Uncover AI fraud detection's role in banking with enhanced accuracy and real-time prevention. Explore advanced machine learning, real-world success. Learn more now!

Prithvi Bharadwaj

Updated on

December 26, 2025 at 11:26 AM

Digital banking and payment channels have exploded in popularity, offering unprecedented convenience but also opening the door to increasingly sophisticated fraud. Today, financial institutions face a surge in threats such as identity theft, phishing, synthetic-identity accounts and card-not-present fraud.

Traditional rule-based fraud detection systems, built on fixed thresholds and manual rules, are no longer sufficient in this fast-moving environment. According to the Federal Trade Commission, consumers reported losses of over US $12.5 billion to fraud in 2024, a 25 % increase over the previous year.

In this context, artificial intelligence (AI) becomes essential: it enables real-time, learning-based detection and intervention, shifting fraud prevention from reactive to proactive.

Key Takeaways

AI has become central to modern banking security, transforming fraud detection from manual rule checks to intelligent, real-time monitoring.

Legacy systems can’t keep pace with today’s complex fraud tactics, often leading to delayed detection, false positives, and operational inefficiencies.

AI-powered tools, like machine learning, deep learning, NLP, and behavioral biometrics, enable banks to identify suspicious behavior, prevent synthetic identities, and protect genuine customers.

Real-time insights and automation allow banks to act instantly, reducing financial loss, regulatory risk, and customer friction.

Voice-based AI solutions, such as Smallest.ai, provide an added layer of security through instant voice verification and multilingual fraud response capabilities.

Future-ready banks will rely on predictive, adaptive AI systems that learn continuously, detect deepfakes, and deliver safer, more seamless digital experiences.

How Fraud Detection in Banking Has Evolved

In the early stages of digital banking, fraud detection relied heavily on manual checks and predefined rule-based systems. Transactions were flagged based on fixed criteria such as unusual locations, sudden large purchases, or deviations from typical spending patterns. Analysts reviewed alerts and decided whether to block or allow transactions.

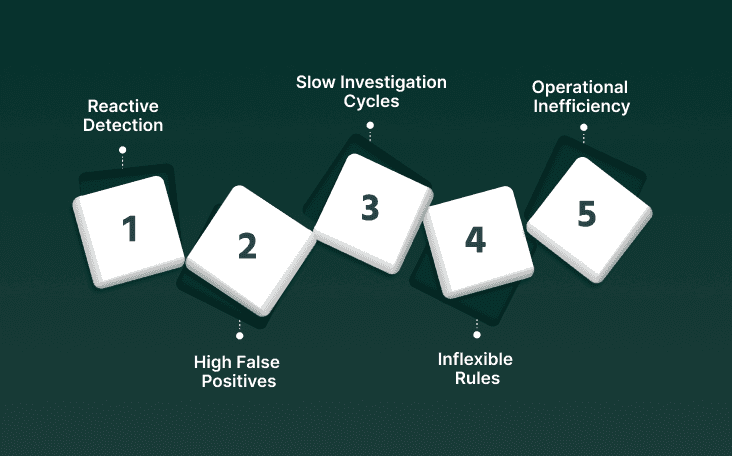

Limitations of Traditional Systems

While useful initially, rule-based fraud detection soon showed major weaknesses:

Reactive detection often identifies fraud only after losses occur

High false positives, legitimate customers are frequently blocked or challenged

Slow investigation cycles, heavy reliance on manual review

Inflexible rules, unable to adapt to new or sophisticated fraud tactics

Operational inefficiency as digital transactions scaled

As fraudsters evolved, static rules failed to keep pace.

Transformation Toward Automated, AI-Based Fraud Intelligence

The banking industry has now shifted to AI-driven fraud detection that learns, adapts, and responds in real time. Modern systems analyze behavior, detect anomalies instantly, and continuously update models as new fraud patterns emerge.

Key capabilities include:

Real-time behavioral and transaction monitoring

Machine learning-based risk scoring

Adaptive models that learn new attack patterns

Faster case handling with automated alerts & insights

This evolution has moved banks from reactive defense to proactive, intelligent fraud prevention, improving security, reducing customer friction, and accelerating fraud response.

Also Read: Top AI voice agents for BFSI (Banking, Financial Services, and Insurance) in 2025?

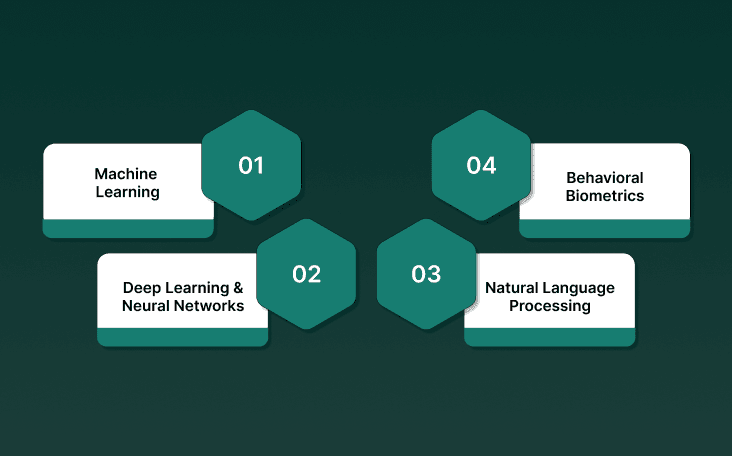

Core AI Technologies Transforming Fraud Detection

AI has revolutionized financial security by enabling continuous monitoring, real-time decision-making, and adaptive defenses. These technologies allow banks to identify subtle risks long before they cause harm, reducing fraud losses and enhancing customer trust.

Machine Learning (ML)

Machine Learning helps banks shift from static rule checks to dynamic, intelligence-driven fraud prevention.

Learns from millions of historical transactions to identify normal vs. suspicious patterns

Detects unusual behavior such as sudden spending spikes, device changes, or unusual merchant behavior

Flags accounts linked to known fraud networks through pattern correlation

Continuously improves accuracy by learning from newly identified fraud attempts

Enables real-time fraud scoring that supplements (or replaces) traditional rule engines

ML reduces false positives and catches fraud earlier, improving security and customer experience.

Deep Learning & Neural Networks

Deep learning models excel at understanding complex fraud signals across diverse data sources.

Recognizes subtle behavioral anomalies and hidden attack paths

Detects multi-layer fraud patterns such as coordinated bot activity and mule account networks

Enables voice recognition, face matching, and biometric authentication for identity protection

Enhances AML monitoring by mapping transaction flows across networks and entities

Performs sequence analysis, detecting fraud patterns over time, not just single transactions

Deep learning catches sophisticated fraud rings and synthetic identities that traditional models can’t detect.

Natural Language Processing (NLP)

NLP helps banks understand human language in fraud-related communication and verification workflows.

Analyzes emails, SMS, chat logs, and call transcripts to identify phishing and scam attempts

Flags urgency phrases, spoofed communication patterns, and fraudster persuasion tactics

Supports customer service & fraud teams by auto-summarizing fraud claims and disputes

Assists KYC teams by extracting and verifying identity information from documents

Detects insider fraud signals in employee communication systems

NLP helps banks fight social-engineering fraud, now one of the fastest-growing attack methods globally.

Real-Time Behavioral Biometrics

Behavioral biometrics verify identity based on how a user behaves, not just what they enter.

Tracks continuous user behavior: keystrokes, mouse movement, swipe patterns, and pressure

Monitors device metadata, IP reputation, network behavior, and location consistency

Detects anomalies in login patterns, e.g., impossible travel or rapid device switching

Helps stop account takeover fraud by identifying when a different person controls the account

Invisible verification protects users without adding login friction or extra steps

Behavioral biometrics provide continuous authentication, closing gaps left by passwords, OTPs, and devices alone.

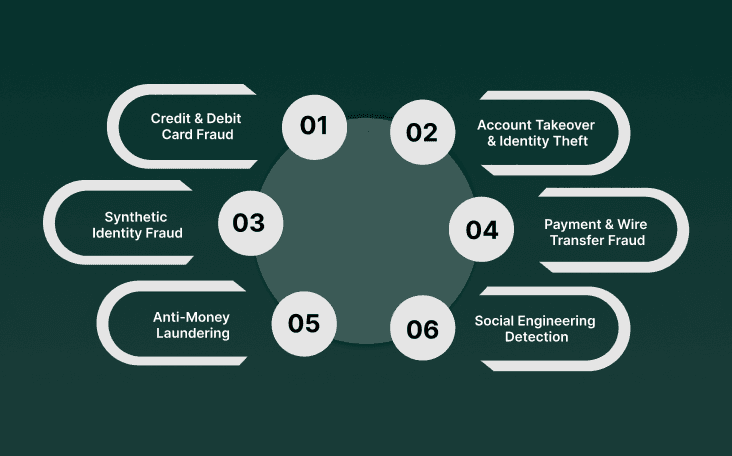

Real-World Banking Fraud Scenarios Tackled by AI

AI is helping banks stop fraud as it happens, identifying abnormal patterns, preventing unauthorized access, and blocking scammers in real time.

Credit & Debit Card Fraud

AI scans transaction behavior to detect unusual card activity instantly.

How AI Helps

Spots suspicious spending patterns or sudden high-value purchases

Detects rapid small transactions used to test stolen cards

Identifies risky merchant behavior or compromised terminals

Example: A customer usually spends $50–$200 locally. Suddenly, $1,200 is attempted in another country within minutes, AI instantly flags and blocks it before approval.

Account Takeover (ATO) & Identity Theft

AI prevents unauthorized access by spotting unusual login behavior.

How AI Helps

Detects login from a new country or an unknown device

Flags unusual account changes (password, email, phone update)

Uses biometrics to confirm the real user

Example: A hacker logs in using stolen credentials but types and navigates differently. Behavioral biometrics detect the change, resulting in an immediate account lock and alert.

Synthetic Identity Fraud

AI identifies fake identities created by blending real and false information.

How AI Helps

Analyzes the maturity of digital identity footprint

Detects inconsistent ID & data patterns

Flags multiple accounts tied to the same device/IP

Example: An account with a new SSN, no past activity, and sudden rapid credit behavior is flagged as a synthetic identity setup.

Payment & Wire Transfer Fraud

AI monitors money movement to detect suspicious transfers.

How AI Helps

Flags unusual target accounts or abnormal transfer sizes

Monitors device fingerprints & IP addresses for consistency

Uses dynamic verification for risky transactions

Example: A user who normally transfers $200 monthly suddenly initiates a $9,000 overseas wire. AI blocks it and triggers a verification call instantly.

Anti-Money Laundering (AML)

AI tracks transaction networks for illegal fund movements.

How AI Helps

Detects layered transactions used to hide funds

Monitors linked accounts & entity networks

Automates sanction list checks

Example: Multiple small deposits are quickly transferred to various newly created accounts. AI identifies a mule network pattern and freezes accounts for investigation.

Scam & Social Engineering Detection

AI detects when customers are being manipulated by fraudsters.

How AI Helps

Flags anxious behavior or scripted responses during interactions

Detects unusual withdrawal attempts triggered by scam calls

Prompts extra verification questions

Example: A senior customer tries withdrawing $20,000 urgently after a “government" phone call. AI detects suspicious behavior and alerts staff to intervene.

Also read: Voice AI for Banks & Financial Services: Use Cases, Architecture & Best Practices

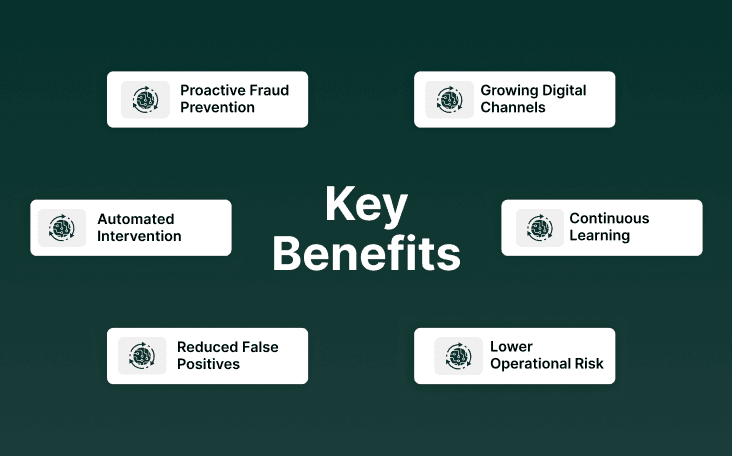

Key Benefits of AI-Powered Fraud Detection

AI doesn’t just streamline fraud prevention, it transforms it. By combining real-time intelligence with adaptive learning, banks gain operational efficiency, stronger security, and greater customer trust.

Proactive fraud prevention: AI detects evolving fraud patterns and intent signals before transactions are completed, enabling banks to stop threats early rather than reacting after financial losses or customer harm.

Real-time alerts & automated intervention: With continuous monitoring across accounts, devices, and channels, AI triggers instant actions, from temporary holds to automated verification, reducing the window for fraudulent activity to succeed.

Reduced false positives & improved customer experience: Intelligent risk scoring helps banks avoid blocking legitimate users, reducing customer frustration, call-center load, and friction during digital transactions, especially critical in mobile-first banking.

Lower operational risk & reduced financial loss: By automating detection and investigation workflows, AI cuts manual review effort, decreases chargebacks, and minimizes regulatory penalties tied to AML or fraud compliance failures.

Continuous learning & adaptation to new threats: Unlike static rule systems, AI continuously learns from global fraud signals, new scams, and user behavior shifts, ensuring banks stay ahead of emerging attack techniques like deepfakes and synthetic IDs.

Scalable protection across growing digital channels: AI seamlessly monitors millions of transactions, apps, APIs, and platforms in parallel, supporting scale as customers shift to digital banking, fintech apps, and instant payments.

Challenges & Compliance Considerations

Every business adopting voice AI must navigate various technical, ethical, and regulatory challenges. Ensuring compliance with data privacy laws and maintaining transparency are essential for building user trust and long-term success.

Challenge | What It Means | Why It Matters in Banking |

|---|---|---|

Data Privacy & Regulation | AI systems use sensitive customer data | Must comply with GDPR, PCI-DSS, FFIEC, RBI, MAS etc. to avoid legal & financial risk |

Model Transparency (Explainability) | Black-box AI models are hard to interpret | Banks must explain decisions (declined transactions, blocked accounts) to regulators & customers |

Bias & Fairness | AI may unintentionally discriminate based on behavior or demographics | Can lead to unfair fraud alerts, reputational damage, and regulatory penalties |

Legacy System Integration | Older banking infrastructure may not support advanced AI | Creates implementation challenges, data silos, latency & operational friction |

Data Quality & Availability | AI needs clean, comprehensive data to work accurately | Poor data leads to weak detection, false alerts, and missed fraud signals |

Adversarial AI Threats | Fraudsters now use AI for deepfakes, phishing, synthetic IDs | Banks must constantly update defenses to stay ahead of evolving threats |

Human Oversight Balance | Full automation isn't feasible or compliant in high-risk cases | Banks need human review & escalation workflows for critical decisions |

How Smallest.ai Enhances Fraud Prevention in Banking

As banks adopt AI to stop fraud in real time, voice-based intelligence is emerging as a critical layer of security. Smallest.ai adds this missing capability, enabling secure, real-time voice verification and customer interaction.

Provides an enterprise-grade Voice AI Suite (voice agents, TTS, live call understanding) that can run in secure on-premises environments, keeping sensitive data inside the bank’s infrastructure, essential for compliance-heavy financial institutions.

Offers sub-100ms real-time response and natural voice interaction, allowing banks to instantly verify suspicious transactions or login attempts through automated voice calls instead of manual escalation delays.

Supports 16+ languages, enabling multilingual voice verification and fraud-response workflows for banks operating across diverse regions and customer bases.

Integrates with CRMs, call systems, and internal workflows, allowing seamless routing from fraud-detection alerts to automated voice checks, reducing dependence on call-center agents and speeding up customer verification.

In benchmark tests, Lightning ASR achieved a 295 ms time-to-first-transcript, outperforming GPT-4o Mini (480 ms) and Deepgram (310 ms) in streaming response speed

Delivers secure and compliant infrastructure (SOC 2 Type II, HIPAA, PCI, ISO) and private deployment options, giving banks full control over voice data while enhancing customer security and trust.

Why this matters for banks: Smallest.ai brings voice-layer authentication and automated interaction into the fraud-control stack, helping banks confirm genuine customers faster, stop account-takeover attempts, and reduce friction without compromising security.

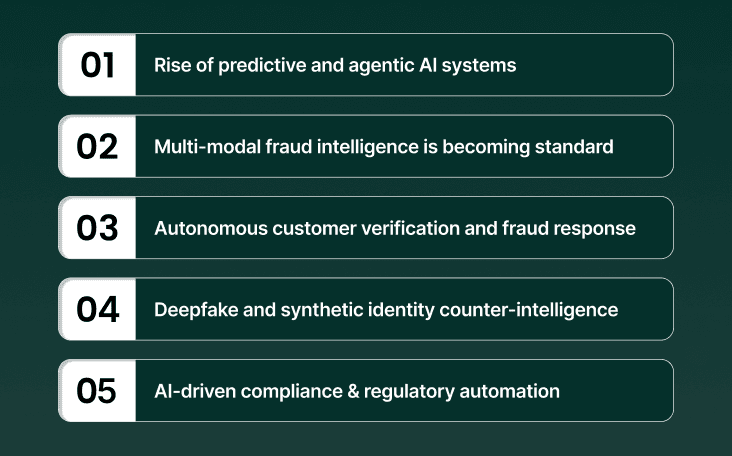

Future Trends in AI-Driven Fraud Detection in Banking

Banking fraud prevention is shifting from reactive controls to intelligent, self-learning systems that anticipate and neutralize threats before they occur.

Rise of predictive and agentic AI systems: Banks are evolving from detection to prevention, using AI that can automatically identify risk, trigger verification workflows, and stop suspicious transactions without human intervention.

Multi-modal fraud intelligence is becoming standard: Fraud detection is expanding beyond transaction data, incorporating device identity, biometrics, voice patterns, network behavior, and customer interaction signals to build a 360º risk profile.

Autonomous customer verification and fraud response: AI-powered voice bots, behavioral checks, and adaptive authentication will replace manual verification, enabling banks to instantly confirm high-risk actions like fund transfers or password resets.

Deepfake and synthetic identity counter-intelligence: As criminals use AI for voice cloning, document forgery, and digital identity fraud, banks will deploy AI that detects deepfake signals and validates identity authenticity in real time.

AI-driven compliance & regulatory automation: Banks will use AI to automatically monitor transactions, generate compliance reports, and enforce evolving KYC/AML rules, reducing manual burden and enabling real-time regulatory adherence

Conclusion

AI has become the core of modern fraud prevention, shifting banking security from static rule-based checks to intelligent, adaptive, and real-time defense systems. As fraudsters evolve with deepfakes, automation, and synthetic identities, banks must embrace voice intelligence and behavioral biometrics to strengthen identity verification and customer trust. The future of fraud prevention will blend advanced automation with human oversight, creating secure, efficient, and customer-friendly banking experiences.

Ready to explore how voice-enabled AI can boost your fraud prevention strategy?

Book a demo with Smallest.ai and see enterprise-grade voice intelligence in action.

FAQ

1. How does machine learning detect fraud?

It analyzes transaction histories, spending habits, and user behavior to distinguish normal from abnormal patterns and flags suspicious activity in real time.

2. What role does deep learning play in fraud detection?

Deep learning models identify complex fraud patterns, detect synthetic identities, and recognize multi-layered scams such as mule networks and bot-driven attacks.

3. How does NLP help fight financial fraud?

NLP scans text and speech from emails, chats, and calls to detect phishing attempts, scam language, and insider fraud cues.

4. What are behavioral biometrics?

They analyze how users interact with devices, such as typing speed, swipe motion, and mouse movement, to verify identity continuously and invisibly.

5. How does AI detect credit card fraud?

AI tracks real-time transaction data, spotting sudden spending spikes, location inconsistencies, or rapid small charges typical of stolen cards.