Find how insurance AI chatbots use voice AI, conversational AI, and voice agents to improve claims, policy, and billing calls with steady, real-time support.

Nityanand Mathur

Updated on

January 27, 2026 at 8:13 PM

“Hi, I filed a claim last week. Can you check if the inspection happened?”

“One moment, I need to open your file.”

A pause.

“Sorry, I only see part of the update. Can you confirm your policy number again?”

Carriers see millions of calls that follow this pattern. Customers ask for clear updates while agents switch between systems that refresh at different speeds. It slows everyone down and increases pressure during peak claim periods.

This is why global teams are turning to an insurance AI chatbot driven by voice AI, conversational AI, voice agents, and voice cloning. When customers try again, an insurance AI chatbot can return inspection dates, stage progress, payment activity, or renewal timing without repeating questions or jumping between systems.

Analysts tracking this market expect sharp growth, with projections pointing toward USD 6.08 billion by 2033, reflecting rising investment in real-time insurance support.

In this guide, you will see how insurance AI chatbots improve real service workflows, support high-volume claims and policy questions, fit into existing systems, and how voice AI from Smallest.ai raises service standards across global insurance teams.

Key Takeaways

Claim calls rarely involve one question: Customers combine inspections, payments, adjuster updates, and documents in a single call, making real-time system access a critical requirement for automation.

Coverage clarity breaks down when teams read different sources: Chatbots reduce interpretation drift by pulling rider, deductible, and exclusion wording from the carrier’s approved product text instead of agent summaries.

Billing accuracy depends on timestamp-level data: Renewal disputes often stem from mismatched timestamps across billing, collections, and policy systems; chatbots return these records instantly.

Verification sequences shift constantly: Product lines, risk level, and regional rules change verification order; chatbots follow the correct sequence without slowing the caller.

Language drift creates hidden compliance risk: Multilingual servicing introduces inconsistent phrasing of exclusions and claim steps; voice cloning keeps terms identical across languages and regions.

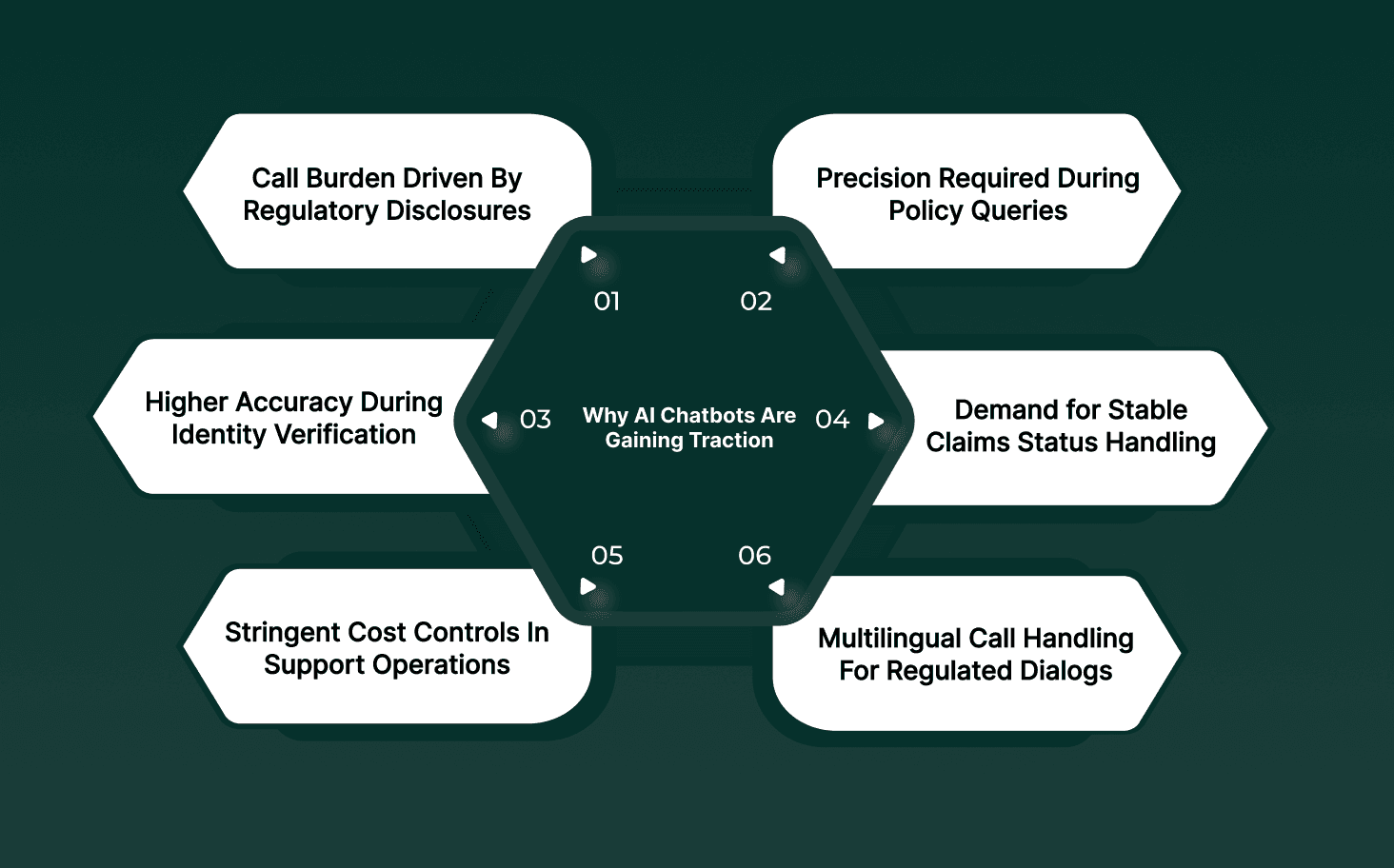

Why AI Chatbots Are Gaining Traction Across Finance Teams

Finance teams adopt insurance AI chatbot systems when they see clear gains in call resolution accuracy, regulatory consistency, and throughput during periods where manual teams fall behind. Carriers report that structured conversational flows cut repeat-contact rates, improve disclosure delivery, and shorten verification steps during policy or claims interactions.

Call Burden Driven By Regulatory Disclosures: Insurers using AI chatbots for customer service face rising disclosure obligations during sales, renewals, and claims. Automated flows keep each disclosure in the correct sequence without human drift.

Precision Required During Policy Queries: AI chatbots insurance customer service deployments keep coverage terms, riders, state rules, and renewal conditions tied to an internal knowledge graph so responses match current filings instead of older playbooks.

Higher Accuracy During Identity Verification: An AI chatbot insurance workflow can run multi-factor prompts, voiceprint checks, and policy-linked questions in a fixed order that meets audit requirements without slowing callers.

Demand for Stable Claims Status Handling: AI chatbots in insurance respond with claim stage codes, adjuster notes, and document requirements drawn directly from internal systems. This reduces miscommunication during high-pressure claims cycles.

Stringent Cost Controls In Support Operations: Carriers adopt an AI-powered chatbot for insurance sector functions when per-interaction costs trend upward due to seasonal surges, long handle times, or fragmented agent training.

Multilingual Call Handling For Regulated Dialogs: Insurance services AI chatbot deployments handle state-specific phrasing across languages without inconsistent agent translations, which protects clarity during sensitive conversations.

To compare voice AI systems designed for claims, policy, and financial support calls, review the Top AI voice agents for BFSI (Banking, Financial Services, and Insurance) in 2025?

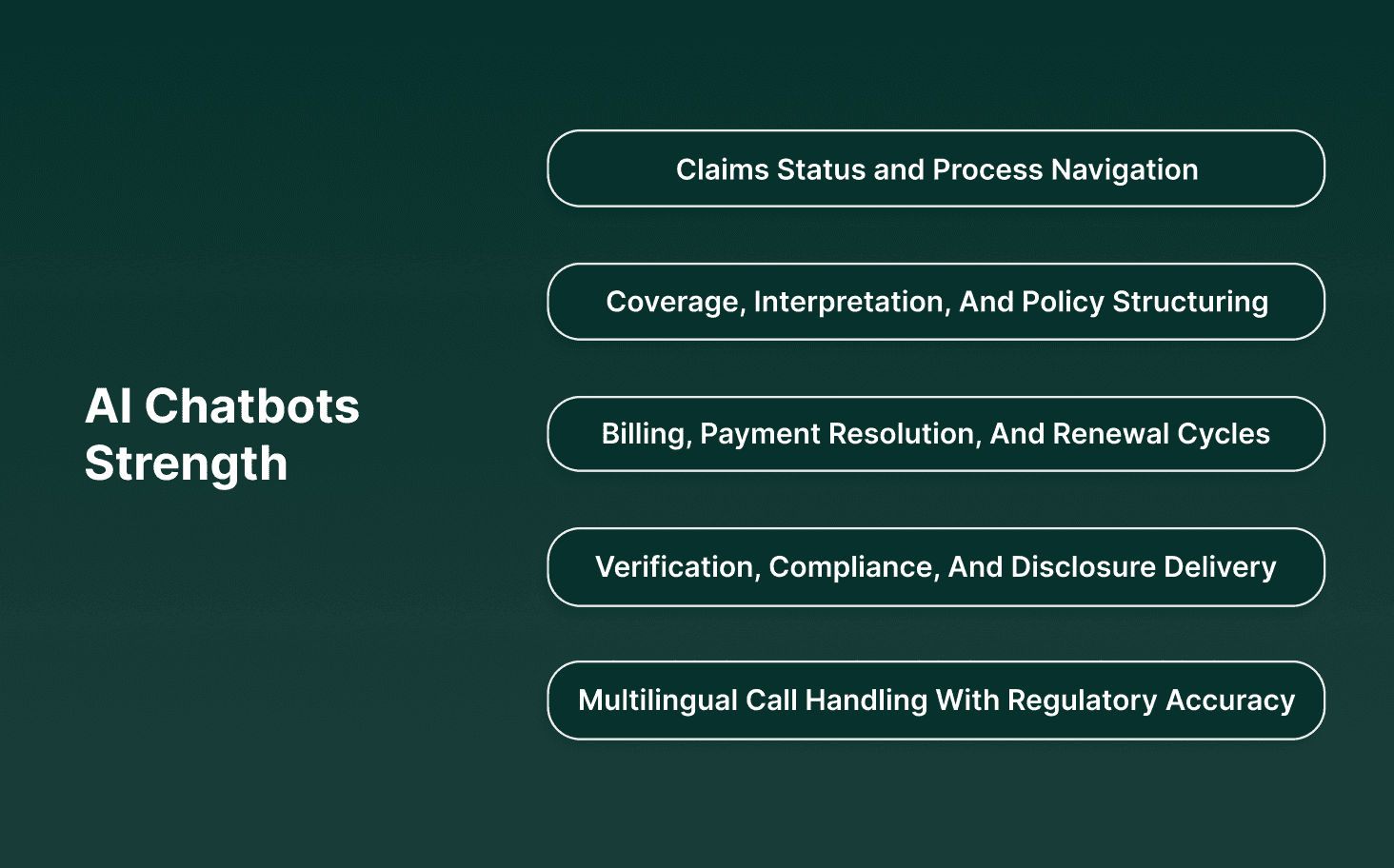

Where AI Chatbots Strengthen Insurance Workflows and Customer Support

Insurance contact centers manage wide swings in policy questions, renewal disclosures, verification steps, and claim surges. An insurance AI chatbot with voice AI, conversational AI, and voice agents reduces friction in these pressure points by responding from live system data. The strongest gains appear when responses follow approved phrasing and match existing service workflows.

1. Claims Status and Process Navigation

Claim calls pull data from multiple systems, so customers usually combine requests for adjuster activity, payments, estimates, inspections, and documents in one interaction. These records update at different times, which creates delays and mismatches for service teams.

An insurance AI chatbot with voice AI and conversational AI connects these data points in real time, returning the same updates that adjusters and back-office teams log during high-volume periods.

Retrieval of Adjuster Activity: Surfaces the latest inspection dates, desk adjuster notes, and body shop progress pulled directly from claim files.

Verification of Document Cycles: Shows whether medical reports, photos, police files, or contractor invoices passed internal checks used by claims examiners.

Lower Follow-Up Pressure During Surge Events: Returns live claim events during weather or regional spikes, which cuts repeat calls driven by delays in human follow-through.

2. Coverage, Interpretation, And Policy Structuring

Coverage questions mix policy terms, deductible interactions, waiting periods, rider rules, and region-specific conditions in one call, pulling from documents that service teams interpret differently. These variations create inconsistent explanations across agents and partners. Voice AI, conversational AI, and voice cloning like smallest.ai keep coverage wording aligned with approved product text for clearer, regulation-ready conversations.

Consistent Delivery Of Product Wording: Returns coverage language drawn from policy schedules, rider documents, and endorsement files without phrasing drift across regions or partners.

Structured Handling Of Multi-Part Coverage Queries: Breaks down questions involving deductibles, triggers, and waiting periods so customers receive clean, sequential responses rooted in product rules.

Fewer Transfers For Common Coverage Clarifications: Resolves frequent interpretation gaps around exclusions, sub-limits, and benefit conditions without needing immediate escalation to licensed staff.

3. Billing, Payment Resolution, And Renewal Cycles

Billing calls surge during renewals, grace-period checks, and payment verification requests that depend on precise timestamps. These interactions slow down when payment, policy, and collections systems store conflicting or delayed records. An insurance AI chatbot with voice AI and conversational AI reads these sources in real time, giving customers accurate billing updates without long queues.

Payment Confirmation Retrieval: Returns processing timestamps, confirmation IDs, and reconciliation status directly from billing and payment gateways.

Accurate Renewal Condition Checks: Reads renewal rules shaped by policy type, customer profile, and regional timelines to show whether a policy is active, pending, or near lapse.

Reduced Strain During High-Volume Renewal Months: Handles routine billing questions at scale, giving service teams room to manage exceptions and escalations.

4. Verification, Compliance, And Disclosure Delivery

Insurance calls follow strict verification and disclosure sequences tied to product type, jurisdiction rules, and claim or policy status. When call volumes spike, service teams struggle to keep these steps in the correct order, which creates audit gaps and inconsistent customer experiences.

Voice AI and conversational AI help carriers apply these rules consistently by reading verification logic and disclosure text directly from approved sources.

Verification Paths That Match Product Rules: Applies ID checks based on policy type, claim category, or regional requirements before releasing account information.

Detection of Irregular Caller Patterns: Flags mismatches between caller inputs and account history when permitted under local regulation.

Accurate Delivery of Required Disclosures: Presents cancellation, renewal, and claim-handling notices in the correct sequence for compliance tracking.

5. Multilingual Call Handling With Regulatory Accuracy

Carriers must deliver identical coverage, billing, and claims explanations across languages because even small phrasing drift can create compliance exposure or misinterpretation. Human translation varies by region, vendor, and shift, which leads to inconsistent delivery of exclusions, waiting periods, and claim conditions. Voice cloning and multilingual voice agents give insurers a controlled way to keep policy language stable across all customer segments.

Consistent Rendering Of Approved Policy Text: Uses the same product wording across languages so exclusions, limits, and claim steps match the carrier’s approved documents without variation.

Clarity For Customers During High-Stress Events: Supports callers who need claim or billing details in their primary language during accidents, health issues, or property damage.

Stable Quality Across Global Service Models: Removes variation created by multilingual outsourced teams and keeps regulated conversations uniform during peak claim seasons.

See how Smallest.ai delivers real-time voice agents with natural speech, sub-100ms responses, and multilingual accuracy across insurance calls. Book a demo.

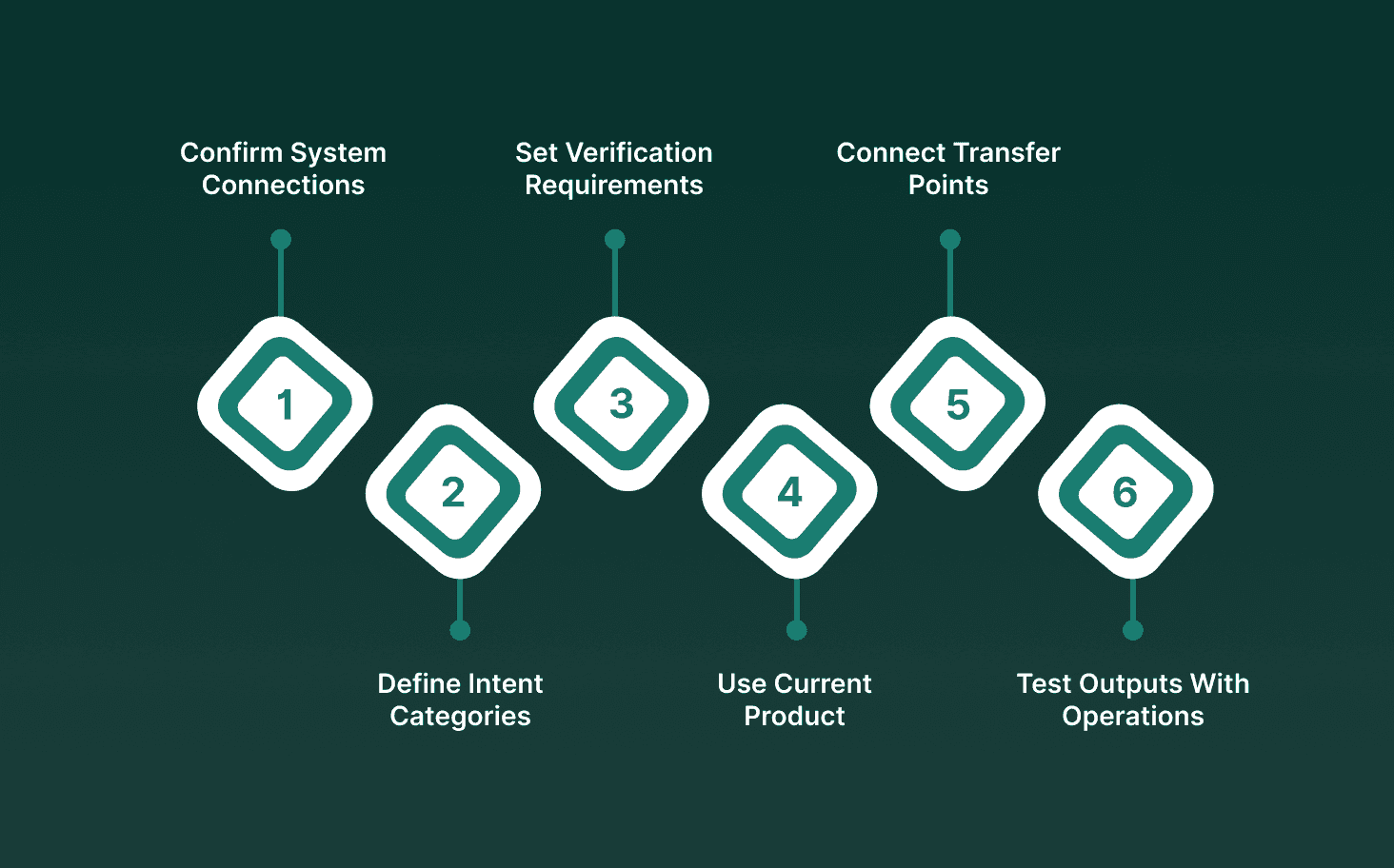

Simple Steps for Bringing Insurance AI Chatbots Into Existing Systems

Strong deployments start with clear alignment between the insurance AI chatbot and the systems that hold policy, claims, and billing data. Teams that approach this as a structured operational build, rather than a surface-level automation add-on, see higher accuracy during live customer use and fewer downstream corrections.

Confirm System Connections and Access Rules: Insurers using AI chatbots for customer service set approved API routes into policy, claims, billing, and payment records to protect data flow integrity.

Define Intent Categories Linked To Actual Processes: AI chatbots, insurance customer service teams group intents based on measurable call patterns such as coverage checks, claim stage updates, renewal timelines, and payment status.

Set Verification Requirements Before Sensitive Responses: An AI chatbot insurance workflow applies identity prompts tied to policy numbers, contact details, or claim reference codes before releasing account information.

Use Current Product And Regulatory Content As The Response Base: AI chatbots in insurance rely on product filings, rate documents, and approved service scripts, so coverage explanations and renewal conditions remain accurate.

Connect Transfer Points To Qualified Live Support: An AI-powered chatbot for insurance sector operations assigns warm transfers to queues that match product lines or claim categories for minimal customer handoff friction.

Test Outputs With Operations And Compliance Teams: Insurance services AI chatbot responses pass through wording checks, disclosure reviews, and data-update validation to confirm clarity before going live.

For a closer look at how voice AI supports risk-sensitive insurance workflows, see Real-Time Insurance Fraud Detection Using Voice AI

Common Roadblocks Insurance Teams Face When Rolling Out AI Chatbots

Insurance teams often find that the hardest part of launching an insurance AI chatbot comes from gaps in their own workflows. Policy, billing, and claims systems update at different speeds, and service rules vary across product lines, creating issues that surface as soon as automation goes live.

Roadblock | What Happens In Practice |

Inconsistent Data Across Policy And Claims Systems | Policy, billing, and claims sources return conflicting fields or outdated notes. |

Unclear Intent Boundaries For High-Variation Queries | One customer question contains multiple sub-requests tied to coverage terms, documents, or payments. |

Verification Steps That Slow The Dialog | Identity checks differ across product lines or rely on mismatched customer identifiers. |

Gaps In Approved Service Scripts | Product language contains missing clauses that surface during live testing. |

Limited Internal Ownership For Conversation Quality | Oversight is split across service, product, and compliance units without a single owner. |

Escalation Paths That Do Not Match Real Call Flows | Transfer queues fail to match claim severity, state rules, or product category. |

The challenges that surface during rollout often point directly to the capabilities carriers expect in the coming wave of systems.

What the Next Phase of Insurance AI Chatbots Will Look Like

The next wave of insurance AI chatbot development focuses on deeper context, voice-led engagement, and workflows that match how policy and claims teams already operate. Carriers move toward systems that respond with precision during regulated conversations while reducing gaps between customer questions and backend data sources.

Direct Access To Live Policy And Claim Events: Insurers using AI chatbots for customer service pursue connections that return current claim stages, payment flags, and policy changes without manual refresh steps.

Coverage For Multi-Intent Customer Queries: AI chatbots insurance customer service teams prepare for questions that combine document status, coverage limits, and renewal timing in one interaction.

Voice-Led Customer Engagement Across Service Lines: AI chatbots in insurance extend beyond text to voice-driven calls that follow established phrasing used in contact centers.

Verification Depth That Shifts With Risk Signals; An AI chatbot insurance workflow adapts identity prompts based on claim type, recent account activity, or suspicious interaction patterns.

Claim Guidance Supported By Historical Case Patterns: An AI-powered chatbot for insurance sector operations surfaces next steps or missing items by comparing current claims with prior cases.

Language Support That Maintains Regulatory Precision: Insurance services AI chatbot systems expand cross-language phrasing while keeping coverage, exclusions, and claim conditions aligned with approved product wording.

These shifts set the stage for platforms built to handle real-time insurance demands with greater steadiness and precision.

How Smallest.ai Raises Customer Experience Standards for Insurance Providers

Insurance teams work with complex service flows, regulated scripts, and unpredictable call volumes. Smallest.ai supports these pressures with voice agents and models built for real-time accuracy, multilingual clarity, and controlled data handling. The platform brings speed, precision, and call consistency that align with how policy, claims, and billing teams already operate.

Human-Like Voice Quality Across Insurance Calls: Insurance AI chatbot use cases benefit from natural speech that keeps coverage explanations, renewal steps, and claim updates clear for policyholders.

Fast Responses Backed By Sub-100ms Latency: Insurers using AI chatbots for customer service gain quicker call handling through real-time voice generation tuned for live policy and claim interactions.

Reliable Automation With Low Fallback Rates: AI chatbots in insurance customer service teams see stronger consistency because Smallest.ai models handle complex use cases with minimal handoff requirements.

Real-Time Call Analysis For Better Service Accuracy; AI chatbots in insurance use live transcription and monitoring to keep explanations aligned with approved wording across product lines.

Voice Agents That Support High-Volume Claim and Policy Queries: An AI chatbot insurance workflow benefits from agents that take calls, complete steps, and return verified information without delays.

Security Standards That Protect Regulated Customer Data: An AI-powered chatbot for insurance sector operations runs on SOC 2 Type 2, HIPAA, and PCI-ready infrastructure for protected policyholder conversations.

Broad Language Support For Diverse Policyholder Bases: Insurance services AI chatbot systems gain clarity across 16 languages, helping carriers maintain accuracy during multilingual calls.

With Smallest.ai, insurers gain voice systems that match real operational needs while raising service quality across policy, billing, and claims conversations.

Conclusion

Insurance teams work under steady pressure as call volumes rise, policyholders expect quicker answers, and internal systems move at different speeds. The value of an insurance AI chatbot becomes clearer when it brings consistency across these moving parts without reshaping the carrier’s core processes. By bringing structured clarity to claims, policy, and billing conversations, an insurance AI chatbot gives service teams room to focus on interactions that require judgment, empathy, or human discretion.

Smallest.ai brings voice AI, conversational AI, voice agents, and voice cloning built for live insurance calls. The platform reads system data in real time, handles complex questions across claims, renewals, and billing, and keeps phrasing consistent across languages. With sub-100ms responses and natural speech, it delivers steady, clear service for high-stakes conversations.

To see how this fits into your service workflows, book a demo.

FAQs About Insurance AI Chatbot

1. Can an insurance AI chatbot read claim or policy data without creating new risk for internal systems?

Yes. An insurance AI chatbot can read policy, billing, and claim events through controlled API routes that mirror existing access rules. This lets carriers keep current security controls in place while improving caller clarity.

2. How do insurers using AI chatbots for customer service manage complex multi-intent calls?

Many carriers receive calls that mix claim status, coverage checks, and billing questions. Insurers using AI chatbots for customer service map each part of the call to a backend action so the system can return accurate updates without sending the caller through multiple agents.

3. Do AI chatbots support compliance-driven disclosures in insurance customer service teams?

Yes. AI chatbots insurance customer service teams use approved text from policy filings and jurisdiction guidelines, which helps carriers keep phrasing steady during cancelation notices, renewal discussions, or claim updates.

4. How do AI chatbots in insurance support voice-driven calls instead of text-only flows?

Modern AI chatbots in insurance connect with voice AI and voice agents so callers can speak naturally. These systems return claim events, renewal timing, and payment details with lifelike delivery through voice cloning.

5. Can an AI-powered chatbot for insurance sector operations support multilingual regions without losing accuracy?

Yes. An AI-powered chatbot for insurance sector conversations can deliver coverage, claims, and billing explanations across languages using a single source of approved text. This keeps phrasing consistent for every policyholder using an insurance services AI chatbot.

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now