Compare top-rated AI agents for financial services, including voice, compliance, and scale. See which platforms perform reliably in regulated environments.

Wasim Madha

Updated on

February 24, 2026 at 8:53 AM

Every financial services leader hits the same breaking point. Call volumes spike, margins tighten, regulators listen to every recorded interaction, and hiring more agents stops being an option. Searches for top-rated AI agents for financial services usually start at that exact moment, when legacy IVRs fail, chatbots fall apart, and real-time voice execution becomes mission-critical.

That urgency is reshaping the market fast. The AI agents market is expected to grow at a strong CAGR of 22.6% from 2025 to 2033, reaching an estimated USD 116.6 billion by 2033. Buyers evaluating top-rated AI agents for financial services are no longer comparing features; they are pressure-testing latency, call accuracy, concurrency, and audit readiness in live environments.

In this guide, we break down what actually separates enterprise-grade agents from everything else.

Key Takeaways

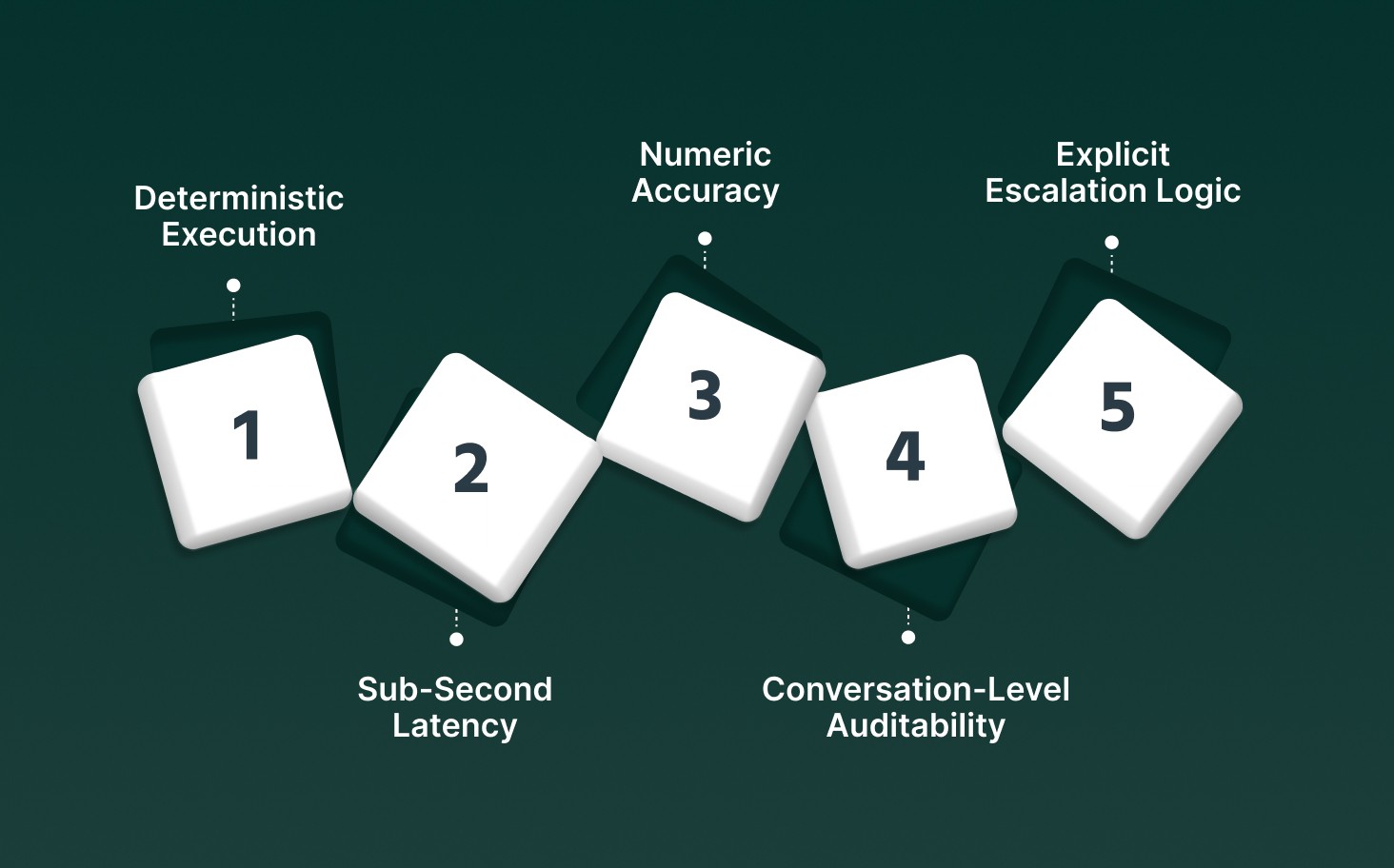

Deterministic Execution Over Intelligence: Financial AI agents must follow predefined workflows and escalation rules to meet compliance requirements, not generate flexible or probabilistic responses.

Latency Directly Impacts Compliance: In voice-based financial interactions, inconsistent or slow responses increase abandonment, disclosure errors, and regulatory risk.

Auditability Must Be Conversation-Native: Effective agents provide timestamped transcripts, action logs, and escalation markers per interaction, allowing direct regulatory review.

Voice Remains the Highest-Risk Channel: Critical actions like payments, disclosures, and fraud handling still occur over live calls, making real-time voice execution essential.

Agent Selection Is an Architectural Decision: Choosing an AI agent depends on where it operates in the stack and how it integrates with regulated systems, not on feature breadth.

Why Financial Services Demand a Different Kind of AI Agent

Financial services workflows expose AI agents to regulated speech, time-critical decisions, and irreversible customer actions. Agents operating in this environment must execute deterministically, respond in real time, and leave a verifiable interaction trail that aligns with regulatory review standards rather than consumer AI expectations.

Deterministic Execution: Agents must follow pre-approved SOP graphs with fixed state transitions to prevent off-script behavior during payments, account changes, or disputes.

Sub-Second Latency: Voice agents must sustain sub-100ms response cycles to avoid conversational drift, abandonment, and compliance risk in recorded calls.

Numeric Accuracy: Speech systems must preserve exact digits for account numbers, policy IDs, and amounts, requiring models optimized for numeric stability.

Conversation-Level Auditability: Compliance depends on timestamped transcripts and action logs, not post-hoc model explanations.

Explicit Escalation Logic: Human handoffs must trigger on defined risk conditions such as fraud signals or disclosure requirements, not confidence scores.

In financial services, AI agents are evaluated by execution correctness, timing precision, and audit trace completeness. Systems optimized for conversational creativity fail under regulatory scrutiny and live financial operations.

Explore how real-time, regulated AI is reshaping financial operations in our guide on Conversational AI in Finance: Key Applications and Industry Impact

Top-Rated AI Agents for Financial Services

Enterprise buyers evaluating AI agents in financial services are not comparing surface-level automation features. They are assessing how different platforms execute regulated workflows across voice and digital channels, enforce compliance at runtime, integrate with core systems, and scale reliably under real operational load.

The tools listed below represent distinct architectural approaches, ranging from real-time voice execution layers to CRM-native agent frameworks and conversation intelligence–driven automation.

At a Glance

Platform | Core Strength | Primary Execution Layer | Compliance Approach |

Real-time voice execution | Live voice (TTS/STT, calls) | Deterministic flows, full call audit trails, on-prem/VPC | |

Observe AI | BFS conversation intelligence | Voice + agent copilot | Continuous QA, compliance scoring, and runtime monitoring |

Cresta | Human + AI orchestration | Contact center automation | Supervisor oversight, real-time guardrails |

Decagon | Secure CX automation | Chat, email, voice | Validation checkpoints, auditable workflows |

Sierra AI | Trusted customer interactions | Digital + voice support | Policy-driven guardrails, PII masking |

Agentforce (Salesforce) | CRM-native agentic AI | Salesforce workflows | Native governance via Salesforce controls |

1. Smallest.ai

Smallest.ai is a real-time voice AI platform for enterprises, providing voice agents, speech models, and on-premise deployment designed for high-volume, regulated contact center and operational workflows.

Key Features:

Real-Time Voice Agents: Execute live inbound and outbound calls using deterministic agent flows, allowing automated customer interactions at scale while maintaining strict control over scripts, pacing, and responses.

Lightning Speech Models: Low-latency TTS and STT models optimized for live conversations, handling numbers, identifiers, and accents accurately under high concurrency without degrading call quality.

No-Code Agentic Graph Builder: Build and modify agent workflows visually using predefined logic graphs, reducing dependency on engineering teams while enforcing predictable execution across production deployments.

On-Premise and VPC Deployment: Deploy models directly on private infrastructure to meet data residency, latency, and regulatory requirements without routing sensitive voice data through public cloud services.

Voice Cloning for Brand Consistency: Create and deploy professional-grade voice clones to maintain consistent brand tone across calls, campaigns, and regions without relying on third-party voice assets.

Enterprise-Grade Concurrency and Scale: Support thousands of parallel calls with configurable concurrency limits, allowing reliable performance during peak demand periods such as collections drives or support surges.

Best For: Financial services, healthcare, and large enterprises needing real-time, compliant voice AI for contact centers, debt collection, and customer operations where latency, accuracy, and auditability are mandatory.

Smallest.ai Price Details

Free plan available for evaluation with one template AI agent and basic TTS access.

Business plans start at US$1,999 per month with higher concurrency and premium voice features.

Enterprise pricing is custom, supporting on-prem deployment, SLAs, and dedicated account management.

Talk to a voice expert and see how Smallest.ai powers real-time, enterprise-grade voice AI at scale.

2. Observe AI

Observe AI is an enterprise AI agent and conversation intelligence platform for banking and financial services, focused on automating high-volume customer interactions while enforcing compliance, quality assurance, and agent performance controls.

Key Features:

BFS-Specific AI Agents: Automates loan servicing, collections, account management, and payment assistance using regulated conversation flows designed specifically for banking and financial services environments.

Agentic Architecture: Builds action-taking AI agents that follow defined business processes and connect with over 250 enterprise systems, allowing real-time execution rather than passive conversation handling.

AI Copilot for Human Agents: Provides in-call alerts, next-best-action recommendations, authentication cues, and compliance nudges to improve agent accuracy and reduce handling errors during live interactions.

Best For: Banks, lenders, fintechs, and financial services enterprises seeking compliant AI agents for customer service, collections, and servicing operations while improving CSAT, FCR, and operational efficiency.

Observe AI Price Details:

Pricing is enterprise-focused and provided on request.

Cost varies based on interaction volume, AI agent scope, and compliance requirements.

Typically bundled with conversation intelligence, QA, and copilot modules.

3. Cresta

Cresta is an enterprise AI platform for contact centers that combines AI Agents, real-time agent assistance, and conversation intelligence to automate client interactions while enforcing compliance and performance controls.

Key Features:

AI Agent Automation: Automates onboarding, support, and collections conversations with controlled, human-like interactions that execute predefined processes while maintaining privacy, compliance, and enterprise-grade guardrails.

Agent Operations Center: Provides centralized, real-time oversight of AI and human agents, allowing supervisors to monitor performance, intervene during live interactions, and enforce operational and compliance standards.

Real-Time Agent Assist: Guides human agents during complex conversations with instant suggestions, disclosures, and prompts, reducing response time and compliance risk in lending, disputes, and account servicing.

Best For: Banks, lenders, and large financial services contact centers seeking to automate high-volume interactions while augmenting human agents with real-time guidance and maintaining strict compliance oversight.

Cresta Price Details:

Pricing is enterprise-focused and available on request.

Cost depends on interaction volume, allowed modules, and deployment scale.

Typically sold as a unified platform covering AI Agents, Assist, and Analytics.

4. Decagon

Decagon is an enterprise AI agent platform for customer experience automation, allowing financial services teams to resolve secure account issues, enforce compliance, and scale support across chat, email, and voice.

Key Features:

Compliance-Ready AI Agents: Resolve balance inquiries, fraud alerts, dispute workflows, and account issues in real time while enforcing validation, auditability, and regulatory controls required by financial services teams.

Agent Operating Procedures (AOPs): Define business logic in natural language while preserving technical guardrails, allowing CX teams to update workflows without breaking compliance or underlying system integrations.

Deep CRM and Support Integrations: Connects directly with Zendesk, Salesforce, and internal systems to take real-time actions, write back updates, and resolve complex customer issues without workflow changes.

Best For: Fintechs, digital banks, and financial services companies seeking to automate high-volume, secure customer support across channels while maintaining compliance and scaling without additional headcount.

Decagon Price Details

Pricing is enterprise-focused and available on request.

Cost depends on interaction volume, channels allowed, and integration scope.

Typically sold as a platform covering agents, analytics, and experimentation.

5. Sierra AI

Sierra is an enterprise AI agent platform for financial services, focused on delivering secure, personalized customer interactions across digital and voice channels while enforcing privacy, compliance, and operational guardrails.

Key Features:

Trusted AI Agent Platform: Deploy AI agents designed for high-trust financial interactions, delivering real-time, contextual responses while enforcing strict security controls and masking sensitive customer data.

Deep System Integrations: Integrates directly with systems of record and knowledge bases to execute account actions, retrieve balances, and resolve issues without breaking existing operational workflows.

Built-In Guardrails and QA: Continuously monitors agent behavior against predefined goals and policies, allowing controlled optimization while preventing off-script actions in regulated customer conversations.

Best For: Banks, fintechs, and financial services organizations seeking a trusted AI agent to handle secure customer interactions, improve retention, and scale personalized support without increasing operational risk.

Sierra AI Price Details

Pricing is enterprise-based and provided on request.

Cost varies by interaction volume, channels allowed, and integration depth.

Typically bundled with security, QA, and optimization capabilities.

6. Agent Force (Salesforce)

Agentforce is Salesforce’s agentic AI solution for financial services, delivering industry-specific AI agents that automate service workflows across banking, insurance, and wealth management using native Salesforce data and controls.

Key Features:

Financial Services–Specific Roles: Prebuilt agent skills aligned to banking, insurance, and wealth workflows, allowing AI agents to handle routine service requests with domain context and regulated process awareness.

Native Salesforce Data Grounding: Agents operate directly on Financial Services Cloud data and workflows, guaranteeing actions reflect real customer context without external data stitching or duplicated logic layers.

No-Code and Low-Code Configuration: Business teams launch and adapt AI agents using Salesforce admin tools, reducing dependency on IT while preserving governance, approval flows, and operational consistency.

Best For: Banks, insurers, and wealth management firms already standardized on Salesforce seeking agentic AI tightly integrated with CRM, service workflows, and enterprise governance frameworks.

Agentforce Price Details

Pricing follows Salesforce Financial Services Cloud licensing.

Agentforce access is typically bundled with existing Salesforce subscriptions.

Final cost depends on cloud editions, usage, and allowed AI capabilities.

There is no single “best” AI agent for financial services, only the right fit for specific execution, compliance, and infrastructure needs. The strongest platforms distinguish themselves through control, auditability, and performance under live, regulated conditions.

AI Agent Use Cases Across Financial Services

AI agents in financial services are deployed where structured data, regulated actions, and high interaction volume intersect. Their value emerges in execution-heavy workflows where latency, determinism, and auditability directly affect financial risk and operational throughput.

Domain | Execution Focus | Operational Impact |

Banking Contact Centers | Deterministic call flows, real-time STT/TTS, CRM write-backs | Reduced AHT, lower escalation, compliant call handling |

Insurance Servicing | Clause retrieval, endorsement logging, transcript capture | Fewer servicing errors, audit-ready interactions |

Lending Operations | Structured data capture, eligibility validation | Faster application throughput, lower intake error rates |

Debt Collection | Jurisdiction rules, consent tracking, and call pacing | Regulatory adherence, controlled recovery outcomes |

Wealth Support | Read-only data surfacing during live calls | Reduced advisor handling time without advice risk |

See how financial institutions design and deploy real-time voice systems in our deep dive on Voice AI for Banks & Financial Services: Use Cases, Architecture & Best Practices

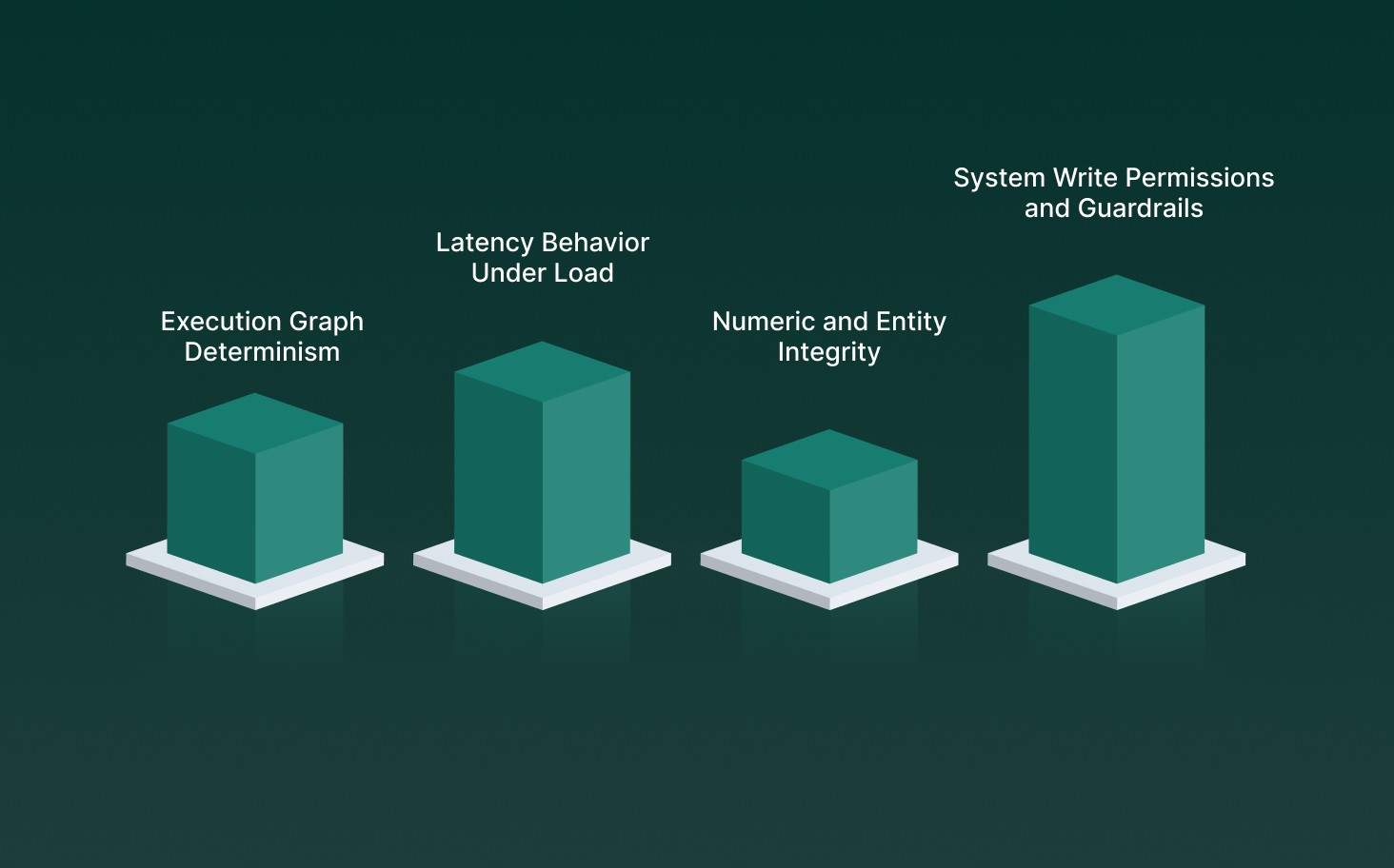

How to Choose the Right AI Agent for Your Financial Organization

Selecting an AI agent in financial services is a systems engineering decision, not a UX choice. The right agent must interoperate with regulated infrastructure, enforce policy at runtime, and remain inspectable under audit without degrading real-time performance.

Execution Graph Determinism: Verify the agent operates on explicit state machines or DAG-based workflows where every transition, retry, and failure state is predefined, version-controlled, and approval-gated.

Latency Behavior Under Load: Test response latency at peak concurrency using production-equivalent traffic. Agents should maintain predictable response times under simultaneous calls without queue buildup or conversational drift.

Numeric and Entity Integrity: Validate end-to-end handling of sensitive entities such as account numbers, monetary values, policy IDs, and dates. The agent must preserve exact token sequences across speech recognition, processing, and speech synthesis.

System Write Permissions and Guardrails: Inspect how the agent performs write-back actions to CRMs, core banking systems, or claims platforms. All mutations should be schema-validated, reversible, and logged with pre- and post-state snapshots.

Understand how modern lending teams apply AI across origination, servicing, and recovery in our analysis of How AI Lending Is Transforming the End-to-End Borrower Experience

Why Real-Time Voice AI Is Becoming Central to Financial Agent Adoption

Financial institutions continue to rely on voice channels for high-risk, high-value interactions where latency, turn-taking accuracy, and speech fidelity directly influence transaction success, regulatory exposure, and customer trust. Real-time voice AI has moved from an interface layer to a core execution component in financial agent architectures.

Turn-Level Latency Sensitivity: Voice interactions require sub-turn response alignment. Delays beyond conversational tolerance thresholds cause agents to interrupt, talk over customers, or miss confirmations during payments, disclosures, and identity verification.

Speech-First Risk Surfaces: Fraud alerts, vulnerable customer disclosures, and consent statements occur primarily over voice. Real-time speech processing allows immediate detection and response, which text-based agents cannot replicate post hoc.

Continuous Context Retention: Live voice agents must maintain conversational state across interruptions, clarifications, and corrections without resetting flows. This requires low-latency streaming ASR tightly coupled with agent state management.

Prosodic Control in Regulated Speech: Financial conversations demand controlled pacing, emphasis, and pauses when reading disclosures, amounts, or legal language. Real-time TTS with prosody control reduces misinterpretation and post-call disputes.

Real-time voice AI aligns with how financial risk is communicated and mitigated in practice. Its centrality stems from execution timing, speech precision, and continuity, not from conversational novelty.

Conclusion

Choosing AI agents in financial services has become less about ambition and more about operational reality. As adoption accelerates, the platforms that endure are the ones that perform predictably under load, respect regulatory boundaries by design, and integrate cleanly into existing systems without creating new risk surfaces.

For teams where voice remains the highest-stakes channel, execution quality becomes the deciding factor. Smallest.ai focuses on this layer of the stack, allowing real-time, controlled voice interactions built for scale and compliance.

Talk to a voice expert to see how Smallest.ai supports enterprise-grade financial operations in production.

Answer to all your questions

Have more questions? Contact our sales team to get the answer you’re looking for

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now