Explore generative AI in insurance with 6 real use cases, risks, tools, and examples insurers use to cut delays, control costs, and scale operations. Read more.

Kaushal Choudhary

Updated on

January 27, 2026 at 10:13 AM

Insurance work still runs on reading, re-reading, and rewriting. Claims files stretch into dozens of pages, policy language invites misinterpretation, and every delay shows up in customer frustration and operational cost. If you are searching for generative ai in insurance, it usually signals a very practical problem. Manual processes take too long, scale poorly, and leave teams buried in documents instead of decisions. This is exactly where generative AI in insurance is starting to change daily operations.

The shift is accelerating. The generative AI in the insurance market size is valued to increase by USD 4.3 billion, at a CAGR of 40.8% from 2024 to 2029, as insurers push to handle unstructured data faster across health, life, and P and C lines.

In this guide, we cover why adoption is rising, the most valuable generative AI use cases in the insurance industry, real examples from US insurers, the risks leaders must manage, and the core tools insurers rely on today for claims, underwriting, servicing, and customer communication.

Key Takeaways

Unstructured Data Is The Bottleneck: Claims, medical records, and policy documents slow insurance workflows more than pricing or rules logic.

Decision Support Beats Decision Automation: Generative AI delivers value when summarizing and structuring data, not replacing underwriting or claims authority.

Health and Life Insurance See Early Gains: Medical documentation review and risk summarization show faster turnaround without regulatory disruption.

Governance Determines Scale: Explainability, data residency, and human review controls decide whether gen AI deployments expand or stall.

Operational Use Cases Outperform Pilots: Measurable impact appears where generative AI removes reading and writing effort from live insurance workflows.

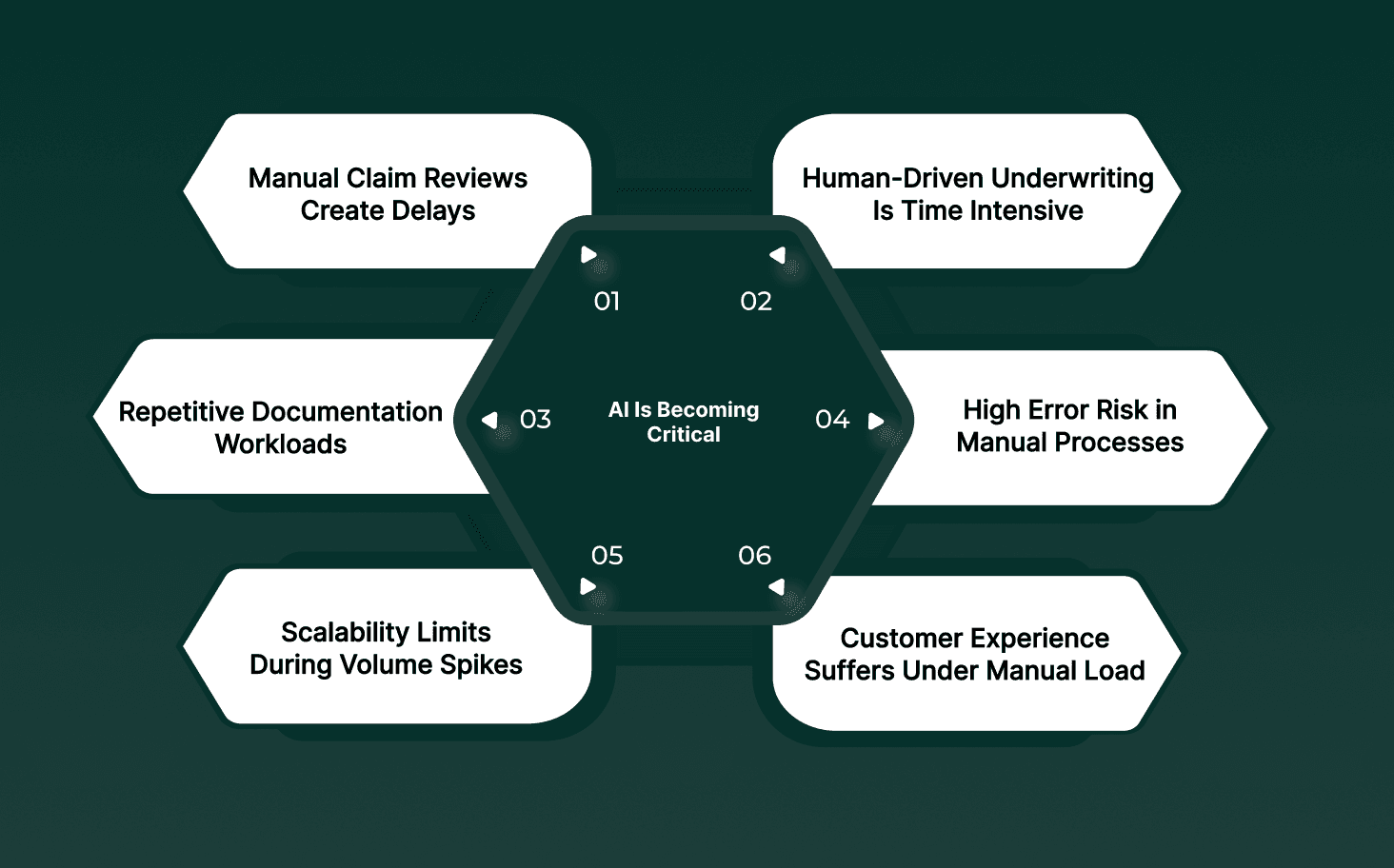

Why Generative AI Is Becoming Critical for the Insurance Sector

Generative AI in insurance is gaining urgency as manual, document-heavy workflows struggle to keep pace with operational demands. Insurance teams still rely on human review for claims, underwriting, and policy servicing, creating delays, inconsistencies, and cost pressure. Generative AI reduces this dependency by processing unstructured information at speed while maintaining traceability.

Manual Claim Reviews Create Delays: Adjusters often read through long medical reports, emails, and attachments line by line, slowing claim assessment and settlement timelines.

Human-Driven Underwriting Is Time Intensive: Risk evaluation depends on manually extracting data from applications, financial records, and disclosures, increasing turnaround time for policies.

Repetitive Documentation Workloads: Large portions of agent and operations time are spent drafting responses, summaries, and compliance notes rather than resolving cases.

High Error Risk in Manual Processes: Copy-paste workflows and fragmented systems increase the likelihood of missed details, inconsistent decisions, and rework.

Scalability Limits During Volume Spikes: Manual teams struggle to handle seasonal claim surges, catastrophe events, or enrollment periods without adding headcount.

Customer Experience Suffers Under Manual Load: Slow responses and repeated information requests frustrate policyholders across health and life insurance lines.

As claim volumes rise and regulatory scrutiny tightens, insurers cannot rely on manual processes without risking delays, higher costs, and uneven outcomes. Generative AI in the insurance industry addresses these constraints by handling language-heavy tasks at scale, allowing teams to focus on judgment, oversight, and customer-facing work.

If you want to see how similar AI-driven conversations are applied in regulated, customer-facing workflows outside healthcare, explore Conversational AI for Insurance: Uses, Benefits, and Key Challenges

High-Impact Generative AI Use Cases Across the Insurance Industry

Generative AI in insurance delivers value when applied to workflows dominated by long documents, fragmented data, and bottlenecks in human judgment. These use cases reflect how insurers deploy large language models across claims, underwriting, servicing, and compliance systems today.

1. Claims Intake, Parsing, and Triage

Generative AI models ingest first notice of loss submissions across email, PDF forms, voice transcripts, and portal uploads to create a structured claim record before adjuster involvement.

Multi-Source Claim Normalization: Converts narrative loss descriptions, attachments, and call transcripts into structured fields such as incident type, injury severity, and coverage triggers.

Automated Severity Scoring: Uses historical claim patterns and textual indicators to assign priority tiers before human review.

Early Exception Detection: Flags missing documents, contradictory statements, or policy mismatches at intake rather than during downstream processing.

2. Medical Record Interpretation in Health Insurance

Generative AI processes clinical documentation that traditional rules engines cannot interpret reliably due to variability in language and format.

Clinical Text Decomposition: Breaks down physician notes, discharge summaries, and diagnostic narratives into medically relevant entities tied to benefit rules.

Policy-to-Procedure Mapping: Aligns extracted medical events with coverage conditions, exclusions, and reimbursement criteria.

Reduced Manual Medical Review Load: Shortens the time reviewers spend reading multi-page records for routine eligibility checks.

3. Life Insurance Underwriting Assessment

Generative AI supports underwriters by synthesizing applicant disclosures, medical exams, and financial records into decision-ready summaries.

Cross-Document Risk Synthesis: Consolidates medical history, lifestyle disclosures, and third-party reports into a single risk narrative.

Inconsistency Detection: Identifies conflicts between applicant statements and external records that require escalation.

Faster Underwriting Turnaround: Reduces review time per application without altering underwriting authority or approval thresholds.

4. Policy Servicing and Coverage Clarification

Generative AI interprets policy language dynamically to answer servicing requests without manual policy lookup.

Clause-Level Policy Reasoning: Retrieves and explains exact policy sections relevant to customer questions.

Context Preservation Across Interactions: Maintains continuity across prior claims, endorsements, and servicing history.

Lower Agent Escalation Rates: Resolves repeat inquiries that typically consume frontline service capacity.

5. Fraud Investigation Narrative Analysis

Generative AI assists special investigation units by analyzing written case material, not just structured fraud signals.

Narrative Pattern Correlation: Links claim descriptions, adjuster notes, and communication logs across cases.

Early Fraud Signal Surfacing: Highlights linguistic and behavioral markers associated with known fraud typologies.

Investigator Review Compression: Reduces time spent reading repetitive documentation across related claims.

6. Regulatory and Audit Documentation Generation

Generative AI produces defensible records that explain how decisions were made across the policy lifecycle.

Decision Rationale Reconstruction: Generates clear summaries tied directly to policy terms and data inputs.

Audit-Ready Reporting Output: Produces standardized documentation for regulators and internal review teams.

Reduced Compliance Preparation Time: Limits manual compilation of decision histories during audits.

If your insurance teams need real-time voice agents that handle live calls at scale, run securely on your infrastructure, and maintain low-latency performance under heavy load, see how Smallest.ai supports production-grade voice AI.

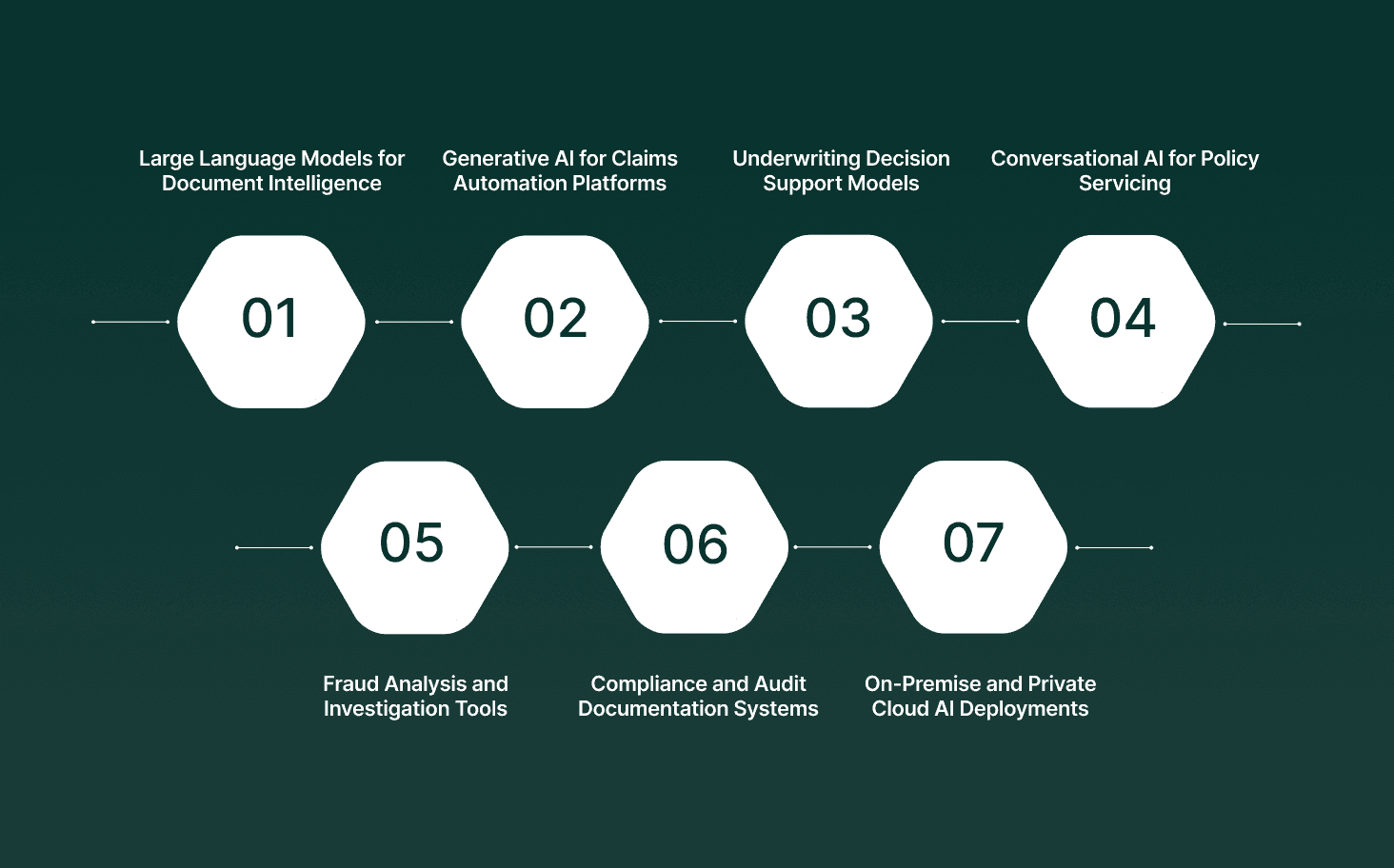

Leading Generative AI Tools Used by Insurance Providers Today

Insurance providers adopt generative AI tools based on how well they handle unstructured data, integrate with core systems, and support regulated decision workflows. These tools are typically deployed as embedded capabilities inside claims, underwriting, servicing, and compliance platforms rather than as standalone products.

Large Language Models for Document Intelligence: Used to read, summarize, and reason over policy contracts, medical records, claim narratives, and legal correspondence where traditional OCR and rules engines fail.

Generative AI for Claims Automation Platforms: Embedded within claims systems to parse first notice of loss, extract incident details, classify severity, and prepare adjuster-ready summaries.

Underwriting Decision Support Models: Applied to synthesize applicant disclosures, third-party risk reports, and medical data into structured underwriting insights without automating final approvals.

Conversational AI for Policy Servicing: Deployed across chat and voice channels to interpret coverage language, answer policy questions, and manage servicing requests using policy-specific context.

Fraud Analysis and Investigation Tools: Used by SIU teams to analyze investigator notes, communication logs, and historical claim narratives to surface non-obvious fraud patterns.

Compliance and Audit Documentation Systems: Generate explainable summaries of decisions, communications, and policy actions aligned with regulatory and internal audit requirements.

On-Premise and Private Cloud AI Deployments: Preferred by insurers handling sensitive health and financial data, allowing model inference within controlled infrastructure environments.

These generative AI tools allow insurers to process language-heavy workflows at scale while maintaining control, auditability, and regulatory alignment across insurance operations.

Key Risks and Challenges of Using Generative AI in Insurance

Generative AI in insurance introduces material operational, regulatory, and governance risks when deployed across claims, underwriting, and customer-facing workflows. These challenges stem from model behavior, data sensitivity, and the regulated nature of insurance decision processes.

Hallucinated Policy Interpretation: Language models can generate plausible responses that misstate coverage terms, exclusions, or benefit limits when guardrails are weak.

Regulatory Explainability Gaps: Many generative models struggle to provide decision-making reasoning that meets audit, dispute-resolution, and regulator-review standards.

Data Privacy and Residency Exposure: Health, financial, and personally identifiable information increases risk when models operate outside tightly controlled infrastructure.

Training Data Bias Propagation: Models can reflect historical underwriting or claims biases embedded in legacy datasets, leading to inconsistent outcomes across demographics.

Integration With Legacy Core Systems: Claims and policy administration platforms often lack clean interfaces for real-time AI-driven workflows.

Operational Overreach Risk: Applying generative AI to decision authority rather than decision support raises governance and liability concerns.

Model Drift in Long-Lived Policies: Policy language, regulations, and medical standards change faster than static model behavior can keep pace without continuous oversight.

Insurers that treat generative AI as a controlled operational layer, rather than an autonomous decision maker, reduce exposure while gaining measurable value across insurance workflows.

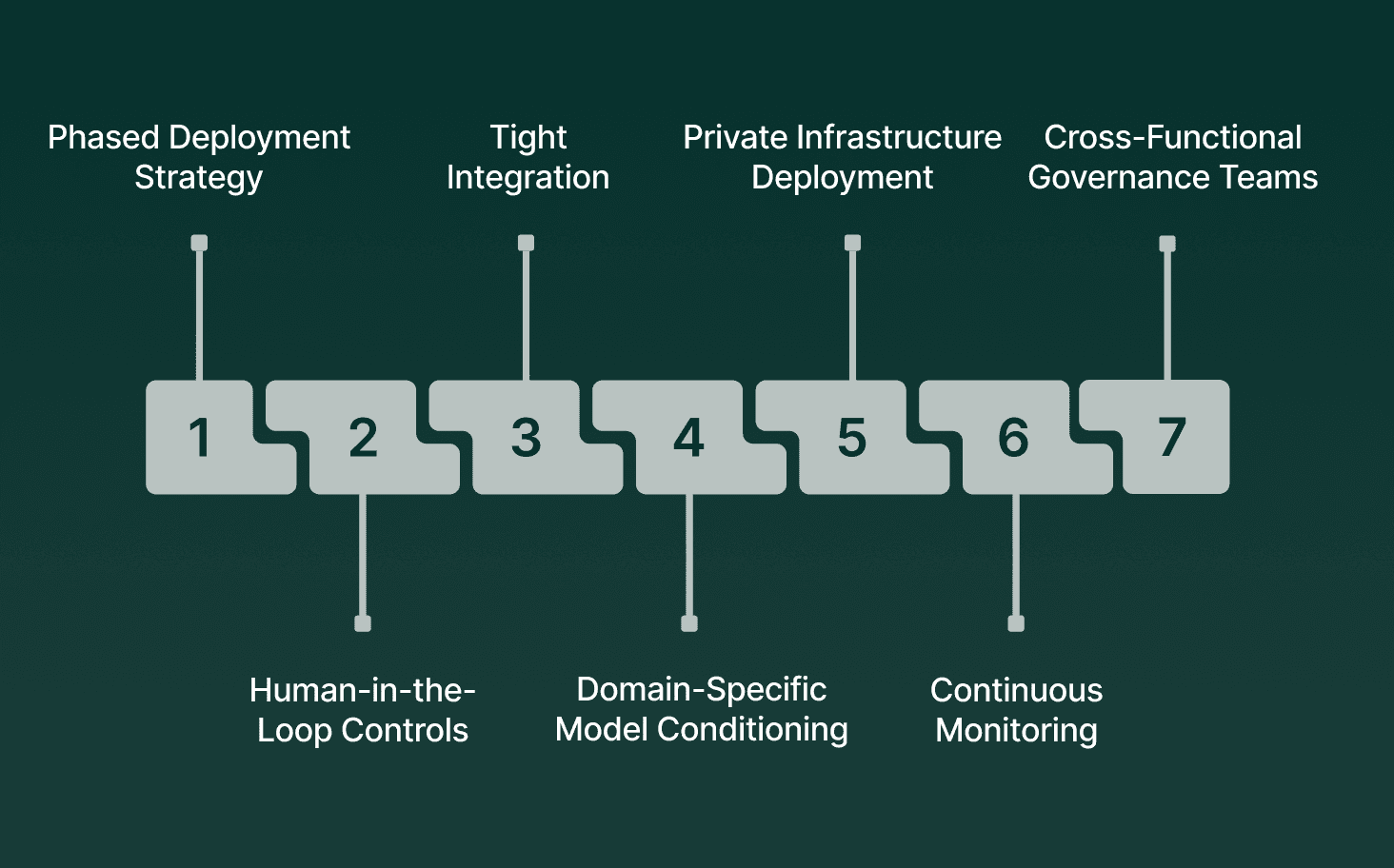

How Insurance Companies Are Adopting Generative AI at Scale

Insurance companies scale generative AI by embedding it into existing workflows rather than deploying isolated pilots. Adoption focuses on governance, system integration, and controlled expansion across claims, underwriting, and servicing functions.

Phased Deployment Strategy: Insurers start with low-risk, high-volume tasks such as document summarization and intake before expanding to decision-adjacent workflows.

Human-in-the-Loop Controls: Generative AI outputs are reviewed or approved by adjusters, underwriters, or compliance teams to maintain accountability.

Tight Integration With Core Platforms: Models are connected directly to policy administration, claims management, and CRM systems to avoid parallel processes.

Domain-Specific Model Conditioning: Models are constrained using policy language, underwriting guidelines, and regulatory rules to limit incorrect outputs.

Private Infrastructure Deployment: Many insurers run inference in private cloud or on-premise environments to control data access and residency.

Continuous Monitoring and Evaluation: Output quality, error rates, and drift are tracked using real production data rather than offline benchmarks.

Cross-Functional Governance Teams: Legal, compliance, IT, and business leaders jointly define usage boundaries and escalation paths.

Insurance providers achieve scale when generative AI operates as a governed capability within core systems, supported by oversight, integration, and continuous validation.

Real-World Examples of Generative AI in Insurance Operations

These examples show how generative AI is being applied beyond customer support and claims, extending into core technology modernization, internal productivity, and revenue-facing workflows. Each case highlights a distinct operational problem where manual effort previously limited speed or scale.

Allstate: Allstate tested generative AI to speed up migration from a legacy insurance tech stack to a new platform supporting a modern auto product.

Using large language models to automate scoping, analysis, and rule comparison across states, the PoC reduced manual effort in identifying common and unique patterns. Early results showed a 20% faster migration timeline, lowering costs and validating generative AI as a practical tool for large-scale insurance system modernization.

USAA: USAA is using generative AI to augment internal teams through service copilot tools, code-assist systems, and large-scale analysis of unstructured data across claims, underwriting, and servicing.

The company prioritizes inward-facing deployments first, focusing on accuracy, governance, and productivity gains before exposing GenAI directly to members. Early implementations show faster development cycles, reduced employee cognitive load, and a clear path to embedding generative AI into core insurance operations at scale.

Together, these deployments show that generative AI in insurance delivers value when applied to specific, high-friction workflows, producing measurable gains in speed, cost control, and execution without disrupting core decision authority.

How Smallest.ai Supports Generative AI in Insurance Workflows

Smallest.ai provides real-time voice and conversational AI systems designed for insurance operations where speed, accuracy, and control matter. The platform fits into claims, servicing, and collections environments where language-heavy interactions and live decision support drive outcomes.

Real-Time Voice Agents: Handle inbound and outbound insurance calls with low latency while following predefined scripts, rules, and escalation paths.

Live Speech-to-Text Processing: Converts ongoing calls into structured text streams that downstream systems can act on during the conversation.

Context-Aware Responses: Uses policy data, call history, and workflow state to keep conversations consistent across touchpoints.

High-Volume Call Handling: Supports thousands of concurrent calls without degrading response quality or timing.

On-Premise and Private Deployments: Runs within controlled infrastructure for insurers managing sensitive customer and health data.

Operational Visibility: Provides call logs, transcripts, and performance signals that teams can review and audit.

Smallest.ai allows insurers to apply generative AI to live voice workflows while retaining control, predictability, and compliance across customer-facing processes.

Conclusion

Generative AI in insurance is settling into a clear operational role. The insurers seeing results are not chasing novelty. They are applying these systems where language, volume, and time pressure intersect, then setting firm boundaries around oversight, data handling, and accountability. As these deployments mature, the advantage shifts from experimentation to execution. Teams that cleanly integrate generative AI into live workflows move faster without increasing risk or operational noise.

This is where real-time voice becomes a practical next step. Platforms like Smallest.ai apply generative AI directly inside live customer conversations, handling high-volume calls with low latency, precise controls, and predictable behavior.

If your teams are ready to bring generative AI into production voice workflows, see how Smallest.ai supports insurance-grade performance and scale. Book a demo to see it in action.

FAQs

1. How Is Generative AI in Insurance Different From Traditional Automation?

Generative AI in insurance goes beyond rule-based automation by interpreting unstructured data, including claim narratives, medical notes, and policy language. Unlike traditional systems that rely on fixed logic, generative AI applications in insurance reason over documents and conversations, making them well-suited to claims, underwriting, and servicing workflows.

2. Which Gen AI Use Cases in the Insurance Industry Deliver Value First?

The fastest-impact use cases of gen AI in the insurance industry appear in document-heavy workflows, including claims intake, medical record summarization in health insurance, and underwriting risk reviews in life insurance. These areas reduce manual reading time before any decision is made.

3. How Is Generative AI Used in Health Insurance Without Replacing Medical Review?

Generative AI use cases in health insurance focus on summarizing and structuring clinical documentation rather than approving or denying claims. The models extract coverage-relevant details from medical records, enabling reviewers to work more quickly while retaining full decision-making authority.

4. Can Generative AI in Life Insurance Be Used Safely in Underwriting?

Yes, when used as decision support. Generative AI in life insurance typically consolidates applicant disclosures, exam reports, and third-party data into underwriting summaries. Final risk classification and pricing remain with human underwriters to meet regulatory expectations.

5. What Limits the Scale of Generative AI Applications in Insurance?

The primary constraint on scaling generative AI applications in insurance is not model capability but governance. Data privacy controls, explainability requirements, and integration with legacy systems often determine how widely gen AI can be deployed in the insurance industry.

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now