A closer look at AI in AML transaction monitoring, explaining core systems, detection methods, voice-based support, and how reviews stay compliant. Read more.

Ranjith M S

Updated on

January 19, 2026 at 8:37 AM

When transaction alerts keep stacking up, and every review feels time-critical, teams start looking for ways to work with clearer signals and fewer distractions. That is often when AI in AML (Anti-Money-Laundering) transaction monitoring comes into focus. Compliance leaders are not chasing shortcuts. They want defensible outcomes, manageable alert volumes, and processes that hold up during audits.

For AML heads, compliance officers, and risk teams, interest in AI in AML transaction monitoring often comes from operational pressure. Rising transaction volumes, tighter regulatory expectations, and limited investigator capacity drive closer evaluation of how modern systems detect risk and support reviews without shifting accountability. This focus is backed by market momentum. The Anti-money Laundering market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 22.7 billion by 2035.

In this guide, we break down how AI is applied in AML transaction monitoring, the core system components, how voice-based tools support operations, and what teams evaluate when adopting these capabilities.

Key Takeaways

Behavior Beats Thresholds: AI evaluates long-term customer behavior across transactions instead of relying on static limits or single-event checks.

Alerts Are Ranked, Not Equal: Risk scoring prioritizes alerts by likelihood, helping investigators focus on higher-risk cases first.

Models Learn From Investigators: Confirmed cases and false positives are fed back into models, improving detection accuracy over time.

Explainability Is Built In: Reason codes and feature impact logs support audits and internal validation.

Voice AI Stays Outside Decisions: Voice-based tools collect evidence and enforce timelines, while risk scoring and alert closure remain manual.

What Is AI in AML Transaction Monitoring?

AI in (Anti-Money-Laundering) transaction monitoring refers to the use of machine learning and data-driven models to analyze financial transactions at scale, detect suspicious activity patterns, and surface risks that rule-based systems often miss.

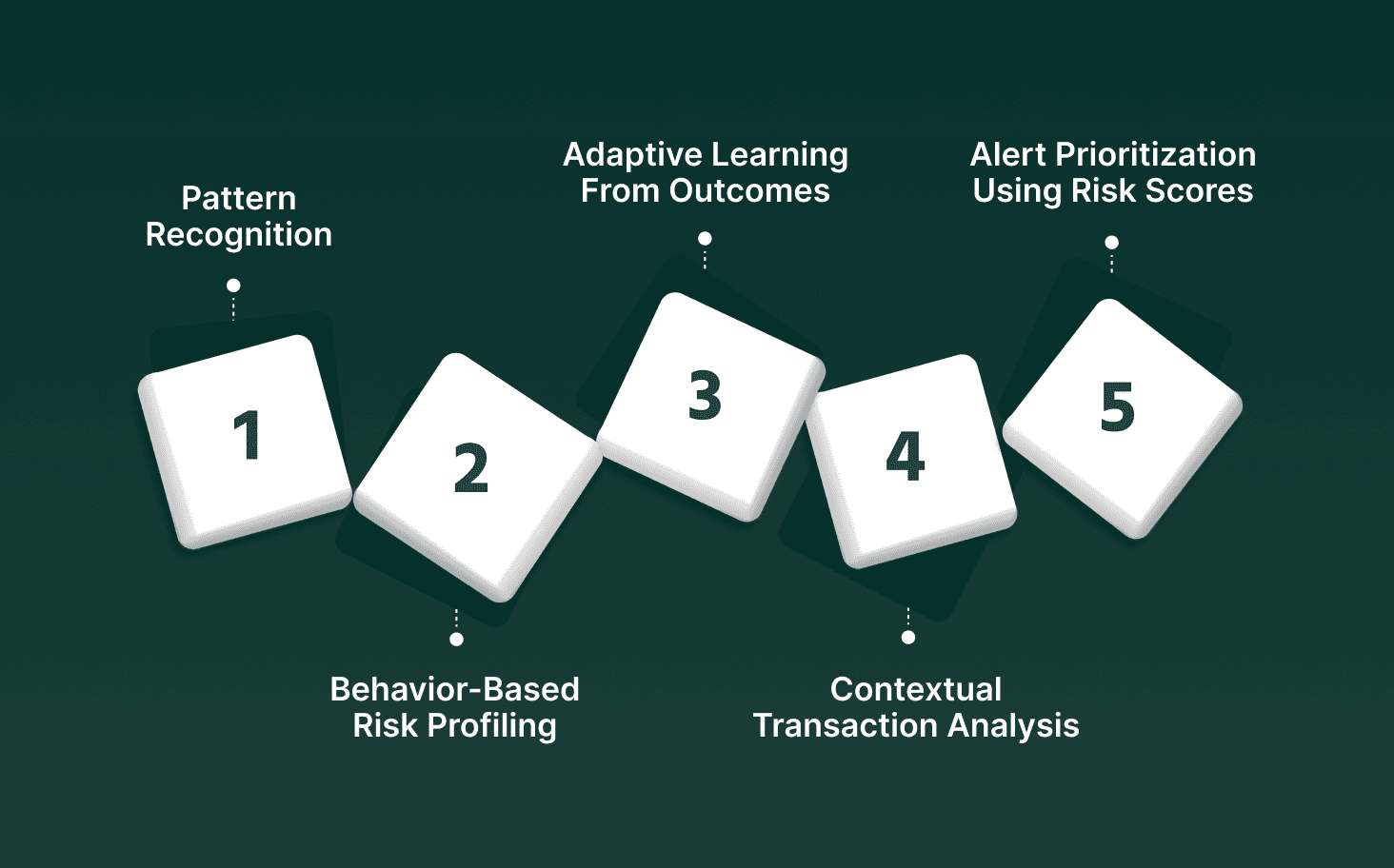

Pattern Recognition Across Large Volumes: AI models review millions of transactions simultaneously, identifying abnormal behaviors across amounts, frequency, counterparties, locations, and timing that deviate from historical norms.

Behavior-Based Risk Profiling: Instead of static thresholds, AI builds dynamic risk profiles for customers and accounts based on ongoing transaction behavior, allowing earlier detection of unusual changes.

Adaptive Learning From Outcomes: AI systems learn from investigator feedback, confirmed cases, and false positives, refining detection logic over time without manual rule rewrites.

Contextual Transaction Analysis: Transactions are evaluated in context rather than isolation, linking activity across accounts, channels, and time windows to reveal complex laundering patterns.

Alert Prioritization Using Risk Scores: AI assigns relative risk scores to alerts, helping compliance teams prioritize transactions with a higher likelihood of true AML risk.

AI in AML transaction monitoring shifts detection from static rule-based enforcement to continuous, behavior-based analysis, improving accuracy while reducing unnecessary alerts.

Explore where AI delivers measurable impact across compliance, monitoring, and operational risk workflows in financial services. Top 7 Use Cases Where AI in Banking Risk Management Matters

Core Components of AI in AML Transaction Monitoring Systems

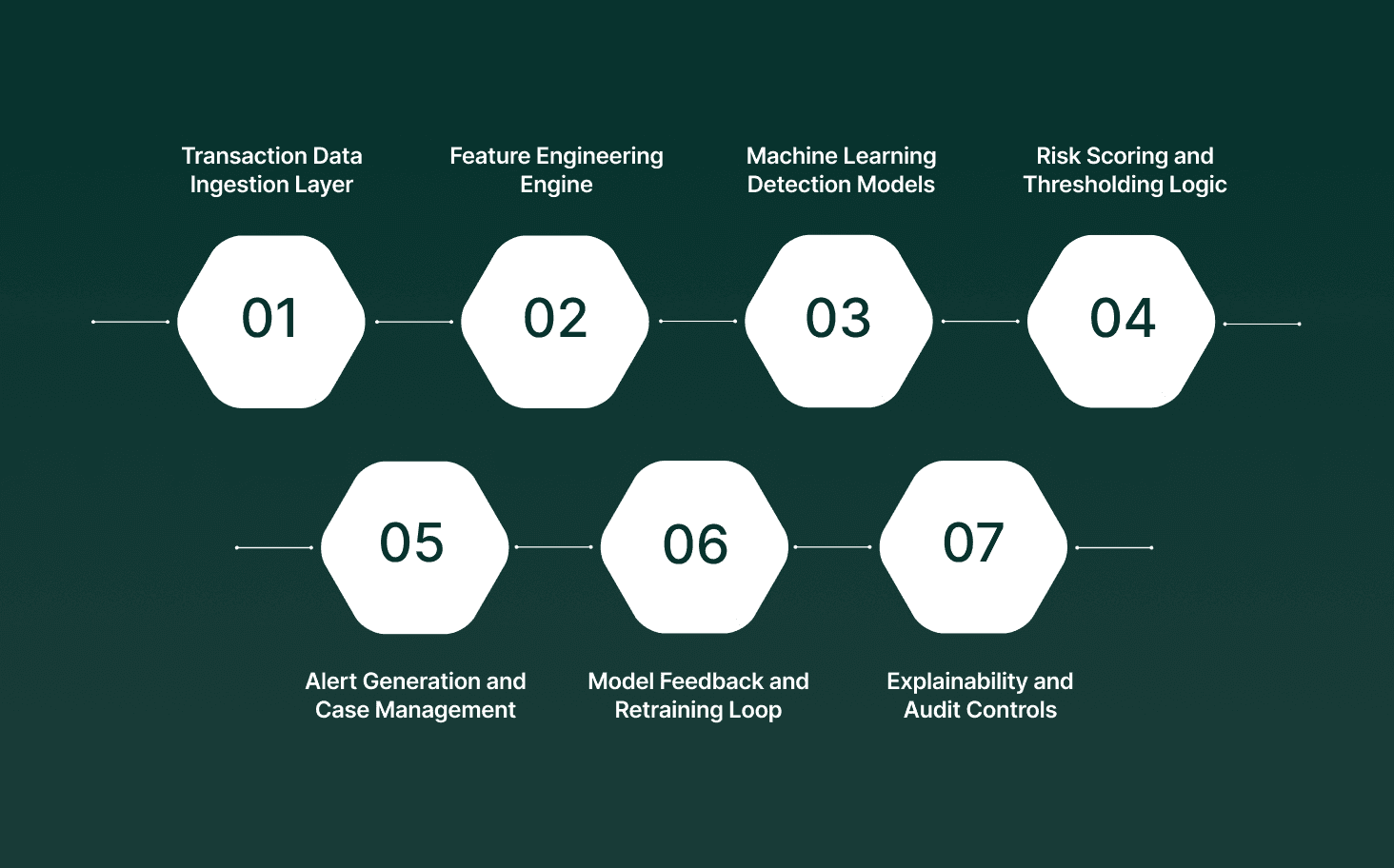

AI-driven AML transaction monitoring systems rely on multiple tightly connected components that ingest transaction data, detect risk patterns, and support investigator decisions with measurable accuracy.

Transaction Data Ingestion Layer: Collects structured transaction data from core banking systems, payment rails, wallets, and third-party processors in near real time or batch form.

Feature Engineering Engine: Transforms raw transaction data into analyzable signals such as transaction velocity, counterparty concentration, geographic movement, time-of-day behavior, and value dispersion.

Machine Learning Detection Models: Apply supervised and unsupervised models to identify anomalous behavior, peer-group deviations, and known laundering patterns using historical cases and live data.

Risk Scoring and Thresholding Logic: Converts model outputs into normalized risk scores and applies configurable thresholds to identify transactions or accounts that trigger alerts.

Alert Generation and Case Management: Groups related alerts into cases, maintains audit trails, and supports investigator workflows, including notes, evidence attachment, and disposition tracking.

Model Feedback and Retraining Loop: Uses investigator outcomes such as confirmed suspicious activity or false positives to recalibrate models and improve detection accuracy over time.

Explainability and Audit Controls: Provides reason codes, feature impact summaries, and model version tracking to support regulatory reviews and internal validation.

Together, these components allow AI in AML transaction monitoring systems to detect risk with greater precision, support compliance workflows, and maintain the transparency required for regulatory oversight.

See how modern AI systems help banks identify suspicious activity faster and reduce fraud losses across channels. Top AI Fraud Detection Tools for Banking

How Voice-Based AI Supports AML Transaction Monitoring

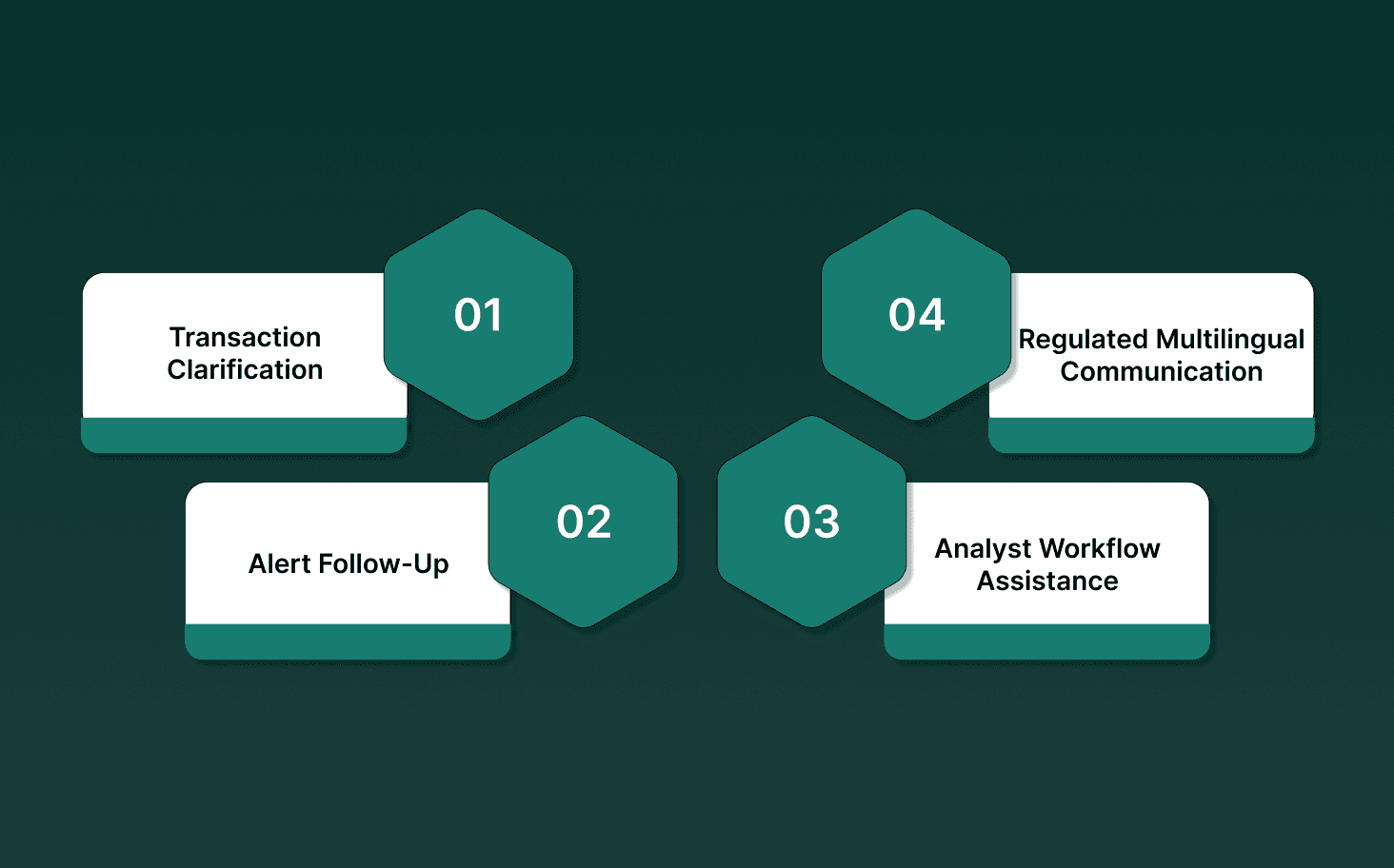

Voice-based AI supports AML transaction monitoring by executing controlled voice interactions that feed structured signals into AML workflows, without participating in risk scoring or regulatory decisioning.

1. Transaction Clarification And Evidence Collection

Voice-based AI is used to collect missing or ambiguous transaction context directly from customers when alerts require clarification.

Structured Verification Flows: Executes predefined call scripts mapped to alert types, such as source of funds, beneficiary relationship, or transaction purpose.

Entity And Value Capture From Speech: Converts spoken responses into structured fields, including dates, amounts, counterparties, and intent markers.

Evidence Attachment To AML Cases: Stores call recordings, transcripts, and extracted fields directly within case management systems.

2. Alert Follow-Up And SLA Enforcement

Voice-based AI supports timely follow-up on unresolved AML alerts without analyst intervention.

Automated Outreach Triggering: Initiates calls based on alert age, risk tier, or regulatory response timelines.

Deterministic Retry Logic: Applies controlled retry schedules and fallback rules aligned with compliance policies.

Disposition Signaling: Updates case states based on call outcomes such as contact made, no response, or refusal to cooperate.

3. Analyst Workflow Assistance

Voice-based AI reduces manual friction during investigations by interacting with AML systems through controlled commands.

Case Data Retrieval: Fetches transaction histories, alert rationales, and prior notes through authenticated voice requests.

Read-Only Summarization: Vocalizes timelines and transaction sequences without modifying underlying data.

Action Logging: Records voice-initiated queries and system responses for audit traceability.

4. Regulated Multilingual Communication

Voice-based AI allows consistent AML communication across jurisdictions while preserving message control.

Script-Locked Language Delivery: Uses regulator-approved phrasing translated into supported languages without semantic drift.

Language Detection And Routing: Selects language flows based on customer profile or detected speech input.

Uniform Disclosure Handling: Guarantees disclosures and notices are delivered consistently across regions.

Voice-based AI supports AML transaction monitoring by executing controlled voice interactions that capture structured evidence, enforce response timelines, and reduce analyst workload, while detection logic and compliance judgments remain within core AML systems.

Run real-time voice agents with low latency, live system access, and production-grade control using smallest.ai. Book a demo to see it in action.

How AI-Driven AML Transaction Monitoring Differs From Traditional System

AI-driven AML transaction monitoring replaces static, rule-heavy detection with data-driven models that adapt to behavior, scale with volume, and reduce investigative noise without weakening regulatory control.

Area | Traditional Transaction Monitoring | AI-Driven AML Transaction Monitoring |

Detection Logic | Fixed rules and thresholds defined manually | Machine learning models trained on historical and live transaction data |

Pattern Identification | Evaluates transactions in isolation or short windows | Analyzes long-term behavior across accounts, channels, and time |

False Positives | High alert volumes due to rigid thresholds | Lower false positives through behavior-based risk scoring |

Adaptability | Requires manual rule updates when patterns change | Models adjust through retraining using investigation outcomes |

Risk Prioritization | All alerts are treated similarly once triggered | Alerts ranked by probabilistic risk scores |

Scalability | Performance degrades as transaction volumes grow | Designed to process millions of transactions in parallel |

Investigator Effort | Significant time spent clearing low-risk alerts | Focus shifted toward higher-risk, better-contextualized cases |

Audit Support | Rule logic is transparent but limited in context | Model outputs supported by explainability and feature impact logs |

AI-driven AML transaction monitoring changes detection from rigid rule enforcement to adaptive risk analysis, improving signal quality while preserving compliance traceability.

How Smallest.ai Fits Into AML Monitoring

Smallest.ai supports AML programs at the interaction layer by handling controlled, high-volume voice interactions that sit alongside transaction-monitoring and case-management systems, without participating in risk detection or compliance decisions.

Scripted Voice Interactions: Executes predefined call flows approved by compliance teams, guaranteeing consistent customer conversations without free-form responses.

Scalable Call Execution: Handles large volumes of concurrent inbound and outbound calls, supporting outreach and follow-ups without adding human capacity.

Multilingual Communication Support: Delivers the same approved voice scripts across more than 16 languages to support customers in different regions.

Call Artifact Generation: Produces call recordings, transcripts, timestamps, and metadata for storage or review within existing AML workflows.

Secure Deployment Options: Supports cloud and on-premise deployments, allowing teams to retain control over data residency and infrastructure.

Smallest.ai integrates with AML monitoring by enabling consistent, secure, and auditable voice interactions, while all transaction analysis, risk scoring, and regulatory decisions remain within core AML systems.

Final Thoughts!

As AML programs mature, the conversation shifts away from whether AI belongs in transaction monitoring and toward how each layer fits within the overall framework without weakening accountability. The real progress comes from clearly separating detection, investigation, and interaction, then tightening how those pieces work together under regulatory pressure. Teams that get this right gain better control over volume, evidence quality, and response timelines without changing who makes the final calls.

This is where supporting technologies start to matter. Voice infrastructure, when used correctly, helps teams handle customer interactions at scale, capture verifiable context, and keep records clean, while core AML systems continue to own risk logic and decisions.

If you want to see how enterprise-grade voice agents can support controlled, auditable interactions alongside your AML stack, explore how Smallest.ai fits into regulated workflows and speak with a voice expert today.

FAQs

1. How Does AI In AML Transaction Monitoring Reduce Alert Noise Without Missing Risk

AI in AML transaction monitoring analyzes transaction behavior over time instead of relying only on fixed thresholds, which helps surface meaningful risk patterns while suppressing low-value alerts that lack contextual deviation.

2. What Role Do AI Anti-Money Laundering Systems Play After An Alert Is Generated

AI anti-money laundering systems support post-alert workflows by grouping related transactions, ranking alerts by relative risk, and supplying contextual signals that investigators review before taking action.

3. Can AI For Anti-Money Laundering Adapt To New Laundering Techniques

AI for anti-money laundering adapts through retraining on confirmed cases and investigator outcomes, allowing systems to recognize emerging behaviors such as quick movement patterns or new structuring tactics without rewriting rules.

4. How Do AI Systems For Anti-Money Laundering AML Handle Customer Behavior Changes

AI systems for anti-money laundering AML continuously update customer baselines, so sudden shifts in transaction size, frequency, or counterparties are evaluated against prior behavior rather than static profiles.

5. Is AI Anti-Money Laundering Used Only By Large Financial Institutions

AI anti-money laundering tools are increasingly used by mid-size banks, fintechs, and payment providers as transaction volumes grow and manual monitoring struggles to scale under regulatory expectations.

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now