Discover what conversational AI in insurance is, explore real-world use cases, and learn about the main challenges facing insurers today.

Akshat Mandloi

Updated on

January 27, 2026 at 5:00 PM

Insurance has always been about trust and clear communication, but the ways people interact with their providers are changing fast. Conversational AI is stepping up to handle everything from answering coverage questions to guiding customers through claims, no hold music, no confusing menus, just straightforward help when it's needed.

The momentum behind this shift is impossible to ignore, the conversational AI in the insurance market is on track for a 26.60% annual growth rate through 2031, with a projected value of $1.01 trillion. As these systems become more common, the real challenge is making sure every interaction feels less like a transaction and more like a conversation that actually helps.

In this guide, you’ll find a closer look at how conversational AI is being used across the insurance sector

TL;DR (Key Takeaways):

Claims Automation at Scale: Conversational AI cuts manual claims work by up to 80%, handling intake, checks, and fraud detection in real time for faster settlements.

24/7 Personalized Support: AI chatbots and voice agents answer policy questions and give recommendations any time, driving higher satisfaction.

Easy System Connections: Modern solutions link directly to policy, billing, and CRM systems, enabling real-time updates without ripping out old tech.

Data Security and Compliance: Platforms like smallest.ai meet SOC 2 Type 2, HIPAA, and PCI standards, keeping insurance data protected and compliant.

Scalable, Human-Like Voice Automation: Smallest.ai’s AI agents handle thousands of calls at once, negotiate payments, and use natural language for complex insurance tasks.

What is Conversational AI in Insurance?

Conversational AI in insurance refers to digital systems, like chatbots and virtual assistants, that interact with people using natural language, either through text or voice. These systems handle everything from answering policy questions to processing claims, all while sounding less like a script and more like a real person.

How It Works in Practice?

Here’s how conversational AI actually handles the day-to-day work that matters most:

Claims Processing: Instead of waiting on hold or filling out lengthy forms, policyholders can report an accident or file a claim by chatting with a virtual agent. The AI collects details, verifies information, and even initiates the claim review process, often in real time.

Policy Management: Customers can ask about their coverage, request changes, or get documents sent to their email, all through a conversation with the AI. This cuts down on back-and-forth emails and phone calls.

Quoting and Sales: Prospects can get personalized quotes by answering a few questions in a chat window. The AI pulls data, calculates premiums, and explains coverage options in plain English.

Customer Support: Virtual assistants handle routine questions, like billing, renewal dates, and coverage details, freeing up human agents to focus on more complex requests.

While conversational AI sets the foundation for smarter, more responsive insurance operations, its real impact shows up in the day-to-day work. Here’s where these tools are actively changing how insurers handle everything from claims to customer feedback

Read more: What Are AI Phone Agents and How They Work

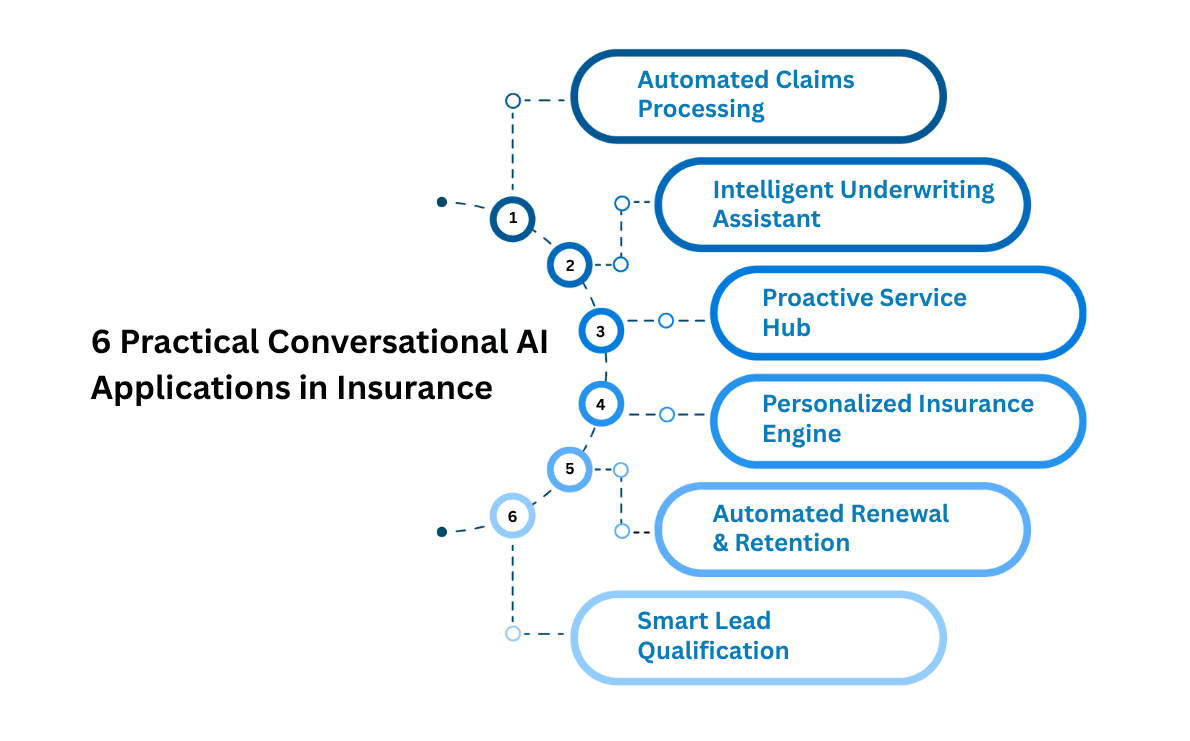

6 Practical Conversational AI Applications in Insurance

Conversational AI is moving beyond simple automation to address specific challenges insurers face every day. Here are six practical applications where these tools are actively improving workflows, customer interactions, and operational outcomes:

1. Real-Time Claims Processing Automation

Conversational AI transforms the traditional claims process from a weeks-long ordeal into a streamlined, minutes-long interaction. This application handles first notice of loss (FNOL) through smart document analysis and automated decision-making.

What it does for businesses:

Immediate Claims Intake: Claims can be filed instantly through natural language interactions, with AI extracting key information from conversations and uploaded documents. The system processes damage assessments using image recognition and OCR technology, reducing initial claim processing time by up to 80%.

Automated Documentation and Verification: AI systems automatically verify policy details, cross-reference coverage information, and generate necessary documentation without human intervention. This eliminates manual data entry errors and accelerates the entire verification workflow.

Fraud Detection Integration: Advanced algorithms analyze claim patterns and flag suspicious activities in real-time, with accuracy rates reaching 99.9% in detecting fraudulent claims. This proactive approach helps insurers prevent losses before they occur.

Intelligent Claims Routing: Claims are automatically categorized and routed to appropriate specialists based on complexity, with routine claims processed through straight-through processing while complex cases receive human attention.

2. Intelligent Underwriting Assistant

Conversational AI revolutionizes underwriting by analyzing vast amounts of data in real-time, providing underwriters with actionable insights and automating routine risk assessments.

What it does for businesses:

Automated Risk Assessment: AI systems analyze applicant data, financial statements, and historical claims to generate comprehensive risk profiles. This process reduces underwriting time from days to hours while maintaining accuracy levels that match experienced professionals.

Document Analysis and Extraction: Advanced OCR and NLP technologies extract critical information from applications, medical records, and financial documents. The system identifies missing information and flags potential concerns automatically.

Regulatory Compliance Monitoring: AI continuously monitors for compliance violations and regulatory changes, ensuring underwriting decisions align with industry standards and legal requirements.

Dynamic Pricing Optimization: Machine learning algorithms analyze market conditions, competitor pricing, and risk factors to recommend optimal premium structures in real-time.

3. Proactive Customer Service Hub

AI-powered customer service provides 24/7 support across multiple channels, handling routine inquiries while smoothly escalating complex issues to human agents.

What it does for businesses:

Multichannel Support Integration: Customers receive consistent service across phone, chat, email, and social media platforms. AI maintains conversation context across all channels, ensuring smooth transitions between touchpoints.

Instant Policy Information Access: Customers can retrieve policy details, coverage information, and payment schedules through natural language queries. The system provides personalized responses based on individual policy data.

Predictive Issue Resolution: AI identifies potential problems before they escalate, proactively reaching out to customers with solutions. This approach reduces complaint volumes and improves customer satisfaction scores.

Automated Follow-up Management: The system schedules and conducts follow-up communications, ensuring customers receive timely updates on their cases without manual intervention.

4. Personalized Insurance Recommendations Engine

This application analyzes customer data to provide customized insurance recommendations, creating personalized experiences that drive conversion and retention.

What it does for businesses:

Dynamic Risk Profiling: AI analyzes lifestyle data, behavioral patterns, and financial information to create comprehensive customer profiles. These profiles enable more accurate pricing and personalized coverage recommendations.

Real-Time Product Matching: The system matches customers with suitable insurance products based on their specific needs, preferences, and risk factors. This approach increases conversion rates by presenting relevant options.

Behavioral Analytics Integration: AI tracks customer interactions and preferences to continuously refine recommendations. This learning capability improves suggestion accuracy over time.

Cross-Selling and Upselling Automation: The system identifies opportunities for additional coverage based on life events and changing circumstances, automatically presenting relevant options to customers.

5. Automated Policy Renewal and Retention

AI streamlines the renewal process by automating communications, identifying at-risk customers, and personalizing retention strategies.

What it does for businesses:

Predictive Renewal Management: AI identifies policies expiring 60-90 days in advance and initiates automated renewal workflows. The system personalizes communication timing and channels based on customer preferences.

Churn Prevention Analytics: Machine learning algorithms analyze customer behavior patterns to identify at-risk policyholders. The system then triggers targeted retention campaigns with personalized offers.

Automated Documentation Processing: AI handles policy updates, endorsements, and renewals without manual intervention. The system generates necessary documents and processes payments automatically.

Competitive Analysis Integration: The system monitors market rates and competitor offerings to ensure renewal pricing remains competitive, automatically adjusting recommendations as needed.

6. Intelligent Lead Generation and Qualification

Conversational AI captures and qualifies leads through engaging interactions, nurturing prospects through the sales funnel with personalized communication.

What it does for businesses:

Interactive Lead Capture: AI engages website visitors through personalized conversations, gathering contact information and qualifying interest levels. This approach increases lead capture rates compared to traditional forms.

Automated Lead Scoring: The system analyzes prospect interactions and responses to assign lead scores, prioritizing high-quality prospects for sales team follow-up.

Personalized Nurturing Campaigns: AI creates customized follow-up sequences based on prospect behavior and interests, maintaining engagement throughout the sales cycle.

Sales Funnel Optimization: The system tracks prospect journey analytics and identifies optimization opportunities, automatically adjusting conversation flows to improve conversion rates.

Seeing how conversational AI delivers results across insurance workflows sets the stage for solutions built to handle real-world demands. smallest.ai brings these capabilities to life, offering tools designed for the unique challenges of insurance operations.

How Smallest.ai Delivers Powerful Conversational AI in Insurance

Smallest.ai stands out by offering AI voice agents that handle complex conversations with natural pacing and intonation, even when dealing with acronyms and numbers. These agents don’t just automate calls; they negotiate, resolve debts, and manage compliance, all while keeping data secure on custom hardware.

Key Features of smallest.ai for Insurance

AI Voice Agents for Debt Collection: Automate calls to debtors, negotiate payments, and resolve accounts quickly, freeing human teams for higher-value work.

Lightning-Fast Speech Generation: Voice responses are generated in under 100ms, allowing for fluid, human-like conversations that don’t frustrate policyholders or debtors.

Smart Automation for Higher Recovery Rates: Data-driven outreach targets the right people, at the right time, on the right channel, raising collection rates and customer satisfaction.

Cost Reduction Without Compromising Quality: AI agents reduce the need for in-house teams, cut collection costs, and eliminate high third-party fees, all with transparent pricing.

Scalable, Real-Time Operations; Supports up to 10,000 concurrent calls, making it easy to manage large insurance portfolios or sudden spikes in claims and collections.

Secure Data Handling: Meets SOC 2 Type 2, HIPAA, and PCI standards, with strict audits and on-premises options to keep sensitive insurance data protected.

Integration with Legacy Systems: Designed to work with existing insurance software and data pipelines, reducing friction when adopting new AI-driven processes.

Customizable Voice and Instructions: Adjust agent instructions, connect to your knowledge base, and select brand-specific voices to match your company’s tone and compliance needs.

smallest.ai’s conversational AI doesn’t just automate, it brings a human touch to insurance interactions, making debt collection and customer service faster, smarter, and more secure.

What Technical Aspects Define Conversational AI in Insurance?

The technical side of conversational AI insurance solutions shapes everything from reliability to compliance. Here’s what goes on behind the scenes that decision-makers should keep on their radar:

Natural Language Processing (NLP) Engines: NLP models decode user intent, extract policy details, and handle insurance-specific jargon for accurate responses. Fine-tuning these models on claims, underwriting, and policy data improves precision.

Context Management and Memory: Systems track conversation history, policy numbers, and prior claims, allowing AI to reference past interactions and deliver continuity across channels.

Multilingual Support: Conversational AI insurance platforms often support multiple languages and dialects, adapting to regional terms and compliance needs.

Integration with Core Insurance Systems: APIs connect AI with policy administration, claims management, and CRM platforms, enabling real-time data retrieval and updates without manual intervention.

Document and Image Processing: AI reads forms, IDs, and damage photos using OCR and computer vision, automating claim intake and fraud checks.

Security and Compliance: Encryption, access controls, and audit trails protect sensitive data, while systems are built to comply with HIPAA, GDPR, and state insurance regulations.

Voice Technology: Voice bots use speech recognition and text-to-speech for phone-based claims, support, and policy queries, improving accessibility for all customers.

Continuous Learning and Feedback Loops: Models retrain on new claims, customer feedback, and regulatory updates, adapting to changes in language and insurance rules.

Analytics and Reporting: Dashboards track metrics like claim resolution time, customer sentiment, and intent accuracy, helping teams fine-tune AI performance.

While technical choices set the stage for reliable conversational AI, real-world adoption brings its own set of hurdles. Addressing these challenges head-on is what separates a promising pilot from a solution that actually delivers value at scale.

Here’s an interesting read: Revolutionizing Outbound Calls in 2025 with AI: The Future of Customer Communication

What Are the Key Challenges and Solutions for Conversational AI in Insurance?

Rolling out conversational AI in insurance brings a unique set of hurdles, but practical solutions are emerging that address both technical and operational pain points:

Challenge | Solution |

|---|---|

Ambiguity in Customer Queries | Train NLP models on real insurance conversations and update regularly. |

Data Privacy and Security | Apply strict encryption, access controls, and regular compliance audits. |

Integration with Legacy Systems | Use APIs and middleware to connect AI with existing insurance platforms. |

Handling Complex Claims | Route nuanced cases to human agents with full conversation history. |

Multilingual and Regional Nuances | Build language models for local dialects and insurance-specific terms. |

Regulatory Shifts | Set up monitoring for new rules and retrain AI as policies change. |

Maintaining Conversation Context | Deploy memory modules to track user history across all channels. |

Detecting Fraud Patterns | Combine AI with external data sources and continuous model retraining. |

Conclusion

Conversational AI in insurance is moving well beyond basic automation, now driving real gains in collections, customer satisfaction, and operational clarity. The best solutions aren’t just about answering questions, they’re about handling sensitive tasks like debt recovery, policy updates, and compliance with speed and accuracy. smallest.ai stands out in this space by delivering voice agents that combine rapid response times, natural conversation, and strict security protocols.

With the ability to process thousands of calls at once, adapt to complex insurance language, and keep every interaction compliant, smallest.ai gives insurers the tools to address real business challenges, whether it’s reducing manual workload, improving customer touchpoints, or keeping data protected.

For those looking to move past one-size-fits-all automation and make measurable improvements across their operations, smallest.ai brings both the technology and the reliability to get there. Get a free demo!

FAQs About Conversational AI in Insurance

1. How does conversational AI handle complex insurance terminology and prevent misinformation?

AI systems must be trained on industry-specific language and regularly updated to minimize errors, as inaccurate responses can erode trust and potentially expose insurers to legal risks.

2. What are the challenges of integrating conversational AI with legacy insurance systems?

Many insurers rely on older policy management and claims platforms. Conversational AI must connect through flexible APIs and event-driven architectures to avoid creating new operational silos and to ensure real-time updates.

3. How do insurers protect sensitive customer data when using conversational AI?

Providers often choose on-premises or hybrid deployments, enforce strict role-based access controls, and comply with standards like GDPR, HIPAA, and PCI DSS to keep customer information secure.

4. Can conversational AI reduce the need for human intervention in compliance and documentation tasks?

Well-designed AI assistants can automate much of the compliance workflow, from logging interactions to generating audit trails, which reduces manual effort and supports regulatory requirements.

5. What steps can insurers take to address bias and fairness in conversational AI decisions?

Regular audits and ongoing model retraining are needed to identify and correct bias, ensuring that AI-driven recommendations and risk assessments remain equitable and accurate for all customer groups.