Understand the advantages and disadvantages of AI in banking through real-world execution, compliance limits, and what scales in production. Read more.

Rishabh Dahale

Updated on

February 23, 2026 at 9:22 AM

Banks have always adopted technology under pressure. From core banking systems replacing ledgers to online banking reducing branch dependency, each shift followed the same pattern. Efficiency first, control second, consequences later. Artificial intelligence follows that same arc, but at a far greater scale.

Today, leaders searching for the advantages and disadvantages of AI in banking are not looking for definitions. They are weighing execution risk, regulatory exposure, and whether AI actually holds up inside real transaction volumes, customer calls, and compliance workflows.

That question has become unavoidable as adoption accelerates. The AI in the banking market size is valued to increase by USD 77.09 billion at a CAGR of 27.7% from 2024 to 2029, pushing AI directly into lending, fraud prevention, customer service, and compliance operations. This quick shift forces banks to evaluate the advantages and disadvantages of AI in banking side by side, not as theory, but as an operating reality.

In this guide, we break down where AI delivers measurable value, where it introduces structural risk, and what leaders need to evaluate before scaling it across core banking functions.

Key Takeaways

Execution Over Experimentation: The advantages and disadvantages of AI in banking depend on how well AI operates inside real-time, high-volume workflows, not on pilot programs or model complexity.

Scale Multiplies Impact: AI accelerates efficiency at scale, but weak data, governance, or oversight failures grow quickly across banking operations.

Governance Drives Longevity: Explainability, auditability, and human oversight must be built into AI systems from day one to remain viable in regulated environments.

Voice and Agentic AI Raise Stakes: Real-time, voice-driven systems demand low latency, strong identity controls, and consistent policy enforcement to avoid customer and compliance risk.

Proof Determines the Future: Banks that link AI to measurable cost, risk, and performance outcomes will scale successfully through 2030.

Why AI Adoption Has Become Inevitable for Modern Banks

AI adoption in banking is no longer driven by experimentation or innovation agendas. It is a direct response to structural pressures across cost, risk, customer expectations, and regulatory complexity. Banks that delay AI adoption face compounding disadvantages across core operations rather than isolated inefficiencies.

Transaction Volume Growth vs Human Throughput: Banks process millions of transactions per hour across payments, cards, and lending. Human review does not scale with transaction velocity, making ML-based triage and automated decisions mandatory.

Regulatory Complexity and Continuous Monitoring: AML, KYC, sanctions, and conduct risk require real-time surveillance across channels. Manual controls cannot sustain continuous monitoring without unsustainable staffing growth.

Cost Structures Under Margin Compression: Margin compression and rising compliance spend limit headcount-heavy models. AI shifts execution from fixed personnel cost to variable, usage-based compute in high-volume functions.

Customer Expectations for Real-Time Resolution: Customers expect instant approvals, proactive alerts, and uninterrupted service. AI enables event-driven responses that queue-based workflows and branch-centric models fail to support.

Competitive Pressure From Digital-First Institutions: Neobanks operate on AI-native architectures that redefine speed and availability. Incumbents adopt AI to close structural cost and experience gaps, not to pursue novelty.

If you are evaluating how voice AI should operate inside regulated, high-volume banking workflows, explore the Top AI voice agents for BFSI (Banking, Financial Services, and Insurance) in 2025?

Advantages and Disadvantages of AI in Banking

AI adoption in banking delivers measurable gains in speed, scale, and operational control, while also introducing new classes of risk tied to data, governance, and system dependency. The value comes from precise deployment in high-volume, real-time workflows, not blanket automation.

Advantages of AI in Banking

AI provides banks with execution capacity that exceeds human throughput in transaction-heavy, latency-sensitive environments such as customer interactions, fraud monitoring, and compliance workflows.

Advantage Area | Technical Detail and Impact |

Improved Fraud Detection and Prevention | Machine learning models analyze transactions, behavior, devices, and location in real time to detect fraud as it happens. The AI fraud detection market is projected to reach $31.69 billion by 2029, reflecting broad adoption in banking. |

Operational Efficiency and Cost Reduction | AI automates document intake, data validation, and routine customer queries, reducing manual effort and cycle times while reserving human capacity for high-risk or complex cases. |

Faster, More Accurate Decision-Making | AI-based credit and lending models evaluate traditional and alternative data in real time, reducing approval timelines from weeks to minutes. Banks using AI report a 25% improvement in decision-making speed, alongside stronger risk accuracy and lower default exposure. |

Personalized Customer Experiences | Behavioral and transaction data power event-driven recommendations and offers, improving retention, cross-sell, and upsell performance. |

Improved Compliance and Regulatory Oversight | Continuous AI monitoring supports AML and KYC by flagging anomalies and rare events, reducing review errors, and accelerating regulatory reporting. |

24/7 Customer Support Availability | AI assistants handle concurrent interactions at scale, lowering wait times and allowing round-the-clock service without linear staffing growth. |

Disadvantages of AI in Banking

AI introduces structural risks when deployed without strict controls around data quality, oversight, and failure handling, especially in customer-facing and compliance-critical systems.

Disadvantage Area | Operational, Financial, and Regulatory Risk |

High Implementation Costs | AI adoption demands heavy upfront spend on infrastructure, compute, data readiness, and specialist talent. Many banks invest billions before scale, while up to 85% of AI projects fail to reach production, delaying ROI. |

Algorithmic Bias and Discriminatory Lending | Models trained on historical data can replicate systemic bias. Mortgage algorithms charge higher interest rates to Black and Hispanic borrowers with similar credit profiles, creating regulatory and reputational exposure. |

Opaque Decision-Making and Limited Explainability | Black-box models limit explainability for credit, fraud, and risk decisions, complicating audits, customer disputes, and regulatory review. |

Cybersecurity and Data Privacy Exposure | AI systems expand attack surfaces by processing large volumes of sensitive financial data, increasing exposure to breaches, model abuse, and system-level attacks. |

Regulatory Compliance Complexity | AI adoption outpaces regulation. Banks must meet ECOA, FCRA, UDAAP, AML, and emerging AI rules simultaneously. Only 6% of retail banks report a mature AI roadmap at scale. |

High Cost of Errors | Errors in lending, fraud, or risk models can lead to multi-million-dollar losses, even at low error rates, due to the banking transaction scale. |

What This Means for Banking Leaders and Practitioners

The value comes from deploying AI in latency-sensitive, high-volume workflows such as fraud detection, customer interactions, and compliance monitoring, not from broad or experimental adoption.

As AI replaces human throughput, banks must strengthen data governance, model oversight, and escalation paths to prevent small errors from scaling into systemic failures.

Credit approvals, fraud disputes, and compliance exceptions still require human judgment to maintain trust, regulatory alignment, and customer confidence.

While automation reduces manual effort, failures in AI-driven systems carry higher financial, regulatory, and reputational consequences due to their scale and speed.

Banks that treat AI as critical infrastructure with clear boundaries, accountability, and performance controls will outperform those pursuing aggressive but poorly governed deployments.

See how Smallest.ai allows real-time voice automation with policy control, low latency, and audit-ready execution across high-volume banking interactions.

Core Applications of AI in Banking

AI is embedded across banking systems where speed, accuracy, and continuous execution are required. Its most effective applications operate directly on live data streams, allowing banks to process transactions, interactions, and risks at machine scale without manual intervention.

Transaction Monitoring and Fraud Detection: AI models inspect transaction sequences, behavioral baselines, device fingerprints, and location signals in real time, identifying fraud patterns that emerge only when multiple signals are evaluated simultaneously.

Credit Scoring and Lending Automation: Machine learning systems assess creditworthiness using dynamic inputs such as cash flow behavior, repayment history, and external data, allowing instant loan decisions and continuous risk reassessment post-disbursement.

Customer Interaction and Service Automation: AI-driven assistants handle inbound and outbound customer interactions across voice and chat, resolving routine requests, validating identity, and routing complex cases to human agents when predefined thresholds are crossed.

Compliance Surveillance and Regulatory Reporting: AI continuously screens accounts and transactions against AML, sanctions, and conduct rules, flagging anomalies and generating audit-ready reports without relying on periodic manual reviews.

Risk Analytics and Financial Forecasting: Predictive models analyze market signals, portfolio exposure, and liquidity metrics to support capital planning, stress testing, and early identification of emerging financial risks.

The strongest AI outcomes in banking come from deploying intelligence at execution points where real-time data, scale, and consistency are mandatory. Banks that embed AI directly into these core workflows achieve durability, not incremental gains.

To understand how automation fits into governed banking operations, see 10 Ways RPA in Banking Improves Efficiency and Control

How Voice AI Is Changing Customer Interaction in Banking

Voice AI is reshaping how banks manage customer conversations by moving interaction handling into real-time execution layers. Instead of routing calls through rigid IVRs or agent queues, banks now use voice-driven systems that interpret intent, authenticate users, and act during the conversation itself.

Real-Time Intent Detection: Speech signals and conversational context are analyzed as the call unfolds, identifying intent within seconds without menu-driven IVRs or after-call classification.

Inline Identity Verification: Voice and behavioral signals authenticate callers during the conversation, reducing reliance on static security questions and manual checks.

Live Transaction Resolution: Voice AI completes actions such as balance inquiries, payment confirmations, scheduling, and card status updates mid-call, eliminating back-office delays.

Dynamic Escalation Control: Confidence scoring determines when automation continues, or a human agent takes over, with full conversational context preserved.

Consistent Policy Enforcement Across Calls: Standardized disclosures and response logic are applied on every call, reducing variability and compliance drift at scale.

Voice AI shifts banking interactions from reactive support to real-time execution. Banks that deploy it as a core interaction layer gain speed, consistency, and control without sacrificing human oversight where it is required.

What the Next Phase of AI in Banking Will Look Like

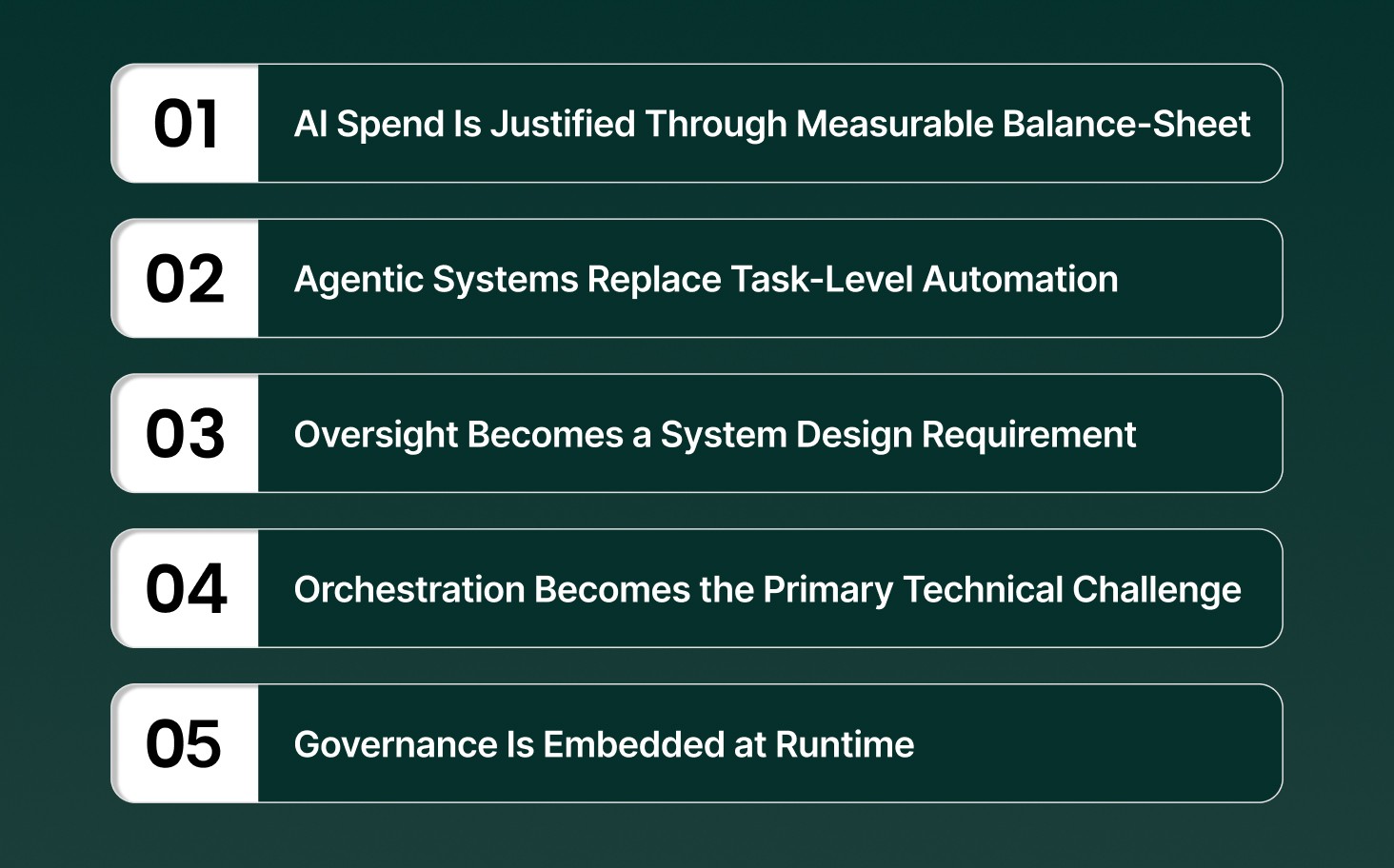

The next era of AI in banking is not defined by new models, but by accountability. Between 2026 and 2030, AI programs will be evaluated, constrained, and scaled based on provable economic impact, audit survivability, and operational fit within regulated banking workflows.

What the Next Phase of AI in Banking Will Look Like

The next era of AI in banking is not defined by new models, but by accountability. Between 2026 and 2030, AI programs will be evaluated, constrained, and scaled based on provable economic impact, audit survivability, and operational fit inside regulated banking workflows.

AI Spend Is Justified Through Measurable Balance-Sheet Impact: Deployments are approved based on measurable effects on cost-to-serve, fraud loss, cycle time reduction, revenue recovery, or compliance outcomes.

Agentic Systems Replace Task-Level Automation: Banks shift from single-function automation to AI agents that execute end-to-end workflows such as onboarding, servicing, investigations, and dispute handling with explicit control boundaries.

Human Oversight Becomes a System Design Requirement: Review, override, and approval steps are embedded directly into AI workflows, with role-based controls mapped to regulatory and risk exposure.

Orchestration Becomes the Primary Technical Challenge: Differentiation moves to coordinating AI agents, APIs, legacy systems, and human operators within a unified execution layer that exposes performance and risk.

Governance Is Embedded at Runtime, Not After Deployment: Policy enforcement, explainability, and audit logging occur before and during AI actions, not after deployment.

The next era of AI in banking is defined by proof, not promise. Institutions that redesign workflows, governance, and operating models around accountable AI execution will scale. Those who treat AI as an add-on will struggle under cost, risk, and regulatory pressure.

Smallest.ai Powers Real-Time Voice Operations Inside Live Banking Systems

Smallest.ai is built for banks that run voice at scale, where latency, policy enforcement, and auditability cannot fail. It allows AI-driven voice interactions to execute actions during live calls while remaining tightly governed within regulated banking environments.

Live Call Action Execution: Executes account queries, transaction confirmations, service updates, and workflow triggers directly during ongoing customer calls without post-call processing delays.

Policy-Bound Conversation Logic: Locks conversations to predefined banking rules, escalation thresholds, and response boundaries, guaranteeing agents never deviate from approved operational or compliance paths.

Continuous Voice Authentication: Verifies callers using behavioral voice signals and interaction dynamics throughout the call, reducing reliance on static identity questions that slow resolution.

Runtime Compliance Enforcement: Injects mandatory disclosures, consent checks, and regulatory language dynamically during calls, generating consistent, reviewable interaction records.

High-Concurrency Voice Scaling: Runs thousands of simultaneous voice agents with predictable latency, controlled routing, and safe handoff to human teams when confidence drops.

Smallest.ai allows banks to move voice AI from experimentation into regulated production. It supports real-time execution while preserving the control, traceability, and reliability that banking operations demand.

Final Thoughts!

AI in banking has reached a point where outcomes matter more than ambition. The institutions that gain ground are not those deploying the most models, but those redesigning workflows so AI can operate reliably under real conditions: live customers, regulatory scrutiny, and financial risk. This shift demands tighter execution, clearer ownership, and systems that perform consistently across voice, data, and decision flows. The next phase will reward banks that treat AI as core infrastructure rather than an experiment layered onto legacy operations.

This is where platforms built for real-time execution, auditability, and scale separate from generic AI tooling. Smallest.ai provides voice AI and agent infrastructure designed for high-volume banking workflows, with latency control, compliance alignment, and operational reliability at the core.

If you are evaluating how AI should actually function inside customer interactions, fraud response, or service operations, talk to the Smallest.ai team to see how production-grade voice AI can fit into your banking stack.

Answer to all your questions

Have more questions? Contact our sales team to get the answer you’re looking for

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now