Explore the top benefits of conversational AI for debt collection and learn how it automates outreach and improves recovery outcomes effectively.

Akshat Mandloi

Updated on

January 27, 2026 at 4:58 PM

Debt collection teams today face a tough balancing act: they need to recover more, stay compliant, and keep costs low, all while delivering a respectful experience to increasingly diverse and digitally intelligent debtors. Traditional methods like static IVRs and rigid scripts simply can’t keep up with the volume, complexity, or sensitivity required.

That’s where conversational AI comes in.

Unlike old-school bots or batch-style outreach, conversational AI uses real-time data and natural language to hold intelligent, human-like conversations with debtors across voice, SMS, email, and chat. These systems don’t just remind people to pay; they negotiate, adapt, and escalate when needed, all while staying fully compliant.

In this blog, we’ll break down the core applications and benefits of conversational AI in debt collection, from automating payment plans to predicting risk and optimizing outreach, and show how platforms like smallest.ai are helping agencies scale smarter, not harder.

TL;DR (Key Takeaways)

Hybrid approach: AI agents handle the majority of standard cases autonomously, optimizing contact timing and channel, while human agents focus on high-value, complex, or sensitive situations, maintaining debtor trust and regulatory rigor.

Omnichannel and data-driven: Platforms retain context across SMS, voice, email, and chat, and use predictive analytics to segment debtors, prioritize contacts, and customize payment plans, resulting in higher engagement and faster resolution.

Compliance is engineered in: Built-in regulatory engines track every interaction for FDCPA, TCPA, and Reg F adherence, with automatic escalation for disputes or legal disclosures that require human oversight.

Enterprise platforms like Smallest.ai demonstrate ROI at scale: Capable of handling thousands of concurrent calls with sub-100ms latency, secure integration, and enterprise-grade compliance, delivering both immediate operational gains and strategic flexibility for future growth.

What is Conversational AI in Debt Collection?

Conversational AI in debt collection refers to advanced software that autonomously manages interactions with debtors across multiple communication channels using natural language. Unlike traditional scripted solutions, these intelligent systems engage in fluent, adaptive conversations, predicting outcomes and responding to nuanced debtor inputs in real-time.

Key Components of Conversational AI in Debt Collection

The following components define modern platforms, each working in concert to transform how debtors are engaged, payments are negotiated, and compliance is maintained.

Large Language Models (LLMs): Power the conversation engine, allowing interpretation and response to natural language in both text and voice formats.

Natural Language Processing (NLP): Interprets debtor intent, sentiment, and context, even in colloquial or ambiguous phrasing, going far beyond keyword matching.

Automatic Speech Recognition and Text-to-Speech: Enable natural discussions over phone and voice platforms such as smallest.ai, transcribing and voicing conversation on the fly.

Data-Driven Decision Support: AI integrates historical payment data, behavioral analytics, communication logs, and compliance status to inform every interaction.

What are its Architectural Features?

Conversational AI platforms in debt collection are engineered on an architecture that exceeds basic automation, blending advanced algorithms and modular workflows to manage scale, complexity, and compliance with precision. Below are the defining architectural features that set leading systems apart:

Multi-Layered Systems: Process vast, diverse datasets to generate contextually relevant responses. These systems continually update debtor profiles using live data from every interaction.

Omnichannel Continuity: Retain conversational context across channels (voice, SMS, webchat, email, and mobile), ensuring that transitions between mediums are smooth and frictionless.

Multi-Agent Negotiation Frameworks: Use specialized modules for risk assessment, communication management, compliance monitoring, and payment negotiations, allowing for more balanced and rational outcomes.

Conversational AI transforms static automation into dynamic, intelligent engagement, capable not only of initiating contact but also of interpreting responses, analyzing intent, and adapting strategy in real time.

This technology enables a range of use cases that go far beyond scripted reminders, fundamentally altering how agencies recover outstanding accounts.

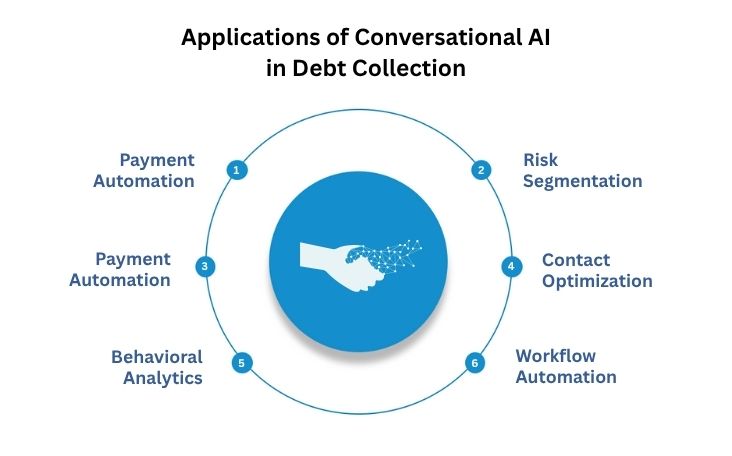

Applications of Conversational AI in Debt Collection

Conversational AI platforms for debt collection move from theoretical potential to direct operational impact, transforming standard outreach into a series of intelligent, adaptive processes. These systems deliver precise interventions that traditional methods cannot match at scale, addressing both recovery targets and debtor experience.

1. Payment Reminder and Follow-up Automation

Conversational AI automates the entire payment reminder workflow through intelligent multi-channel communication systems that deliver personalized reminders across voice, SMS, email, and messaging platforms. These systems analyze debtor communication preferences, payment history, and engagement patterns to determine optimal contact timing and messaging strategies.

Core Benefits:

24/7 Availability: AI systems provide continuous debtor engagement capabilities, reaching customers at any time without operational constraints or staffing limitations.

Personalized Messaging: Advanced natural language processing crafts contextually relevant reminders that adapt tone, urgency, and payment options based on individual debtor profiles.

Omnichannel Consistency: Maintains smooth conversation context across all communication channels, ensuring debtors receive consistent messaging regardless of platform.

Automated Escalation: Intelligently routes complex cases or non-responsive accounts to human agents while maintaining detailed interaction histories.

Compliance Monitoring: Built-in regulatory oversight ensures all communications adhere to FDCPA, TCPA, and Reg F requirements through automated compliance checking.

2. Intelligent Customer Segmentation and Risk Assessment

Conversational AI platforms use machine learning to segment debtors dynamically, grouping them based on financial risk, repayment history, and demographic patterns. This allows debt collection teams to allocate resources more effectively and apply the right engagement strategy to each segment from the start.

Core Benefits:

Automated Risk Scoring: AI models evaluate credit behavior, outstanding balances, and past interactions to assign repayment likelihood scores in real time.

Smart Segmentation: Debtors are grouped into actionable categories (e.g., high-risk, likely-to-pay, needs follow-up) using a combination of static and behavioral attributes.

Targeted Collection Strategies: Each segment receives a customized outreach approach, such as softer communication for at-risk individuals or accelerated reminders for high-probability payers.

Resource Prioritization: Collection teams can focus efforts on high-value or high-risk accounts while lower-priority cases are handled automatically.

Scalable Profiling: As new data is collected, the system updates risk profiles and segments continuously, improving precision over time.

3. Automated Payment Arrangement and Negotiation

Conversational AI systems handle complex payment plan negotiations through intelligent dialogue management that assesses debtor financial capacity, proposes viable payment arrangements, and processes agreements in real-time. These systems can evaluate multiple variables, including income stability, expense obligations, and historical payment behavior, to structure optimal repayment solutions.

Core Benefits:

Real-time Financial Assessment: AI evaluates debtor financial circumstances instantly through integrated data sources and conversation analysis to propose feasible payment arrangements.

Dynamic Negotiation Capabilities: Advanced dialogue systems adapt negotiation strategies mid-conversation based on debtor responses and willingness indicators.

Automated Settlement Processing: Smooth integration with payment gateways enables immediate processing of negotiated agreements and payment arrangements.

Multi-scenario Planning: AI generates multiple payment arrangement options simultaneously, presenting debtors with choices that maximize both recovery potential and affordability.

Compliance Documentation: Automatic generation and storage of legally compliant payment agreements with detailed audit trails for regulatory oversight.

4. Predictive Dialing and Contact Optimization

AI-enhanced predictive dialing systems revolutionize outbound collection efforts by intelligently timing calls, optimizing agent utilization, and predicting successful contact outcomes. These systems analyze historical call data, debtor availability patterns, and agent performance metrics to maximize connection rates while minimizing operational costs.

Core Benefits:

Intelligent Call Pacing: Advanced algorithms predict optimal call timing based on debtor behavior patterns, historical answer rates, and time zone considerations.

Agent Productivity Maximization: Predictive models ensure agents spend maximum time in productive conversations by filtering out non-productive calls and optimizing call queues.

Answer Rate Optimization: Machine learning models identify optimal calling windows for specific debtor segments, significantly improving connection rates.

Automated Call Filtering: Advanced detection systems identify and filter out busy signals, voicemails, and disconnected numbers before routing to agents.

Performance Analytics: Comprehensive analytics track call effectiveness, agent performance, and campaign optimization opportunities.

smallest.ai utilizes verified caller IDs and intelligent pacing to maximize engagement and reduce human fallback.

5. Behavioral Analytics and Intervention Triggers

Beyond static risk profiles, conversational AI platforms continuously monitor how debtors behave across channels, analyzing tone, responsiveness, payment hesitation, and timing, to detect when and how to intervene for better outcomes.

Core Benefits:

Engagement Pattern Monitoring: Tracks how debtors interact (e.g., delay in opening messages, changes in tone, or repeated deferrals), surfacing early signs of friction or disengagement.

Real-Time Intervention Signals: AI detects behavior shifts that may indicate confusion, stress, or payment hesitation, and can automatically escalate or adapt tone and messaging style.

Emotion and Sentiment Analysis: Voice and text inputs are analyzed for emotional cues like frustration, anxiety, or compliance, enabling more empathetic and appropriate AI responses.

Trigger-Based Automation: Certain behaviors (e.g., asking the same question multiple times or hesitating during negotiation) trigger predefined actions, like offering alternate payment plans or transferring to a human.

Outcome Prediction Models: AI learns which behaviors lead to successful collections, using that insight to guide current and future engagements.

Automated Workflow and Process Orchestration

Comprehensive workflow automation systems manage end-to-end collection processes from initial account assignment through final resolution. These systems coordinate multiple AI agents, human interventions, and system integrations to create smooth, efficient collection operations.

Core Benefits:

Process Standardization: Automated workflows ensure consistent application of collection strategies across all accounts while maintaining flexibility for unique circumstances.

Task Prioritization: Intelligent routing systems automatically prioritize high-value accounts and urgent interventions based on predictive analytics and risk assessments.

Integration Management: Smooth coordination between CRM systems, payment platforms, and communication channels eliminates manual data entry and reduces errors.

Compliance Automation: Built-in compliance monitoring ensures all workflow steps adhere to regulatory requirements with automatic documentation and audit trail generation.

Performance Optimization: Continuous monitoring and adjustment of workflow parameters based on success metrics and changing business requirements.

As agencies adopt conversational AI’s advanced capabilities, predictive outreach, behavioral segmentation, and real-time negotiation, the practical demands shift from theory to technical execution, requiring a platform that delivers both scale and operational control.

Here’s an interesting read: Top 11 Conversational AI Platforms In 2025

How Smallest.ai Can Simplify Debt Collection With Conversational AI

Smallest.ai provides advanced conversational AI voice agents designed to transform debt collection. These agents automate calls, negotiate payments, and resolve accounts quickly. By contacting debtors at the best time and via the optimal channel, they improve collection rates, reduce costs, and maintain a respectful debtor experience.

The conversational AI uses data-driven strategies to customize interactions, making the recovery process both more effective and more customer-friendly.

Main Features

24/7 Automated Voice Calls: Reach debtors anytime with reminder calls.

Human-like Engagement: AI communicates firmly and empathetically, earning the debtor's trust.

Smart Automation: Negotiates terms, confirms payments, and updates CRM systems in real-time.

Instant Escalation: Transfers to live agents when necessary, with smooth handover.

Recovery Insights: Full dashboard for tracking call attempts, payments, and success rates.

Lightning-Fast Response: Speech generated in under 100ms for smooth conversations.

Handles Scale Easily: Supports thousands of simultaneous calls (up to 10,000 concurrent).

Secure & Compliant: Meets SOC 2, HIPAA, and PCI standards; data stays on secure infrastructure.

Custom Voices & Integration: Fully customizable brand voice and easy connection to legacy systems.

Successfully deploying conversational AI at scale tests not only the technology’s reach but also its discernment, knowing when to escalate from automated workflows to the human expertise that resolves ambiguity, exceptions, and exceptional cases.

Human Intervention in Conversational AI for Debt Collection

Human intervention in conversational AI debt collection systems is structured, deliberate, and always informed by real-time system intelligence, never an afterthought or arbitrary escalation.

The platform continuously evaluates interaction complexity, debtor sentiment, and regulatory need, triggering handoffs only when human judgment and discretion become decisive factors. This hybrid approach preserves automation’s scale while ensuring that cases requiring empathy, dispute resolution, or compliance nuance receive direct attention.

Controlled Escalation to Human Agents: Conversational AI platforms in debt collection handle routine cases autonomously, escalating only complex, sensitive, or unresolved matters to human agents. This approach reduces the load on staff, allowing them to focus on high-value, difficult accounts where nuanced judgment is necessary.

Preservation of Relationship Quality: Human agents remain essential for maintaining debtor relationships in situations that require empathy, such as financial hardship, disputes, or requests for exceptions. AI can recognize these scenarios and route debtors to human support, preserving trust and rapport that might erode with purely automated systems.

Continuous Oversight and Training: Conversational AI systems benefit from ongoing human oversight. Staff monitor AI interactions for accuracy, regulatory compliance, and effectiveness, providing feedback that refines AI behavior and improves success rates over time.

Compliance and Dispute Resolution: Human intervention is required when regulatory disclosures, dispute resolution, or documentation need verification. AI can flag these cases, ensuring that all legal and compliance requirements are met by qualified personnel.

Adaptation to Unique Cases: Debt collection often involves exceptions or unusual circumstances not covered by standard scripts or algorithms. Human agents step in to resolve these cases, maintaining operational flexibility.

Performance Benchmarking: Comparing human and AI collection outcomes helps organizations identify areas where AI excels and where human judgment adds value. This data-driven approach supports continuous process improvement.

Handoff Coordination: Effective conversational AI systems include smooth transition protocols, context, and case history transfer automatically when moving from AI to human agents, preventing redundant conversations and improving the debtor experience.

Read more: Complete Guide on AI Phone Agents for 2025

Conclusion

Conversational AI is now a practical, daily reality for debt collection, not just a flashy experiment. With more accounts to manage, tighter budgets, and ever-changing rules, firms can’t afford to rely on manual processes alone. Smart, automated systems step in to reach more debtors, speed up solutions, and trim costs, without sacrificing compliance or burning bridges with customers. When agencies make this shift, they’re not just keeping up, they’re setting themselves up to grow, with clear metrics and a real difference in how much they collect.

At Smallest.ai, we deliver conversational AI that works for debt collection, not just by automating calls, but by engaging debtors with fast, natural conversations, real-time integrations, and enterprise-grade security. Our platform scales smoothly, handles thousands of calls at once, and gives your team clear analytics and instant control over escalations. It’s designed for agencies ready to move beyond manual processes and see measurable gains in recovery rates, cost efficiency, and compliance, without sacrificing the human touch when it matters most. Request a demo today.

FAQs About Conversational AI in Debt Collection

1. Can conversational AI handle strong regional accents?

Most platforms perform well with varied speech, but certain regional accents may still challenge recognition. Fine-tuning and regular model updates improve accuracy.

2. Does conversational AI support international compliance?

Basic frameworks can be localized, but full compliance with each country's rules demands customization and legal review before launch.

3. What if the conversational AI can’t resolve a debt collection case?

When the system hits its operational limits, it escalates to a live agent or schedules a callback. Every case, conversation, and context is logged for a smooth handover and follow-up, so nothing falls through the cracks.

4. How is debtor data protected in conversational AI debt collection?

Data is encrypted at all times, with robust access controls and regular compliance checks. Some platforms also offer private deployments for organizations that need even tighter control over sensitive information.

5. Can the conversational AI negotiate complex payment plans in debt collection?

Routine payment arrangements are handled autonomously. For unique financial situations, cases escalate to a live agent for resolution.

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now