Boost debt recovery with AI voice collections for banking. Automate routine tasks, enhance engagement with personalized calls, and improve payment rates. Act now for increased efficiency!

Akshat Mandloi

Updated on

December 26, 2025 at 11:26 AM

Still relying on human agents to chase thousands of overdue accounts?

In banking, debt collection often means missed calls, long hold times, and inconsistent follow-ups, leading to low recovery rates and frustrated customers. AI-powered voice agents are transforming this by automating payment reminders, offering personalized repayment plans, and engaging customers in natural, two-way conversations instead of rigid scripts.

Are you also struggling with large volumes of delinquent accounts, frustrated by low contact rates, and worried about the rising operational cost of collections? This blog explores how AI voice agents simplify debt recovery, why they're becoming essential in banking, and their various applications to enhance efficiency.

Key Takeaways

Traditional debt recovery methods are slow, expensive, and often non-compliant, leading to low recovery rates and customer dissatisfaction.

AI voice agents automate debt collection tasks, including payment reminders, verification, and the use of natural language, as well as real-time logic.

These agents work 24/7, verify borrower identity, personalize payment options, and escalate complex cases to human collectors.

Key applications include mass calling, dispute handling, repayment negotiation, consistent follow-ups, and automated reporting.

What Are AI Voice Agents?

An AI voice agent for debt collection in banking is a conversational system that uses natural‑language voice technology to engage with delinquent borrowers in real time. It integrates with your credit and collections systems to make outbound calls or respond to inbound contacts, understand borrower intent, offer payment options, negotiate resolution, and escalate when needed.

These voice agents are mainly designed for repeatable, compliant interactions. These agents free your human collectors to focus on more complex cases and support higher‑volume outreach with consistent, 24/7 capability.

However, to see their true value, it’s essential to examine where traditional debt recovery methods fall short.

Also Read: FDCPA Guidelines for AI Voice Agents in Debt Collection

Why Traditional Debt Recovery Fails

Traditional debt collection in banking often falls short because it’s slow, expensive, and doesn’t scale well with today’s borrower expectations. Manual outreach also limits the number of accounts you can handle while staying compliant.

Here are the key challenges you likely face with legacy approaches:

1. The Limitations of Legacy Collection Systems

Most banks earlier depended on outdated dialers and scripts that don’t adapt to borrower behavior. These systems can’t personalize conversations or respond in real time. As a result, many calls go unanswered, and borrower engagement drops.

2. The Rising Costs of Inefficiency

Hiring, training, and managing a large collections team is expensive, and most of their time goes to repetitive tasks. Manual processes slow down recovery rates and limit your ability to scale during delinquency spikes.

3. Compliance and Regulatory Challenges

Debt collection in banking is heavily regulated under laws such as the FDCPA and TCPA. Traditional methods increase the risk of non-compliance through human error, such as miscommunication, improper call times, or missing consent, all of which can lead to legal issues.

Traditional debt recovery methods no longer meet the speed, scale, or compliance demands of modern banking. To improve collection rates and reduce risk, you need a smarter, more automated approach.

To overcome these challenges, banks are turning to AI voice agents equipped with key features that streamline and strengthen the entire debt collection process.

Key Features of AI Voice Agents

When applied to debt collection in banking, AI voice agents bring advanced automation and responsiveness to your outreach while preserving compliance and lender‑borrower trust.

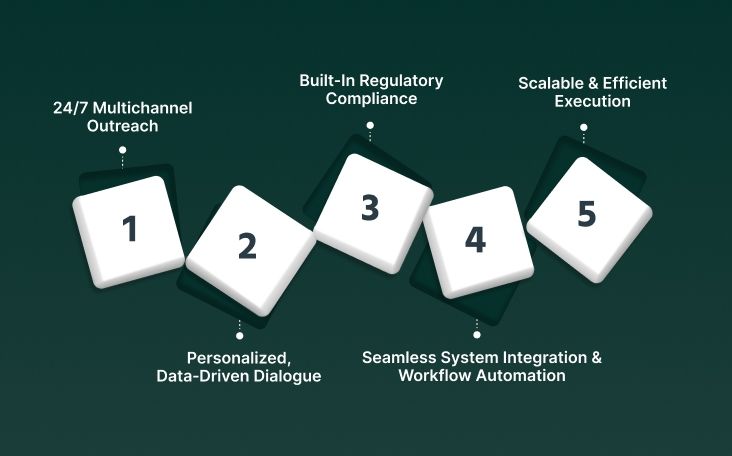

Here are five key features:

24/7 Multichannel Outreach: The system engages borrowers via voice calls anytime, increasing your contact rate and enabling continuous collection efforts.

Personalized, Data‑Driven Dialogue: It uses borrower history, behavior, and risk signals to tailor the conversation (tone, payment options, next steps) for each individual, improving engagement and repayment likelihood.

Built-In Regulatory Compliance: Interactions follow collection legislation (such as FDCPA/TCPA), capture audit trails, and apply compliant scripting automatically, enabling your bank to manage risk effectively.

Seamless System Integration & Workflow Automation: The solution connects to your collections/CRM platforms, handles identity verification, negotiates payment plans, logs outcomes, and only escalates when human intervention is required.

Scalable & Efficient Execution: It handles high volumes of calls and interactions simultaneously, freeing your human collectors to focus on complex cases and boosting operational efficiency.

AI voice agents deliver measurable gains, including shorter collection cycles, lower manual costs, and enhanced borrower satisfaction, all while ensuring full compliance oversight.

If you’re looking for a platform that offers all these features, Smallest.ai delivers exactly that. With real-time, sub-100ms latency, voice cloning, enterprise-grade compliance (SOC 2, HIPAA, PCI), and deep integration into your collections stack.

Now, let's explore how AI voice agents actually work in the banking debt collection process.

Also Read: How Voice AI Enhances Auto Loan Collections

How do AI Voice Agents work in Debt Collection?

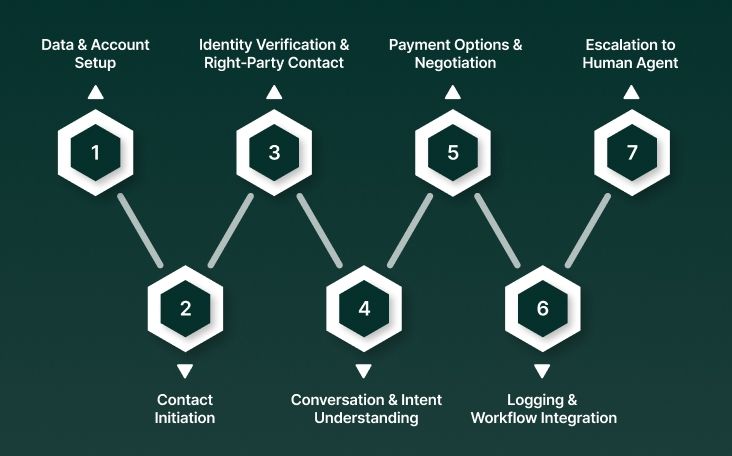

In debt collection, AI voice agents operate end-to-end from initiating contact to managing resolutions with minimal human intervention. Here are the key steps of how this works within your debt collection operations:

Data and Account Setup: The system retrieves portfolio data from your CRM or debt-management system, including borrower identity, loan status, outstanding amounts, and previous contact history.

Contact Initiation: The agent places outbound calls (or answers inbound ones) to the borrower, using pre‑defined rules on timing, channel, and priority to maximize the chance of engagement.

Identity Verification & Right‑Party Contact (RPC): The agent confirms that it’s speaking to the correct borrower, using verification steps such as account number, DOB, or SSN check to ensure compliance.

Conversation & Intent Understanding: Through natural language understanding, the agent interacts with the borrower, explaining the debt, listening for intent (willingness to pay, hardship, or dispute), and perceiving sentiment.

Payment Options & Negotiation: The agent offers suitable repayment paths (one-time payment, installments, hardship plan) based on the borrower's context and your bank’s policy.

Logging & Workflow Integration: Every interaction is logged into your system, outcomes are updated (promise-to-pay, partial pay, dispute), and next steps or escalations are triggered as needed.

Escalation to Human Agent: If the situation is complex, non-standard, or requires human judgment (e.g., legal issues, emotional distress), the call is transferred to a human collector with full context.

By following these steps, the AI voice agent helps automate large volumes of routine collection work, ensuring compliance and freeing your human agents for high-value interactions.

Once you understand how AI voice agents operate within the debt collection workflow, the next step is seeing where they make the biggest impact across your banking operations.

Applications of AI Voice Agents in Debt Collection

In banking, AI voice agents don’t just replace manual calling; they plug into your entire debt collection workflow, from the first reminder to final resolution. They help you reach more borrowers, handle routine conversations, and keep every step traceable and compliant.

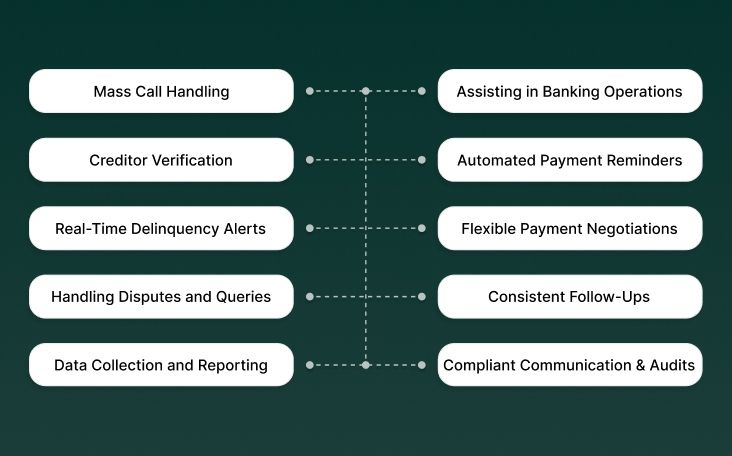

Here are 10 practical applications of AI voice agents in your bank’s debt collection process:

1. High Volume Call Handling

AI voice agents can simultaneously call thousands of delinquent borrowers, eliminating the need to hire additional staff. They follow the bank's call strategy and adjust pacing automatically.

This lets you increase right-party contacts and coverage across your portfolio, even during peak delinquency periods.

2. Assisting in the Functioning of Banking Operations

In day-to-day collections, the agent becomes an operational “helper” across teams. It can pre-screen accounts, collect basic information, route calls to the right queue, and sync updates back into your core banking or collections system. You get smoother hand-offs between automated calls and human collectors, with less manual admin work.

3. Creditor Verification

Before discussing any payment, the AI agent verifies the details. It confirms the borrower’s identity and clearly states your bank and account details. It follows right-party contact rules so you stay aligned with internal policies and external regulations. This reduces miscommunication and builds trust early in the call.

4. Automated Payment Reminders

You can use AI voice agents to send timely reminders before due dates, on the due date, and after a missed payment. The agent explains the amount due, due date, and payment options in simple language, and can guide the borrower to pay during the same call or via a secure link or IVR. This keeps your reminders consistent, polite, and always on time.

5. Real-Time Delinquency Outreach

When your systems detect a missed EMI, a broken promise-to-pay, or a high-risk signal, the AI agent can trigger a real-time call instead of waiting for the next batch campaign. It contacts the borrower while the event is still fresh, clarifies what happened, and offers a quick resolution path. This helps you move from reactive chasing to proactive collections.

6. Flexible Payment Plan Negotiations

AI voice agents can guide borrowers through various payment options based on your policy, including one-time settlements, short-term instalment plans, or hardship arrangements. They calculate eligible amounts, confirm dates, and capture consent during the call. Once the borrower agrees, the agent updates your system so your team doesn’t have to rekey details later.

7. Handling Disputes and Queries

When borrowers raise disputes (wrong amount, already paid) or ask questions about interest, fees, or dates, the AI agent can handle structured scenarios using your approved scripts and knowledge base. It collects the necessary details, opens a dispute ticket or flags the account, and only transfers the matter to a human when judgment or exceptions are required. This reduces call time for your collectors and keeps records clean.

8. Consistent Follow-Ups

After a promise-to-pay or partial payment, the AI agent can schedule and execute follow-up calls exactly on the agreed date and time window. It checks if the payment has gone through, reminds the borrower if it hasn’t, and updates the status automatically. This eliminates reliance on spreadsheets and manual callbacks, helping you adhere to your follow-up strategy without gaps.

9. Data Collection and Reporting

Every AI-handled call generates structured data: contact success, borrower intent, reasons for non-payment, sentiment, and outcome. This data flows into dashboards, allowing you to see which scripts, timings, and segments perform best. Over time, you can adjust your strategy on who to call, when to call, and what to say based on insights, not guesswork.

10. Compliance-Safe Communication & Audit Trails

AI voice agents can enforce call-time rules, frequency caps, consent checks, and mandatory disclosures on every interaction. They log recordings and transcripts with timestamps and outcomes, giving you a clear audit trail for regulators and internal compliance teams. This reduces the risk of accidental breaches that often happen in large, human-only calling teams.

AI voice agents bring structure, scale, and consistency to every stage of your debt collection process. By automating routine tasks and enhancing contact quality, they help banks recover more quickly, faster, and with fewer compliance risks.

To put these applications into action, leading platforms like Smallest.ai are already offering purpose-built solutions tailored for banking.

Also Read: Voice AI for Banks & Financial Services: Use Cases, Architecture & Best Practices

How Smallest.ai Helps in Debt Collection

Smallest.ai offers AI voice agents tailored to expedite debt collection while maintaining customer relationships. Instead of relying only on human callers, you can use real-time voice agents that contact the right borrowers, at the right time, and guide them all the way from reminder to resolution.

With Smallest.ai, you can:

Available 24/7: You can contact debtors at any time through voice calls for effective and timely payment reminders.

Build Debtor Trust: Your AI collects information to ensure a respectful and empathetic experience for every borrower.

Take Real Actions: Negotiate terms effectively, confirm payments promptly, and update CRM systems in real-time to keep operations running smoothly without delays.

Recovery Insights: Track call attempts, promises to pay, and successful collections in a single, user-friendly dashboard that simplifies monitoring and reporting.

Escalate When Needed: Connect borrowers to live agents when necessary, ensuring that no opportunity or concern goes unresolved.

Why wait to modernize your collections? Book a demo today and see how Smallest.ai can transform your bank’s recovery process.

Conclusion

AI voice agents are transforming how banks manage debt recovery, bringing speed, consistency, and empathy into a process long slowed by manual calls and compliance risks. From real-time payment reminders to automated follow-ups, these solutions streamline communication, boost recovery rates, and help your team focus on high-value accounts.

That’s exactly where Smallest.ai comes in. Our AI-powered voice agents are built for real-time, compliant, and human-like engagement across every stage of the debt recovery journey. So, do you also want to reduce costs, stay compliant, and recover more? Book a demo with Smallest.ai today and see it in action.

FAQs

1. Are AI voice agents a complete replacement for human collectors?

No. They are best suited for high-volume, standardized tasks (tier-1 outreach), such as reminders and verification. You still need human agents for complex negotiations, disputes, hardship cases, or escalations.

2. What kind of integration is needed to deploy AI voice agents in a bank’s existing collections infrastructure?

You’ll need to integrate the AI voice system with your CRM/collections data, dialer or SIP trunk, and payment/loan‑management systems so the agent has real‑time access to account status and can update workflows automatically.

3. How do AI voice agents help banks handle multilingual or diverse customer portfolios?

Modern voice-AI solutions support multiple languages and regional accents, and they adapt their interaction style based on borrower sentiment, culture, and channel preference, helping you engage more effectively across different segments.