See how robotic process automation in banking automates KYC, reconciliations, and call operations, reducing cycle time while maintaining full audit accuracy.

Prithvi Bharadwaj

Updated on

January 27, 2026 at 10:00 AM

A single delay in processing a loan or verifying a payment can ripple across departments, lose time, raise compliance flags, and frustrate customers. Multiply that by thousands of transactions a day, and you have the silent drag that keeps even high-performing banks from scaling efficiently.

That’s where Robotic Process Automation in Banking changes the equation. By turning manual, error-prone workflows into machine-driven precision, banks gain real-time control over approvals, compliance checks, and audit trails, without expanding teams or adding new layers of oversight.

The global Robotic Process Automation (RPA) in Banking market size was valued at USD 685.7 million in 2022 and is projected to reach USD 8.79 billion by 2033. As RPA connects with conversational AI, voice agents, and voice AI, banks are exceeding automation to real-time orchestration, where every customer request, transaction, and compliance process runs in sync.

In this guide, we break down ten ways RPA strengthens control, speeds up banking operations, and supports intelligent automation at scale.

Key Takeaways

RPA builds structural control in banking: Robotic process automation in banking brings audit-ready accuracy and accountability, improving how banks manage compliance, approvals, and transaction oversight.

Voice AI connects automation to customers: Voice agents and conversational AI turn real-time interactions into verified system actions, allowing banks to handle requests instantly and consistently.

Fraud prevention gains new precision: RPA-driven speech analytics and voice biometrics detect fraud indicators early, securing KYC and AML workflows with complete traceability.

Automation changes how banks measure success: The value of RPA lies in control reliability, audit clarity, and compliance speed, not in workforce reduction.

Smallest.ai brings RPA and voice together: By linking RPA with voice AI and voice cloning, Smallest.ai gives banks a way to act on verified intent while maintaining full compliance visibility.

Why Banks Can’t Afford to Ignore RPA Any Longer

Robotic process automation in banking is shifting from simple task automation to driving measurable operational intelligence. Banks that adopt RPA are not just cutting costs; they’re systematically reducing friction in high-volume processes while gaining better control over risk and compliance.

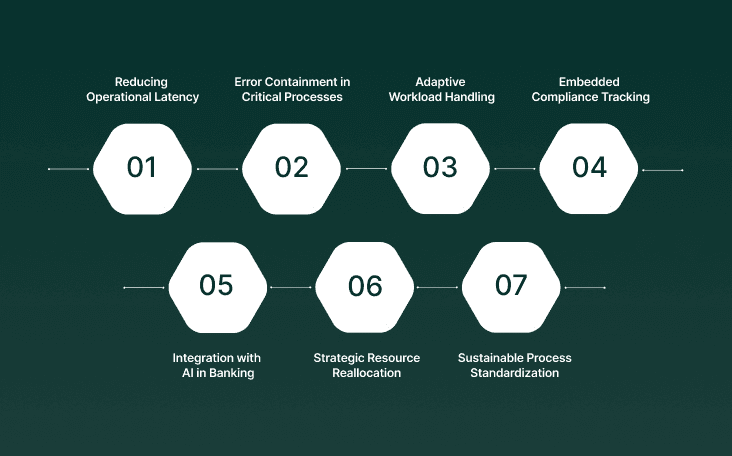

Reducing Operational Latency: RPA accelerates end-to-end processing of loans, payments, and settlements, turning days of manual work into minutes.

Error Containment in Critical Processes: Automates data validation and reconciliation, sharply reducing inaccuracies in reporting and regulatory submissions.

Adaptive Workload Handling: Robots can scale dynamically to handle sudden spikes in transaction volume without adding headcount.

Embedded Compliance Tracking: Maintains immutable audit trails and enforces regulatory rules consistently across accounts and branches.

Integration with AI in Banking: Combining RPA and AI in banking allows anomaly detection in transactions, predictive monitoring, and advanced decision support.

Strategic Resource Reallocation: Frees up experienced staff from repetitive processing so they can focus on high-value tasks like risk analysis and customer advisory.

Sustainable Process Standardization: Robotic process automation for banking creates repeatable, transparent workflows, reducing dependency on individual expertise and ensuring operational consistency.

See how leading institutions are combining automation and conversation to drive measurable control and compliance gains. Read Voice AI for Banks & Financial Services: Use Cases, Architecture & Best Practices.

Manual vs. Robotic Processes: What Banks Need to Know

Robotic process automation in banking shifts the focus from human-driven repetitive work to controlled, measurable workflows. Unlike traditional manual operations, RPA can enforce consistency while providing traceable data insights for critical banking processes.

Aspect | Manual Processes | Robotic Process Automation in Banking |

|---|---|---|

Task Repetition vs. Precision | Relies on human memory and judgment; prone to inconsistencies. | Executes identical workflows with zero deviation, maintaining consistent output. |

Volume Scaling | Struggles to handle spikes in transactions; requires more staff. | Handles high-volume tasks continuously without human fatigue. |

Regulatory Accuracy | Manual reports are prone to errors and omissions. | Produces audit-ready records automatically, reducing compliance risk. |

Processing Speed | Reconciliations and approvals are slow; bottlenecks occur. | Reduces cycle times for payments, settlements, and account updates. |

Error Recovery | Errors require investigation and manual correction. | Logs every step, making anomalies easier to trace and correct. |

Decision Support Integration | Limited ability to detect patterns or anticipate issues. | Combined with AI in banking, provides predictive alerts for unusual activity. |

Operational Transparency | Knowledge often resides with individual staff; visibility is limited. | Creates full visibility into process flows across banking operations. |

Once that contrast is clear, it’s easier to see why automation is now central to how banks deliver service, maintain compliance, and handle customer volume at scale.

Top Ways RPA Is Transforming Banking Operations

RPA has shifted from automating forms to enforcing accountability across every workflow. In banking, automation now acts as a real-time control layer, verifying actions, timestamping transactions, and maintaining data accuracy without slowing operations. When paired with voice AI and conversational AI, it closes the gap between what’s said and what’s recorded, giving banks complete visibility across customer and compliance touchpoints.

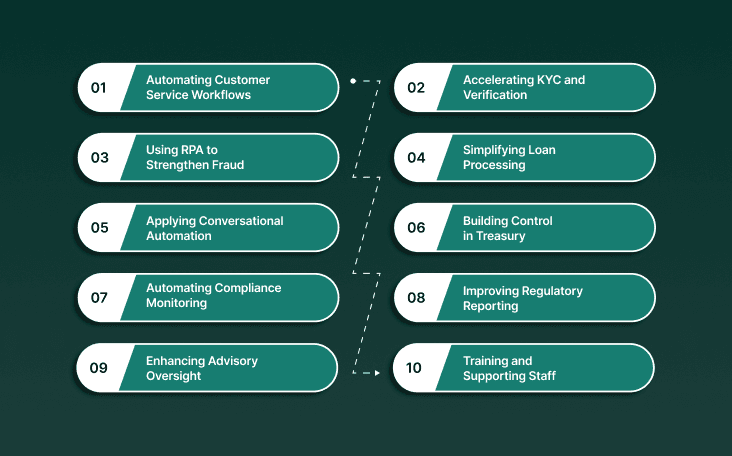

1. Automating Customer Service Workflows with RPA

In retail banking, deploying voicebots with RPA dramatically eases call center load. Banks can automate routine account inquiries, balance checks, or service requests via a conversational voice interface.

This provides an always-on channel and logs every interaction for audit. For example, call centers still handle millions of inquiries; automation can cut human hours while maintaining full records for compliance and quality control.

24/7 Voice Channel: Conversational AI handles routine queries anytime without waiting, improving availability and customer satisfaction.

Smart Call Deflection: RPA bots triage callers, escalating only complex issues to humans, which preserves expert staff for high-value tasks.

Audit-Ready Transcripts: Every voice session is transcribed and timestamped by RPA, creating a verifiable trail for quality assurance and regulatory review.

2. Accelerating KYC and Verification Through Intelligent Automation

Banks face heavy Know-Your-Customer and CIP obligations. Conversational agents can collect personal data via phone and use voice biometrics to verify identity. The system then auto-populates core banking systems via RPA.

Integrating voice biometrics strengthens security: generative-AI deepfakes have begun to undermine ID checks, so authentic voice signatures add a layer of fraud control.

Interactive Onboarding: Voice bots guide customers through KYC questions (e.g., SSN, address) and capture answers directly into compliance workflows.

Biometric Authentication: RPA links voiceprints to customer profiles, adding a unique password-free credential per regulatory CIP rules.

Regulatory Logging: The voice ID check and all responses are recorded, satisfying AML/KYC audit requirements and supporting suspicious-activity review.

3. Using RPA to Strengthen Fraud and AML Monitoring

Voice interactions are rich with cues for fraud. Banks can apply RPA-driven speech analytics to real-time or recorded calls, scanning for anomalies (e.g., unusual scripts, nervousness, or cloned voices). Given that nearly half of financial insurers reported AI-driven fraud like voice cloning, banks use this to flag deepfake fraud schemes early.

Deepfake Defense: AI models analyze caller voice patterns, detecting synthetic or cloned voices to prevent impersonation attacks.

Behavioral Alerts: RPA scans transcripts for suspicious language or trigger words (e.g., “wire transfer auth”), auto-escalating to fraud teams.

Immediate Escalation: On detecting a high-risk pattern, the bot instantly alerts compliance officers or freezes the transaction, tightening control.

Create lifelike, compliant, and high-quality customer interactions in real time with Smallest.ai’s Voice AI and voice cloning. Book a demo.

4. Simplifying Loan Processing with Automated Data Capture

Loan origination often involves tedious Q&A. A voice agent can interview applicants (retail or commercial) by phone, then RPA populates credit systems with the spoken data. This reduces form-filling errors and speeds up underwriting. The combined workflow also enforces that required disclosures are read aloud and recorded, bolstering auditability.

Conversational Intake: A voice assistant asks borrowers for income, collateral, etc., simplifying data capture.

Smooth Data Entry: RPA bots transcribe responses into loan origination platforms in real time, eliminating rekeying errors.

Faster Decisions: With data automated, underwriting triggers can run immediately, cutting processing times while retaining full voice logs for compliance.

5. Applying Conversational Automation in Commercial Banking Operations

Small and mid-market business customers often require complex services. Voice AI integrated with RPA helps relationship managers and SMEs handle routine tasks. For instance, a manager could ask a voice assistant to generate a financial covenant report or schedule a trade, and RPA executes it.

Every request and action is tracked, improving governance in heavily regulated commercial operations.

Customized Assistance: Voice agents guide bankers through workflow steps (e.g., “Generate wire template”), enforcing internal policies as they go.

Task Automation: Upon voice command, RPA performs tasks like running credit checks or compiling documents, reducing manual follow-up.

Control and Oversight: Each voice command and bot action is logged and time-stamped, satisfying audit requirements for client instructions.

6. Building Control in Treasury and Payment Operations with RPA

Corporate and institutional treasurers value efficiency and security. Voice-controlled RPA allows “hands-free” execution of routine treasury functions. For example, a CFO might instruct the system by voice to check a cash balance or initiate a fund transfer. The RPA ensures dual controls (voice authentication plus transaction logs) and real-time compliance checks on limits and policies.

Hands-Free Transactions: Executives use natural language to initiate transfers or roll-over instruments, accelerating workflow.

Real-time Analytics: Voice queries (e.g., “What’s our FX exposure?”) trigger RPA to fetch and speak back consolidated data immediately.

Regulated Audit Trail: All commands and bot transactions are recorded verbatim, creating an indisputable record for internal audit and regulators.

7. Automating Compliance Monitoring Across Customer Communications

Regulators require banks to monitor call-center interactions and advisor calls for compliance. RPA can continuously scan live or recorded calls for mandated disclosures (e.g., fee notices) and flag deviations. Coupled with voice recognition, this ensures conversations remain within legal bounds, and any omission is caught instantly.

Policy Enforcement: RPA checks transcripts to confirm required phrases (e.g., “Funds not FDIC-insured”) were spoken.

Continuous Surveillance: An AI-auditor runs 24/7, flagging any non-compliant language or risk indicators in conversations.

Instant Alerts: Deviations or breaches trigger immediate alerts to compliance officers, allowing swift corrective action and minimizing regulatory risk.

8. Improving Regulatory Reporting with Automated Data Orchestration

Banks must report aggregate customer interaction metrics and suspicious patterns. Voice and RPA can automate these reports: calls are transcribed, categorized, and summarized. Dashboards update automatically with key voice-channel metrics (call volumes by issue type, resolution rates) and compliance scores, improving transparency to regulators.

Transcription Repository: RPA converts voice recordings into structured data, allowing easy search and analysis of call content.

Metrics Dashboard: Automated scripts compile statistics (e.g., call volumes, pending issues) to feed supervisory reports with minimal manual effort.

Complete Audit Logs: Every voice interaction and its processed outcome are archived, simplifying regulatory audits and inquiries.

9. Enhancing Advisory Oversight Through Policy-Governed Automation

In wealth and corporate advisory contexts, voice agents can provide personalized guidance. For example, a bot can walk a client through portfolio reviews or basic investment options. Critically, RPA enforces compliance by keeping recommendations within approved scripts and documenting the advice. This preserves human-like service while preventing unsupervised risk-taking.

Personalized Guidance: The voice assistant uses client data to answer questions on loans, investments, or risk, emulating a human advisor.

Regulated Script Compliance: RPA ensures all advice follows firm-approved policies, reducing the risk of off-policy recommendations.

Traceable Advice: Every recommendation and client response is logged in detail, creating an auditable record of advice given and received.

10. Training and Supporting Staff Through Interactive Process Automation

Banks can use voice agents to train staff on compliance and processes. For instance, tellers or advisors might ask a voice assistant how to handle a specific compliance scenario, and the bot responds with the correct procedure. RPA tracks usage and quiz results. This boosts knowledge retention and provides evidence of training for regulators.

Interactive Learning: Employees engage with a conversational trainer bot that quizzes them on policies or walks them through procedures.

On-Demand Guidance: Staff can vocally query the system (e.g., “What’s our FDIC insurance limit?”) and receive instant, authoritative answers.

Usage Tracking: RPA logs training sessions and questions asked, allowing management to prove compliance training coverage during audits.

These examples show what’s possible when automation is done right. The next leap comes from structure, designing automation as a system of control, not a collection of tools.

A Step-by-Step Guide to Implementing RPA in Your Bank

Banks succeed with automation when they treat it as an operating framework rather than a technology rollout. The real work begins with design, accountability, and clarity of ownership. The following six steps reflect how high-performing institutions structure robotic process automation in banking to strengthen control, compliance, and speed.

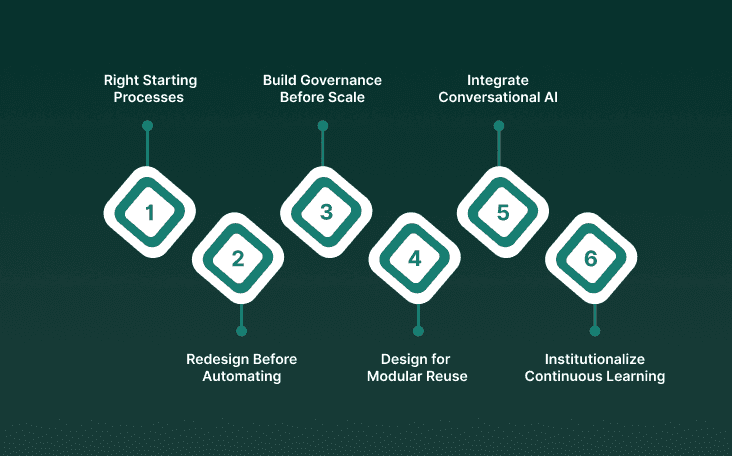

Choose the right starting processes: Select workflows that are high-volume and rule-based, with measurable accuracy and clear audit visibility. Avoid partial or judgment-heavy processes until a stable foundation exists.

Redesign before automating: Remove redundant checks, merge fragmented approvals, and standardize data inputs. Automation applied to a flawed process only accelerates inconsistency.

Build governance before scale: Form a joint council across operations, IT, and compliance. Define approval paths, control metrics, and escalation logic so automation strengthens oversight instead of bypassing it.

Design for modular reuse and hybrid execution: Create automation components that work across KYC, reconciliation, and reporting. Combine attended bots for contextual tasks with unattended ones for continuous operations, all writing to a shared control layer.

Integrate conversational AI where interaction adds value: Voice agents and conversational systems handle information capture, verification, and updates while RPA executes backend actions and records every event for audit review.

Institutionalize continuous learning and measurement: Track error rates, exception patterns, and compliance findings to refine rules. Each update should improve accuracy, shorten cycles, and strengthen data lineage.

Common RPA Challenges in Banking and How to Overcome Them

Automation in banking rarely fails because of technology. It fails because of structure. The most common breakdowns happen between departments, not within code. The goal is not to deploy more bots but to design the right accountability, compliance visibility, and data control that let automation operate safely at scale.

Challenge | Impact | How to Overcome |

|---|---|---|

Disconnected ownership across departments | Fragmented automation efforts create control gaps and duplicate work. | Form a unified automation council across IT, operations, and compliance for shared accountability and audit visibility. |

Automating processes still in flux | Constant policy or system changes lead to rework and unstable performance. | Automate only mature, rule-based workflows with defined exception limits and stable governance. |

Weak integration between RPA and voice AI systems | Data flow breaks between conversational interfaces and backend bots, slowing execution. | Connect voice AI directly to RPA so every interaction triggers a logged, auditable action. |

Incomplete audit and data lineage trails | Missing traceability raises regulatory risks and weakens compliance validation. | Record all bot actions with timestamps, source data, and rule identifiers to create a verifiable audit trail. |

Workforce misalignment and resistance | Employees fear displacement, reducing adoption and accountability. | Redefine roles around exception management, validation, and insight generation to build ownership and confidence. |

Measuring automation success by cost alone | Focus on labor reduction overlooks reliability and control improvements. | Track automation maturity by accuracy, reconciliation speed, and compliance stability instead of headcount change. |

How Smallest.ai Makes Banking Automation Easy and Efficient

Banks already run RPA across their back-office functions, yet the customer-facing side still depends on human routing and manual input. Smallest.ai bridges that gap by linking robotic process automation in banking with real-time voice AI that listens, acts, and records every outcome. This connection turns every conversation, customer or internal, into a verified, automated transaction chain.

Voice AI that executes instantly: Voice agents do more than respond. They connect with core banking systems through RPA, completing actions like transfers, verifications, and report requests without delay.

Conversational AI built for compliance: Each dialog follows banking policy in real time. The system validates disclosures, records approvals, and time-stamps every action to maintain full regulatory traceability.

Voice cloning for personalized interaction at scale: The platform reproduces human tone and regional speech patterns, allowing banks to maintain authentic communication across multilingual regions without adding staff.

Connected automation through enterprise integrations: RPA bots sync with CRMs, loan systems, and payment processors. A single voice command can now initiate an entire process, from customer input to audit log.

Continuous learning and analytics feedback: Speech data converts to insight, showing banks where interactions stall, which steps need escalation, and how automation accuracy improves over time.

Enterprise-grade privacy and deployment flexibility: Smallest.ai meets SOC 2 Type II, HIPAA, and PCI standards across cloud and on-premise setups, with isolation controls that align with financial compliance audits.

With Smallest.ai, banking leaders gain more than automation; they gain operational precision, regulatory confidence, and the ability to act on customer intent in real time.

Conclusion

For financial leaders, control defines credibility. Robotic process automation in banking now serves as a structural system that unites compliance, accuracy, and accountability. When applied with clear governance, it changes oversight from reactive correction to continuous verification. Banks that approach automation as a control framework achieve consistency, traceability, and operational strength across every core function.

Smallest.ai builds on that control with voice AI, conversational AI, and voice cloning that connect directly with RPA to complete verified actions in real time. Every interaction remains auditable, precise, and context-aware, creating a foundation for secure, intelligent banking operations.

See how your bank can strengthen operational control through voice-led automation. Book a demo

FAQs About Robotic Process Automation in Banking

1. How does robotic process automation in banking differ from traditional workflow automation?

Most workflow tools rely on human-triggered steps and predefined macros. Robotic process automation in banking uses logic-based bots that act independently, interact with multiple systems, and apply compliance checks in real time. This makes it adaptive to transaction data, not just scripted commands.

2. Can RPA and AI in banking work together without replacing existing systems?

Yes. Banks can deploy RPA on top of existing infrastructure without altering core software. AI models handle unstructured inputs such as voice or free text, while RPA executes downstream system actions. This allows legacy and modern systems to operate in parallel, improving accuracy without full-scale reengineering.

3. What are the audit implications of robotic process automation for banking processes?

Every automated action generates a timestamped record with rule IDs, input data, and outcomes. These logs strengthen audit reliability, providing regulators with verifiable evidence of process control. In banking and finance, this traceability turns RPA into a governance tool rather than just a productivity system.

4. How can conversational AI and voice agents extend process automation RPA in banking?

Voice agents convert real-time interactions, such as account verification or balance inquiries, into structured RPA triggers. Conversational AI interprets intent, while RPA completes the task within core systems. This bridge between human input and digital execution removes manual intervention from repetitive banking communication.

5. What long-term operational risks should banks anticipate when scaling robotic process automation in banking and finance?

The main risks are version drift, data lineage loss, and control fragmentation. As bots multiply, each must maintain synchronized rule logic and audit consistency. Mature banks prevent this through centralized governance and periodic retraining, ensuring that automation strengthens oversight rather than complicating it.

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now