Discover AI lending's role in faster approvals, personalized experiences, enhanced fraud detection, and smarter underwriting. Click to learn more!

Prithvi Bharadwaj

Updated on

December 26, 2025 at 11:26 AM

Lending used to be a process grounded in manual reviews, extensive paperwork, and reliance on traditional credit-bureau scores. The typical borrower journey involved visiting a branch, submitting physical documents, and waiting for days or even weeks for approval. In contrast, today’s digital-first consumers expect decisions in minutes and a seamless, frictionless experience supported by mobile apps and real-time communication..

This article explores how AI is transforming the lending landscape. We’ll examine what lending is today, how AI is reshaping every stage, from credit decisioning to servicing and recovery, and what these changes mean for both borrowers and lenders as the industry moves toward a smarter, faster, and more inclusive future.

Key Takeaways

AI is transforming lending from manual, paper-heavy reviews to intelligent, automated decision-making, enabling faster, fairer, and more inclusive credit approvals.

Smart credit models powered by machine learning analyze behavioral, transactional, and alternative data, giving lenders a deeper and more accurate understanding of borrower potential.

Automation and predictive analytics enhance every stage of the lending lifecycle, from lead identification and KYC to credit scoring, disbursement, and collections.

AI-driven fraud detection, compliance automation, and explainable decision models build transparency and trust, ensuring ethical and regulation-ready lending practices.

Voice and conversational AI are redefining borrower communication, delivering 24/7 multilingual support, improving collections, and scaling operations without expanding teams.

Platforms like Smallest.ai exemplify the future of AI lending, combining intelligent automation, compliance-grade voice agents, and multilingual engagement to streamline operations at scale.

What Is AI Lending?

AI lending is reshaping how financial institutions evaluate, approve, and manage loans. It brings intelligence, speed, and fairness to what was once a slow and manual process.

AI lending uses technologies like machine learning (ML), natural language processing (NLP), and predictive analytics to automate and improve every stage of the lending journey. From credit scoring to underwriting, AI empowers lenders to make faster, data-driven decisions with higher accuracy.

Traditional vs. AI-Driven Lending

The lending industry has evolved from manual evaluations to intelligent automation. This shift marks a new era of smarter, fairer, and more efficient lending practices.

Aspect | Traditional Lending | AI-Driven Lending |

|---|---|---|

Decision Process | Manual and subjective | Automated and data-driven |

Data Sources | Limited to credit history and income | Includes alternative data (transactions, digital behavior, etc.) |

Speed | Slow, paper-heavy process | Instant or near real-time approvals |

Accuracy | Dependent on human judgment | Enhanced by predictive analytics and ML models |

Bias & Fairness | Prone to human bias | Designed for fairness and explainable outcomes |

Customer Experience | Generic and time-consuming | Personalized, digital-first, and seamless |

Core Principles of AI Lending

AI lending operates on a few key principles that define its effectiveness and integrity. These principles ensure decisions are not only fast but also fair, transparent, and personalized.

1. Data-Driven Decision-Making: AI systems evaluate large volumes of financial and behavioral data to predict creditworthiness more accurately. This minimizes reliance on outdated or limited credit scores.

2. Automation and Efficiency: AI replaces manual processes such as document review, KYC, and risk checks with intelligent automation. This dramatically reduces turnaround time and operational costs.

3. Fairness and Transparency: With explainable AI models, lenders can identify and mitigate bias, ensuring every decision is transparent and ethically sound. This builds greater trust among borrowers.

4. Customer Personalization: AI enables tailored lending experiences by understanding each borrower’s unique financial behavior. Lenders can offer personalized loan terms, recommendations, and repayment options.

How AI Streamlines the Lending Lifecycle (Step-by-Step)

AI reshapes the lending journey from lead generation to collections. Each stage becomes faster, smarter, and more customer-centric through automation and intelligent decisioning.

Step 1: Lead Identification & Pre-qualification

AI helps lenders find the right borrowers before they even apply. It scans behavioral data, spending patterns, and credit signals to identify strong prospects.

Predictive insights highlight borrowers most likely to qualify.

Targeted marketing reduces acquisition costs and boosts conversion rates.

Step 2: Application & KYC Automation

Borrowers experience a faster, simpler onboarding process with AI-driven automation. Document verification and KYC are completed seamlessly in real time.

OCR and face recognition verify identity and extract data instantly.

Smart workflows minimize manual errors and paperwork delays.

Step 3: Credit Scoring & Risk Assessment

AI makes credit evaluation more inclusive and accurate. Machine learning models look beyond traditional scores to understand true borrower potential.

Alternative data (like digital activity or cash flow) enriches risk insights.

Dynamic scoring models adapt continuously to new information.

Step 4: Loan Decisioning & Underwriting

Automated decision engines replace manual underwriting with transparent, data-backed approvals.

Predictive analytics determine optimal loan terms in seconds.

Explainable AI ensures fairness and regulatory compliance.

Step 5: Loan Disbursement

Once approved, AI ensures funds are released quickly and securely.

Automated validation checks for fraud or incorrect details.

Instant disbursement reduces turnaround time and boosts borrower satisfaction.

Step 6: Collections & Customer Support

AI continues to optimize post-loan interactions through predictive and conversational intelligence.

Predictive analytics flag potential defaults before they occur.

AI chatbots and voice assistants handle reminders, FAQs, and repayment support 24/7.

Also Read: How Voice AI Enhances Auto Loan Collections

Key Use Cases of AI in Lending

AI is redefining every stage of the lending ecosystem, from how lenders identify prospects to how they manage risk and engage customers. By integrating intelligent automation and analytics, financial institutions can deliver faster, fairer, and more personalized lending experiences.

1. Intelligent Credit Scoring

Traditional credit models rely heavily on bureau data and fixed scoring rules. AI expands this by analyzing alternative data such as cash-flow trends, rent payments, or digital transaction histories. This approach helps lenders accurately assess creditworthiness and extend loans to thin-file or underbanked borrowers.

2. Automated Loan Underwriting

AI-driven underwriting tools evaluate risk in real time using predictive analytics and machine learning. They instantly assess income stability, repayment capacity, and fraud indicators. This reduces manual effort and shortens approval times from days to minutes.

3. Fraud Detection and Prevention

Fraudsters continuously evolve, and so do AI models. By detecting unusual patterns in data, AI can flag suspicious activities such as synthetic identities or false documentation. Continuous learning algorithms enhance accuracy, protecting lenders and borrowers alike.

4. Loan Servicing and Collections

AI supports lenders even after disbursement. Predictive analytics identify borrowers who may default early, allowing proactive engagement. Automated reminders and personalized repayment plans improve recovery rates while preserving customer relationships.

5. Conversational and Voice AI Support

AI-powered chatbots and voice assistants simplify customer interactions throughout the loan journey. From answering eligibility questions to providing payment reminders, they offer 24/7 support. Voice AI also helps verify identity and enhance accessibility for diverse borrower groups.

6. Risk Management and Portfolio Monitoring

AI continuously monitors portfolio performance and external factors like market shifts or employment trends. Early risk signals enable lenders to adjust strategies and minimize losses. This leads to smarter capital allocation and stronger portfolio resilience.

7. Compliance and Reporting Automation

AI simplifies complex regulatory reporting by tracking decisions and creating audit-ready documentation. Natural language processing (NLP) can even summarize compliance reports, ensuring transparency and saving valuable analyst hours.

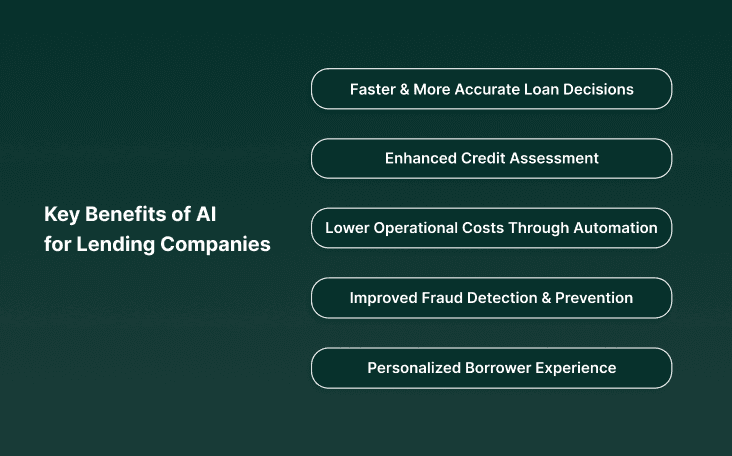

Key Benefits of AI for Lending Companies

AI is becoming a core enabler for modern lending institutions. It doesn’t just automate tasks; it strengthens risk intelligence, accelerates decision-making, and creates a more scalable, customer-focused lending business model.

Below are the most important benefits lenders gain by adopting AI:

Faster and More Accurate Loan Decisions

AI evaluates borrower profiles in seconds, utilizing vast amounts of data points, which reduces manual underwriting time and errors.

Real-time credit evaluation

Consistent and data-driven approvals

Lower turnaround time for loan processing

Loan approvals are now processed in minutes, enhancing customer satisfaction and conversion rates.

Enhanced Credit Assessment and Risk Management

Traditional credit scores miss many essential behavioral and financial signals. AI fills this gap.

Uses transaction data, spending patterns, income stability, and digital behavior

Detects high-risk borrowers early

Predicts default probability and repayment ability

Better loan quality and reduced default rates.

Lower Operational Costs Through Automation

AI reduces manual workloads across onboarding, verification, servicing, and collections.

Automated document checks

AI-powered customer support and voice bots

Streamlined compliance and reporting

Leaner operations, fewer staffing requirements, and higher productivity.

Improved Fraud Detection and Prevention

Fraud has increased with digital lending, and AI acts as a real-time defense system.

Detects identity, application, and document fraud

Biometric and device-level verification

Patterns and anomaly-based fraud alerts

Significantly reduced financial and reputational losses.

Personalized Borrower Experience

Today’s customers expect tailored financial products. AI helps lenders move beyond one-size-fits-all.

Personalized loan offers and pricing

Automated financial assistance and loan suggestions

Behavioral insights for better targeting

Higher customer engagement and stronger loyalty.

Key Challenges and How to Ensure Responsible Adoption

While AI is transforming lending with speed, accuracy, and personalization, it also brings new responsibilities. U.S. lenders must navigate data privacy, fairness, and regulatory scrutiny to ensure AI is adopted safely, ethically, and transparently.

Data Privacy and Security Concerns

AI depends on vast amounts of sensitive borrower data, making security a critical priority. Lenders must use strong encryption, anonymization, and access controls to prevent breaches. Compliance with GLBA, FCRA, and CCPA/CPRA helps protect consumer trust and meet U.S. data standards.

Algorithmic Bias and Fairness

AI can unintentionally inherit bias from historical lending data, creating unfair outcomes. Under ECOA(Equal Credit Opportunity) and the Fair Housing Act, lenders must ensure equal access to credit for all borrowers. Regular bias audits and diverse data inputs help maintain fairness and promote financial inclusion.

Regulatory and Ethical Compliance

The CFPB( Consumer Financial Protection Bureau), and the FDIC (Federal Deposit Insurance Corporation) are increasingly emphasizing transparency and accountability in AI-driven lending. Lenders must follow strong governance frameworks to ensure compliance and model integrity. Clear audit trails and ethical AI practices build long-term credibility and trust.

Need for Explainable AI in Lending Decisions

Transparency is vital when AI influences financial outcomes. Borrowers and regulators must understand how and why a credit decision was made. Explainable AI (XAI) tools like LIME and SHAP clarify model reasoning, meeting Regulation B requirements and strengthening consumer confidence.

Balancing Automation with Human Oversight

Automation enhances efficiency, but human oversight ensures fairness and empathy. A human-in-the-loop approach allows experts to review complex cases and maintain accountability. The future of responsible AI lending lies in balancing machine precision with human judgment.

Also Read: How to Build AI Voice Agents for Debt Collection

What Role Will Voice AI and Virtual Agents Play in Lending?

Modern lending is communication-heavy, including onboarding calls, KYC checks, repayment reminders, delinquency follow-ups, loan servicing queries, and collections. Traditionally, these tasks required large call-center teams, high training costs, and manual effort.

Voice AI is changing that. Today’s lenders are deploying AI-powered voice agents and virtual assistants to automate borrower communication, ensure consistent messaging, and operate at scale without adding headcount.

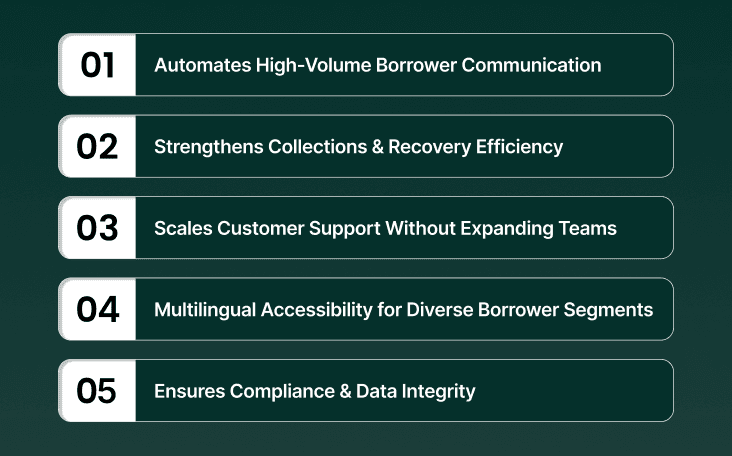

How Voice AI Enhances Lending Operations

Voice AI is revolutionizing lending by automating interactions, accelerating loan processing, and enabling lenders to deliver faster, smarter, and more personalized experiences.

1. Automates High-Volume Borrower Communication

Voice AI can handle routine but critical communication touchpoints at scale, from eligibility calls and document reminders to repayment nudges and delinquency outreach.

Eliminates hold times and manual calling queues

Ensures every borrower receives timely follow-ups

2. Strengthens Collections and Recovery Efficiency

Collections are one of the costliest parts of lending. Voice AI helps lenders:

Send automated due-date reminders and follow-ups

Negotiate payment commitments

Escalate to agents only when necessary

Lenders using voice automation report higher connect rates, improved recovery percentages, and lower manual workload.

3. Scales Customer Support Without Expanding Teams

Voice AI agents can resolve standard queries, provide loan updates, and guide customers through repayment options — 24/7.

Reduces dependency on call-center staff

Delivers consistent, compliant scripts

Improves customer satisfaction by offering instant answers

4. Multilingual Accessibility for Diverse Borrower Segments

In markets like India and Southeast Asia, borrowers expect support in regional languages.

Voice AI platforms such as Smallest.ai offer support across multiple global and regional languages, enabling lenders to build trust and serve wider segments without hiring multi-lingual teams.

5. Ensures Compliance and Data Integrity

Financial communication must follow regulatory and audit-ready standards.

Voice AI supports:

Standardized scripts and compliance workflows

Real-time call recording and analytics

Audit trails for every borrower interaction

How Smallest.ai Is Driving the Future of Lending

Platforms like Smallest.ai are leading the lending transformation by combining AI-driven insights, automation, and personalization to streamline operations and deliver faster, smarter borrower experiences.

Custom-trained voice agents built for enterprise workflows: they handle hundreds of complex scenarios and execute predictable loan-lifecycle scripts.

High scalability: agents that manage thousands of calls in parallel, enabling servicing and collections at a large scale.

Multilingual and global reach: support for over 16 languages (including regional Indian languages such as Hindi, Kannada, and Tamil), perfect for diverse borrower populations.

Low latency, natural-sounding voice conversations (<100ms response times) to mimic human interaction and retain borrower engagement.

Seamless integration with existing systems: APIs, SDKs, CRM/telephony integration to embed voice agents into loan servicing platforms.

Compliance and enterprise-grade security: designed for regulated industries, with enterprise deploy options (cloud, on-premises, VPC) and certifications like SOC 2 Type II.

In lending and debt recovery, these strengths translate into lower cost per contact, higher connect and promise-to-pay rates, and improved borrower experience.

Conclusion

AI is reshaping lending into a faster, fairer, and more intelligent system, one where credit decisions are data-driven, experiences are seamless, and borrowers are supported throughout their financial journey. Institutions that embrace AI now, while prioritizing transparency, ethical decision-making, and customer-centric design, will be the ones redefining trust and leadership in modern finance.

The future of lending belongs to lenders who combine technology, responsibility, and empathy, delivering smarter decisions, better borrower outcomes, and scalable growth.

Automate borrower communication, boost collections, and deliver 24/7 support with enterprise-grade AI voice agents.

Book a demo with Smallest.ai to experience the future of lending communication

FAQ

1. How does AI ensure fairness in lending decisions?

By using diverse data and explainable AI models, lenders can minimize bias. Regular audits and transparent decision logs further support fair, ethical lending practices.

2. What are the main challenges in adopting AI in lending?

Challenges include bias in models, data-privacy compliance, legacy system integration, and lack of AI-ready workforce training. Addressing these ensures smooth, responsible implementation.

3. How does AI enhance risk management?

AI continuously monitors borrower behavior and market signals to predict defaults early. It enables proactive measures like reminders, restructuring, or customized repayment plans.

4. Will AI replace human loan officers?

Not entirely. AI handles repetitive and analytical tasks, freeing human officers to focus on complex cases, relationship-building, and strategic decision-making.

5. Is AI in lending secure and compliant?

Yes, when implemented with enterprise-grade systems. Solutions like Smallest.ai follow SOC 2 Type II standards, encryption protocols, and audit-ready communication workflows.

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now