Learn how conversational AI use cases in banking work in production, with real deployments, system depth, and compliance realities at scale. Read more.

Akshat Mandloi

Updated on

January 19, 2026 at 8:37 AM

Customer conversations in banking rarely follow a neat script. A balance check turns into a fraud concern. A payment question becomes a compliance issue. Teams searching for conversational AI use cases in banking are often trying to solve this exact problem at scale while keeping risk, accuracy, and service quality intact. That pressure explains why banks are accelerating adoption, with the global conversational AI banking market projected to reach USD 16.14 billion by 2033.

Interest in conversational AI use cases in banking is driven less by novelty and more by necessity. Leaders want systems that can handle real transactions, validate identity, manage exceptions, and support customers across voice and chat without adding operational fragility. They are looking for clear examples, proven patterns, and practical guidance grounded in production reality.

In this guide, we break down how conversational AI works inside banking operations, the top use cases deployed globally, real examples from banks in production, where investment is flowing, best practices for deployment, and how enterprise-grade platforms support these requirements end-to-end.

Key Takeaways

Conversational AI As Execution Layer: In banking, conversational AI functions as a controlled system that executes actions across core platforms, not as a standalone chatbot.

System Access Defines Use Case Depth: The maturity of conversational AI banking use cases depends on direct access to systems of record, payment rails, and risk engines.

Deterministic Design Beats Generative Flexibility: Reliable deployments prioritize bounded flows, rule enforcement, and predictable failure handling over open-ended responses.

Compliance Is Embedded, Not Added Later: Identity checks, policy enforcement, audit logging, and jurisdictional rules are integral to every conversational flow.

Production Scale Exposes Weak Platforms: High concurrency, numeric accuracy, multilingual support, and controlled escalation separate production-ready tools from pilots.

How Conversational AI Works Across Core Banking Operations

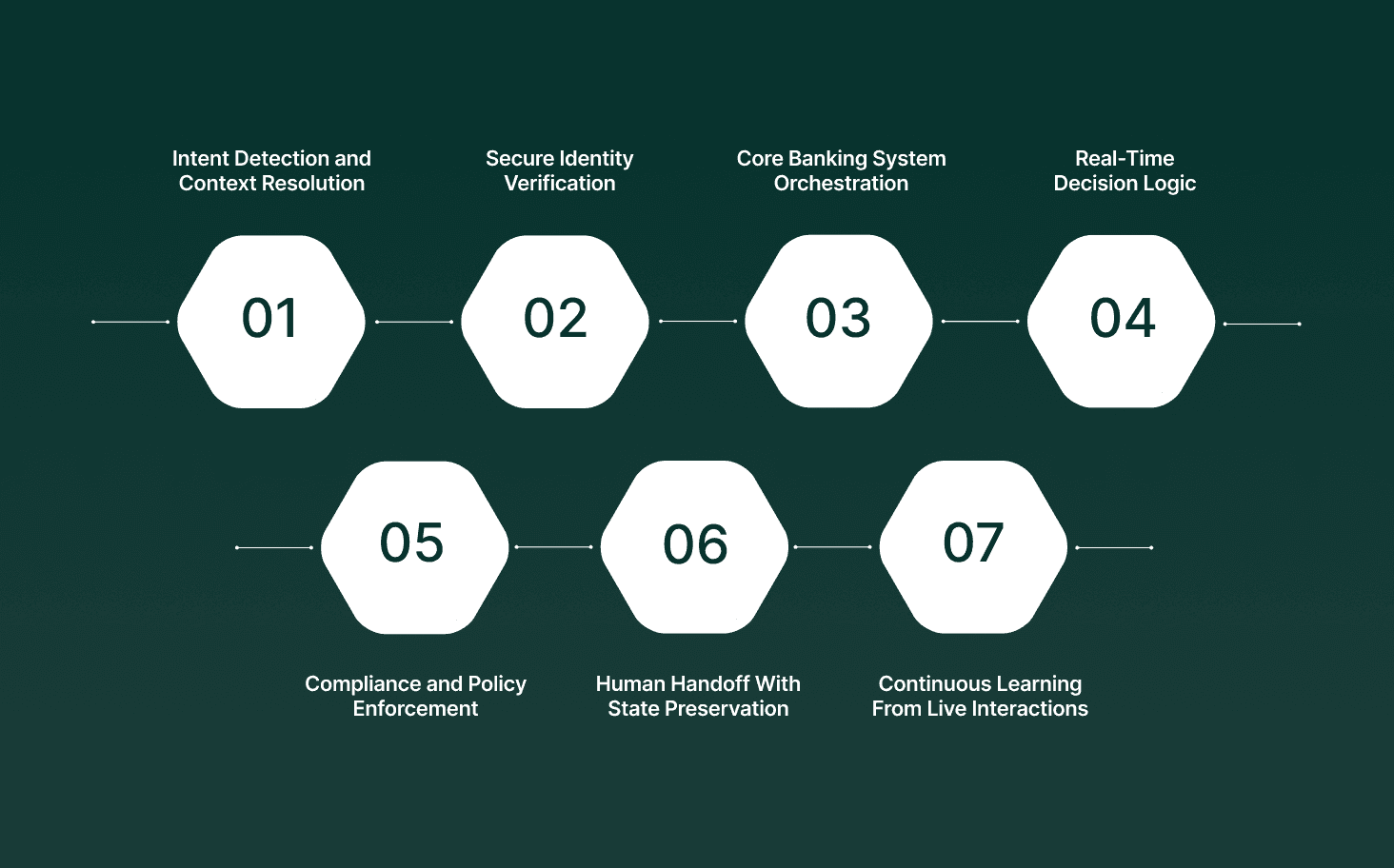

Conversational AI in banking operates as an orchestration layer between customer channels, banking systems, and compliance controls. It converts unstructured customer input into validated intents, executes actions across core platforms, and returns regulated responses in real time across chat and voice channels.

Intent Detection and Context Resolution: User input is parsed using domain-trained NLU models that map utterances to banking-specific intents such as balance inquiry, card dispute, or loan status. Session context persists across turns to track account type, authentication state, and prior actions.

Secure Identity Verification: Authentication is handled through step-up flows such as OTP, device fingerprinting, behavioral signals, or voice biometrics. Risk scoring determines when additional verification is required before allowing access to sensitive operations.

Core Banking System Orchestration: Validated intents trigger API calls to CBS, CRM, payment rails, card management systems, and loan servicing platforms. Transactional actions follow strict validation rules, timeouts, and rollback handling to prevent partial execution.

Real-Time Decision Logic: Rule engines and ML models evaluate eligibility, thresholds, and exception cases. Examples include transaction limit checks, overdraft risk assessment, or fraud scoring before completing an action.

Compliance and Policy Enforcement: All responses pass through policy layers that apply jurisdiction-specific rules such as KYC, AML, and disclosure requirements. Conversations are logged with immutable audit trails for regulatory review.

Human Handoff With State Preservation: When confidence drops or exceptions arise, the session is routed to an agent with full conversation history, customer context, and system actions already performed. This avoids repetition and reduces handling time.

Continuous Learning From Live Interactions: Conversation transcripts, fallback cases, and abandoned flows are reviewed to retrain intent models, refine rules, and close coverage gaps across banking scenarios.

Conversational AI in banking functions as a controlled execution layer, not a chatbot wrapper. Its value depends on deep system access, risk controls, and deterministic behavior under real operational load.

To see how banks extend automation across operations and controls, explore 10 Ways RPA in Banking Improves Efficiency and Control

Top 10 Conversational AI Use Cases in Banking

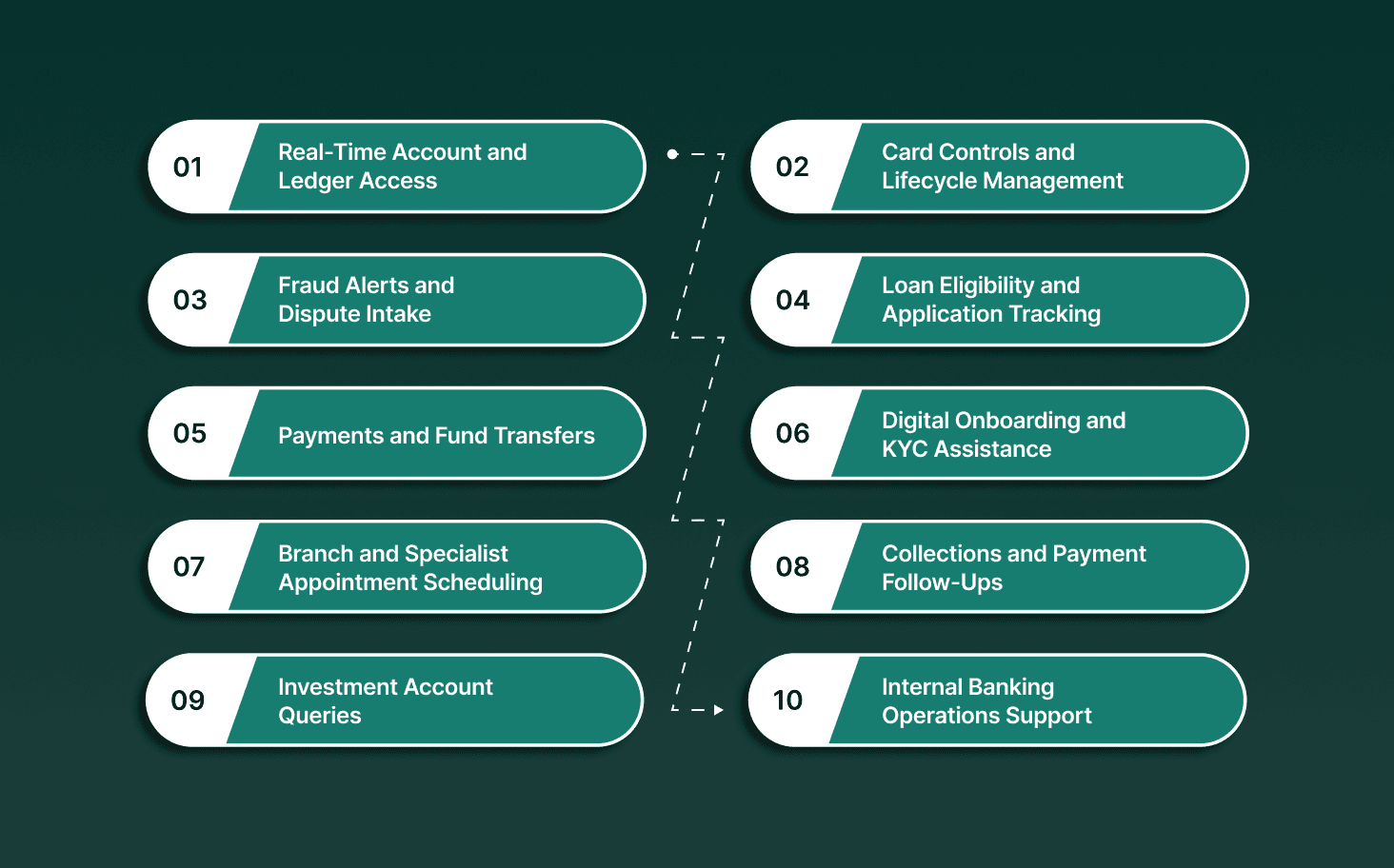

Conversational AI use cases in banking operate as controlled interaction layers between customer channels and regulated banking infrastructure. Each use case depends on deterministic system behavior, identity enforcement, and auditable execution across geographies.

1. Real-Time Account and Ledger Access

Conversational AI retrieves financial information by querying authoritative ledgers while respecting posting states and settlement timing.

Ledger State Resolution: Differentiates between available, current, and pending balances based on authorization, posting, and clearing cycles across systems.

Transaction Line Item Mapping: Resolves merchant descriptors, authorization references, and timestamps sourced from card processors and core banking platforms.

Cross-System Consistency Checks: Validates responses against multiple systems to prevent mismatches between statements, ledgers, and customer-facing views.

2. Card Controls and Lifecycle Management

Automates card actions through direct integration with issuing processors and network controls.

Network-Level Enforcement: Executes block and unblock actions at the authorization layer to prevent further transaction approvals immediately.

Spend and Usage Controls: Updates transaction limits, channel permissions, and geographic restrictions tied to the card profile.

Reissuance and Token Refresh: Coordinates card replacement, token updates, and delivery workflows across payment ecosystems.

3. Fraud Alerts and Dispute Intake

Manages fraud confirmation and dispute initiation with structured, compliant data capture.

Event Confirmation Handling: Links customer responses to specific fraud alerts generated by transaction monitoring systems.

Scheme-Aligned Dispute Capture: Collects reason codes and supporting details aligned with global card network requirements.

Case Status Communication: Surfaces dispute progress while shielding internal risk models and thresholds.

4. Loan Eligibility and Application Tracking

Conversational AI supports lending journeys by interrogating credit, underwriting, and loan servicing systems while enforcing product rules and risk controls.

Rule-Based Prequalification: Evaluates eligibility using configured income ranges, credit score bands, existing exposure, and product-specific constraints.

Pipeline State Visibility: Retrieves application status across document intake, credit checks, underwriting review, and approval workflows.

Exception Identification: Detects stalled or failed applications caused by missing documents, verification errors, or rule violations.

5. Payments and Fund Transfers

Conversational AI executes payments by interfacing with payment engines while applying rail-specific validation and transaction controls.

Rail-Aware Execution: Applies scheme-specific rules such as amount limits, format validation, and processing windows for each payment rail.

Payee Risk Controls: Enforces cooling periods, transaction limits, and behavioral checks when beneficiaries are added or modified.

Settlement Awareness: Communicates processing timelines, cut-off times, and settlement finality accurately. Differentiates reversible and irreversible payment states to set correct customer expectations.

6. Digital Onboarding and KYC Assistance

Conversational AI coordinates onboarding by managing document flows and screening checkpoints across identity systems.

Document Requirement Guidance: Directs customers on acceptable identity and address documents based on jurisdiction and account type. Validates completeness before submission to reduce screening failures.

Screening Progress Updates: Reports onboarding progress across identity verification, sanctions screening, and watchlist checks. Notifies customers when additional information or remediation is required.

Controlled Failure Messaging: Explains onboarding delays or rejections using policy-approved language. Avoids disclosure of internal thresholds, scoring logic, or screening sensitivities.

7. Branch and Specialist Appointment Scheduling

Conversational AI coordinates in-person banking interactions by aligning customer intent with branch capabilities, staff authorization levels, and operational constraints across regions.

Capability-Based Routing: Maps customer intent to services such as account opening, lending, wealth, or dispute resolution using predefined service taxonomies. Matches appointments only with staff holding the required certifications, approvals, and system access.

Live Calendar Synchronization: Integrates with branch scheduling and workforce systems to reflect real-time availability across locations and time zones.

Pre-Visit Context Capture: Collects visit purpose, supporting documents, and special requirements prior to the appointment.

8. Collections and Payment Follow-Ups

Conversational AI manages early-stage collections by executing structured outreach while enforcing policy, risk controls, and regional compliance rules.

Delinquency Stage Awareness: Classifies accounts by days past due, product type, and historical repayment behavior. Adjusts scripts, tone, and next actions based on predefined delinquency tiers.

Commitment Recording: Captures promises to pay, including amount, date, and preferred payment method. Logs commitments into collections systems and schedules automated follow-ups or escalations.

Regulatory Timing Controls: Enforces permissible contact windows, frequency limits, and disclosure requirements per market. Suppresses outreach automatically during restricted periods to avoid compliance breaches.

9. Investment Account Queries

Conversational AI provides controlled access to investment account data by querying portfolio, custody, and market data systems while preventing advisory behavior and regulatory exposure.

Portfolio Data Retrieval: Pulls position-level data, including quantity, cost basis, unrealized gains, and currency exposure from portfolio and custody platforms.

Corporate Action Visibility: Surfaces confirmed and pending corporate actions, including dividends, splits, redemptions, and rights issues tied to account holdings.

Advice Boundary Enforcement: Detects advisory-seeking language such as buy, sell, or rebalance intent within the conversation flow. Redirects the interaction to licensed advisors or approved channels while preserving session context.

10. Internal Banking Operations Support

Conversational AI supports internal teams by acting as a controlled access layer for systems, procedures, and operational signals.

Role-Scoped Knowledge Access: Serves responses based on role-based entitlements, limiting visibility to approved systems and functions. Prevents exposure of restricted processes, credentials, or privileged operational data.

System Health Awareness: Aggregates status signals from core banking, payment rails, and third-party services. Communicates incidents, degradation, and maintenance windows without exposing root-cause diagnostics.

SOP and Policy Retrieval: Answers procedural questions using version-controlled operating manuals and policy repositories. Guarantees guidance reflects the latest approved workflows and regulatory updates.

Conversational AI banking use cases deliver value when designed as controlled execution systems with predictable behavior, strict data access, and global regulatory guardrails. Depth at the system layer defines reliability at scale.

For banks ready to run conversational AI at production scale, Smallest.ai delivers enterprise voice agents built for real-time calls, numeric accuracy, high concurrency, multilingual support, and on-premise control across regulated banking workflows.

Real-World Conversational AI Banking Examples

These examples show how leading global banks deploy conversational AI as a production system integrated with core banking, payments, fraud, and internal operations, not as surface-level chat interfaces.

Bank of America – Erica (Retail, Wealth, Internal Operations)

Erica operates as a cross-channel conversational layer embedded across consumer banking, wealth platforms, and employee tools.

It has surpassed 3 billion client interactions, supports payments, fraud alerts, appointment scheduling, and investment queries, and is used by over 90% of employees for internal operations, significantly reducing service desk load.

NatWest Group – Cora (Retail Banking and Fraud Support)

NatWest deploys conversational AI through Cora, its digital assistant handling everyday banking, fraud queries, and account servicing at scale. In 2023, Cora handled 10.8 million customer queries, operating 24/7 across mobile and web channels, with deep integration into core banking systems. The launch of Cora+ adds generative AI to handle more complex, contextual queries while preserving compliance and controlled handoffs to human agents.

DNB Bank – Aino (End-to-End Digital Customer Service)

DNB uses conversational AI through its virtual agent Aino as the first line of customer support across digital channels. Within six months, Aino automated over 50% of incoming chat traffic and now handles more than 20% of total customer service requests, interacting with over one million customers. The deployment reduced agent workload, improved resolution rates, and shifted human teams toward higher-value banking tasks.

Best Practices for Deploying Conversational AI in Banking

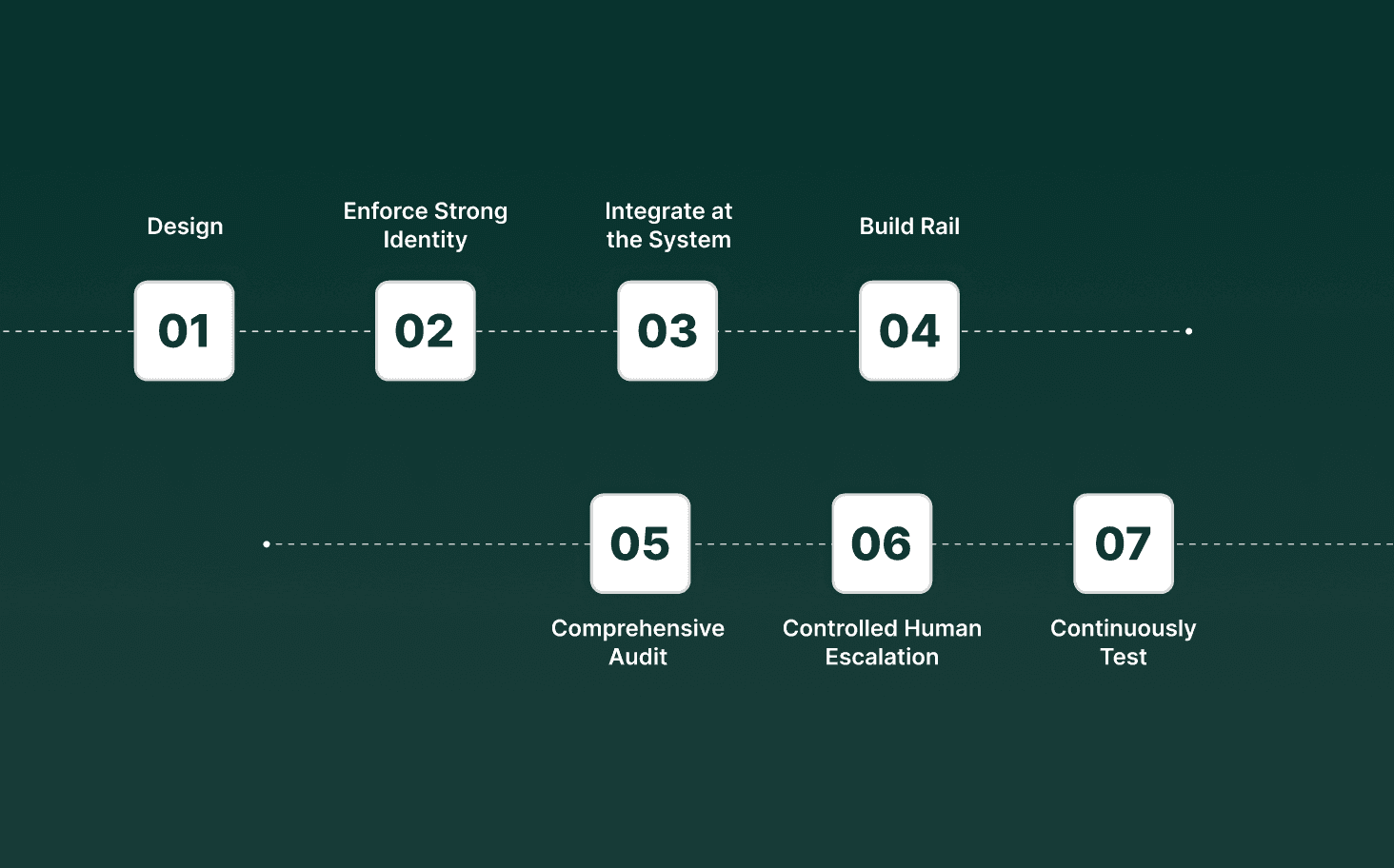

Successful conversational AI in banking deployments treats the system as regulated infrastructure. Best practices focus on deterministic behavior, controlled data access, and predictable outcomes under production load across regions.

Design for Deterministic Execution: Define explicit intent-to-action mappings with bounded flows and failure states. Avoid open-ended generation for transactional paths to preserve accuracy and auditability.

Enforce Strong Identity and Authorization: Gate sensitive actions behind multi-factor authentication and behavioral risk checks. Apply role-based and context-aware access controls consistently across channels.

Integrate at the System of Record: Connect conversational AI directly to authoritative systems such as core banking, payment engines, and loan platforms. Avoid relying on replicated or cached data for customer-facing responses.

Build Rail- and Product-Aware Logic: Encode payment rails, product rules, and regional constraints into execution logic. Prevent invalid actions by enforcing scheme-specific limits and cut-off times.

Implement Comprehensive Audit Logging: Log every intent, decision, system call, and response with immutable records. Support regulatory review, dispute handling, and internal governance requirements.

Plan for Controlled Human Escalation: Design handoff paths that preserve full session context and system actions. Guarantee human agents receive an actionable state rather than raw conversation history.

Continuously Test Against Edge Cases: Validate behavior across fraud scenarios, partial failures, and high-volume spikes. Retrain and refine models using real production fallouts and exception patterns.

Conversational AI in banking succeeds when built as a controlled execution infrastructure. Discipline at the design and governance layers determines reliability at scale.

For teams evaluating what comes next after conversational automation, see how data-driven forecasting supports smarter banking operations in 9 Types of Predictive Analytics in Banking Used by Top Teams

Smallest.ai for Enterprise Conversational AI in Banking

Smallest.ai provides enterprise-grade conversational AI infrastructure designed for high-volume, regulated banking environments. Its voice agents and models operate as real-time execution layers, built to handle complex workflows, numeric accuracy, and compliance-driven controls at scale.

Enterprise-Ready Voice Agents: Voice agents are custom-trained on bank-specific data and SOPs to handle edge cases reliably. They are designed for predictable behavior across servicing, collections, fraud, and outbound banking workflows.

On-Premise and Private Deployment: Models can be deployed directly on bank-owned infrastructure or custom hardware. This allows banks to retain full control over inference, latency, and data residency requirements.

High-Concurrency Call Handling: The platform supports thousands of parallel calls without degradation. Concurrency control allows consistent performance during peak inbound and outbound banking volumes.

Numeric and Financial Accuracy: Voice models handle card numbers, account identifiers, OTPs, and monetary values with controlled pacing. This reduces transcription errors in regulated financial interactions.

Multi-Language Voice Coverage: Supports over 16 global languages to serve multilingual customer bases. Language handling is designed for real banking conversations rather than generic voice playback.

Workflow Evaluation and Analytics: Every interaction is logged for performance evaluation and insight extraction. Call data can be exported into banking analytics and visualization tools for audit and optimization.

Developer SDKs and API Control: Python, Node.js, and REST APIs allow direct integration with core banking, CRM, and telephony systems. This allows banks to embed conversational AI into existing architectures without workflow duplication.

Smallest.ai is built for banks that treat conversational AI as operational infrastructure. Its focus on control, scale, and execution reliability aligns with real banking deployment requirements.

Final Thoughts!

Conversational AI in banking has settled into a clear role. It operates as a controlled execution layer that sits close to core systems, payments, and risk engines, handling real customer intent at production scale. Banks that succeed focus less on conversation quality in isolation and more on predictability, numeric accuracy, compliance enforcement, and system depth across regions and channels.

As adoption grows, the gap widens between surface-level assistants and platforms built for live banking operations. Teams evaluating next steps are prioritizing solutions that can manage thousands of concurrent interactions, support multilingual voice and chat, and operate within strict data and deployment constraints.

For banks looking to deploy conversational AI as real infrastructure rather than an experiment, platforms like Smallest.ai are built to support high-volume, regulated environments with on-premise control, precise voice handling, and enterprise-grade workflows.

Explore how Smallest.ai can support production-ready conversational AI deployments in banking. Book a demo!

FAQs

1. How do conversational AI use cases in banking handle partial system failures during live interactions?

Conversational AI use cases in banking rely on fallback logic and state preservation when downstream systems time out or return errors. This allows the interaction to pause, retry, or escalate without losing customer context.

2. Are conversational AI banking use cases suitable for regulated voice interactions, not only chat?

Yes, conversational AI banking use cases increasingly operate over voice, handling authentication, numeric inputs, and disclosures. Voice deployments require stricter pacing, transcription accuracy, and audit logging than chat-based flows.

3. What limits automation depth in conversational AI use cases in banking?

Automation depth is limited by system access, risk thresholds, and regulatory rules rather than model capability. Many conversational AI use cases in banking stop short of execution due to incomplete backend integration.

4. How do banks evaluate the best conversational AI tools for banking beyond demo performance?

The best conversational AI tools for banking are assessed on concurrency handling, numeric accuracy, deployment control, and failure behavior under load. Demo conversation quality alone is not a reliable indicator of production readiness.

5. Can conversational AI banking use cases support global operations with regional policy differences?

Yes, conversational AI banking use cases can apply region-specific rules for payments, onboarding, and collections. This requires policy layers that adapt responses and actions based on jurisdiction and product type.