Learn how AI in SME lending keeps applications moving, fixes execution gaps, and scales credit operations using agents and real-time voice workflows. Read more.

Kaushal Choudhary

Updated on

February 24, 2026 at 8:56 AM

Every SME lender knows the moment when momentum is lost. The credit logic is sound, yet a missed call, an unanswered clarification, or a delayed follow-up quietly pushes a live application into limbo. This is where AI in SME lending is being adopted as an execution tool, focused less on scoring and more on keeping deals moving when human capacity becomes the constraint.

That shift is accelerating as volume rises. The SME lending market is expected to grow at a CAGR of 9.2% from 2025 to 2033, reaching USD 13.7 trillion by 2033, while operational teams stay lean. In this environment, AI in SME lending is increasingly judged by how well it drives real borrower interactions, resolves blockers in real time, and protects throughput.

In this guide, we break down how AI agents reshape SME lending workflows, where voice-based execution fits, and how lenders can deploy these systems with control, compliance, and clear ROI.

Key Takeaways

Execution Drives Results: AI in SME lending delivers impact by removing execution delays such as stalled follow-ups, document gaps, and system handoffs, not by scoring alone.

Agents Reshape Operations: AI agents run intake, underwriting support, servicing, and monitoring in parallel, allowing lenders to scale volume without linear headcount growth.

Voice Reduces Drop-Offs: Voice-based AI agents resolve clarifications, obtain consent, address missing documents, and expedite early collections faster than portals or email.

Governance Allows Scale: Policy controls, human approval gates, and audit-ready logs are required to deploy AI in SME lending safely.

Infrastructure Unlocks ROI: Real-time voice infrastructure turns AI decisions into borrower action, making execution platforms central to measurable returns.

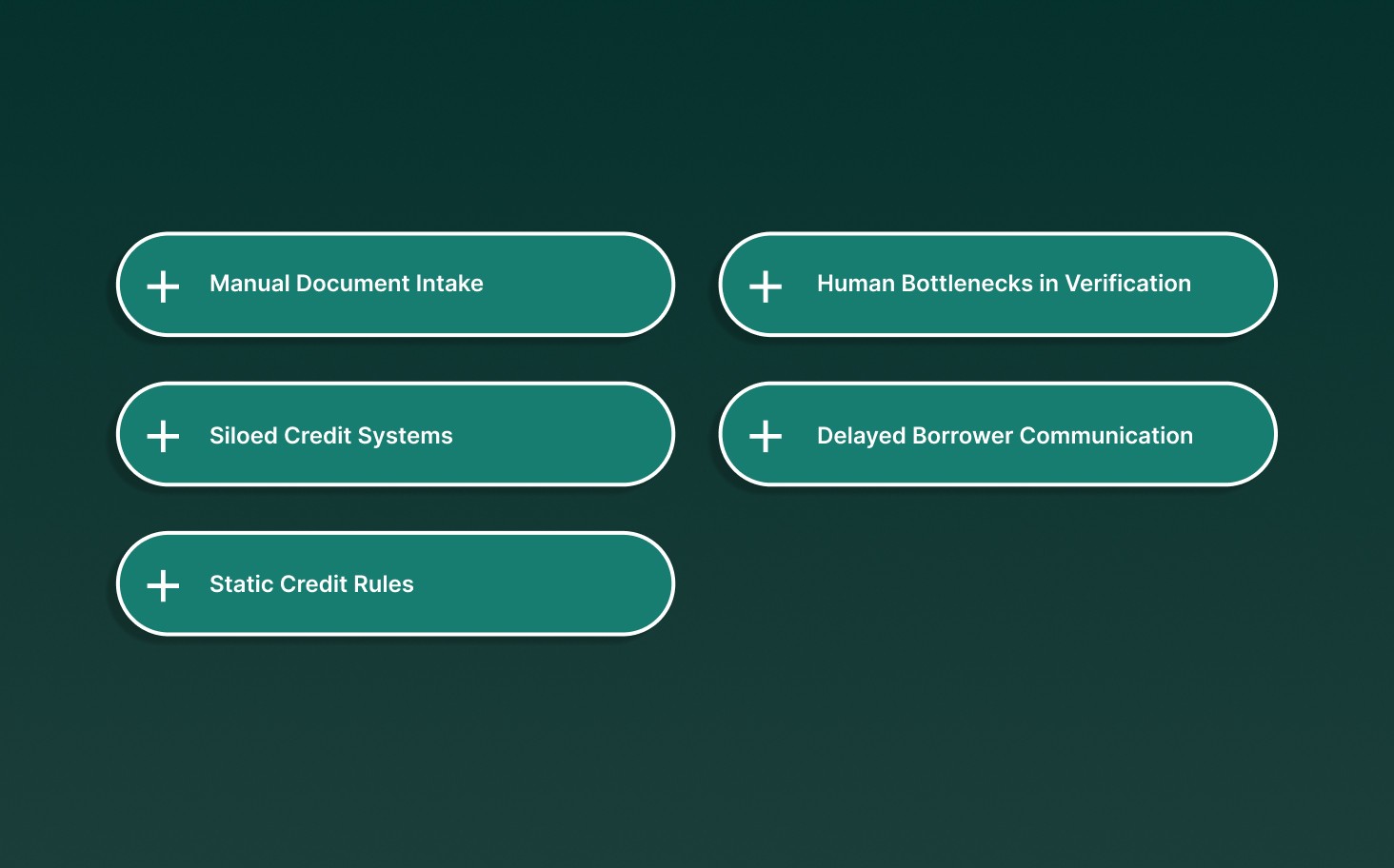

Where Traditional SME Lending Breaks Down

Traditional SME lending workflows were built for balance sheet stability, not speed, volume, or fragmented borrower data. As demand shifts toward faster credit cycles and higher application volumes, these systems fail at execution rather than intent.

Manual Document Intake: Bank statements, GST VAT returns, and financials arrive as PDFs or scans, forcing underwriters to extract line items manually, increasing turnaround time and data transcription risk.

Siloed Credit Systems: CRM, loan origination systems, core banking, and risk tools operate independently, requiring repetitive data entry and creating version conflicts during underwriting and servicing.

Static Credit Rules: Rule engines rely on fixed thresholds and historical ratios, making them brittle when cash flows fluctuate or when alternative data signals contradict legacy metrics.

Human Bottlenecks in Verification: KYC, KYB, and affordability checks queue behind limited analyst capacity, delaying approvals even when risk is low and documentation is complete.

Delayed Borrower Communication: Follow-ups for missing documents or clarifications happen via email or outbound calls scheduled hours or days later, causing drop-offs during high-intent application stages.

See how lenders are closing execution gaps, improving borrower communication, and driving measurable outcomes across the credit lifecycle in How AI Lending Is Transforming the End-to-End Borrower Experience.

How AI Agents Are Changing SME Lending Operations

AI in SME lending shifts operations from sequential, human-dependent workflows to parallel, agent-led execution across intake, underwriting, servicing, and monitoring, with policy-aware controls and measurable outcomes.

1. Intelligent Application Intake and Pre-Qualification

AI agents handle borrower conversations, eligibility checks, and data capture across channels, validating inputs against product rules before applications ever reach underwriting queues.

Policy-Aware Screening: Agents apply lender-specific eligibility rules, sector exclusions, turnover thresholds, and exposure limits in real time, preventing unqualified applications from entering downstream systems.

Automated Data Collection: Agents request precise documents and permissions dynamically, based on entity type, geography, and product, reducing incomplete submissions and repeated borrower follow-ups.

Multi-Channel Orchestration: Intake runs consistently across chat, voice, and email, preserving context and guaranteeing borrower responses update CRM and LOS records instantly.

Business impact: Higher application-to-approval conversion, reduced intake labor minutes per file, and materially shorter time-to-decision for low-risk SME borrowers.

2. Automated Financial Analysis and Underwriting Support

AI agents parse financial documents, normalize cash flows, and assemble underwriting artifacts that align directly with internal credit policy and reviewer expectations.

Document-Level Intelligence: Agents extract structured data from bank statements, tax filings, and invoices, flagging anomalies such as revenue volatility, concentration risk, or unexplained expense spikes.

Cash Flow Normalization: Transaction-level categorization adjusts for seasonality, one-off events, and owner compensation, producing lender-ready affordability metrics without manual spreadsheet work.

Credit Memo Drafting: Agents generate first-draft credit notes with cited ratios, trends, and policy references, allowing underwriters to review, adjust, and approve rather than author.

Business impact: Underwriters handle more files per day, manual review time drops sharply, and credit decisions become more consistent across teams and regions.

3. Continuous Portfolio Monitoring and Early Risk Detection

AI agents move risk management from periodic reviews to continuous surveillance using live financial and behavioral signals.

Real-Time Signal Ingestion: Agents monitor bank feeds, ERP data, and payment behavior to detect cash flow deterioration, covenant stress, or abnormal transaction patterns early.

Policy-Driven Alerts: Risk flags trigger only when thresholds aligned to credit policy are breached, avoiding alert fatigue and focusing attention on actionable deterioration.

Automated Borrower Outreach: Agents initiate structured check-ins or documentation requests when risk signals appear, preserving relationships while issues remain manageable.

Business impact: Lower delinquency rates, earlier intervention on stressed accounts, and improved portfolio visibility without expanding risk operations headcount.

4. AI-Led Servicing and Collections Execution

AI agents handle high-volume servicing and early collections tasks while enforcing tone, timing, and actions defined by lender policy.

Self-Service Resolution: Agents answer balance, payoff, and covenant queries instantly, pulling authoritative data from core systems without human involvement.

Policy-Constrained Collections: Outreach sequences, payment plan options, and escalation paths follow pre-approved rules, guaranteeing compliance and consistent borrower treatment.

Context-Preserved Handoffs: When human intervention is required, agents transfer full interaction history and risk context, eliminating repetitive borrower explanations.

Business impact: Reduced servicing costs, higher borrower satisfaction, and improved recovery outcomes through timely, consistent, and policy-aligned engagement.

5. System-to-System Orchestration Across the Lending Stack

AI agents act as execution layers that coordinate actions across fragmented SME lending systems.

CRM and LOS Synchronization: Agents update stages, statuses, and tasks automatically as borrower interactions and underwriting milestones occur.

Tool Invocation at Runtime: Credit bureau checks, KYC workflows, e-sign requests, and disclosures are triggered precisely when conditions are met.

Audit-Ready Traceability: Every action, data source, and decision step is logged with timestamps and versions, supporting audits and model risk reviews.

Business impact: Fewer operational errors, faster cross-team coordination, and lending workflows that scale without proportional increases in operational complexity.

See how Smallest.ai helps lending teams resolve borrower friction in real time, reduce follow-ups, and execute AI-driven credit workflows through low-latency, policy-controlled voice agents.

Real-World Examples of AI in SME Lending

AI in SME lending is already delivering measurable impact across underwriting, servicing, and portfolio management, with lenders using AI to accelerate decisions, standardize risk assessment, and scale operations without linear cost growth.

1. OakNorth

OakNorth uses AI models to analyze SME cash flows, sector dynamics, and downside scenarios to support credit decisions for mid-market businesses. The system evaluates borrower resilience under stress rather than relying only on historical ratios.

Operational impact:

Faster underwriting for complex SME loans.

More consistent credit decisions across sectors.

Improved risk visibility for long-tenor facilities.

2. Funding Circle

Funding Circle applies machine learning to assess SME applications using bank data, transaction behavior, and performance signals to automate large portions of loan approval and pricing.

Operational impact:

Shorter approval cycles for SMEs.

Scalable underwriting without linear headcount growth.

Improved approval accuracy at volume.

3. American Express (Kabbage platform)

American Express uses AI models to underwrite and service short-term SME credit using continuous bank data ingestion, allowing near real-time eligibility and limit adjustments.

Operational impact:

Quick access to capital for small businesses.

Dynamic credit limits based on live cash flow.

Reduced manual review for repeat borrowers.

4. Shawbrook Bank

Shawbrook combines AI-driven data ingestion and analysis with human credit judgment. AI accelerates document handling and risk analysis, while underwriters retain final decision authority.

Operational impact:

Faster decision turnaround.

Lower manual document workload.

Maintained human oversight for complex cases.

5. Biz2X

Biz2X deploys AI agents for document parsing, underwriting assistance, borrower communication, and portfolio monitoring across banks and fintech lenders.

Operational impact:

Reduced application processing time.

Standardize credit workflows across partners.

Better scalability for government and private SME programs.

These real-world examples show that AI in SME lending succeeds when embedded into core workflows, supporting human judgment while improving speed, consistency, and risk control across the credit lifecycle.

Core Capabilities Required for SME Lending AI Agents

SME lending agents must operate inside regulated credit workflows, interact with fragmented systems, and execute decisions under policy constraints. Capability gaps show up immediately in accuracy, compliance, or borrower outcomes.

Core Capability | What It Allows in SME Lending |

Policy-Constrained Reasoning | Executes credit policies as deterministic logic, enforcing exposure limits, sector caps, affordability rules, and approval thresholds without probabilistic deviation. |

Deterministic Tool Invocation | Triggers bureau checks, KYC workflows, pricing engines, disclosures, and e-sign requests via validated API calls with reversible, auditable outcomes. |

Financial Document Semantics | Extracts and reconciles line-level data from bank statements and tax filings, flags manipulated documents, and normalizes volatile cash flows. |

Stateful Workflow Memory | Maintains borrower context, decision history, and pending conditions across multi-day lending journeys without resetting conversations or duplicating steps. |

Audit-Grade Traceability | Logs every data source, rule evaluation, model output, and action with timestamps and versions to support audits, disputes, and model risk governance. |

Explore how lenders are strengthening risk controls, improving decision consistency, and responding earlier to portfolio stress in How AI Credit Risk Assessment Is Transforming Risk Management.

Voice-Based AI Agents for SME Lending Use Cases

Voice-based AI agents address the highest-friction moments in SME lending where portals fail, response latency matters, and borrowers require immediate clarification to progress applications or resolve issues.

Pre-Qualification Clarification Calls: Agents validate eligibility in real time by asking targeted follow-ups on turnover, entity structure, and use of funds, applying product rules before routing applications into underwriting queues.

Missing Document Recovery: Voice agents trigger outbound calls when required documents are absent or inconsistent, explain specific gaps, and confirm receipt, reducing stalled applications caused by unread emails or portal fatigue.

Consent and Data Authorization Flows: Agents guide borrowers through Open Banking or data-sharing consent step-by-step, handling objections live and confirming authorization without manual agent involvement.

Early-Stage Collections Outreach: Agents conduct policy-constrained payment reminders and restructuring conversations, adjusting scripts based on risk tier, payment history, and borrower responses while logging outcomes automatically.

Post-Approval Servicing Calls: Voice agents handle payoff quotes, covenant explanations, and repayment schedule changes by pulling authoritative data from core systems and responding without hold times.

Voice-based AI agents convert stalled SME lending moments into executable outcomes by combining low-latency speech, policy enforcement, and real-time system access where digital channels break down.

Human Oversight and Trust in AI-Driven SME Lending

AI-driven SME lending requires structured human oversight to manage model risk, regulatory accountability, and borrower trust, especially when automated decisions affect credit access and financial outcomes.

Human-in-the-Loop Approval Gates: Credit-impacting actions such as pricing overrides, limit increases, restructurings, and declines route to designated approvers with full agent rationale and supporting evidence.

Explainability and Reason Codes: Every recommendation includes traceable policy references, ratio calculations, and data sources, allowing underwriters to justify decisions to regulators and borrowers without reverse engineering models.

Model Risk Management Controls: Agent behavior is versioned, validated, and monitored for drift, bias, and performance degradation, aligning with internal model governance and regulatory expectations for AI-assisted credit decisions.

Compliance-Aware Execution: Agents enforce consent management, data minimization, and jurisdiction-specific requirements for KYC, AML, and customer communications across voice and digital channels.

Audit and Dispute Readiness: Immutable logs capture prompts, tool calls, decisions, and human overrides, allowing quick reconstruction of lending decisions during audits, complaints, or legal review.

Human oversight transforms AI from an automation risk into a controlled execution system, allowing SME lenders to scale speed and accuracy while maintaining regulatory trust and decision accountability.

Implementation Roadmap for SME Lenders

Successful adoption of AI in SME lending requires a staged rollout that prioritizes control over execution, policy fidelity, and measurable outcomes before expanding agent autonomy across the lending lifecycle.

Stage | What It Covers |

Use Case Prioritization | Target high-volume, low-discretion workflows such as intake triage, document extraction, and servicing inquiries where policy rules are stable and impact is quickly measurable. |

Data and System Readiness | Standardize product codes, clean CRM fields, and expose LOS, core banking, and document repositories through secure APIs to avoid inconsistent or stale agent inputs. |

Policy Encoding and Validation | Convert credit guidelines, risk thresholds, and escalation logic into executable rules, validating outputs against historical decisions before production rollout. |

Copilot-to-Autonomy Progression | Begin with agents assisting underwriters and service teams, expanding to autonomous execution only after accuracy, exception rates, and override patterns meet benchmarks. |

Continuous Monitoring and Tuning | Monitor decision accuracy, SLAs, borrower outcomes, and model drift, updating rules and prompts through controlled change management. |

Discover how leading banks use predictive models to anticipate risk, optimize operations, and improve outcomes in 9 Types of Predictive Analytics in Banking Used by Top Teams.

How Smallest.ai Powers Real-Time Voice AI for SME Lending

Smallest.ai provides the real-time voice execution layer required to operationalize AI agents in SME lending, allowing low-latency, policy-controlled borrower interactions tightly integrated with core lending systems.

Sub-Second Voice Latency: Real-time speech synthesis and recognition operate under strict latency thresholds, allowing agents to hold natural conversations during eligibility checks, consent flows, and servicing calls without conversational lag.

Policy-Governed Voice Execution: Voice agents execute only pre-approved intents, scripts, and actions defined by lending policy, preventing unauthorized disclosures, pricing deviations, or non-compliant collections language.

Deep Telephony and System Integration: Native integration with telephony, CRM, LOS, and core banking systems allows voice agents to fetch live account data, update records, and trigger workflows during active calls.

Context-Preserved Multi-Turn Dialogues: Stateful voice sessions retain borrower context across interruptions, callbacks, and escalations, guaranteeing continuity without forcing borrowers to repeat information.

By acting as the execution layer between AI decisions and live borrower conversations, Smallest.ai allows SME lenders to deploy voice-based AI agents that operate at production scale without compromising control, compliance, or responsiveness.

Conclusion

AI in SME lending has reached a point where success depends less on ambition and more on execution discipline. Lenders that win are the ones translating intent into action, resolving borrower friction in real time, and maintaining control across risk, compliance, and operations as volume scales.

This is where execution infrastructure matters. Smallest.ai provides the real-time voice layer that turns AI-driven decisions into live borrower conversations, helping lending teams act faster without losing oversight.

If you are evaluating how to operationalize AI agents across SME lending workflows, talk to a voice expert at Smallest.ai to see how real-time voice execution fits your stack.

Answer to all your questions

Have more questions? Contact our sales team to get the answer you’re looking for

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now