Learn how generative AI in debt collection allows real-time conversations, adaptive negotiation, and built-in compliance for scalable, live recovery operations

Wasim Madha

Updated on

January 28, 2026 at 2:39 PM

Most collection leaders recognize the moment when scripts stop working. A borrower hesitates, raises a dispute, or signals hardship, and the conversation stalls because the system was built for fixed paths, not real dialogue.

That tension is why generative AI in debt collection has moved from experimentation to active deployment. The AI for debt collection market size is forecast to increase by USD 2.77 billion, at a CAGR of 15.0% between 2024 and 2029, driven by the need for real-time judgment, compliance control, and scalable execution during live interactions.

Interest in generative AI in debt collection reflects a practical need to move beyond batch analytics and post-call automation. Teams want clarity on what performs under regulatory pressure, how AI behaves during live conversations, and how operating models change once AI participates directly in outreach, negotiation, and resolution.

In this guide, we break down real-world use cases, system architecture, operational impact, and what it takes to run generative AI safely and effectively in modern debt collection environments.

Key Takeaways

Generative AI in debt collection works inside live interactions: Value is created during real-time conversations, not through post-call analysis or static automation.

Legacy systems fail under scale and regulation: Scripted, linear workflows cannot adapt to disputes, hardship signals, or compliance pressure in live calls.

Production systems require real-time, policy-bound architecture: Low-latency generation, persistent conversation state, and in-call regulatory enforcement are mandatory.

Team roles and metrics fundamentally change: Agents focus on supervision and exceptions, while success is measured by resolution quality and compliance, not call volume.

Infrastructure determines success: Real-time voice platforms with deterministic control are critical for running generative AI safely at enterprise scale.

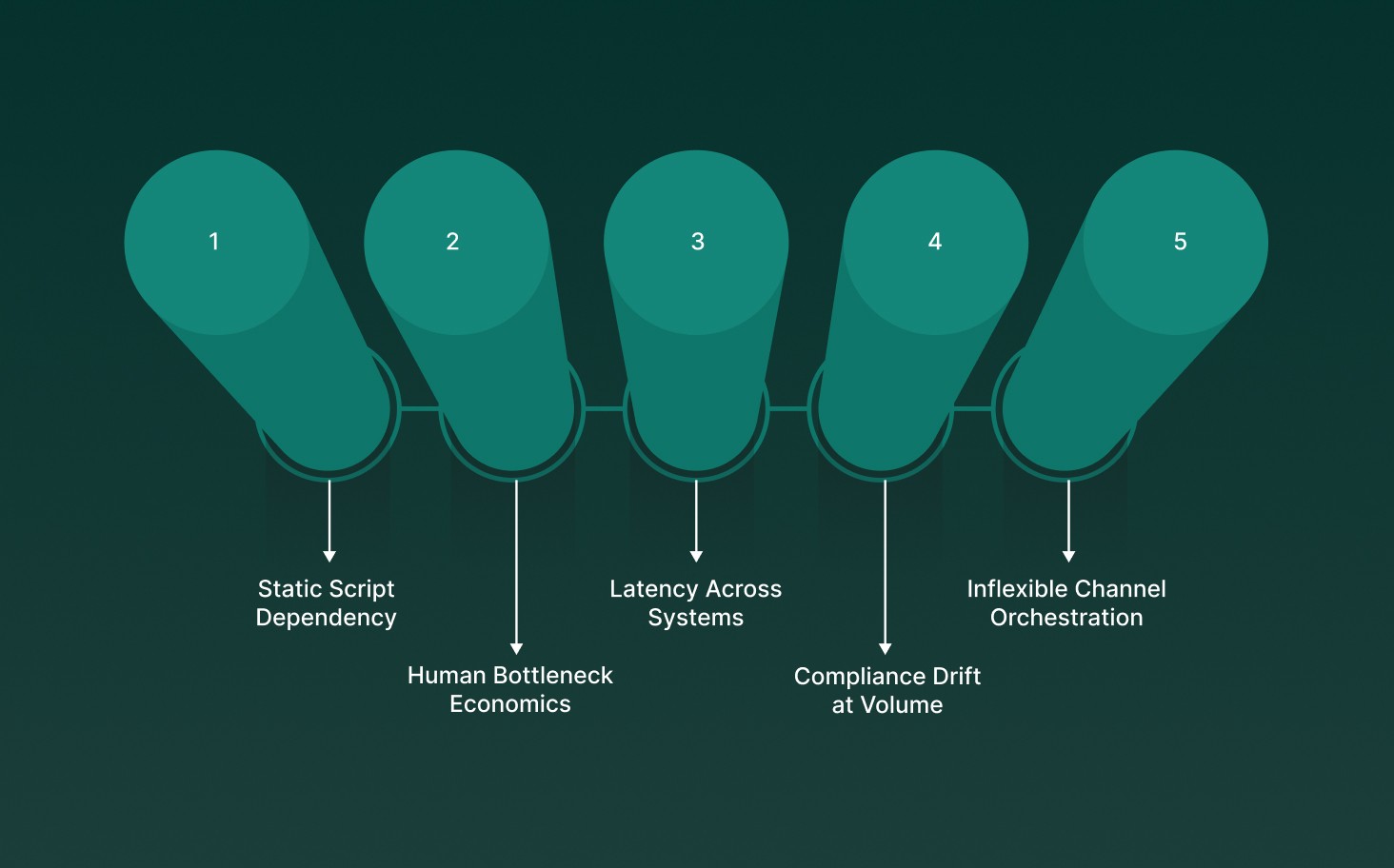

Why Traditional Debt Collection Systems Break at Scale

Legacy debt collection platforms were built for linear workflows, fixed scripts, and human-heavy execution. At enterprise volumes, these systems fail under real-time complexity, regulatory pressure, and modern borrower expectations.

Static Script Dependency: Rule-based scripts cannot adapt mid-call to borrower intent, dispute signals, or affordability changes, leading to stalled conversations and abandoned resolutions.

Human Bottleneck Economics: Call-center scaling depends on agent headcount, creating hard ceilings on throughput, coverage hours, and cost control during delinquency spikes.

Latency Across Systems: CRM, dialer, payment, and compliance tools operate in silos, causing delays between intent detection and action execution during live interactions.

Compliance Drift at Volume: Manual phrasing, inconsistent disclosures, and post-call logging increase FDCPA and audit exposure as call volumes grow.

Inflexible Channel Orchestration: Traditional systems treat voice, SMS, and digital touchpoints separately, preventing coordinated follow-ups based on real borrower behavior.

At scale, traditional collection systems collapse under latency, rigidity, and human dependency. Modern collections require real-time, context-aware execution rather than scripted workflows.

Core Use Cases of Generative AI in Debt Collection

Generative AI in debt collection allows real-time risk intelligence, adaptive negotiation, and regulatory enforcement across the full collections lifecycle. These use cases focus on execution inside live workflows, not offline analytics or static automation.

Use Case 1: Propensity-to-Pay Scoring and Debtor Prioritization

Machine learning–driven propensity models predict repayment likelihood at the account level and continuously reprioritize outreach as new behavioral signals emerge.

Multi-Model Risk Scoring: Ensemble models combine behavioral, transactional, and credit variables to generate dynamic repayment probability scores per account.

Temporal Roll-Rate Forecasting: Sequence models predict delinquency progression paths rather than static risk snapshots.

Resource Allocation Logic: High-probability accounts route to human agents while low-probability segments enter automated or hardship workflows.

Strong impact: Higher recovery efficiency through focused agent effort, earlier intervention on deteriorating accounts, and reduced outreach to low-conversion segments.

Use Case 2: Generative AI Script Generation With Contextual Relevance

LLM-based systems generate real-time conversation guidance grounded in historical outcomes, debtor context, and regulatory constraints.

Two-Stage Retrieval and Ranking: Semantic recall narrows candidate responses, followed by LLM ranking on empathy, problem fit, and context alignment.

Chain-of-Thought Negotiation Logic: Structured reasoning ensures responses respect payment constraints and disclosure requirements.

Latency-Optimized Inference: Distilled models deliver guidance within milliseconds during live calls.

Strong impact: Higher agent effectiveness with measurable settlement gains and reduced cognitive load.

Use Case 3: Sentiment Analysis With Real-Time Behavioral Intelligence

NLP and voice analytics detect emotional state and intent mid-interaction, driving immediate strategy adjustments.

Multi-Modal Sentiment Detection: Combines speech features and linguistic markers to quantify stress and willingness signals.

Intent Disambiguation: Separates disputes, hardship claims, and resistance to route-correct workflows.

Sentiment Trajectory Tracking: Monitors emotional change across conversation turns to trigger escalation or handoff.

Strong impact: Improved resolution quality through earlier de-escalation, more accurate routing of hardship and dispute cases, and reduced complaint risk during live interactions.

Use Case 4: Multi-Modal AI Across Voice, Text, and Documents

Unified conversation intelligence maintains debtor context across channels without resets or duplication.

Centralized Conversation State: Shared context persists as interactions shift between voice, SMS, email, and chat.

Cross-Channel Sentiment Propagation: Emotional signals detected in one channel calibrate tone in the next.

Document NLP Integration: OCR and semantic parsing generate actionable summaries instead of static attachments.

Strong impact: Higher contact efficiency through context continuity, fewer redundant outreach attempts, and reduced debtor frustration caused by repeated explanations.

Use Case 5: Synthetic Data Generation for Secure Model Training

Privacy-preserving synthetic datasets expand training coverage without exposing real customer records.

CTGAN and VAE Modeling: Learns joint distributions of debtor attributes while removing individual identifiability.

Rare-Event Oversampling: Balances defaulter and fraud cases to correct real-world class imbalance.

Differential Privacy Controls: Mathematical bounds prevent reverse inference of real customer data.

Strong impact: Faster model development with improved sensitivity and regulatory safety.

Use Case 6: Real-Time AI Compliance Monitoring and Enforcement

Compliance logic operates inside live interactions to prevent violations before they occur.

Live Language and Disclosure Checks: NLP flags missing disclosures or restricted phrasing mid-call.

Cross-Channel Contact Budgeting: Central engines enforce frequency and time-of-day limits across all channels.

Automated Consent Documentation: Verbatim, timestamped records support audit defense.

Strong impact: Reduced regulatory exposure through in-interaction enforcement, consistent policy application across channels, and audit-ready documentation without manual review.

Use Case 7: Dynamic Debtor Profiling and Behavioral Segmentation

AI builds evolving behavioral profiles that guide tone, timing, and settlement structure.

High-Dimensional Clustering: Unsupervised models segment debtors beyond credit score into actionable personas.

Psychographic Signal Extraction: NLP infers negotiation style, resistance patterns, and empathy needs.

Litigation and Dispute Propensity Scoring: Early warning for high-risk handling paths.

Strong impact: More effective strategy alignment through behavior-aware segmentation, reduced agent effort on mismatched approaches, and improved consistency in handling high-risk and sensitive accounts.

Use Case 8: AI-Assisted Payment Arrangement Negotiation

Generative agents optimize settlement terms in real time against affordability and profitability constraints.

Scenario Simulation at Scale: Thousands of term combinations evaluated per proposal.

Multi-Dimensional Term Optimization: Simultaneous tuning of amount, duration, and payment method.

Automated Agreement Generation: Audit-ready documentation produced instantly after acceptance.

Strong impact: More consistent negotiation outcomes through capacity-aligned term proposals, faster agreement finalization, and reduced risk of downstream settlement failure.

Execute live debt collection conversations with sub-second voice latency, policy-controlled language, and enterprise-grade concurrency using Smallest.ai, built for regulated, real-time financial interactions.

Architecture of Generative AI in Debt Collection Systems

Generative AI in debt collection requires a low-latency, policy-aware architecture that can reason, generate language, and execute actions during live interactions. Unlike analytics stacks, this architecture operates inside real-time voice and digital workflows while enforcing compliance and auditability.

Architecture Layer | Core Components | Technical Function in Debt Collection |

Data Ingestion Layer | CRM records, payment history, call logs, digital interaction data, and credit bureau feeds | Aggregates structured and unstructured debtor data with strict schema validation and versioning for traceability. |

Feature & Signal Layer | Behavioral features, transaction velocity metrics, sentiment scores, risk indicators | Converts raw inputs into real-time signals used for scoring, routing, and dialogue decisions. |

Language Model Layer | Domain-tuned LLMs and compact language models | Generates compliant, context-aware responses and negotiation logic under latency constraints. |

Orchestration & Control Layer | Prompt routers, policy engines, state managers | Coordinates model calls, enforces business rules, maintains conversation state across channels. |

Real-Time Execution Layer | Voice STT/TTS, telephony APIs, messaging gateways | Executes conversations and actions with sub-second response requirements. |

Compliance & Governance Layer | Disclosure checkers, contact-limit enforcers, consent trackers | Prevents regulatory violations during interactions and records audit-ready evidence. |

Learning & Feedback Layer | Outcome tracking, human overrides, retraining pipelines | Continuously refines models using resolved outcomes and supervised corrections. |

Evaluate which platforms are built for live, compliant debt recovery workflows in Top 10 AI Collection Tools for Debt Recovery.

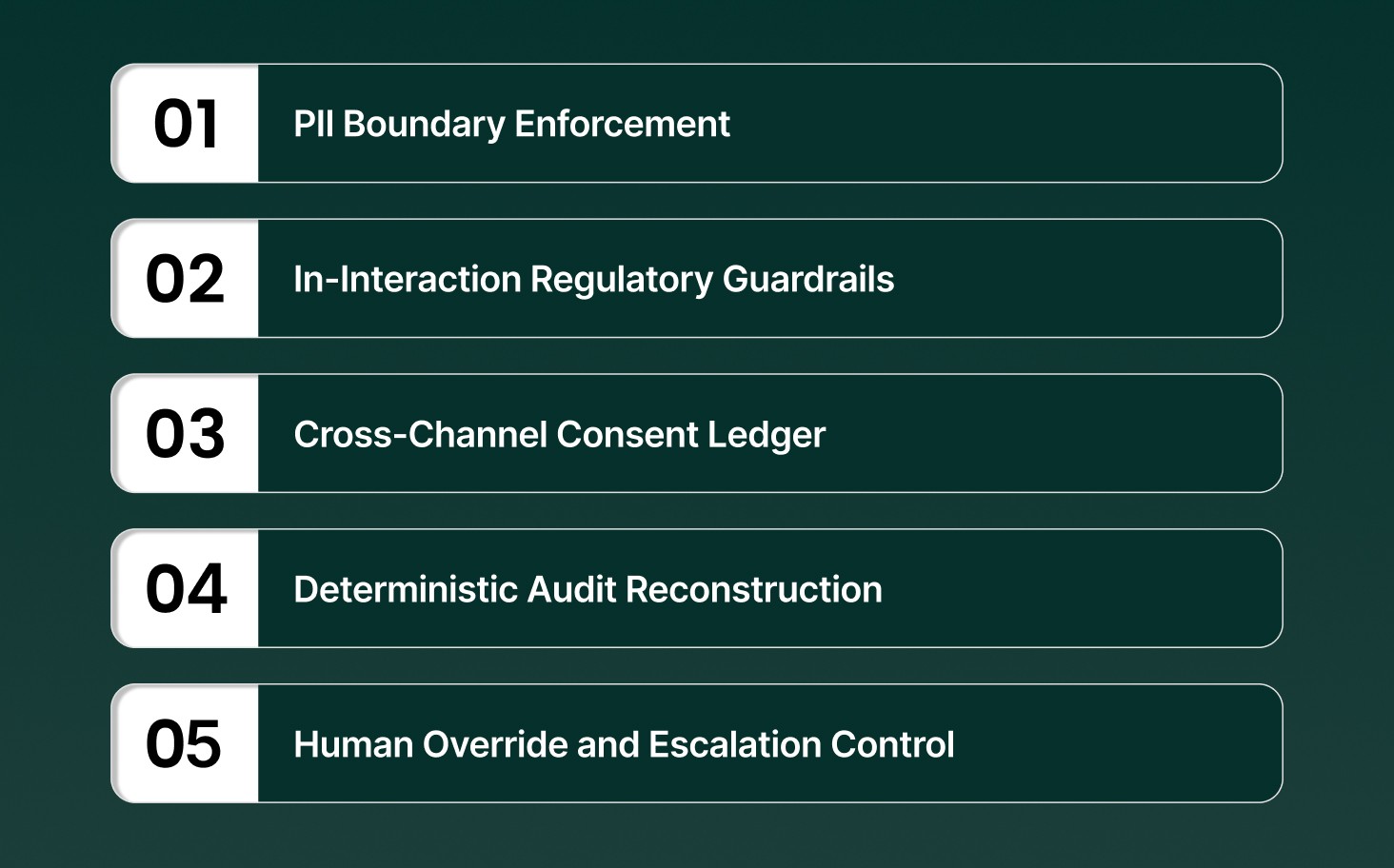

Security, Compliance, and Governance in AI-Driven Collections

AI-driven collections operate on regulated financial data and real-time consumer interactions, making security and governance part of system execution rather than post-process controls. Modern architectures embed enforcement, traceability, and oversight directly into live workflows.

PII Boundary Enforcement: Tokenization and field-level encryption isolate sensitive identifiers such as SSNs, account numbers, and phone records from model inference paths, preventing raw PII exposure to language models.

In-Interaction Regulatory Guardrails: FDCPA and TCPA constraints are encoded as machine-readable policies that intercept generated language and contact actions before delivery, not after QA review.

Cross-Channel Consent Ledger: Unified consent state tracks opt-ins, opt-outs, revocations, and channel permissions across voice, SMS, email, and chat with timestamped provenance.

Deterministic Audit Reconstruction: Every AI decision captures inputs, model version, prompt state, policy checks, and output text, allowing exact replay of any interaction during regulatory audits.

Human Override and Escalation Control: Risk thresholds, dispute detection, and hardship signals trigger mandatory human review paths, preventing fully autonomous handling of sensitive or ambiguous cases.

How Debt Collection Teams Change With Generative AI

Generative AI shifts collection teams from script execution and manual case handling toward supervision, exception management, and policy-controlled negotiation. Team structure, skill requirements, and performance metrics change as real-time AI systems assume first-line execution.

Agent Role Recomposition: Frontline agents transition from reading scripts to overseeing AI-led conversations, handling disputes, hardship cases, and edge scenarios that require human judgment.

Real-Time Supervision Functions: Team leads monitor live AI interactions through dashboards showing sentiment drift, compliance risk flags, and escalation triggers rather than reviewing calls post hoc.

Policy and Prompt Governance Roles: New operational roles emerge to manage prompt libraries, negotiation constraints, and regulatory language templates, replacing static script maintenance.

Training and Ramp Compression: Agent onboarding focuses on exception handling, compliance interpretation, and AI oversight, reducing time spent memorizing call flows and disclosures.

Performance Measurement Redesign: KPIs shift from call volume and handle time toward resolution quality, escalation accuracy, compliance adherence, and intervention effectiveness.

With generative AI, collection teams evolve into control, oversight, and exception-resolution units, optimizing outcomes through supervision and governance rather than manual execution.

See what it takes to deploy real-time, compliant voice AI in live collections workflows in How to Build AI Voice Agents for Debt Collection

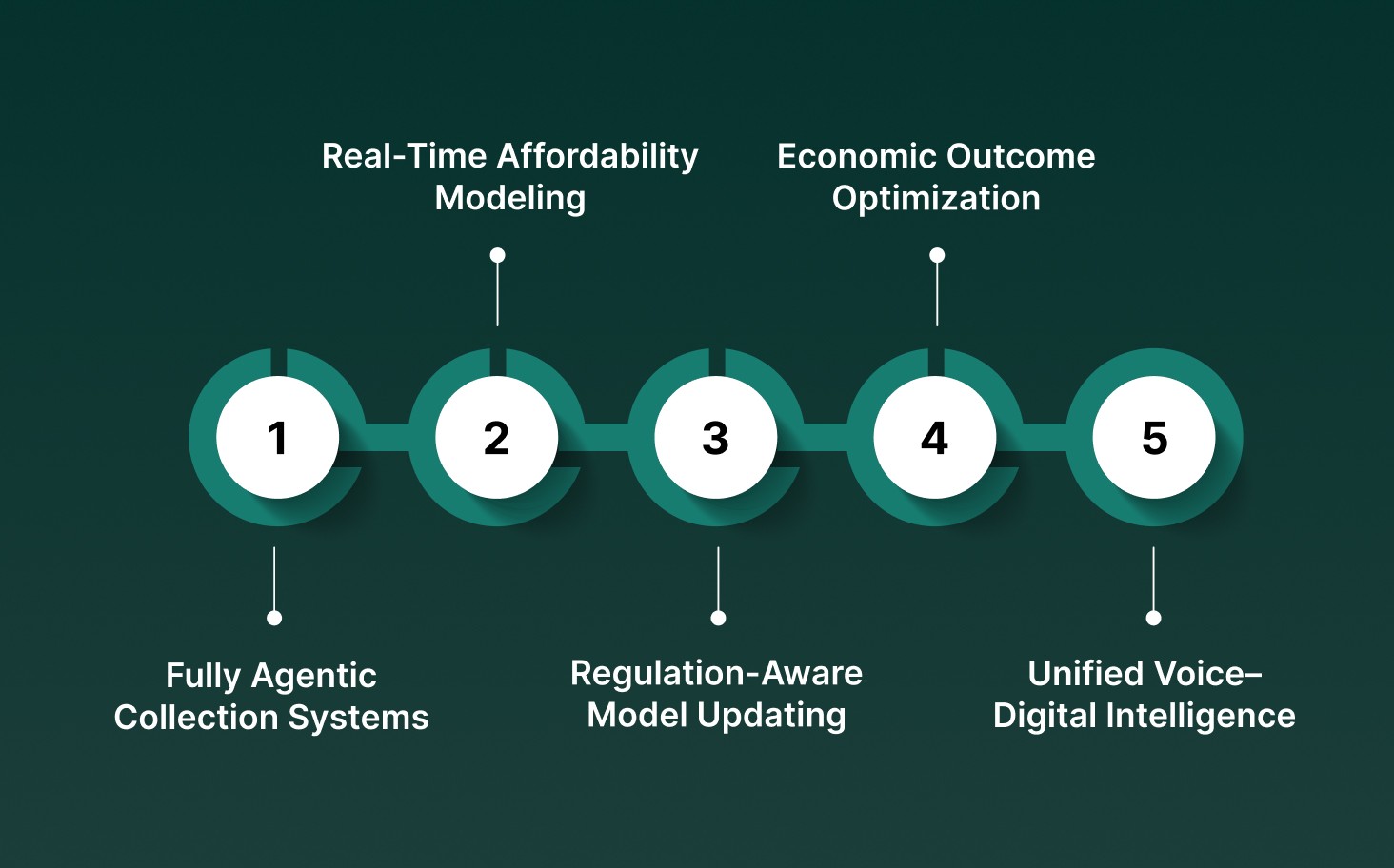

Future Trends of Generative AI in Debt Collection

Generative AI in debt collection is evolving from assistive tooling into execution infrastructure, with advances driven by latency reduction, tighter regulatory embedding, and deeper economic reasoning inside live interactions.

Fully Agentic Collection Systems: AI agents will execute end-to-end collection flows, including contact initiation, negotiation, agreement finalization, and follow-up enforcement, with human involvement limited to exception review.

Real-Time Affordability Modeling: Models will infer debtor capacity during conversations using live behavioral cues, transaction patterns, and verified income signals, updating repayment proposals dynamically mid-call.

Regulation-Aware Model Updating: Compliance policies will be updated as machine-readable rules that immediately propagate across all AI agents, eliminating retraining cycles when regulatory guidance changes.

Economic Outcome Optimization: Collection AI will optimize for probability-weighted lifetime recovery rather than single-event settlements, balancing immediate payment against default risk and customer retention.

Unified Voice–Digital Intelligence: Voice, SMS, chat, and document interactions will share a single reasoning layer, allowing strategy decisions to persist consistently across all borrower touchpoints.

The next phase of generative AI in debt collection centers on autonomous execution with embedded compliance and economic reasoning, redefining how collections operate at enterprise scale.

Why Smallest.ai Fits Real-Time Debt Collection Use Cases

Real-time debt collection demands sub-second response, tight control over language, and deterministic execution during live conversations. Smallest.ai is built as a real-time voice infrastructure rather than a post-call analytics or chatbot layer, making it suitable for high-stakes collection workflows.

Sub-Second Voice Latency: Speech-to-text, reasoning, and text-to-speech operate within tight latency budgets required for live negotiation, preventing conversational gaps that reduce debtor trust or trigger call abandonment.

Conversation-State Persistence: Call context, debtor intent, sentiment signals, and compliance state are maintained turn by turn, allowing decisions to carry forward without resetting logic or tone mid-call.

Policy-Constrained Generation: Language generation is bounded by configurable rules for disclosures, phrasing restrictions, and escalation conditions, blocking non-compliant output before it reaches the debtor.

High-Concurrency Execution: Architecture supports thousands of simultaneous calls without agent queuing, allowing outbound scale during delinquency spikes while maintaining consistent response quality.

Deployment Control Options: Supports controlled environments, including private and on-prem setups, allowing financial institutions to manage data locality, access boundaries, and audit requirements directly.

Smallest.ai functions as a real-time execution infrastructure for debt collection, combining low-latency voice handling with policy-controlled generation required for live, regulated financial interactions.

Conclusion

Generative AI is reshaping debt collection at the point where outcomes are decided. The advantage does not come from automating messages or accelerating reporting, but from placing intelligence directly inside live interactions where tone, timing, and judgment determine recovery. As models mature, the differentiator becomes execution quality under real constraints: low latency, consistent behavior across channels, and enforceable compliance during every conversation rather than after it.

This is where infrastructure matters as much as algorithms. Smallest.ai is built for real-time voice and conversational execution, supporting debt collection workflows that require millisecond response, controllable behavior, and predictable performance at scale.

If your organization is evaluating how generative AI should operate inside live collections, not around them, talk to a Smallest.ai voice expert to see what production-grade deployment looks like.

Answer to all your questions

Have more questions? Contact our sales team to get the answer you’re looking for