See how AI in insurance claims brings clarity to caller inputs, supports stronger routing, and helps teams move cases through each stage with fewer hold-ups.

Prithvi Bharadwaj

Updated on

January 19, 2026 at 8:38 AM

Carrier teams feel the strain when claim calls rise, intake details come in incomplete, or adjusters receive files without the signals needed to move work forward. These slow points add cost, extend cycle time, and weaken policyholder confidence. Leaders who own claims operations need a clear view of where change produces real movement, not broad claims of automation. This is where AI in insurance claims becomes practical, especially with voice AI, conversational AI, voice agents, and voice cloning guiding callers and shaping cleaner data from the start.

The market for AI in insurance claims is forecast to reach USD 29.8 billion, which reflects how many carriers are now prioritizing real-time tools that improve intake clarity, tighten routing, and cut rework tied to missing or unclear inputs.

In this guide, you will see the top ways AI speeds each part of the claim chain so leaders can focus on upgrades that produce measurable progress, not theoretical gains.

Key Takeaways

AI Builds Cleaner FNOL Files: Guided dialog captures impact points, locations, timelines, and media during the first call, giving adjusters structured fields without repeated outreach.

Triage Decisions Read Multiple Signal Types: Models combine voice cues, image severity, document consistency, and prior case patterns to route files toward the right team on the first pass.

Document Inputs Convert Into Verified Fields: OCR and NLP extract diagnostic codes, repair part numbers, injury notes, and invoice details while cross-checking them against policy rules.

Image Models Replace Early On-Site Inspections: Computer vision reads frame deformation, intrusion depth, and structural cracks from photos to produce early repair signals without field visits.

Voice Agents Improve Daily Claim Movement: Real-time voice AI captures caller intent, guides media submission, updates missing proof, and passes structured data directly into routing and review systems.

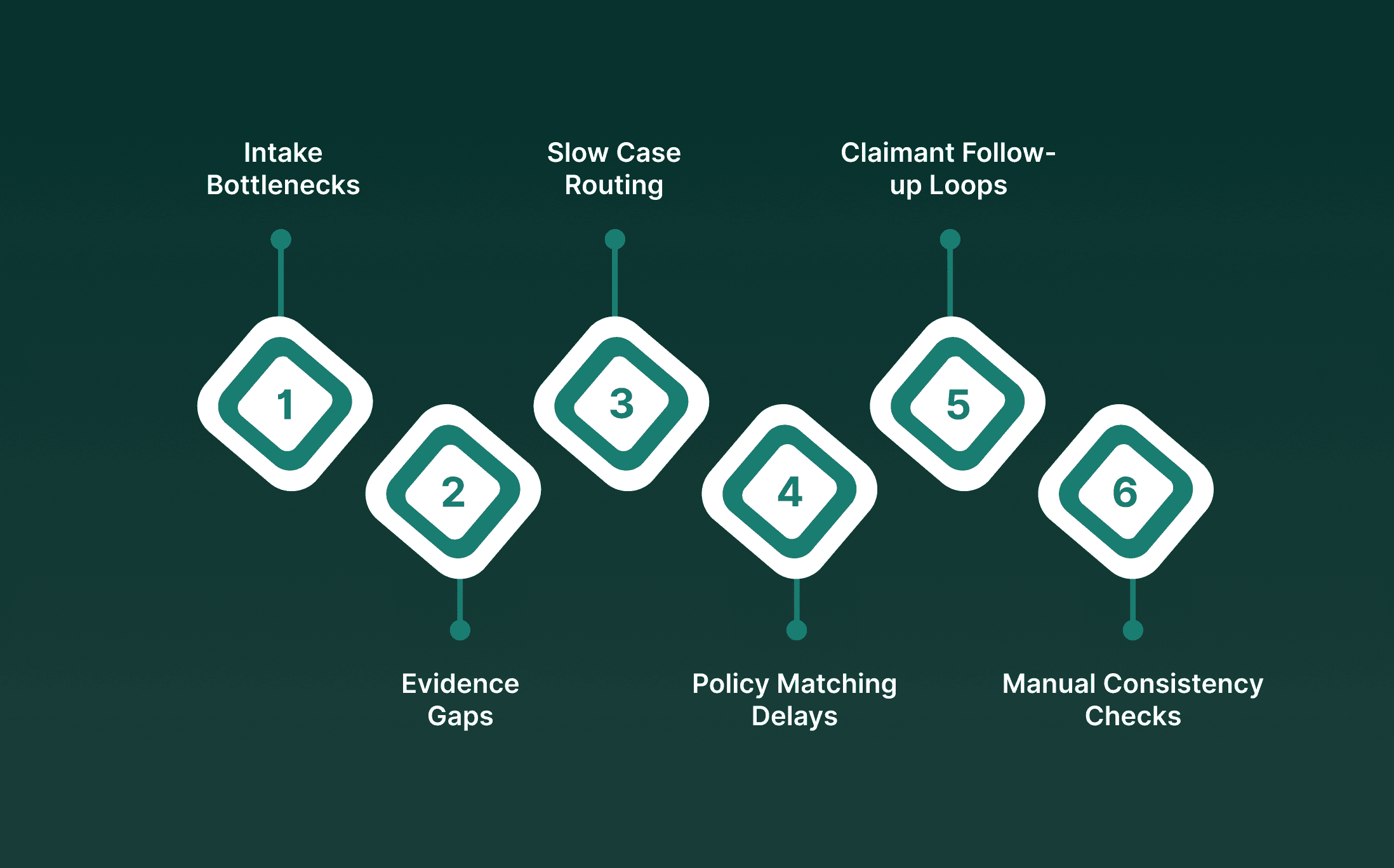

Where Insurance Claims Slow Down And Why It Matters

Rising claim volume and fluctuating case complexity place heavy pressure on carrier teams. The friction rarely comes from a single task. It builds across disconnected intake points, incomplete evidence, uneven documentation, and delayed follow-ups.

This creates long gaps between each step, which directly affects loss costs and claimant confidence.

Intake Bottlenecks: Call centers struggle when policyholders provide long narratives with missing fields, leading to repeated outreach and duplicated work.

Evidence Gaps: Photos, repair notes, medical files, and receipts arrive in different formats, slowing verification and pushing adjusters to review the same case multiple times.

Slow Case Routing: Claims reach teams that lack the right background or authority, which sends the file back through internal channels and extends cycle time.

Policy Matching Delays: Coverage rules, endorsements, and exclusions are often buried in dense documents, causing long review loops before an adjuster can move forward.

Claimant Follow-up Loops: Cases stall when carriers wait for missing paperwork or clarification from policyholders who may not know how to submit the correct material.

Manual Consistency Checks: Teams spend long hours comparing statements, reports, and media across systems. Manual checks make it hard to keep pace with high daily volume.

With Smallest.ai, claims teams gain real-time conversation signals, quicker routing, and accurate voice outputs that keep cases on track. Book a demo

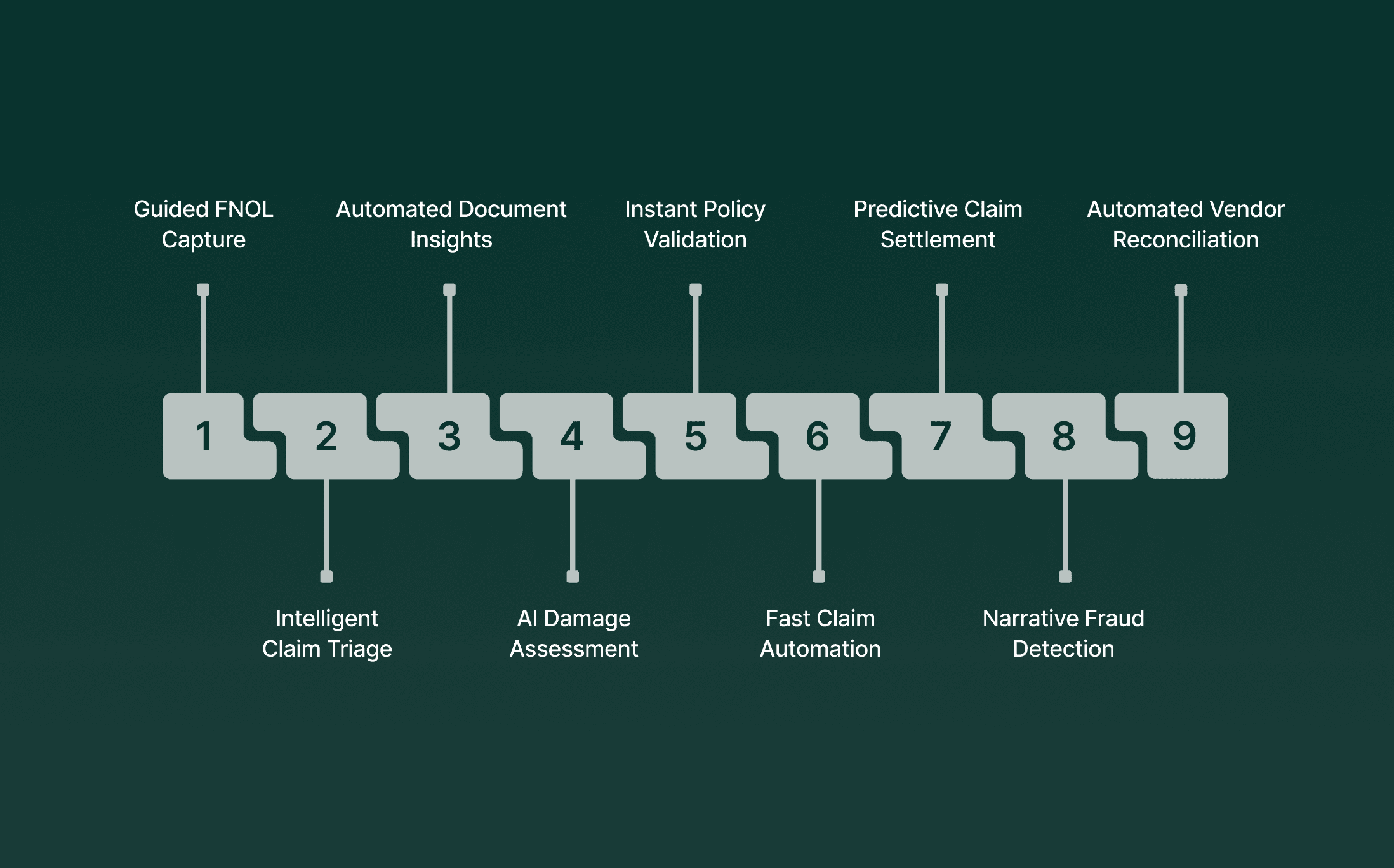

Ways AI In Insurance Claims Speeds Work From Intake To Settlement

AI helps carriers move claims faster by connecting information that normally sits in separate steps. When voice inputs, documents, images, and policy details feed into the same intelligence layer, FNOL becomes cleaner, routing is more accurate, and review work arrives with fewer gaps.

Below shows how this improves speed and consistency from intake through settlement.

1. Conversational AI Automates First Notice of Loss (FNOL) With Guided Capture, Not Forms

Conversational AI replaces rigid forms with real-time dialog that conditions each question on caller responses, extracting clean FNOL fields, temporal details, and evidence signals during the first interaction.

Guided Capture: The agent requests incident angle, point-of-impact cues, weather context, object involvement, and location metadata while callers describe events.

Evidence Prompts: Instructions steer users to capture vehicle or property images at specific distances or angles, improving downstream computer vision scoring.

Real-Time Validation: The agent detects gaps, missing timestamps, unclear injury descriptions, incomplete loss sequences, and requests clarification before the call ends.

2. Intelligent Triage Routes Claims to the Right Resources Based on Complexity, Not Adjuster Availability

AI replaces manual case assignment with scoring pipelines that read incident mechanics, claimant patterns, media cues, and policy interactions to route files accurately at intake.

Multi-Signal Scoring: Combines voice patterns, image severity, document consistency, and historical claim types to map complexity tiers.

Early Risk Flags: Detects mismatched narratives, prior claim clustering, exposure drivers, and subject matter requiring specialized investigation.

Automated Paths: Directs low-risk property, auto, and medical claims to automated handling tracks while escalating complex cases to senior adjusters.

For a closer look at how voice systems support clinical teams and patient interactions, continue with Voice AI in Healthcare: Transforming Patient Care and Workflow Efficiency

3. Document Processing Extracts Buried Risk Signals From Unstructured Submissions

IDP combines OCR, NLP, and layout-aware extraction to convert unstructured packets, scans, handwritten forms, and medical codes into normalized fields tied to policy rules and claim type.

Semantic Mapping: Distinguishes diagnostic codes, repair part numbers, injury notes, police incident sections, and financial line items.

Cross-Field Validation: Links reported injury mechanics to clinical treatment data and repair estimates to image-based severity findings.

Discrepancy Detection: Flags contradictions between claimant statements, police narrative, medical procedure codes, and repair invoices.

4. Real-Time Damage Assessment Replaces In-Person Inspection With Image Analysis

Computer vision models interpret vehicle and property photos, classify component-level damage, and generate early repair signals without scheduling a physical inspection.

Component Mapping: Identifies bumper intrusion, frame deformation, glass shatter patterns, roof displacement, and structural cracks.

Severity Logic: Distinguishes repairable vs. replace-required parts based on visual features and historical repair outcomes.

Integrity Review: Detects prior claim image reuse, geometry mismatches, altered pixels, and location inconsistencies at ingestion.

5. Claim Validation Against Policy Terms Happens in Seconds, Not Days

AI executes rule-based and model-based validation by comparing loss details to policy triggers, time conditions, endorsements, deductibles, and excluded perils.

Trigger Matching: Links incident mechanics to policy conditions (e.g., fire, theft, collision, water ingress) and validates eligibility.

Clause Identification: Highlights timing issues, late reporting, non-covered use cases, jurisdiction mismatches, and attaches relevant policy sections.

Dependency Resolution: Detects missing documents (police report, medical certification, itemized estimate) and requests them instantly.

6. Straight-Through Processing Auto-Approves Low-Risk Claims in Minutes

STP pipelines push claims with consistent data, clear liability, validated coverage, and no exposure flags through an automated approval flow.

Rule Execution: Verifies policy conditions, image severity levels, invoice alignment, and coverage limits before initiating payout steps.

Repair Network Flow: Routes repairable auto or property losses to connected vendors with auto-generated authorization packages.

Guardrail Checks: Prevents auto-approval when inconsistencies show up in FNOL narrative, image metadata, or extracted document fields.

7. Predictive Modeling Identifies Settlement Opportunities Before Negotiation Stalls

Predictive models use historical patterns, jurisdiction behavior, injury class trends, and claimant signals to guide settlement timing and strategy.

Settlement Projection: Predicts likely settlement window and amount using matched prior cases, injury class, and loss characteristics.

Litigation Signal Detection: Flags patterns tied to high dispute probability, representation timing, repeated denial cycles, and jurisdiction trends.

Resource Allocation: Directs high-risk or high-exposure cases to early senior adjuster engagement while routing low-risk cases to fast-track paths.

8. Natural Language Processing Extracts Fraud Signals From Claim Narratives

NLP examines written and spoken narratives across intake, adjuster notes, physician records, and claimant communication to surface linguistic and contextual anomalies.

Linguistic Deviations: Identifies narrative shifts, timeline contradictions, unnatural repetition, and coached phrasing typical of organized activity.

Cross-Source Comparison: Compares claimant description with police narrative, repair notes, and medical findings for mismatched intent or impact mechanics.

Behavioral Markers: Links language patterns across multiple claims tied to the same address, account, or social connections.

9. Integration With Vendor Networks Automates Repair Authorization and Billing Reconciliation

Vendor integration connects claim approvals with repair shops, contractors, or medical providers while validating each step against scope and cost rules.

Vendor Matching: Considers severity class, location radius, service capacity, and prior performance to select an appropriate vendor.

Automatic Authorization: Generates a scoped work order and dispatches it to the vendor without manual adjuster communication.

Billing Logic: Compares vendor invoices against approved parts, procedure lists, and historical cost benchmarks to prevent overcharging.

Experience voice cloning and multilingual voice agents built for high-volume claim work. Book a demo.

How AI In Insurance Claims Supports Each Step In The Claims Chain

Carriers handle an expanding mix of claim types, each with its own evidence standards, documentation rules, and handoff paths. The real impact of AI in insurance claims appears when the system treats each claim as a moving data object rather than a static file.

The intelligence layer tracks context, compares signals across sources, and helps teams move from reactive review to proactive oversight.

Early Intake Structuring and Voice Pattern Signals: AI turns caller narratives into verified fields and detects hesitation shifts or phrasing gaps that hint at timing or injury inconsistencies.

Media Severity Scoring and Collision Insight: Image models classify impact zones, part damage, and structural risk, while collision cues like intrusion depth and bumper mismatch support early liability clarity.

Repair Path and Vendor Match Logic: Models forecast repair needs using historical outcomes and part availability, then route cases to the right contractor or shop based on severity and ZIP data.

Policy Interaction and Injury Pattern Validation: The system checks loss details against coverage triggers and compares injury codes with event mechanics to surface mismatches for early review.

Subrogation and Delay Prediction Signals: AI identifies third-party exposure, prior at-fault patterns, and missing-proof risks, flagging cases likely to stall without targeted follow-up.

For a deeper look at how dialogue-led systems support claim intake and routing, read Conversational AI for Insurance: Uses, Benefits, and Key Challenges.

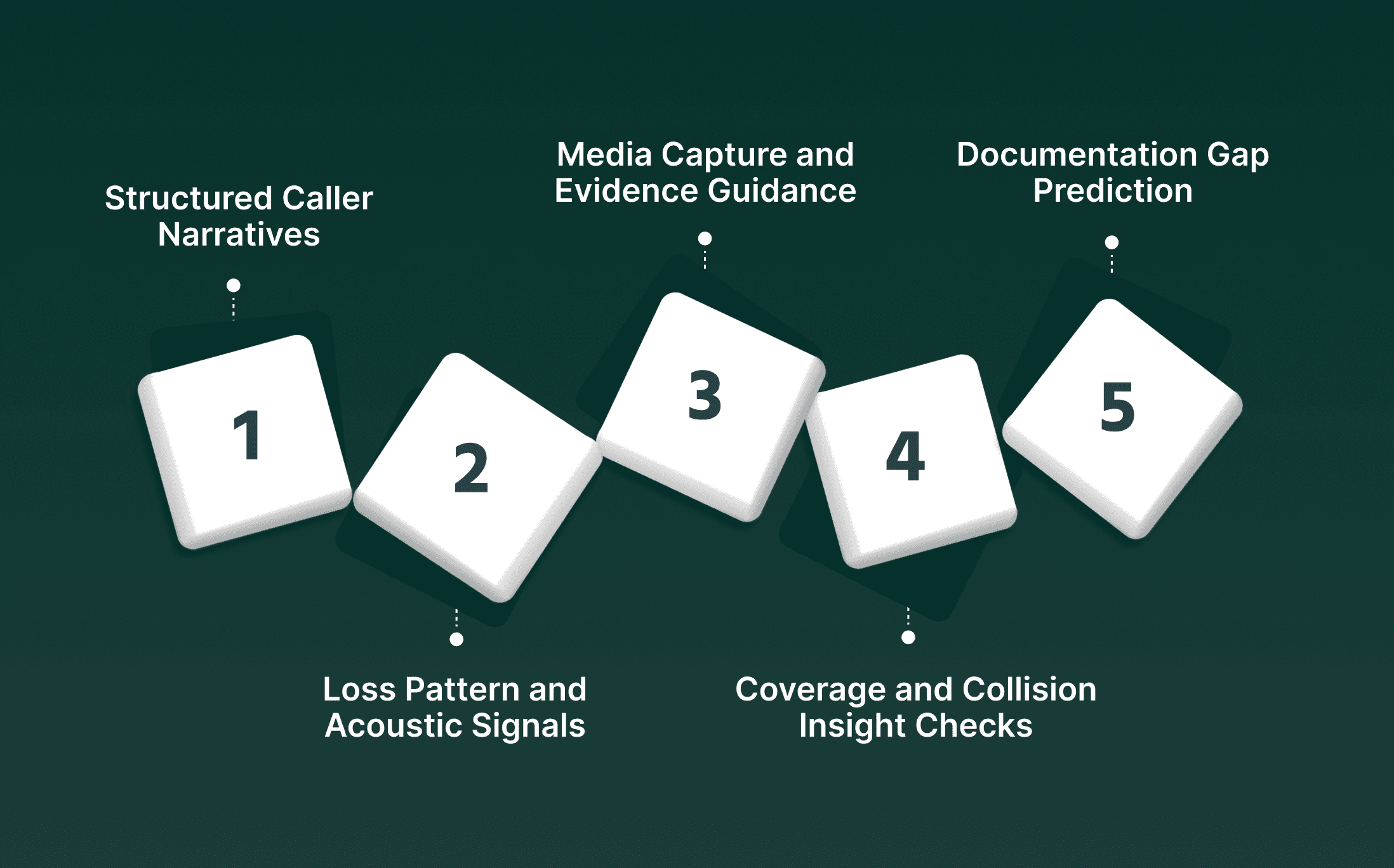

Real-Time Voice AI In Insurance Claims For Faster First Notice Of Loss

FNOL is the earliest point where carriers can shape case clarity. Real-time voice models give teams structured, verified loss details during the first call rather than scattered notes that require repeated follow-ups. This helps AI in insurance claims operate with a stronger baseline data before documents or media arrive.

Structured Caller Narratives and Event Precision: Voice models turn long explanations into verified fields and extract timestamps, locations, injuries, and vehicle or property details during the first call.

Loss Pattern and Acoustic Signals: Real-time cues highlight hesitation shifts or conflicting phrasing tied to timing, vehicle paths, or reported damage scale for early context.

Media Capture and Evidence Guidance: Voice agents like smallest.ai prompt callers to capture photos or clips that meet claim type requirements, improving downstream scoring and reducing repeat outreach.

Coverage and Collision Insight Checks: The system matches spoken inputs with policy triggers and collects impact angles, speed indicators, and point-of-contact clues for clearer liability direction.

Urgency and Documentation Gap Prediction: Models classify the required handoff path and predict missing documents early, guiding callers to provide the right material before the file advances.

For deeper insight into how voice signals surface risk indicators during early calls, read Real-Time Insurance Fraud Detection Using Voice AI.

How Smallest.ai Strengthens Operations With AI In Insurance Claims

Carriers need FNOL calls, follow-ups, and claimant outreach to move without lag. Smallest.ai supports this by pairing low-latency voice models with agents that capture accurate information, guide callers through complex steps, and keep the claim file moving. This lifts the quality of AI in insurance claims and brings clarity across intake and service paths.

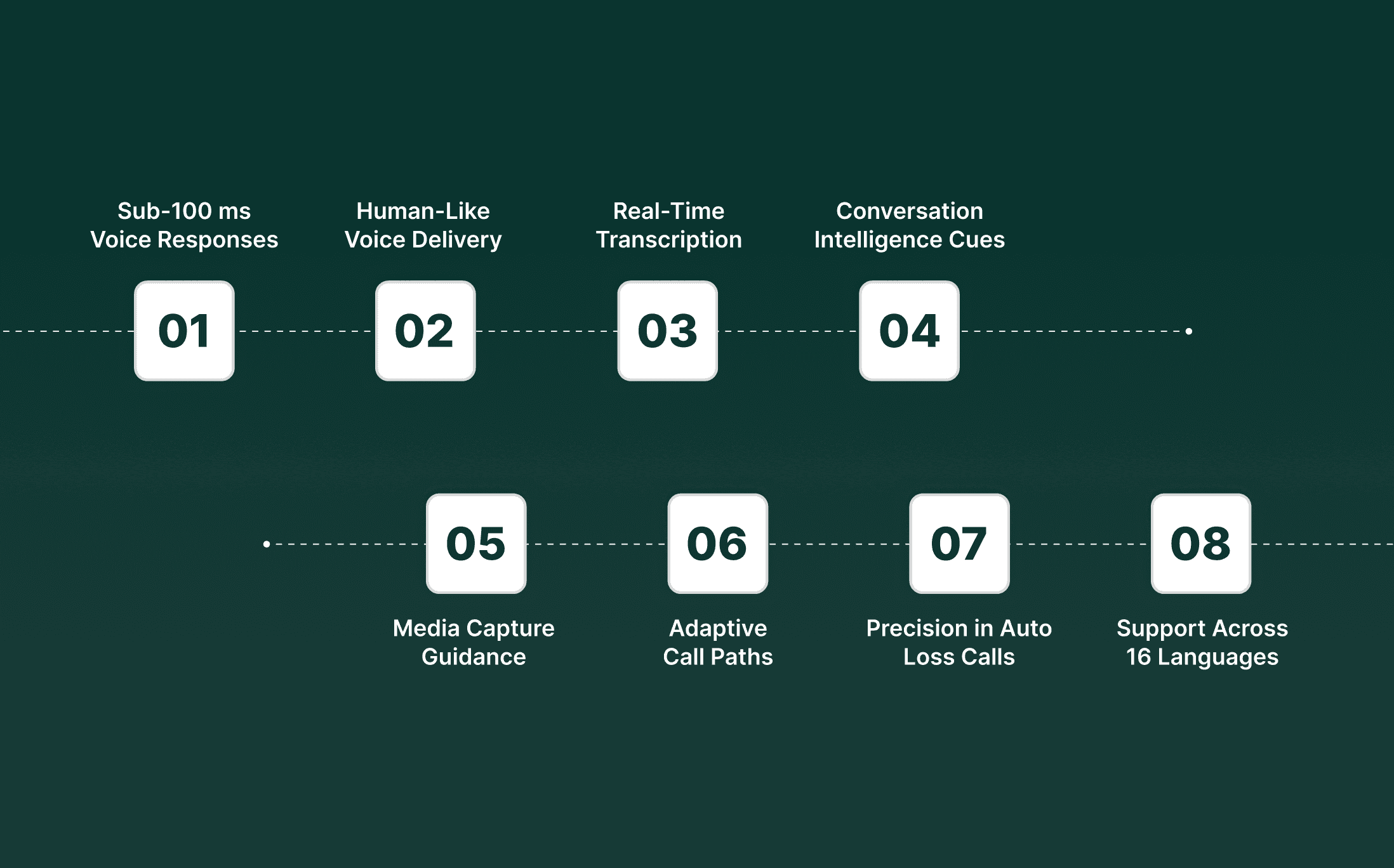

Sub-100 ms Voice Responses: Live conversations flow without pauses, helping policyholders explain loss details naturally.

Human-Like Voice Delivery: Calls sound consistent across accents and languages, reducing misunderstandings during high-pressure moments.

Real-Time Transcription: Speech is converted into structured data while the caller is speaking, giving adjusters clean inputs for routing.

Conversation Intelligence Cues: Models pick up phrasing shifts tied to timing, injury description, or event mechanics.

Media Capture Guidance: Voice agents guide callers to record photos or clips that match claim type requirements.

Adaptive Call Paths: Call flow adjusts when callers mention injuries, hazards, or third parties so the right questions surface at the right moment.

Precision in Auto Loss Calls: In the AI in auto insurance market, voice agents gather impact points, part involvement, and location details that support downstream scoring.

Multilingual Support Across 16 Languages: Policyholders communicate in their preferred language, improving clarity for intake and follow-up.

Smallest.ai adds the precision and speed carriers need to keep every call clear, consistent, and ready for downstream claim work.

Conclusion

Claims leaders reach a point where adding more staff or adding more checkpoints does not move files any faster. What creates real progress is clarity at the start of each case, steady movement between steps, and fewer handoffs weighed down by missing or unclear inputs.

This is where AI in insurance claims shows its practical value. It gives teams cleaner caller signals, improves how evidence enters the file, and supports reviewers with information that arrives ready for action. When carriers look at their full claim chain, they see that AI in insurance claims is not a side project. It is a direct path to improving cycle time without adding more manual effort.

Smallest.ai strengthens this shift with voice AI, conversational AI, voice agents, and voice cloning that support real call flows, guide claimants with clear prompts, and deliver structured data during the first interaction. The platform brings speed without losing clarity. Voice agents handle intake, request missing proof, read caller cues, route cases correctly, support follow-up calls, and keep each case moving with reliable signals that help claim teams cut slow points across high-volume work.

To see how this works inside a real carrier setup and where your team can gain the most, book a demo with Smallest.ai.

FAQs About AI in Insurance Claims

1. How does AI in insurance claims handle mismatched audio, image, and document inputs?

It cross-checks spoken details, media signals, and extracted text to build a unified loss profile that reduces errors during early review.

2. Can AI claim automation flag patterns linked to repeat claimants with shifting narratives?

Yes. It detects timing gaps, phrasing shifts, and evidence inconsistencies across past interactions to guide adjusters toward closer inspection.

3. What role does AI in auto insurance market play when callers cannot provide clear photos during FNOL?

Voice-led intake collects directional clues like impact points and vehicle positions, helping models form a preliminary view even with limited media.

4. How does claims automation AI help identify third-party involvement earlier in the process?

It analyzes caller statements, incident mechanics, and related documents to surface signals tied to external parties or shared liability.

5. What advantage does AI in insurance claims management offer during contractor or repair shop coordination?

It matches severity data with contractor capacity and job type, helping teams assign the right partner without lengthy back-and-forth.

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now