Discover how AI in financial services improves fraud detection, customer experience, and operations while overcoming legacy challenges and driving real impact.

Prithvi Bharadwaj

Updated on

January 19, 2026 at 8:39 AM

Financial transactions are moving faster than ever, and even a minor oversight can lead to significant losses. AI in financial services now plays a central role in detecting risks, automating complex processes, and guiding real-time decisions. With voice AI, conversational AI, and intelligent voice agents, including voice cloning detection, institutions can respond to customer needs instantly while keeping sensitive data secure.

The artificial intelligence (AI) in the BFSI sector market size is forecast to increase by USD 101.35 billion, at a CAGR of 54.2% between 2024 and 2029. Organizations adopting financial services AI can act on insights immediately, prevent fraud, improve compliance, and deliver more precise customer experiences.

In this guide, we cover key challenges, emerging trends, and practical applications of AI in financial services, including voice AI, conversational AI, and intelligent voice agents.

Key Takeaways

Real-Time Fraud Detection: AI analyzes transactions, voice interactions, and behavioral patterns across multiple channels to catch fraud instantly.

Smarter Customer Engagement: Conversational AI and voice agents reduce manual workloads while improving customer interaction quality and response speed.

Inclusive Loan Decisions: Predictive credit scoring utilizes alternative data, enabling faster and fairer decisions beyond traditional credit scoring methods.

Compliance Made Efficient: Generative AI automates reporting, creating accurate, audit-ready documents for regulators and compliance teams instantly.

Voice Cloning Protection: AI identifies synthetic or manipulated voices during live calls, safeguarding institutions from fraud and maintaining trust.

Challenges Financial Institutions Face with Traditional Processes

Most financial institutions still rely on legacy systems built for a different era, rigid, manual, and fragmented. These systems slow down operations and make it difficult to respond quickly to new market demands. As AI in financial services becomes central to how leading organizations operate, the gap between traditional and AI-driven workflows is widening fast.

Data Silos Limit Quick Analysis: Fragmented databases slow down transaction validation and compliance reporting, often requiring manual cross-checks across departments.

Compliance Bottlenecks Delay Growth: Manual KYC and AML checks result in backlogs, risking missed regulatory deadlines and creating audit stress.

Fraud Detection Lags Real-Time Threats: Legacy rule-based monitoring misses subtle or emerging attack patterns, allowing fraud to escalate before mitigation.

Customer Onboarding Remains Tedious: Old onboarding workflows rely heavily on paperwork, which frustrates users and increases abandonment rates.

Personalized Service Is a Challenge: Without automated insights, advisors struggle to deliver customized recommendations at scale.

Risk Assessment Relies on Outdated Models: Traditional models use historic data and static scoring, overlooking fast-shifting market conditions.

Transaction Processing Is Prone to Errors: Batch processing architectures introduce reconciliation delays and error-prone manual overrides.

Loan Decisions Are Often Conservative: Manual underwriting relies on fixed criteria, excluding nuanced patterns accessible by data-driven AI systems.

Discover how your financial team can handle customer interactions smarter and faster, and explore the Top AI voice agents for BFSI (Banking, Financial Services, and Insurance) in 2025.

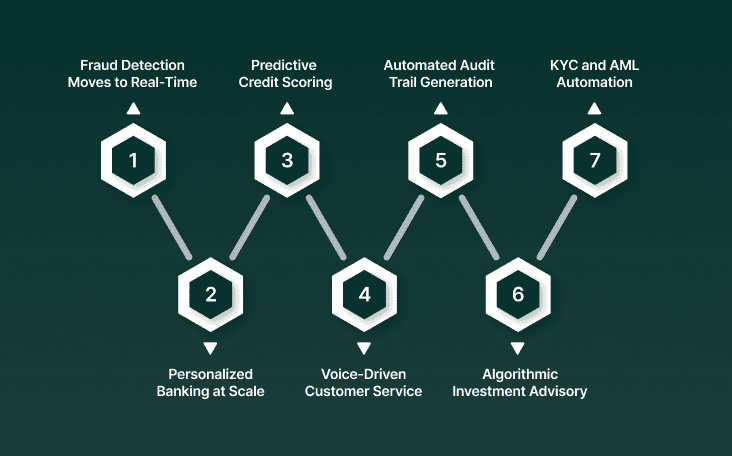

What Improvement Does AI Bring to the Financial Institutions

AI turns raw financial and customer data into actionable insights, speeding decisions, reducing errors, and making customer interactions smarter and more responsive.

Fraud Detection Moves to Real-Time: Neural net models sift live transactions for subtle anomalies, stopping fraud midstream rather than after damage is done.

Personalized Banking at Scale: AI engines parse customer data to trigger custom product offers and service suggestions across thousands of accounts.

Predictive Credit Scoring: Creditworthiness assessment shifts from fixed rules to adaptive scoring, reducing overlooked opportunities and flagging emerging risks faster.

Voice-Driven Customer Service: Conversational agents handle routine queries and requests, freeing up advisors for relationship building.

Automated Audit Trail Generation: AI tracks every compliance-related interaction, creating instant reports for regulators and auditors.

Algorithmic Investment Advisory: Portfolio recommendations react instantly to market signals, moving from historical forecasts to actionable daily insights.

KYC and AML Automation: AI validates identities and flags suspicious patterns without manual form-checking, slashing onboarding time for both staff and clients.

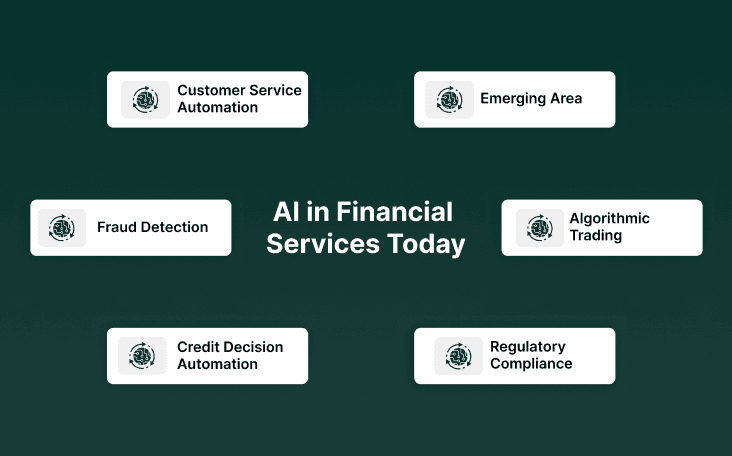

Top Real-World Applications of AI in Financial Services Today

AI in financial services is no longer an experiment; it’s now embedded at the center of how financial institutions operate. Leading banks are using AI to improve customer engagement, detect fraud faster, and simplify compliance. Instead of vague promises, institutions are demanding tangible results, with AI now driving real customer, operational, and revenue impact across the sector.

1. Customer Service Automation with Voice AI

Conversational AI and voice agents are redefining customer interactions across high-volume contact centers.

Voice-Powered 24/7 Support: Voice AI instantly responds to account queries, payment requests, and lost card reports, providing consistent, brand-aligned experiences any time of day.

Smart Escalation: Calls are intelligently triaged, sending only complex issues to human agents, easing workloads and improving satisfaction.

Voice Cloning Defense: AI detects synthetic or manipulated voices, flagging potential fraud attempts with higher accuracy than older systems.

From card queries to loan updates, Smallest.ai voice agents deliver instant, natural conversations that sound human, not robotic, and never miss a compliance cue. Book a Demo

2. Fraud Detection & Real-Time Prevention

AI protects financial networks by recognizing fraud patterns across millions of data points, far beyond what traditional systems can track.

Advanced Pattern Recognition: Machine learning identifies unusual spending and transfer behaviors before they escalate into losses.

Multi-Channel Monitoring: AI connects insights across apps, calls, and transactions to detect mismatched behavior instantly.

Behavioral Biometrics: Subtle differences in voice and interaction style help distinguish genuine users from impostors.

3. Underwriting & Credit Decision Automation

AI transforms how lenders assess applicants, moving from static forms to intelligent, data-driven assessments.

Faster Loan Processing: AI reviews credit histories, transactions, and behavioral data to deliver faster, more consistent decisions.

Expanded Access: Alternative data sources like utility payments or digital activity help extend credit opportunities to underserved segments.

Bias Mitigation: Consistent application of lending criteria reduces human bias while strengthening compliance and reputation.

4. Regulatory Compliance & AML with AI Agents

Regulatory processes demand precision and scale, two areas where financial services AI makes a measurable difference.

Continuous AML Surveillance: AI continuously monitors transactions and communications, detecting suspicious activity as it happens.

Document and KYC Automation: Conversational AI guides users through onboarding with real-time checks that reduce drop-offs and manual errors.

Automated Regulatory Reporting: Reports are generated and validated automatically, freeing compliance teams from repetitive review cycles.

5. Algorithmic Trading & Real-Time Portfolio Optimization

Traders and investors use AI and financial services tools to act on insights that once took hours to surface.

Instant Market Analysis: AI-driven systems scan global data to identify shifts in sentiment and execute precise, timely trades.

Personalized Wealth Management: Conversational AI tools like smallest.ai explain portfolio changes, investment risks, and market trends in human-friendly language.

Self-Adjusting Strategies: Portfolios adjust dynamically based on live data, minimizing exposure to sudden market swings.

6. Emerging Area: Hyper-Personalized Financial Wellness

Financial services and AI are merging to create everyday support for customers, not just transactional convenience.

Real-Time Spending Nudges: AI provides alerts and insights when spending drifts off track or saving goals need attention.

On-Demand Education: Conversational AI offers quick, personalized explanations of financial terms and decisions inside apps or calls.

Budget Coaching Assistants: Voice AI reminds customers of payments, goals, and next steps for better financial discipline.

Overcoming the Complexities of Implementing AI in Financial Services

Adopting AI requires bridging technology, people, and processes. Success comes from aligning data, governance, and expertise to realize value without disrupting existing operations.

Challenge | How to Overcome It |

|---|---|

Regulatory Compliance Complexity | Work closely with compliance teams to embed AI within regulatory frameworks and maintain auditable processes. |

Legacy Systems and Data Silos | Introduce middleware or APIs to bridge old systems and centralize data for AI processing. |

Data Quality and Availability | Conduct data audits, clean datasets, and prioritize consistent, structured inputs for AI models. |

Cultural Resistance and Skill Gaps | Offer training programs and involve teams early to build trust and understanding of AI outputs. |

Explainability and Transparency Demands | Use interpretable AI models and provide clear dashboards for auditors and stakeholders. |

Cost and Resource Allocation | Start with focused pilots to demonstrate ROI, then scale gradually while controlling expenses. |

Incremental Deployment Strategy | Deploy AI in stages, starting with high-impact, low-risk use cases to prove value. |

Collaborations with Domain Experts | Embed financial experts in AI projects to guarantee outputs align with real-world processes. |

Continuous Monitoring and Governance | Implement ongoing performance tracking, issue alerts, and governance controls to maintain reliability. |

Discover how smarter automation and real-time insights are reshaping loan processes in banking with How AI Lending Is Transforming the End-to-End Borrower Experience.

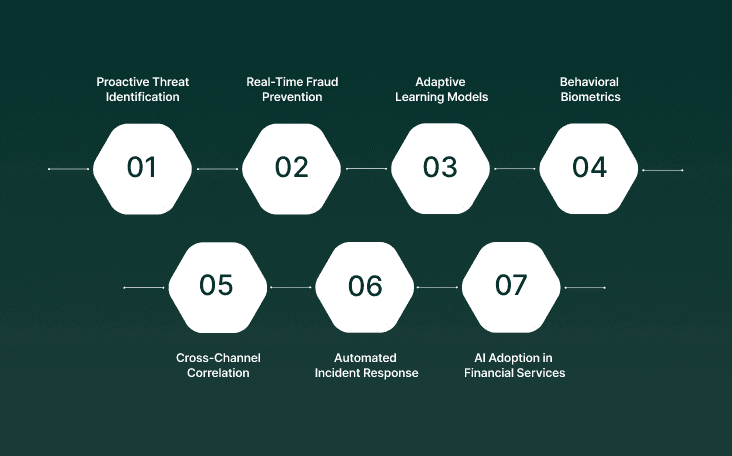

How AI in Financial Services Strengthens Cybersecurity and Fraud Detection

AI monitors transactions, voice interactions, and device activity in real time, catching suspicious behavior early and reducing fraud before it impacts customers or institutions.

Proactive Threat Identification: AI models analyze transaction patterns, device behavior, and voice interactions to flag anomalies long before human teams notice irregularities.

Real-Time Fraud Prevention: Instead of relying on post-incident reports, financial services AI stops fraudulent activity in motion, reacting in milliseconds across payment systems and channels.

Adaptive Learning Models: Machine learning updates itself with every new data input, reducing false positives and keeping pace with changing fraud tactics.

Behavioral Biometrics: AI tracks subtle patterns like typing rhythm, voice tone, and call duration to distinguish genuine customers from impersonators.

Cross-Channel Correlation: Financial services and AI systems connect insights across online banking, mobile apps, and contact centers to spot inconsistencies missed by isolated tools.

Automated Incident Response: When an alert triggers, AI categorizes risk, prioritizes critical threats, and generates recommended actions instantly for security teams.

AI Adoption in Financial Services for Compliance: Adoption of AI-driven fraud controls supports audit readiness by maintaining transparent logs and traceable detection records for every flagged event.

Emerging Trends Shaping AI in Financial Services

The next phase of AI in financial services is moving beyond automation toward intelligence that anticipates customer needs, adapts to regulatory changes, and enhances resilience. These trends reveal where institutions are focusing their investments, on systems that learn, self-correct, and deliver measurable outcomes across the entire financial value chain.

Voice AI for Real-Time Service: Conversational and voice-driven systems are becoming core to banking operations, handling complex interactions that go beyond simple balance checks or FAQs.

Generative AI in Compliance and Reporting: AI and financial services teams are adopting generative models to summarize regulations, detect anomalies in filings, and draft audit-ready reports in seconds.

AI-Powered Risk Intelligence: Predictive models now anticipate liquidity pressure, market swings, and credit exposure far earlier than human analysts can.

AI-Driven Personal Finance Management: Financial services AI is helping consumers plan better through hyper-personalized savings nudges, spending insights, and predictive cash flow alerts.

Integration with Voice Biometrics: AI-driven authentication is expanding, using unique vocal patterns to verify identity and prevent fraudulent access during calls or transactions.

Responsible AI Adoption in Financial Services: Boards and compliance leaders are prioritizing ethical AI frameworks, focusing on transparency, fairness, and auditability across all automated systems.

Convergence of Human and AI Collaboration: The next growth phase will rely on AI assisting, not replacing, human teams, combining speed and context to deliver higher-value outcomes.

How Smallest.ai Empowers Financial Institutions with Smarter AI Solutions

Financial institutions adopting AI in financial services face the challenge of providing real-time, personalized experiences while securing sensitive data. Smallest.ai delivers voice AI, conversational AI, and intelligent voice agents that automate customer interactions, detect anomalies, and improve engagement across contact centers, all in real time.

Voice AI for Live Customer Interactions: Smallest.ai’s voice AI transcribes, analyzes, and responds to calls instantly, allowing faster and more natural conversations with customers.

Conversational AI Agents: Intelligent voice agents handle complex customer queries, guide interactions, and escalate only when necessary, reducing operational load and improving service quality.

Voice Cloning Detection: AI identifies synthetic or manipulated voices during calls, helping institutions prevent fraud while maintaining trust in customer communications.

Lightning-Fast Text-to-Speech: High-quality TTS converts text into natural-sounding speech across multiple languages, supporting global operations without compromising clarity or tone.

Integrated Analytics & Insights: Real-time call and interaction data provides actionable insights, helping teams spot trends, measure engagement, and optimize workflows without manual analysis.

Multi-Channel Connectivity: Smallest.ai connects voice agents to email, chat, WhatsApp, and CRM tools, allowing a single interface to manage all customer touchpoints.

Enterprise-Grade Security: Data is protected under SOC 2 Type II, HIPAA, and PCI standards, with secure on-premise or cloud deployments for sensitive financial operations.

Quick Deployment and Scale: Developers can build, test, and deploy voice agents in minutes using Node or Python SDKs, accelerating AI adoption in financial services.

Global Language Support: Smallest.ai supports lifelike voices in over 16 languages, making it possible to engage customers across regions with authentic, human-like speech.

Together, these capabilities allow financial institutions to deliver faster, safer, and more human customer experiences, proving that Smallest.ai is redefining how AI powers trust and efficiency in modern banking.

Final Thoughts!

AI in financial services is transforming how institutions respond to complexity and uncertainty, giving teams the ability to act on insights that once took hours to uncover. From detecting subtle fraud patterns to guiding intelligent credit decisions, AI in financial services is allowing faster, smarter interactions without adding operational strain.

Smallest.ai helps financial organizations unlock these benefits with voice AI, conversational AI, and intelligent voice agents. Our solutions handle live customer interactions, flag synthetic voices with voice cloning detection, and provide real-time insights, all while supporting multiple languages and maintaining enterprise-grade security.

By reducing manual workloads, improving response quality, and providing clear analytics, Smallest.ai makes AI adoption practical and measurable.

Experience the impact firsthand and see how voice AI and intelligent agents can elevate your operations. Book a demo today.

FAQs About AI in Financial Services

1. How is AI in financial services improving loan accessibility?

AI and financial services use alternative data, like digital behavior and payment history, to assess credit risk beyond traditional credit scores.

2. Can financial services AI detect complex fraud patterns across multiple channels?

Yes. AI in financial services monitors app activity, voice calls, and transactions simultaneously, identifying sophisticated threats that manual systems often miss.

3. What challenges exist in AI adoption in financial services?

Financial services and AI adoption can be slowed by legacy systems, fragmented data, regulatory scrutiny, and the need for skilled personnel to manage AI models.

4. How does AI in financial services improve customer experience beyond chatbots?

AI and financial services allow conversational voice agents, real-time call analysis, and predictive guidance that anticipate customer needs and improve engagement.

5. Are there ethical concerns with financial services AI?

Yes. AI adoption in financial services requires transparency, bias mitigation, and auditability to maintain compliance and preserve customer trust.

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now