Learn how to build voice agents for debt collection. Discover proven strategies, tools, and expert tips to streamline collections. Start building today!

Prithvi Bharadwaj

Updated on

January 27, 2026 at 10:01 AM

Debt collection today is more than just phone calls and reminders—it’s a balancing act between urgency, empathy, and compliance. As global debt surges past $312 trillion, collection teams are under pressure to recover more, faster, and at lower costs. Yet the old playbook—manual dial-outs, repetitive scripts, and overloaded agents—can’t keep up.

What if there was a smarter way to scale your outreach, maintain consistency, and still sound human?

AI voice agents are reshaping how collection agencies and finance teams engage with debtors. These systems make thousands of calls simultaneously, follow compliance rules to the letter, and deliver respectful, human-like conversations 24/7. The result? Less burnout for agents, more right-party contacts, and higher recovery rates.

In this guide, we’ll walk you through how to build AI voice agents specifically for debt collection—from the technology stack and regulatory must-knows to scripting, deployment, and measurement.

TL;DR

AI voice agents streamline debt collection by handling large volumes of calls 24/7, boosting recovery rates while reducing costs.

Key technologies like machine learning, NLP, and text-to-voice drive clear, compliant conversations at scale.

Compliance & tone are crucial; AI agents must follow legal regulations and sound human-like to build trust.

Measure success through metrics like answer rates, promise-to-pay rates, and escalation rates to optimize performance.

Why AI Voice Agents Work for Debt Collection?

Managing high volumes of overdue accounts with limited staff drains time, increases stress, and often leads to missed recovery opportunities. AI voice agents solve this by taking over repetitive calls, keeping every interaction compliant, consistent, and on-script. If you're exploring how to build voice agents for debt collection that actually work at scale, here’s what makes them so effective:

Handle large volumes of outbound calls simultaneously without sacrificing script accuracy or tone.

Stay active 24/7, ensuring timely reminders, follow-ups, and late-stage escalations without waiting for office hours.

Stick to compliance rules automatically, reducing the risk of legal issues from inconsistent phrasing or tone.

Boost right-party contact rates and ensure more accounts are reached compared to manual dial-outs.

Free human agents from routine check-ins so they can focus on high-risk or disputed cases.

Lower operational costs while increasing account penetration and faster response times.

However, building these agents requires the right tools and technologies. Next, let's break down the key technologies that make these agents effective and easy to implement.

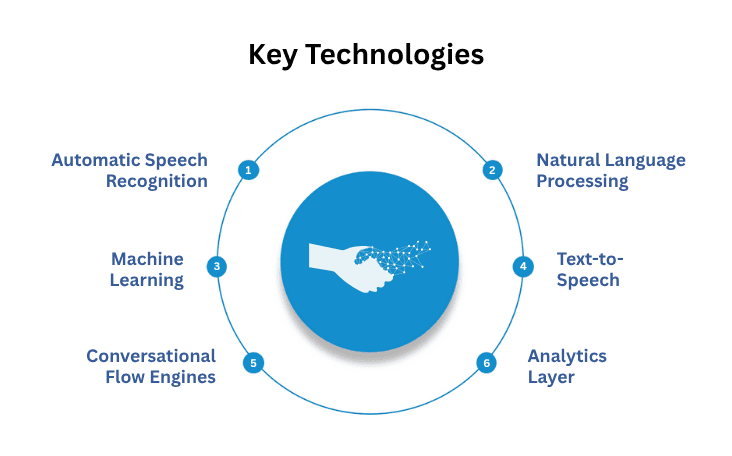

Key Technologies Behind Effective Debt Collection Voice Agents

Understanding how to build voice agents for debt collection starts with knowing the technologies that drive scalable, natural-sounding conversations. These tools work in the background to ensure interactions are not only fast and accurate but also emotionally appropriate and legally compliant.

Here are the foundational technologies:

Automatic Speech Recognition (ASR): Captures what the customer is saying with high accuracy, even with varied accents or noisy environments.

Natural Language Processing (NLP): Interprets intent behind responses like “I can’t pay now” or “call me later,” and guides the agent’s reply.

Machine Learning: Identifies patterns in payment history, helping the system prioritize accounts or adjust messaging based on debtor behavior.

Text-to-Speech (TTS): Converts written scripts into natural-sounding voice output. Modern TTS can match tone, pacing, and emotion to suit the sensitivity of the conversation.

Conversational Flow Engines: Allow branching paths in calls, so the agent can respond differently based on customer responses, rather than following a rigid script.

Analytics Layer: Tracks metrics such as answer rate, payment promises, and call escalations to help you refine scripts and strategy.

These technologies combine to create an intelligent voice experience, capable of real-time adaptation and regulatory compliance.

Key Debt Collection Rules Your AI Agents Must Follow

Jumping into automation without understanding the boundaries can cost more than it saves. Before building AI voice agents for debt collection, it’s important to know where the risks lie and how to build trust from the first call.

Regulations still apply: AI voice agents must follow TCPA and FDCPA rules, only call during approved hours, avoid excessive attempts, and always provide clear identification.

Voice tone is critical: An agent that sounds cold or robotic can trigger complaints. Aim for calm, respectful, and natural speech that reflects your brand’s tone.

Trust must be earned: Every message should mention your agency’s name, the reason for the call, and offer a clear path to speak with a live agent.

Call logging and opt-outs: Store call logs for auditing and include opt-out mechanisms to stay compliant and avoid disputes.

Now, let’s go step-by-step through the process of constructing a functional and effective voice agent for your debt collection operations.

Also read: Everything You Need to Know About AI Voice Assistants

Step-by-Step: How to Build a Voice Agent for Debt Collection

Building an AI agent doesn’t mean learning code or hiring a tech team. It starts with what you already know: your scripts, your customers, and your workflows. Here's how to build voice agents for debt collection using a practical, no-jargon approach.

Step 1: Write What the Agent Should Say

Your voice agent still needs to speak like your best-performing agent. Start with what already works in live calls.

Here’s how to shape your first script:

Break down the message into clear chunks: greeting, reason for the call, repayment reminder, and closing.

Focus on one message per sentence to keep it natural and easy for customers to follow.

Create variations for different segments; new delinquents, repeat defaulters, or high-risk accounts.

Make sure each version fits the customer’s situation without sounding too general or too aggressive.

Step 2: Decide the Right Voice and Tone

Tone affects trust. A cold, robotic voice won’t help you connect, especially in sensitive repayment conversations. Here’s how to choose the right voice for your AI agent:

Pick a tone that feels warm, calm, and professional, it should match how your team already speaks.

Use platforms with diverse voice catalogs offering gender, accent, and emotional tone options.

Test 2-3 voices internally to find one that sounds human, not automated.

Avoid voices that feel rushed, sharp, or monotone, especially when delivering payment reminders.

Step 3: Map Out Possible Conversations

Your customers won’t all follow the script. Some will ask questions, push back, or get emotional.

Here’s how to map out your agent’s conversations:

List common responses from past calls: “I paid,” “wrong number,” “call me later,” or “need help.”

Create a matching reply for each customer input and link it to the next step or outcome.

Use AI tools with drag-and-drop call flows to build logic without coding.

Include a clear path to escalate to a human agent when the system reaches a dead end.

Step 4: Use a Platform That Handles the Tech

Building a voice agent doesn’t mean building your own infrastructure. The right platform removes that burden.

Here’s how to set up your agent without technical complexity:

Upload your final script into the tool and assign it to your selected voice.

Configure rules like time-of-day calling, retries, and what happens on no response.

Track performance with built-in dashboards showing pickup rates, promise-to-pays, and handoffs.

Use tools like Smallest.ai (Atoms), designed for non-technical teams in collections.

Step 5: Test Like It’s a Real Call

Testing shows what your customers will hear. and where things could go wrong before they do.

Here’s how to run realistic tests:

Call yourself or a teammate and act out common scenarios, cooperative, confused, upset, or skeptical customers.

Identify spots where tone feels off, phrasing sounds unnatural, or logic breaks down.

Adjust scripts or call flows to fix those issues before launch.

Confirm the handoff-to-agent trigger works smoothly under real conditions.

Step 6: Start Small, Then Scale

No need to roll out to your full portfolio on day one. Controlled pilots give you space to test and adjust. Here’s how to expand safely and confidently:

Start with a pilot, target around 100–200 accounts in early-stage delinquency.

Monitor call results: pickups, response rates, promises, and transfers to agents.

Fine-tune your scripts, voice tone, or call logic based on what you learn.

Scale gradually across segments, campaigns, or regions once your results are consistent.

By looking at key outcomes, you can adjust strategies and fine-tune the agent’s effectiveness. This next section will guide you on what to look for and how to interpret the data from your voice agents.

Ready to launch your first AI voice agent?

Smallest.ai lets you build and deploy compliant, human-sounding agents fast, no code, no setup delays. Upload scripts, customize flows, and start collecting.

Also read: AI Assistants for Business: How They Work, Use Cases, and Top Platforms

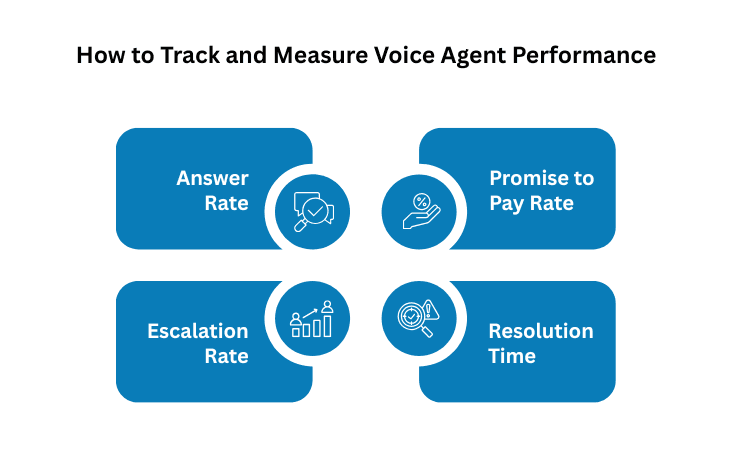

How to Track and Measure Voice Agent Performance

Success in debt collection isn’t just about making calls; it’s about moving accounts toward resolution efficiently and respectfully. AI voice agents should prove their value with clear, trackable outcomes tied to your collection goals.

Here are the key metrics that help measure how well your voice agents are working:

1. Answer Rate

Answer rate tells whether customers are picking up calls from your AI agent. A low rate may signal trust issues or poor timing. Check whether calls are happening during compliant hours and if the caller ID is recognizable. Use voice agent software that lets you A/B test time slots or tweak scripts for better engagement.

2. Promise to Pay Rate

The promise-to-pay rate shows how many customers commit to paying after the call. This metric indicates if your message resonates and feels persuasive without pressure. Scripts that are clear, respectful, and empathetic usually drive better outcomes. Adjust tone, language, and repayment framing based on segment behavior.

3. Escalation Rate

Escalation rate tracks how often a call needs to be transferred to a human agent. A high rate could mean your AI agent isn’t handling objections or FAQs well enough. Review common triggers for handoffs, like billing disputes or aggressive language, and build better responses for those. Ensure your platform supports seamless, real-time transfers to avoid customer frustration.

4. Resolution Time

Resolution time reflects how quickly an account moves from contact to payment after the AI call. A shorter resolution time often means your agent’s message was clear, the repayment link worked, and the timing was right. Use this metric to fine-tune delivery, maybe weekend reminders or 3-day follow-ups, speed up results. Your goal is faster outcomes with less manual effort.

Finding a balance between both will yield the best results. Let’s take a closer look at how these two compare and how they complement one another in debt recovery

Comparison: AI Voice Agents vs. Human Agents

Understanding where AI excels, and where human interaction still matters, can help improve your recovery strategy. The goal isn’t replacement, but smart allocation. Here's how both stack up:

Aspect | AI Voice Agents | Human Agents |

|---|---|---|

Speed & Availability | Operates 24/7, responds instantly, handles large volumes without burnout. | Limited by shift hours and capacity; response time varies. |

Consistency | Delivers the same message every time, reducing compliance risks. | Message delivery can vary based on emotion, energy, or training. |

Empathy & Complex Cases | Can sound human-like, but still lacks real empathy or emotional judgment. | Handles emotional nuance, objections, and sensitive situations better. |

Cost-Effectiveness | Lower long-term cost; no overtime or hiring bottlenecks. | Higher cost per contact; salaries, benefits, and training all add up. |

Compliance Control | Easy to program with strict adherence to call times and language. | Risk of human error; harder to monitor every interaction in real time. |

Scalability | Instantly scales up or down based on call volumes or campaigns. | Scaling means hiring, training, and scheduling, time-intensive and costly. |

Personalization | Can segment messages by account type, payment history, or risk level. | Can personalize in the moment, but depends on memory and availability of data. |

Resource Allocation | Ideal for first-touch calls, payment reminders, and low-risk accounts. | Best for disputes, escalations, or high-value recoveries. |

If you're starting out, begin Smallest.ai with AI for predictable, rule-based calls and reserve your human agents for complex, high-impact interactions.

Also read: Free AI Voice Generator: Realistic Text to Speech Online

Common Mistakes That Undermine AI-Powered Debt Recovery

Mistakes in setup or execution can limit the impact of your AI voice agent, leading to poor engagement or compliance risks. Proactively avoiding these issues helps you protect brand reputation and recover more accounts.

Here are the key missteps to avoid:

Flat, robotic tone that feels impersonal: A monotone or overly scripted voice reduces trust and increases hang-ups in debt collection calls.

No real-user testing before launch: Without live testing, your call flow may miss edge cases like escalations or emotional objections.

Same script across customer types: New defaulters, chronic delinquents, and high-value accounts need tailored voice and message logic.

Neglecting regulatory compliance checkpoints: Missing legal disclosures or contacting outside allowed hours can result in regulatory action.

Failing to log calls or update CRM systems: Incomplete data reduces campaign visibility and undermines your collections follow-up process.

Modern platforms like Smallest.ai simplify AI-powered debt recovery with prebuilt compliance logic, flexible scripting, and real-time analytics, no coding required.

Build Your Own Debt Collection Voice Agent with Smallest.ai

If you're ready to explore how to build voice agents for debt collection, Smallest.ai offers enterprise-grade features that streamline setup, ensure compliance, and improve recovery rates without technical barriers.

Here’s what makes Smallest.ai ideal for debt collection agencies:

Deploy real-time AI voice agents to collect, negotiate, and resolve debts while freeing your human team for complex cases

Benefit from auto‑dialers with verified caller IDs that lift pickup rates and improve connect ratios

Use built-in dashboards to monitor answer rates, promise-to-pays, escalations, and resolutions instantly

Employ seamless escalation paths that transfer calls to live agents when needed, no manual effort

Scale easily with Enterprise-grade speed, sub‑100 ms voice generation, multilingual support, and tight integration with legacy systems

Final Thoughts

Building voice agents for debt collection is no longer a technical black box; it’s a practical, strategic move that saves time, improves customer response, and helps you scale faster. By combining real agent insights with AI precision, you can streamline recovery workflows without sacrificing human tone or compliance. What matters is getting started with the right steps, the right tools, and a platform built for the realities of debt collection.

At Smallest.ai, we make it simple to bring voice into your collections strategy. With prebuilt call flows, customizable tone, and secure integrations, you can launch voice agents that feel natural and respond quickly, all without relying on engineering.

Book a demo and see how easily you can put AI-powered voice to work in your operations.

Frequently Asked Questions (FAQs)

1. How can voice agents improve debt collection efficiency?

Voice agents automate outbound calls, provide 24/7 service, and maintain professional call tones. They increase answer rates and reduce costs compared to manual outreach.

2. Can voice agents handle repayment disputes or complaints?

Yes, voice agents answer common questions and escalate to human agents when needed for complex issues or disputes. They help resolve concerns while maintaining consistent messaging.

3. Are voice agents compliant with debt collection regulations like FDCPA?

When set up correctly, voice agents strictly follow permitted calling times, required disclosures, and transfer logic. That reduces legal risk and ensures record-keeping.

4. Do modern voice agents support multiple languages?

Advanced vendors offer multilingual voice agents that engage diverse debtor populations effectively. This improves contact rates across segments.

5. How long does it take to deploy a voice agent in debt collection?

Most platforms allow teams to start testing within days, from script upload to pilot launch. Full rollout typically takes a few weeks with proper planning.