Discover the top AI voice agents transforming BFSI in 2025. Learn how conversational AI agents in financial services boost CX, cut costs, ensure compliance, and scale support.

Akshat Mandloi

Updated on

January 27, 2026 at 5:02 PM

The world of Banking, Financial Services, and Insurance (BFSI) is changing, and a big part of that change comes from AI voice agents. Imagine having a conversation with your bank just like you would with a human assistant; no wait times, no endless menus, just clear, immediate answers. This isn't science fiction anymore; it's happening right now.

Conversational AI agents in financial services are changing how customers interact with financial institutions. With Natural Language Processing (NLP) and Machine Learning (ML), these smart assistants can understand complex queries, make decisions, and provide real-time solutions, all through simple voice commands.

As we look at 2025, AI voice agents are set to become even more integrated into banking operations, enhancing customer service and making interactions feel more human-like than ever before. This blog covers what voice agents are, why BFSI needs them, top solutions in 2025, and how to choose the right one for your institution.”

TL;DR

AI voice agents are revolutionizing customer service in the BFSI sector, offering personalized, real-time interactions with minimal human intervention.

They enable 24/7 service availability, seamless integrations with existing systems, and reduce operational costs.

Top solutions like Smallest AI, IBM Watson, and Amelia enhance customer engagement, improve decision-making, and ensure regulatory compliance.

Voice agents help automate tasks such as fraud detection, KYC processes, and personalized financial advice, improving overall customer experience.

To stay ahead in the evolving BFSI landscape, adopting AI voice agents is key for operational efficiency and enhanced customer loyalty.

AI Voice Agents: What Are They?

AI voice agents are digital assistants powered by artificial intelligence, designed to perform tasks, answer questions, and engage in conversations with users through natural language. Unlike traditional automated systems, which rely on fixed commands or scripted responses, AI voice agents learn and adapt based on interactions.

They use advanced Natural Language Processing (NLP) to understand spoken language, interpret context, and generate human-like responses. These agents can handle everything from answering basic queries, like checking account balances or loan status, to more complex tasks, like recommending financial products or providing personalized investment advice.

The real magic lies in how these agents are able to continuously learn and improve, adapting to a customer’s needs over time.

Also Read: Everything You Need to Know About AI Voice Assistants

The Growing Demand for AI Voice Agents in BFSI

The financial industry is undergoing massive digital change, and customer expectations are evolving just as quickly. People want banking, insurance, and investment services to be instant, available 24/7, and tailored to their specific needs—all without navigating long wait times or clunky web portals.

Voice AI bridges this gap by delivering:

On-demand access: Customers can check balances, file claims, or receive loan updates using just their voice.

Always-on service: AI agents operate 24/7, offering support even outside of business hours or across time zones.

Faster, frictionless workflows: From payment reminders to identity verification, tasks that once took minutes (or manual input) are now handled in seconds.

But it’s not just about convenience. For BFSI institutions, voice AI means:

Lower support costs

Higher customer satisfaction

Scalable operations without expanding headcount

As voice-first interaction becomes the new normal, AI voice agents are emerging as a strategic asset, not just for service delivery but for competitive differentiation.

Top AI Voice Agents for BFSI in 2025

The BFSI sector is rapidly adopting AI voice agents to streamline services, enhance customer engagement, and ensure operational efficiency. Here's a look at some of the top AI voice agents that are leading the way in 2025:

1. Smallest AI

Smallest.AI is a leading provider of high-quality, real-time voice AI solutions customized for various industries. Their Voice AI Suite helps businesses engage customers through intelligent, lifelike conversations. With advanced natural language processing (NLP) and deep learning, Smallest AI offers a range of capabilities designed to optimize customer service, automate tasks, and improve operational efficiency. With solutions like Atoms, their hyper-realistic multi-modal agents, Smallest AI creates AI-powered agents capable of handling complex tasks autonomously and improving over time.

Key Features:

Real-time Voice Interaction: Facilitates seamless communication with lifelike voices, ensuring a human-like experience across 16 global languages.

Voice-First Decision Automation: Agents can handle tasks like balance inquiries, loan status updates, KYC checks, and fraud alerts without human input, escalating only when necessary.

Multilingual & Multichannel: Supports 16+ languages across voice, chat, email, and WhatsApp. Ideal for global BFSI institutions serving multilingual customer bases.

Security and Compliance by Design: Built-in support for SOC 2 Type 2, HIPAA, GDPR, and PCI-DSS ensures secure deployment in regulated environments.

Plug-and-Play Integrations: Works seamlessly with tools like Salesforce, Zendesk, Twilio, WhatsApp, and legacy BFSI systems via APIs and SDKs.

Self-Improving AI: Powered by Electron (Smallest’s in-house SLM framework), voice agents improve over time by learning from real conversations, not just pre-scripted data.

Limitations:

Pricing Tiers: While there's a free plan to start, advanced use cases and enterprise-scale support fall under premium plans (e.g., Business: $1,999/month).

Smallest AI’s solutions, like Atoms, enable BFSI companies to automate end-to-end workflows, engage customers more effectively, and make real-time decisions, all while maintaining a personalized, secure experience.

2. IBM Watson Financial Services

IBM Watson Financial Services has long been a key player in the AI space, offering powerful solutions aimed at risk management, compliance, and customer engagement within the financial sector. This AI-driven platform helps financial institutions automate complex tasks, while maintaining regulatory compliance and ensuring transparency in operations.

Key Features:

Advanced NLP Capabilities: It interprets complex regulatory documents and customer queries, providing real-time insights.

Predictive Analytics: Helps financial institutions predict risks, improve portfolio management, and optimize credit risk.

AI-Driven Compliance Solutions: Ensures adherence to stringent financial regulations like GDPR and Basel III.

Limitations:

Customization to specific financial needs is necessary, which can increase costs and time for integration.

Integration complexities may arise with existing financial systems.

3. Amelia by IPsoft

Amelia by IPsoft is designed to handle a wide range of customer service tasks, particularly in the BFSI sector. Known for its conversational intelligence and emotional understanding, Amelia offers a highly interactive, human-like experience, making it a valuable tool for banks and insurers looking to elevate their customer engagement.

Key Features:

Emotional Intelligence: Understands and responds to customer emotions, making interactions feel more human-like.

Real-Time Learning: Continuously learns and improves from each customer interaction, adapting its responses for future engagements.

Comprehensive Automation: Provides a complete customer service solution, managing everything from onboarding to claims processing.

Limitations:

High initial implementation costs make it better suited for larger institutions.

Domain-specific customization is required to address the unique needs of different financial sectors.

4. Avaamo’s Conversational AI

Avaamo provides an AI-driven conversational platform specifically designed for industries like banking, insurance, and wealth management. Its primary focus is on secure transactions, multilingual support, and improving customer engagement, making it ideal for global BFSI institutions.

Key Features:

Secure Transactions: Facilitates secure financial transactions through conversational interfaces.

Multilingual Support: Avaamo can handle customer interactions in multiple languages, making it ideal for global institutions.

AI-Driven Customer Engagement: Continuously analyzes customer data to improve engagement and service personalization.

Limitations:

Integration with legacy systems can be complex, especially for larger organizations.

Primarily focused on transactional services rather than full-scale decision-making.

5. Microsoft Dynamics 365 AI

Microsoft Dynamics 365 AI integrates advanced voice interaction capabilities into CRM and ERP systems, enhancing customer insights and streamlining operational tasks. It’s ideal for banks and financial firms that want to improve customer relationships and automate workflows.

Key Features:

Embedded Intelligence: Seamlessly integrates AI into CRM and ERP workflows, automating tasks like account management and service request handling.

Predictive Analytics: Helps institutions predict customer needs, streamline operations, and offer proactive service.

Built-in Compliance Tracking: Ensures that financial regulations are adhered to, maintaining transparency and compliance.

Limitations:

Primarily designed for CRM/ERP systems, limiting standalone AI voice agent functionality.

Higher integration and licensing costs can be a barrier for mid-sized firms.

6. Google Dialogflow

Google Dialogflow is a highly customizable conversational AI platform that excels in understanding complex financial language and can be deployed across multiple channels. It is an excellent option for financial institutions looking to provide a seamless, omnichannel experience for their customers.

Key Features:

Advanced NLP for Financial Conversations: Google Dialogflow excels at understanding complex financial language and providing relevant responses.

Omnichannel Support: Allows banks to deploy their voice agents across various platforms, such as mobile apps, websites, and smart speakers.

AI Integration with Google Cloud: Leverages Google's extensive cloud capabilities for better scalability and enhanced features.

Limitations:

Requires significant technical expertise for deep customization and integration.

Hosting data on Google Cloud servers might raise compliance and data privacy concerns for some institutions.

7. Amazon Lex and Polly

Amazon Lex, combined with Polly, offers a robust platform for creating intelligent voice-driven assistants. Its ability to generate realistic, natural voice interactions makes it an excellent option for BFSI organizations looking to integrate conversational AI into customer-facing services.

Key Features:

Realistic Voice Interactions: Polly creates lifelike voice responses that make interactions feel more natural and less robotic.

Optimized for Financial Services: Specifically tailored for transactional tasks, such as balance inquiries, payment reminders, and customer support.

Seamless AWS Integration: Easy to integrate with AWS services and backend systems, ensuring a smooth deployment.

Limitations:

Limited built-in financial compliance modules, requiring additional customization for regulatory adherence.

Greater dependence on AWS cloud infrastructure, potentially limiting flexibility for non-AWS users.

As we move toward a more automated and customer-centric future, choosing the right AI voice agent will not only drive operational efficiency but also provide a more personalized and engaging experience for customers in the BFSI sector.

Also Read: Top 11 Conversational AI Platforms In 2025

Key Factors to Consider When Selecting AI Voice Agents for BFSI

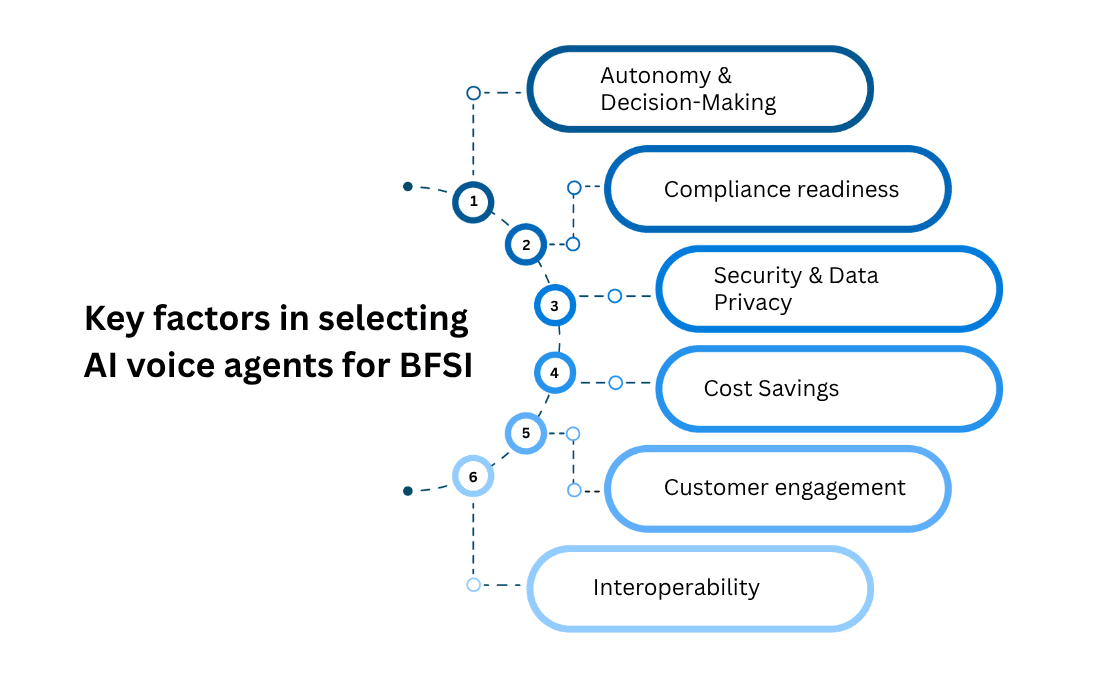

Selecting the right AI voice agent for BFSI goes beyond just using the latest technology; it depends on the institution's specific needs and the goals it aims to achieve. Let’s look at the key factors to keep in mind when choosing the best AI voice agent for your organization:

1. Autonomy and Decision-Making

For AI voice agents to truly add value, they must be capable of making autonomous decisions based on evolving data. In dynamic banking environments, where customer needs, financial trends, and market conditions change rapidly, having an agent that can adapt and act independently is a game changer.

2. Regulatory Compliance Readiness

Given the heavily regulated nature of the BFSI industry, compliance is a top priority. Your AI voice agent must be built with compliance frameworks in mind, ensuring it can maintain transparency, auditability, and explainability in its operations.

Ensuring the voice agent complies with regulations like GDPR, CCPA, and financial regulations such as Basel III will protect both customer data and the bank’s reputation.

3. Security and Data Privacy

The sensitive nature of financial data means security and privacy are non-negotiable. Look for AI voice agents that offer end-to-end encryption, secure storage, and robust authentication protocols to prevent unauthorized access to customer information.

Banks and financial institutions must also ensure that voice interactions are stored securely and that customers' privacy is always protected.

4. Customer Personalization and Engagement

AI voice agents must go beyond generic responses and leverage customer data to offer tailored advice, personalized recommendations, and proactive alerts. For example, AI voice agents can provide investment tips based on a customer’s risk profile or remind them about upcoming loan repayments.

Voice agents that understand customer behavior, preferences, and financial goals will provide a deeper, more meaningful experience that builds long-term customer loyalty.

5. Interoperability

One of the biggest challenges in banking is integrating new technology with existing systems. AI voice agents must seamlessly work with core banking systems, CRM platforms, and payment processors. The ability to integrate without major system overhauls will significantly reduce deployment time and complexity.

6. Continuous Learning and Adaptability

AI voice agents in banking should not be static. As customer interactions and financial markets evolve, these agents need to learn continuously. AI agents that adapt to new data and improve over time can offer more accurate, timely recommendations and solutions.

By aligning the agent’s capabilities with your goals, you’ll be better equipped to enhance customer interactions and streamline operations.

Also Read: Why Insurance Companies Need Voice Agents in 2025: The Complete Analysis

Wrapping Up

AI voice agents are no longer a future-facing innovation—they’re a present-day competitive edge in the BFSI sector. Whether it’s improving customer experience, reducing support costs, or enhancing fraud prevention, voice AI is redefining how banks, insurers, and financial services firms operate.

As 2025 unfolds, success in this space won’t just depend on who adopts AI, but on who implements it intelligently, with the right mix of personalization, compliance, and integration.

Whether you're launching a new digital banking experience or modernizing legacy systems, investing in a voice AI solution that’s secure, scalable, and human-like is a step toward future-proofing your customer engagement.

Ready to Explore What AI Voice Agents Can Do for You?

Smallest.ai helps BFSI teams deploy lifelike, real-time voice agents that go beyond basic automation. With 16+ languages, smart decision-making, and built-in compliance, it's a powerful way to modernize your customer support without sacrificing trust or control.

Request a demo and see how Smallest.ai can transform your customer experience.

FAQs

1. How much can AI voice agents reduce customer support costs in financial institutions?

AI voice agents can reduce support costs by 30–50%, thanks to automation, 24/7 availability, and reduced reliance on large call center teams. They also decrease churn by improving response speed and quality.

2. Are AI voice agents compliant with BFSI regulations like GDPR, PCI-DSS, or HIPAA?

Yes. Leading AI voice platforms are built with compliance in mind, offering features like audit trails, data encryption, and access controls. Always ensure your vendor supports financial regulations relevant to your region.

3. Can AI voice agents handle complex use cases like KYC, fraud alerts, or claims processing?

Absolutely. Advanced AI agents can now automate KYC verifications, detect anomalies for fraud prevention, and guide users through claims or loan processes, all through voice-driven workflows.

4. How easily can AI voice agents integrate with existing banking and CRM systems?

Top AI agents offer plug-and-play integrations via APIs/SDKs with platforms like Salesforce, Twilio, Oracle, legacy core banking systems, and even custom-built CRMs, reducing IT burden during deployment.

5. What kind of ROI can BFSI organizations expect from deploying conversational AI agents?

ROI can be realized within 6–12 months, depending on scale. Benefits include cost savings, faster resolutions, higher NPS scores, and increased agent productivity, especially during high-volume periods.

6. Can conversational AI replace human agents in BFSI call centers?

Not entirely—but AI voice agents can handle 70–80% of Tier 1 queries, freeing human agents to focus on high-touch, complex, or emotionally sensitive interactions.

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now