best AI collection software and platforms available in 2025. Each section focuses on features, strengths, and practical considerations to help your organization select a solution suited to its operational goals and collection strategy.

TL;DR (Key Takeaways)

Lower costs, higher efficiency: Automating routine tasks like calls and reminders cuts operational costs by up to 25% and boosts productivity.

Improved recovery & engagement: ML-based personalization of timing and channels drives up to 2× higher recoveries and 3–5× better response rates.

24/7, compliant outreach: AI agents operate round the clock across voice, SMS, and email while ensuring regulatory compliance.

Smarter collections with real-time insights: Dashboards and predictive analytics enable risk-based strategies and fast campaign adjustments.

Scalable & integrated platforms: Modern tools plug into existing systems and scale easily, supporting growth and secure data handling.

What is AI in Debt Collection?

AI in debt collection refers to the application of artificial intelligence, including machine learning, conversational agents, and data analytics, to automate and improve how unpaid debts are identified, prioritized, communicated, and recovered.

These systems analyze vast amounts of debtor data to predict repayment likelihood, personalize engagement, and streamline operations, reducing reliance on manual processes and improving outcomes for both creditors and debtors.

Benefits of AI in Debt Collection

Several aspects of debt recovery stand out when AI collection becomes part of the equation. Here’s how these systems change outcomes for both creditors and the individuals they serve.

Improved Recovery Rates: AI models assess debtor risk and optimize contact strategies, increasing the likelihood of successful repayments without alienating customers.

Personalized Engagement: Machine learning customizes communication timing and tone for each debtor, improving response rates and customer experience.

Operational Cost Reduction: Automating routine calls, emails, and follow-ups enables staff to focus on complex cases, thereby reducing labor costs.

Compliance and Fairness: AI systems apply regulatory rules consistently, helping organizations avoid violations and maintain ethical standards.

Real-Time Analytics: Continuous analysis of campaign performance enables rapid adjustments, maximizing effectiveness across different debtor segments.

How AI in Debt Collection Works

At the core of AI collection is a sequence of actions that convert raw data into actionable debt recovery. Here’s a look at how these systems operate behind the scenes.

Data Analysis: AI reviews historical payment patterns, demographic information, and behavioral data to score each debtor’s likelihood to repay.

Conversational AI Agents: Platforms such as smallest.ai deploy AI-powered voice agents to handle inbound and outbound calls, negotiate payment plans, and answer debtor questions around the clock.

Dynamic Contact Strategies: Systems automatically select the best channel (call, SMS, email) and timing for each contact, based on predictive analytics.

Payment Optimization: AI suggests payment arrangements that balance debtor capacity with creditor needs, often resulting in higher settlement rates.

Feedback Loops: Outcomes from each interaction are fed back into the AI model, continuously refining predictions and strategies.

Several platforms have emerged that apply AI collection to real-world debt recovery situations. Their designs reflect the varied requirements of different sectors and recovery models. Not all systems deliver the same results; distinctions become apparent in how each handles scale, reporting, and compliance.

Top 10 AI in Debt Collection Tools

AI collection tools are designed to fit into specific business environments, addressing compliance, scalability, and integration needs across sectors. The most relevant platforms adapt to industry standards and operational realities, focusing on practical outcomes rather than generic automation. Organizations select these solutions based on how well they align with real-world debt recovery challenges.

Here are some of the leading options available:

1. Smallest.ai

Smallest.ai delivers smart voice agents that accelerate debt collection recovery across entire portfolios. The platform focuses on making debt collection more effective through intelligent automation and respectful customer interactions.

Available 24/7 Voice Outreach: AI voice agents place calls any time with auto-dialers and verified caller IDs, boosting pick-up rates by up to 45% and ensuring timely payment reminders without operational downtime.

Build Debtor Trust with Empathetic AI: Agents interact like top human performers, firm, respectful, and empathetic, delivering smooth and professional experiences to preserve customer relationships.

Take Real Actions with Real-Time CRM Updates: The AI negotiates payment terms, confirms payments, and updates CRM systems in real-time, speeding call resolution by up to 50%, keeping teams synchronized and operations smooth.

Insightful, Unified Dashboard: Track call attempts, promises to pay, and collections in a simple, user-friendly recovery insights dashboard giving full portfolio visibility and actionable intelligence.

Smooth Human Escalation: When cases require complexity beyond automation, leads are automatically escalated to live agents, reducing fallback rates by 65% and capturing every opportunity.

Lightning-Fast, Customizable AI Voices: Speech generation occurs in under 100ms, customizable for brand voice, instructions, and linked knowledge bases.

Highly Scalable Infrastructure: Supports up to 10,000 concurrent calls with auto-scaling, integrating easily with legacy systems common in banking or manufacturing environments.

Enterprise-Grade Security: Smallest.ai safeguards data on custom inference hardware, ensuring no information leaves the client’s infrastructure. Compliance includes SOC 2 Type 2, HIPAA, and PCI standards for cloud and on-premises deployments.

2. TrueAccord

TrueAccord offers an AI-driven digital debt collection platform designed specifically for consumers. The platform leverages patented machine learning, called HeartBeat, to create personalized consumer journeys that optimize messaging, timing, and communication channels for each debtor.

Consumer-Focused Engagement: Uses AI to contact consumers at the right time, place, and channel, improving satisfaction and recovery outcomes.

Personalized Journeys: The patented HeartBeat engine dynamically customizes messaging, timing, and frequency based on individual behaviors, eliminating one-size-fits-all campaigns.

Self-Serve Digital Portal: Empowers consumers to resolve debts independently; 96% of payoffs are completed without human interaction.

Scalable Platform: Efficiently and compliantly scales to any collection volume, adaptable to seasonal changes and external events.

3. HighRadius

HighRadius provides an AI-based automated debt collection software that helps organizations achieve a 20% reduction in past due accounts while increasing productivity by 30%. The platform offers comprehensive automation across the entire collections process.

Automated Email Management: Simplify customer communication by automating follow-ups, reminders, and dunning emails with personalized templates and AI-driven recommendations for improved response rates.

Risk-Based Prioritization: Use artificial intelligence to prioritize accounts and automate task allocation, allowing collectors to focus on high-value activities while the system handles routine tasks.

Productivity Improvement: Streamline collector workflows with centralized dashboards, automated call logging, and intelligent task assignments that double efficiency.

Real-Time Analytics: Gain actionable insights into collection performance, account status, and cash flow trends through interactive dashboards for informed decision-making.

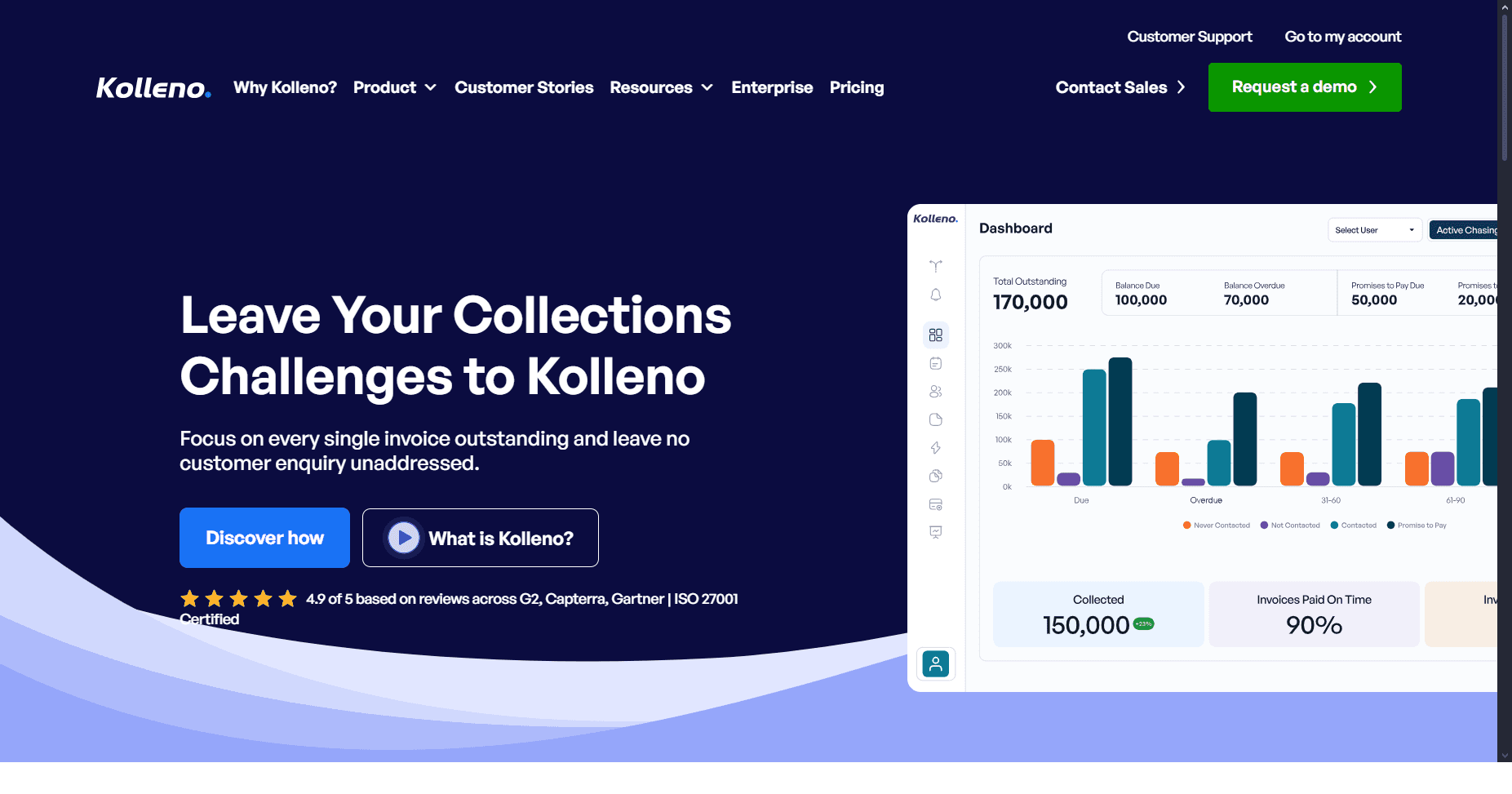

4. Kolleno

Kolleno offers a comprehensive AI debt collection software platform that automates accounts receivable management and collections processes. The solution helps organizations achieve 3-5X increased client response rates while reducing manual workload.

Collection Workflow Automation: Create collection workflows at both invoice and customer levels using a combination of emails, phone calls, notes, and internal task assignments.

Intelligent Dunning Process: Customize dunning processes for each company's credit risk profile, outstanding balance, and days overdue with optimized payment reminders.

AI-Driven Automation: Use machine learning tools to determine the most effective customer communication methods and optimal timing for maximum impact.

Daily Task Management: View daily to-do lists that manage tasks, communications, notes, and reminders with notifications for all customer payments and recommended actions.

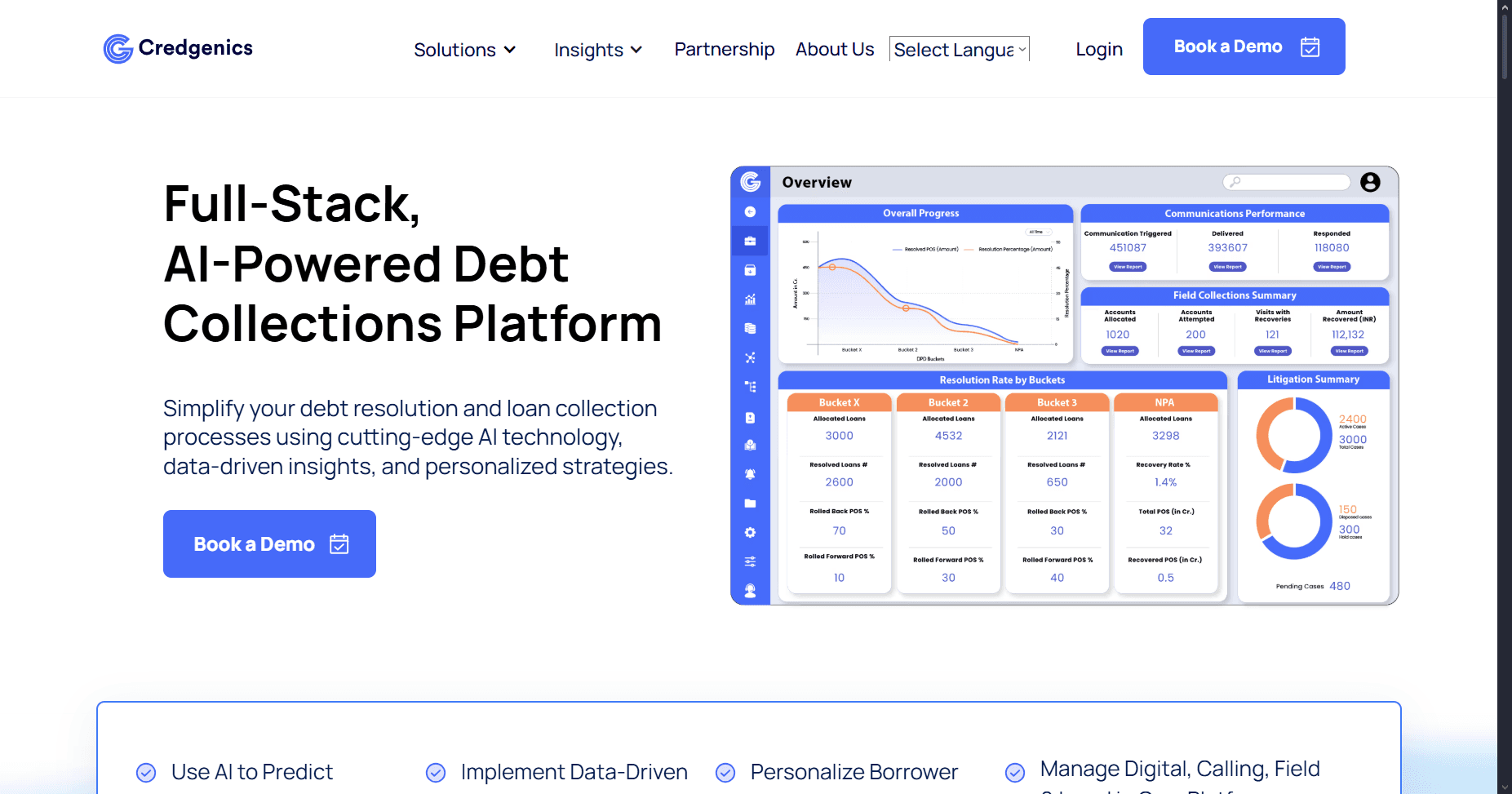

5. Credgenics

Credgenics combines artificial intelligence with data science to optimize and standardize debt collection activities for lenders. The platform handles loan books exceeding USD 180.7 million for major Indian financial institutions.

Operational Efficiency: Optimize collection workflows using predictive analytics and automation to streamline processes and reduce manual intervention.

Intelligent Insights: Predict borrower behaviour and minimize pre-due flow rates with machine learning-powered risk assessments for proactive intervention.

Personalized Engagement: Engage borrowers with multilingual, AI-driven communications specifically designed for individual customer profiles and preferences.

Compliance Monitoring: Stay compliant with smart tracking and integrated regulatory dashboards that automatically monitor adherence to collection regulations.

6. Gaviti

Gaviti operates as an AI-powered accounts receivable platform that automates the repetitive aspects of collections while making A/R controllable, predictable, and scalable. The platform has facilitated billions of dollars in business annually.

Credit Management: Conduct thorough and quick credit checks with ongoing customer risk assessment for faster application processing and better decision-making.

Collections Optimization: Lower DSO and late invoices through effortless customer reminders, unlimited workflow options, and task prioritization for collection teams.

Payment Processing: Provide hands-off customer payment portals that accept payments anytime, allow customers to pay as they prefer, and reduce errors and fraud.

AI Assistant: Access an all-knowing assistant for receivables management that optimizes dunning emails, provides credit decision information, and builds strong customer relationships.

7. Esker

Esker offers a comprehensive accounts receivable solution suite that automates everything within the credit-to-cash process using AI technology. The platform provides end-to-end efficiency while reducing DSO and improving team productivity.

Credit Management: Optimize credit approval and risk monitoring processes by combining internal and external credit information with predictable insights for data-driven decisions.

Collections Management: Efficiently collect cash by automating key collection strategy steps and prioritizing tasks based on AI predictions and risk analysis.

Cash Application: Eliminate repetitive tasks in cash allocation by reconciling incoming payments to open items with AI-powered remittance management and auto-matching.

AI-Driven Risk Analysis: Analyze customer payment behaviour to estimate payment default risk and help reprioritize collection efforts accordingly.

8. InDebted

InDebted provides human-centred collections and decision-making solutions that improve customer experience, liquidation, and efficiency through scalable infrastructure, data analytics, and AI.

AI-Powered Decision Making: Use machine learning decision engines for personalized outreach strategies based on real-time customer data and payment behaviour patterns.

Omnichannel Communication: Reach customers through their preferred channels, including voice, SMS, email, and digital platforms for maximum engagement.

Vulnerability Detection: Inform real-time agent decision-making and vulnerability detection using an ML-driven strategy for better customer outcomes.

Compliance Integration: Ensure all consumer protection laws and regulatory requirements are built into AI systems from the start for confident collection practices.

9. Tesorio

Tesorio provides finance leaders with the industry's first AI-driven connected finance operations platform designed to empower business partners while maintaining capital efficiency.

Automated Follow-ups: Deploy pre-built email templates that trigger at key moments with personalized messages including invoice details and payment links.

Personalized Communication: Customize outreach based on customer history, payment trends, and risk levels using AI-powered insights for faster payments.

Predictive Analytics: Analyze transaction-level data using machine learning to anticipate cash flow performance and take proactive action.

Intelligent Workflow: Provide advanced A/R automation tools including payment prediction, collections forecasting, and self-service customer payments.

10. CollectWise

CollectWise automates the entire late-stage debt collection process using AI agents that recover 2X as much debt at a fraction of the cost. The platform enables creditors to achieve 2X higher recovery rates while reducing costs by 50%.

Personalized Collection Strategies: Research and analyze each debtor's financial profile using continuous learning models to craft individual recovery strategies.

Pre-Legal Recovery: Automate the entire pre-legal recovery process across every communication channel, including credit reporting and attorney connections.

Automated Legal Actions: Handle essential legal actions, including asset research, litigation paperwork preparation, and judgment enforcement, such as garnishments or liens.

Recovery Rate Improvement: Enable enterprise creditors and debt buyers to achieve significantly higher recovery rates through intelligent automation.

Here is a detailed look at their pricing options;

Tool | Entry Plan | Mid-Tier Plan | Enterprise Plan |

|---|---|---|---|

Smallest.ai | Free -, basic features | Pro $1,999.00/month - 10 concurrent requests | Custom pricing |

HighRadius | Enterprise pricing only | Contact for a custom quote | Custom enterprise pricing |

Kolleno | BusinessPay - $80/month | Business Plus - $650/month | Enterprise - Custom pricing |

Credgenics | Free plan available | Contact for pricing | Enterprise features available |

Gaviti | Custom pricing based on modules | Modular pricing per feature | Enterprise custom pricing |

Esker | Starting at $1/month | Custom pricing | Enterprise solutions available |

InDebted | Contact for pricing | Contact for pricing | Contact for pricing |

Tesorio | Contact for pricing | Contact for pricing | Custom enterprise pricing |

TrueAccord | Contact for pricing | Contact for pricing | Enterprise - Custom pricing |

CollectWise | Contingency-based pricing | Transparent percentage fees | Custom enterprise solutions |

With the available options in mind, the next step is making a selection that fits your specific needs. The right AI collection tool for one operation might not suit another, given differences in recovery volume, regulatory requirements, and internal systems. The questions you ask about these distinctions often determine the most relevant choice.

Here is an interesting read: Conversational AI for Insurance: Uses, Benefits, and Key Challenges

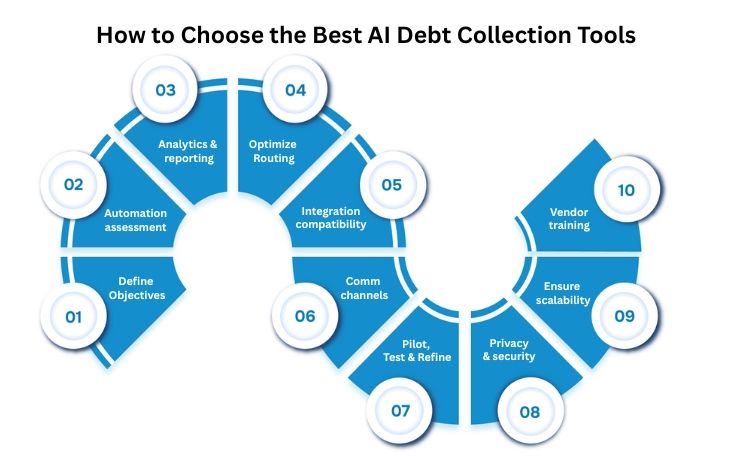

How to Choose the Best AI Debt Collection Tools

A significant evaluation of AI collection tools begins with recognizing what matters most for your recovery process; considerations extend beyond feature lists to practical fit. Your industry needs and system compatibility often determine which AI platform will deliver the best results. Focus on aspects that directly influence daily outcomes for your team and those you serve. Here’s how:

Define objectives and metrics: Clarify the organisation’s main collection goals, whether focused on accelerating repayments, reducing bad debt, or improving customer experience, before assessing any AI collection platform’s suitability.

Assess automation capabilities: Select an AI collection system that automates high-volume tasks such as reminders and account monitoring, freeing teams to concentrate on exceptions and complex cases.

Evaluate analytics and reporting: Choose solutions that provide advanced analytics for debtor segmentation, account risk scoring, collection performance, and predictive insights to inform strategic decisions.

Consider integration and compatibility: The best AI collection tools connect with existing finance, CRM, and ERP systems without disrupting business operations and support centralized data management.

Verify compliance management: Confirm that the platform meets regulatory requirements (such as GDPR, FCA, FDCPA, and PCI DSS), supports audit trails, and keeps all processes transparent and secure.

Check multi-channel communication: Prioritize providers offering voice, SMS, email, and digital portals so organisations can contact debtors via preferred channels for improved engagement.

Review data privacy and security: Select AI collection software with leading certifications and encryption protocols, maintaining data protection for sensitive financial and personal information.

Ensure scalability: Opt for technology that maintains consistent performance across rising volumes, with features designed for enterprise growth and cross-border operations.

Assess user experience and dashboard clarity: Choose a platform with clear user dashboards and intuitive controls to support quick adoption among finance teams and non-specialist staff.

Evaluate vendor support and training: The provider should offer strong customer support, onboarding, and training resources for successful adoption and ongoing performance improvement.

Conclusion

As organizations aim to improve recovery outcomes and operational accountability, AI collection tools are becoming a central part of modern debt management strategies. These platforms allow finance teams to automate outreach, reduce manual effort, and act on real-time insights, while complying with regulatory standards and protecting sensitive data.

Among the most capable solutions, smallest.ai delivers AI-driven voice agents purpose-built for debt collection. Designed to operate at scale, the platform offers 24/7 communication, real-time reporting, and secure integration with existing systems. For organizations looking to modernize collections while maintaining professional customer engagement, Smallest.ai provides a highly practical and effective solution.

To see how smallest.ai can support your collections strategy, request a demo today and explore what AI-driven voice agents can deliver for your organization.

FAQs About AI in Debt Collection

1. Can AI collection agents operate outside typical business hours?

Yes, AI collection tools can engage debtors 24/7, increasing contact rates and allowing interaction during evenings and weekends when traditional call centers are closed.

2. How does AI collection support regulatory compliance?

AI collection systems follow programmed rules based on regional regulations, ensuring consistent adherence and reducing risks of non-compliance.

3. Are AI collection tools effective at prioritizing accounts?

AI uses data-driven risk assessment models to segment debtors by likelihood to pay, enabling collectors to focus resources on high-priority accounts.

4. Can AI collection improve customer experience during debt recovery?

Yes, AI enables personalized communication customized to each debtor’s behaviour and preferences, supporting respectful and non-confrontational engagement.

5. Does AI collection reduce operational costs significantly?

Organizations have documented reductions in staffing needs and up to 25% lower operational costs by automating routine outreach with AI agents.

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now