Explore voice AI investment opportunities shaping 2026, covering enterprise adoption, regulation, and where investors see durable returns across industries.

Hamees Sayed

Updated on

February 4, 2026 at 10:34 AM

The voice AI sector has reached an unprecedented inflection point. With the global voice AI agent market valued at $2.4 billion in 2024 and projected to expand to $47.5 billion by 2034, representing a compound annual growth rate of 34.8%, 2026 emerges as the critical year when voice technology transitions from experimental innovation to essential business infrastructure.

This explosive trajectory, driven by technological breakthroughs, enterprise adoption, and billion-dollar venture capital inflows, creates compelling investment opportunities across multiple segments of the voice AI ecosystem.

In this guide, we will examine where enterprises are deploying voice systems today, which technical and regulatory factors shape returns, and how investors can evaluate voice AI investment opportunities heading into 2026.

Key Takeaways

Production Over Pilots: Enterprise adoption favors voice systems proven under live call pressure, concurrency, and regulatory scrutiny rather than experimental or demo-driven deployments.

Latency As Infrastructure Risk: Sub-second response time determines conversational stability, escalation accuracy, and trust, making latency control central to long-term platform viability.

Vertical Focus Wins: Healthcare, BFSI, logistics, and customer service deployments scale faster due to structured workflows, compliance requirements, and repeatable operational ROI.

Compliance Drives Valuation: Built-in governance, auditability, and regional data controls increasingly determine enterprise sales velocity and defensibility in regulated markets.

Integration Determines Scale: Platforms with strong telephony, CRM, and data system integrations convert faster from initial rollout to sustained production usage.

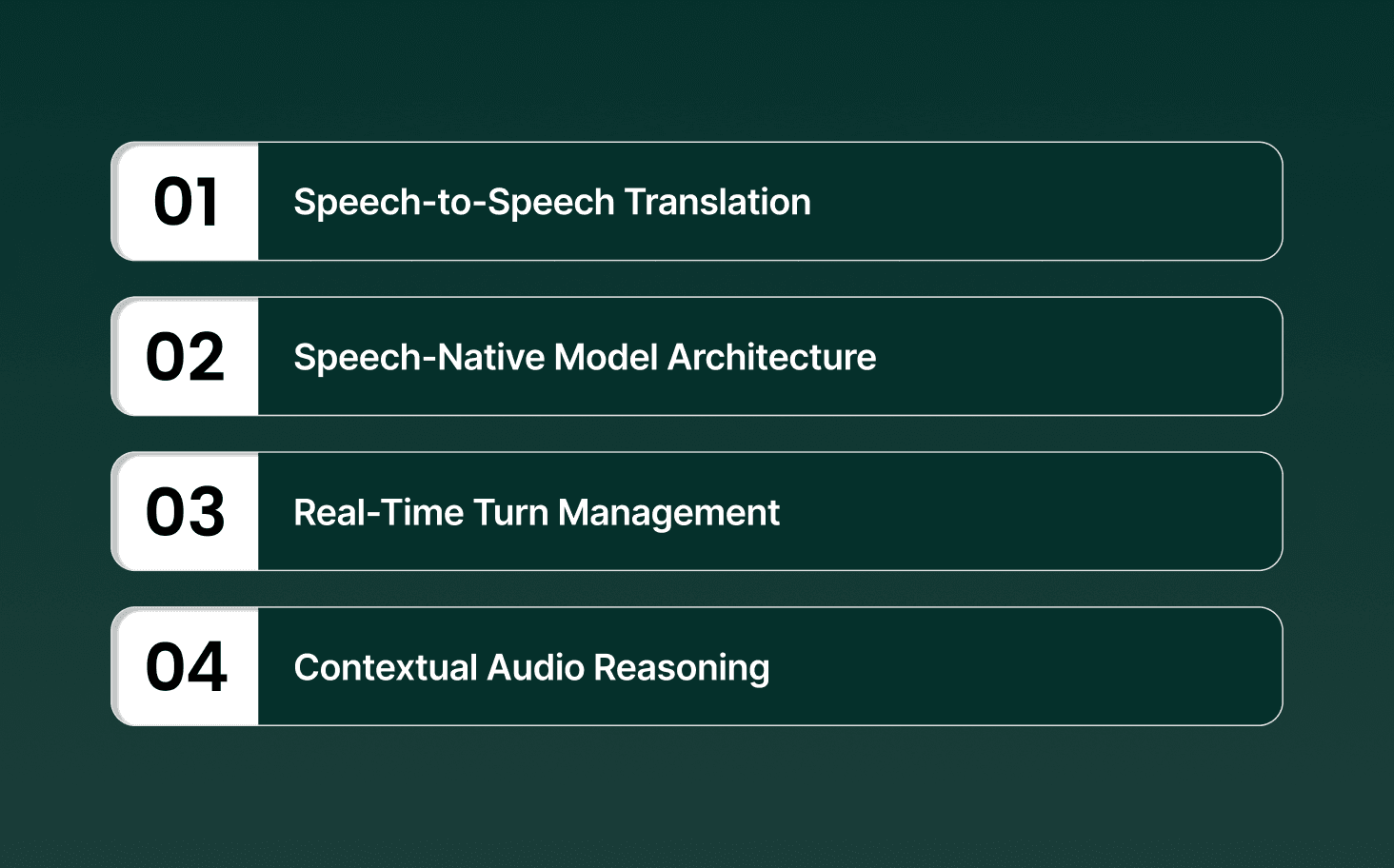

Technology Breakthroughs Allowing Investment Returns

Investment returns in voice AI are being unlocked by concrete technical advances that remove latency, accuracy, and cost barriers that previously limited production-scale deployment.

Speech-to-Speech Translation: End-to-end S2ST systems (Speech-to-Speech Translation systems) reached production viability with real-time translation delivered in the speaker’s original voice at roughly two seconds of delay, halving historical latency and restoring conversational flow.

Speech-Native Model Architecture: Direct audio-to-audio models bypass text intermediaries, achieving sub-300 millisecond latency while preserving context, speaker intent, and conversational timing at scale.

Real-Time Turn Management: Native voice activity detection and interruption handling reduce overlap and silence gaps, allowing natural dialogue under live call pressure.

Contextual Audio Reasoning: Speech-native systems retain prosody, emphasis, and pacing, improving intent recognition and reducing misinterpretation in complex interactions.

Low-latency, speech-native architectures convert voice AI from a reactive interface into a real-time conversational system suitable for revenue-critical workflows.

Voice Technology Investment Opportunities Shaping 2026

Voice AI investment in 2026 is being shaped by enterprise-grade deployments, falling infrastructure costs, and clear monetization paths across regulated and high-volume industries. Capital is concentrating on systems that deliver automation, security, and workflow execution rather than experimental interfaces.

Conversational AI Market Scale: The conversational AI market was valued at $11.58 billion in 2024 and is projected to exceed $41.39 billion by 2030, reflecting sustained enterprise demand for voice-driven automation.

Venture Capital Acceleration: Voice AI companies attracted $2.1 billion in venture funding in 2024 and $500M in Q1'25, signaling institutional confidence in commercial readiness rather than speculative growth.

Voice Biometrics and Security: The voice biometrics market stood at $2.63 billion in 2025 and is forecast to grow at over 16.73% CAGR, driven by fraud prevention and authentication needs in financial services.

Healthcare Voice Agents Market: The AI voice agents in the healthcare market were valued at USD 468 million in 2024 and are projected to reach USD 3.17 billion by 2030, driven by clinical documentation, patient engagement, and automated triage.

Speech and Voice Recognition Adoption: The global speech and voice recognition market reached USD 15.46 billion in 2024, reflecting broad enterprise deployment across customer support, internal workflows, and digital service interfaces.

Voice User Interface Deployment: The voice user interface market was estimated at USD 15.48 billion in 2025, indicating strong uptake in automotive systems, healthcare documentation, and enterprise service platforms.

Call Center Voice Automation: The global call center AI market, which includes voice agent automation, was valued at USD 1.95 billion in 2024 and is expected to scale quickly as enterprises modernize customer service operations.

Voice Analytics Integration: The voice analytics market reached USD 1.59 billion in 2024, supporting large-scale deployment of voice systems through real-time insight extraction and performance monitoring.

Investment momentum in voice AI is converging on agentic systems, security, healthcare, and infrastructure layers, reinforcing the sector’s position as core enterprise technology rather than peripheral innovation.

Explore how real-time voice systems are shaping enterprise operations and investor priorities in The Future of AI Voice-Driven Interactions and Their Impact.

Regulatory Environment and Compliance as Investment Drivers

Regulation is reshaping voice AI from a product differentiator into an enterprise gating factor. In 2026, compliance readiness directly influences sales velocity, deployment scope, and long-term defensibility for voice AI investment opportunities.

EU AI Act Enforcement:

The EU AI Act classifies many voice AI systems as high-risk, triggering mandatory requirements for technical documentation, risk management frameworks, transparency reporting, continuous monitoring, and human oversight. Penalties scale to €35 million or 7% of global revenue, making compliance architecture a prerequisite for enterprise procurement.

Global Voice Privacy Regulation:

Jurisdiction-specific privacy laws are emerging that treat voice data as biometric and sensitive. India’s DPDP Act mandates consent-first collection and explicit storage controls, while UAE and Saudi regulations require encryption, audit trails, and restricted access for voice signatures. Vendors supporting multi-region policy enforcement gain a clear advantage.

Deepfake Detection and Voice Authenticity:

As voice cloning quality increases, regulators are pushing for verifiable content authenticity. Techniques such as audio watermarking, provenance tracking, and tamper detection are becoming baseline expectations in enterprise voice systems to prevent impersonation and misuse.

Compliance maturity is becoming a market filter rather than a legal checkbox. Investors should prioritize voice AI platforms with built-in governance, auditability, and authenticity controls that scale across jurisdictions.

Critical Implementation Challenges and Risk Mitigation

Voice AI performance breaks under real operating conditions if technical, security, and regulatory risks are not addressed at design time. These failure points directly affect deployment scale, enterprise trust, and long-term return on investment in voice AI.

Risk Area | Failure Mode Under Real Conditions | Required Mitigation at Design Time |

Accent and Dialect Variability | Recognition accuracy degrades across regional accents and demographic groups. | Acoustically diverse training datasets and speech-native models that preserve phonetic nuance. |

Complex Query Resolution | Systems fail on multi-step or ambiguous intents beyond scripted flows. | Intent confidence scoring, bounded automation, and real-time escalation logic. |

Environmental Noise Strength | Background noise, compression artifacts, and cross-talk distort audio input. | Advanced noise suppression, adaptive gain control, and edge-trained acoustic models. |

Latency Sensitivity Under Load | Concurrency spikes and network variability introduce conversational lag. | Low-latency inference pipelines, local execution paths, and load-aware routing. |

Voice Data Exposure | Wake-word failures capture unintended or private speech. | Precise activation boundaries, session-scoped recording, and explicit user signaling. |

Unauthorized Data Access | Centralized audio and transcript storage increases internal access risk. | Role-based permissions, encrypted storage, and immutable audit logs. |

Voice Biometric Exploitation | Stolen voice samples allow replay or impersonation attacks. | Encrypted biometric storage, liveness detection, and secondary authentication factors. |

Cross-Border Data Handling | Jurisdictional conflicts create compliance and data-residency risks. | Region-specific storage, consent enforcement, and runtime data routing controls. |

Multi-Regime Regulatory Compliance | Fragmented laws increase audit overhead and deployment friction. | Built-in compliance orchestration supporting EU AI Act, GDPR, CCPA, DPDP, and Middle East regulations. |

Voice AI succeeds at scale only when technical resilience, data security, and regulatory controls are engineered together. Investors should favor platforms that treat risk mitigation as core infrastructure rather than a post-deployment patch.

Look deeper into how enterprise voice systems are built, deployed, and scaled in production environments with Everything You Need to Know About AI Voice Assistants

Where Smallest.ai Fits in Production Voice AI

As enterprises move from pilots to live deployments, voice platforms are evaluated on latency, call concurrency, language coverage, security posture, and deployment control. Smallest.ai aligns with these operational requirements rather than surface-level voice features.

Real-Time Voice Agents at Scale: Smallest.ai operates live voice agents capable of handling concurrent inbound and outbound calls, supporting high-volume contact center workloads without degrading response times or conversational flow.

Low-Latency Speech Models: Its in-house Lightning models are built for real-time speech generation and transcription, supporting natural pacing, accurate handling of numbers and acronyms, and stable performance under load.

Multilingual and Regional Coverage: With lifelike voices across 16 global languages, Smallest.ai supports cross-region deployments without duplicating agent teams or reworking workflows for each market.

On-Premise and Private Deployment Options: Enterprises can run models on their own infrastructure, retaining control over inference, data locality, and compliance requirements in regulated environments.

Enterprise Security and Compliance Readiness: The platform aligns with SOC 2 Type II, HIPAA, PCI, and ISO standards, supporting governance and audit requirements for sensitive voice data.

For teams evaluating production-grade voice AI, Smallest.ai reflects the market's current deployment of voice systems. To see how it performs under real call conditions, book a demo with the Smallest.ai team.

Conclusion

Voice AI investment decisions in 2026 hinge on execution quality rather than novelty. The strongest outcomes emerge when real-time speech systems withstand live-call pressure, operate within regulatory limits, and integrate cleanly into existing enterprise workflows. Capital follows platforms that translate technical maturity into predictable operational outcomes, not those that rely on future promises or surface-level demos.

As adoption deepens across regulated and high-volume environments, the gap widens between experimental voice tools and production-grade systems built for scale, privacy, and control. This shift favors vendors that treat voice as infrastructure rather than an interface.

For enterprises and investors evaluating where this market is heading, Smallest.ai reflects this operational-first direction. Its real-time voice agents, low-latency models, multilingual coverage, and on-premise deployment options align with how large organizations are actually deploying voice systems today.

See how production-ready voice AI performs under real conditions. Talk to the Smallest.ai team and book a demo.

Answer to all your questions

Have more questions? Contact our sales team to get the answer you’re looking for

Automate your Contact Centers with Us

Experience fast latency, strong security, and unlimited speech generation.

Automate Now