Learn how AI in health insurance strengthens call intake, claim review, prior auth, care outreach, and fraud detection, plus the tech and steps needed to scale.

Akshat Mandloi

Updated on

January 19, 2026 at 8:38 AM

Health plan leaders feel the strain when call queues stretch, clinical teams receive incomplete packets, and members want precise answers during the first interaction.

Many executives now pay closer attention to AI in health insurance because so many operational decisions begin in long conversations that teams cannot review at scale. Voice AI, conversational AI, voice agents, and voice cloning bring structure to those moments by capturing details that usually slip through busy workflows.

The momentum is clear. Forecasts show the AI in health insurance market reaching 17.6 billion dollars by 2033, driven by the need for faster intake, stronger documentation, and consistent communication across every member touchpoint.

In this guide, you will see where AI delivers real value, what slows projects down, which technologies matter most, and how health plans move from pilots to production.

Key Takeaways

Rising Workload Pressure: Claims, clinical steps, and member inquiries grow faster than staffing, creating heavier queues and slower reviews.

Cost Control Requires Earlier Signals: Spikes in billed charges and duplicate patterns push plans toward tools that detect irregularities during intake, not weeks later.

Members Want Immediate Answers: First-contact accuracy shapes satisfaction, which raises the need for cleaner intake signals and reliable call handling.

Audits Demand Stronger Evidence: Regulators expect consistent, documented reasoning for every approval or denial, which depends on cleaner data from calls and provider packets.Smallest.ai Supports Real-Time Operations: Healthcare-tuned ASR, low-latency TTS, voice cloning, and call summaries give teams clean data, steady outreach, and faster movement across claims and care programs.

Why Health Insurers Are Moving Quickly on AI

Health plans are increasing their pace with AI in healthcare because the gap between operational demand and available human capacity has widened sharply.

Claims volume, clinical complexity, compliance rules, and member expectations are rising at the same time. Each area strains existing systems, and leaders see AI as a practical way to manage this load without lowering service quality or exposing the organization to regulatory risk.

Below are the forces that actually push carriers forward:

Rising Case Complexity and Limited Staff Capacity: New procedures, updated codes, and layered benefits structures expand review workloads faster than staffing models can support.

Growing Pressure to Control Medical and Administrative Costs: Spikes in billed charges, duplicate submissions, and irregular provider patterns require faster detection and earlier intervention.

Higher Member Expectations During First Contact: Members want clear, immediate answers on benefits, bills, and claim status, creating pressure on call centers and intake teams.

Increasing Regulatory Scrutiny on Evidence and Consistency: Audits require precise justification for each decision, pushing plans to capture cleaner data from conversations, documents, and provider packets.

Growing Fraud Patterns and Variable Intake Signals: Fraud schemes adapt quickly, and valuable intent or eligibility clues inside calls are hard to review manually at scale.

Together, these forces push health plans toward systems that capture clearer signals at intake, reduce rework, and help teams handle rising volume with greater predictability.

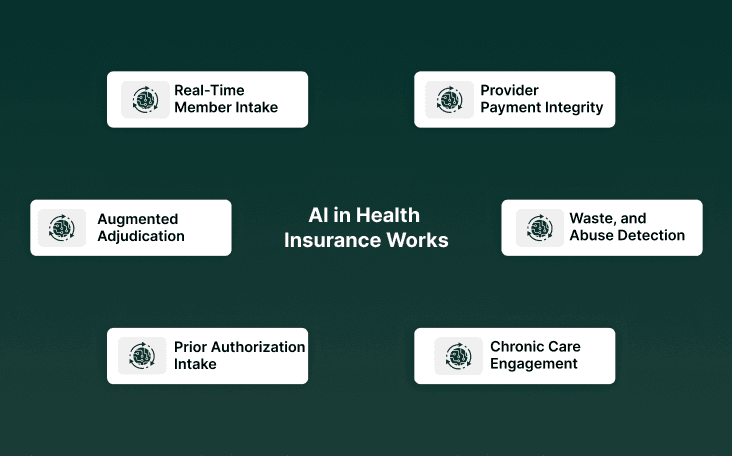

How AI in Health Insurance Works in Daily Operations

AI in health insurance delivers value when it fits into everyday workflows without slowing teams down. Most of the information that shapes claims, benefits, or clinical routing begins in conversations, and voice AI systems help capture that detail accurately during live calls.

By turning these interactions into structured signals, health plans move cases forward with fewer gaps and less rework. The use cases below reflect where this shows up in daily operations.

1. Real-Time Member Intake and Fnol (Voice Agents, Voice AI, Voice Cloning)

Voice-driven intake converts natural dialog into structured fields at the point of contact. That reduces follow-ups and preserves the exact transcript for audit. Real-world pilots report higher first-contact resolution and fewer documentation gaps.

Structured Field Capture: extracts coverage, dates, and claim-relevant facts while the call is live, reducing downstream rework.

Consistent Audit Record: full transcripts and time-stamped events provide traceable evidence for approvals and denials.

Call Routing Rules: voice agents trigger clinical review when specific phrases or risk signals appear.

2. Claims Triage And Augmented Adjudication (AI in Health Insurance Claims)

AI pre-screens incoming claims and highlights likely exceptions for human review. That shifts reviewer time from routine checks to judgment tasks and compresses adjudication cycles.

Document Extraction: OCR plus NLP pulls ICD/CPT entries and matches to benefit language automatically.

Rule Mismatch Detection: models flag inconsistent coding, duplicate charges, and outlier provider patterns.

Risk Scoring: claims receive risk scores that prioritize clinically ambiguous or high-cost items for nurse review.

3. Prior Authorization Intake And Case Completeness

Missing documentation is the single largest cause of prior authorization delays. Conversational AI reduces those delays by collecting the required clinical fields at intake and packaging the packet for reviewers. This shortens the time to decision while improving reviewer throughput.

Prompted Capture: During provider or member calls, agents ask for exact clinical details that reviewers require.

Automatic Packet Assembly: Required attachments and coded summaries are attached to the authorization request.

Pre-Check Rules: Basic medical necessity checks run before human review, reducing obvious denials.

4. Member Outreach And Chronic Care Engagement (Voice Cloning For Continuity)

Regular contact for chronic care needs scales poorly when human-only. A recognizable voice plus conversational flows increases member response and adherence to scheduled interventions, according to clinical voice assistant literature. Use cases include medication adherence checks and post-discharge follow-ups.

Consistent Voice Presence: A familiar voice increases answer rates in longitudinal outreach programs.

Symptom Triage Flows: Agents capture structured symptom data and escalate flagged responses.

Low-Cost Monitoring: Routine check-ins move off clinician schedules to automated voice workflows.

If you want voice agents that respond under 100ms and capture clinical terms accurately from real telephony audio, book a demo.

5. Fraud, Waste, And Abuse Detection (Claims And Call-Level Signals)

Fraud schemes grow quickly. Combining structured claim analytics with conversational signals produces earlier detection than claims-only models. Regulators are flagging the need for explainable systems where decisions affect coverage.

Cross-Channel Correlation: Link repeated caller behavior, provider submissions, and claims timing to find suspect clusters.

Behavioral Anomaly Detection: Unusual call patterns or mismatched claimant details trigger investigator review.

Investigator Prioritization: Models rank cases for human investigators based on potential loss and evidence strength.

6. Provider Payment Integrity And Outlier Detection

Provider billing patterns can indicate systematic issues or exploits. AI finds statistical outliers and supports targeted audits that recover overpayments faster than sampling alone. Aggregated analytics inform payer negotiations and corrective action.

Longitudinal Provider Profiling: Compare procedure mix and frequency against peer cohorts.

Charge Pattern Alerts: Flag new or rising CPT code usage for manual review.

Recovery Prioritization: Focus audit resources where estimated recoverable amounts are highest.

If your team wants accurate intake, steady call handling, and clean summaries from every interaction, see how this works in action with HIPAA-Compliant AI Voice Agents for Healthcare.

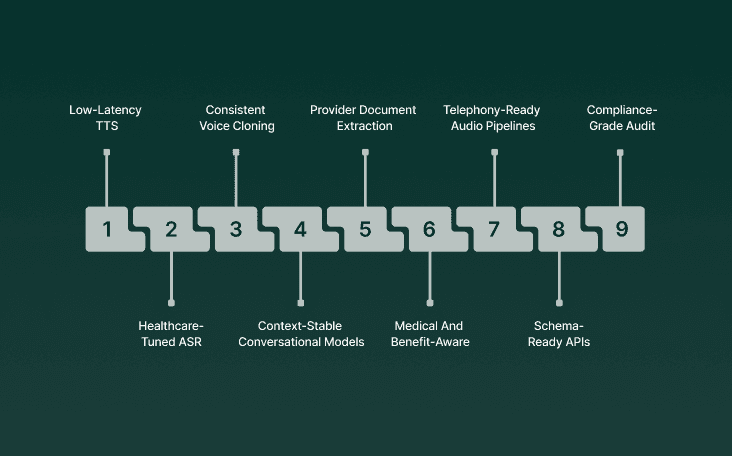

The Tech That Matters When Bringing AI into Health Plans

AI inside a health plan delivers value only when the underlying systems can handle messy audio, inconsistent provider packets, complex benefit rules, and shifting topics during member calls.

The technologies below form the core stack that makes AI in health insurance dependable across AI in healthcare insurance, AI technologies in health insurance, and high-volume workflows across the AI in health insurance industry.

Low-Latency TTS: Live conversations require near-instant speech output so voice agents can speak in a natural rhythm. Health plans rely on this for coverage explanations, prompts, and clarifications.

Healthcare-Tuned ASR: Speech recognition must capture medical terms, drug names, procedure codes, and plan-specific language even when audio quality shifts. This accuracy shapes every downstream step, including claim intake and clinical routing.

Consistent Voice Cloning: Chronic care programs, pharmacy follow-ups, and discharge outreach all benefit from a recognizable voice. Members respond more reliably when the same voice reaches out over time.

Context-Stable Conversational Models: Calls rarely stay on one topic. Members switch between benefits, billing, pharmacy, and claims, and models must keep the thread intact. Losing context creates rework for service teams and claim reviewers.

Provider Document Extraction: Provider submissions often arrive as faxes or low-resolution PDFs. Strong extraction models pull ICD/CPT codes, clinical rationale, and referral details even when formatting is inconsistent. This reduces delays in claims and prior authorization.

Medical And Benefit-Aware Classification: Routing requests correctly is a major driver of cycle time. Models need to distinguish routine cases from those requiring nurse or medical director review while reflecting current policy.

Telephony-Ready Audio Pipelines: Carrier call systems often introduce noise, varied sample rates, and compression. AI pipelines must tolerate this and still capture speaker turns, intent, and key details.

Schema-Ready APIs: AI outputs only help when they move directly into existing claims and care platforms. APIs must pass clean fields, summaries, and routing decisions without manual re-entry.

Compliance-Grade Audit Logging: NAIC, CMS, and state regulators expect full traceability for automated steps tied to coverage or payment. Models must produce time-stamped logs that compliance teams can review without friction.

Together, these capabilities give health plans the technical foundation needed to capture clearer signals at intake, move cases forward with fewer delays, and keep daily operations steady at scale.

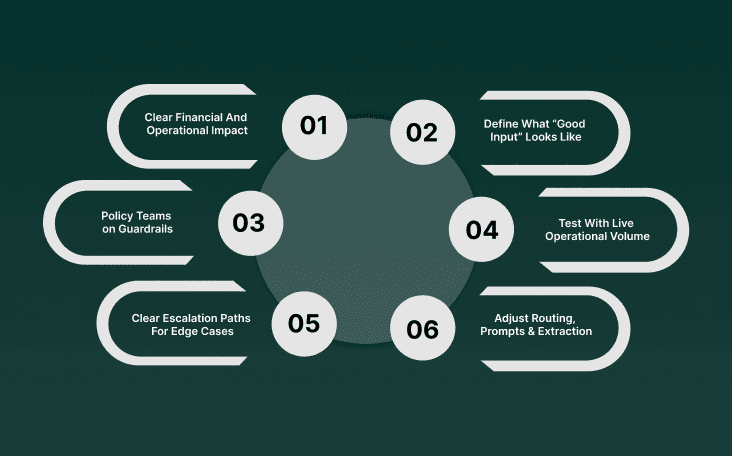

A Simple Six-Step Path to Rolling Out AI

Rolling out AI in health insurance requires more than a technical build. Health plans operate through dense policy rules, varied provider inputs, older core systems, and call centers that run at massive scale.

Programs across AI in healthcare insurance, AI technologies in health insurance, and workloads linked to AI in health insurance claims succeed when the rollout follows a structure that matches how payer operations actually work.

Select A Workflow With Clear Financial And Operational Impact: Pick a process where delays or inconsistencies carry a real cost, such as claim intake accuracy or prior authorization completeness. The first deployment must show measurable improvement, not theoretical value.

Confirm Data Sources and Define What “Good Input” Looks Like: List the exact data streams the workflow depends on: call transcripts, claim lines, provider notes, or member details. Establish the quality thresholds required for the model to perform reliably.

Align Clinical, Compliance, and Policy Teams on Guardrails: Set the precise boundaries for automated steps. Identify which actions require clinical oversight, which need policy logic, and which must generate audit records for regulators.

Build and Test With Live Operational Volume: Run the model on real claims, real provider packets, and real member calls. Controlled samples hide the friction that appears in day-to-day volume.

Define Clear Escalation Paths For Edge Cases: Specify what triggers a handoff to a nurse, claims specialist, or service agent. The system must show staff why a case moved to them, not leave them guessing.

Review Weekly Patterns And Adjust Routing, Prompts, And Extraction: Track the exact points where errors or delays appear. Use these patterns to refine extraction logic, conversational flows, and classification each week until results stabilize.

If you want a clearer view of how voice AI shapes intake, claims, and care programs, start with Why Insurance Companies Need Voice Agents in 2025: The Complete Analysis.

How Smallest.ai Supports Health Insurance Workflows

Smallest.ai’s stack is built around those realities. Across AI in healthcare insurance, AI technologies in health insurance, and the operational demands of the AI in the health insurance industry, Smallest.ai supports the work that determines cost, cycle time, and member satisfaction.

Real-Time Voice Agents for High-Volume Benefit and Claim Calls: Atoms handles large call loads with sub-100ms responses, allowing voice agents to answer benefit questions, claim status checks, and eligibility queries with steady pacing.

Healthcare-Tuned Speech Recognition That Works on Telephony Audio: The ASR engine captures procedure codes, referral details, drug names, and plan-specific language from noisy environments, giving clinical and claims teams accurate, usable inputs.

Waves TTS and Voice Cloning for Clear, Consistent Member Communication: Waves provides natural coverage explanations, while voice cloning supports chronic care programs, medication checks, and follow-ups with a recognizable voice that increases response rates.

AI Summaries and Provider Packet Extraction for Review-Ready Data: Conversational models turn long calls into structured fields, and document extraction pulls ICD/CPT codes, rationale, and attachments from scans or faxes so reviewers start with complete packets.

Secure, Direct Integration Into Existing Claim and Care Platforms: Structured outputs move through APIs into legacy systems, and HIPAA-ready on-prem deployment keeps all PHI on customer-controlled hardware.

With Smallest.ai, health plans gain the call accuracy, data quality, and real-time control needed to keep operations steady at scale.

Conclusion

The shift toward AI in health insurance comes from rising pressure on teams that manage calls, claims, and clinical reviews. Members expect clear answers during the first interaction, yet staff often work with incomplete details from conversations or provider packets.

Leaders who adopt stronger systems gain cleaner inputs at intake, steadier movement through internal steps, and fewer delays tied to missing information. As health plans rely on real-time signals from calls and documents, AI in health insurance becomes a reliable way to keep work moving at a predictable pace while supporting clinical and claims staff with clearer context.

Smallest.ai supports this shift through voice AI and conversational AI that capture key details during live calls, voice agents that keep large call volumes moving, and voice cloning that creates steady communication for ongoing care. The platform converts calls and provider packets into structured fields, builds complete review packets, and produces summaries that give teams a clear place to begin their work.

If you want to see how these capabilities can support your workflows, book a demo

FAQs About AI in Health Insurance

1. How does AI in Health Insurance handle call variability from different member populations?

AI in health insurance must interpret accents, medical terms, and inconsistent descriptions from callers. Systems built for AI in the health insurance industry use healthcare-tuned speech models so coverage questions, symptoms, and claim details remain accurate across diverse member groups.

2. Can AI Technologies in Health Insurance detect missing clinical details before a claim reaches review?

Yes. Many AI technologies in health insurance flag omissions in referral notes, diagnosis fields, or procedure descriptions. This reduces delays inside AI in health insurance claims by identifying gaps before nurses or adjusters begin their work.

3. How does AI in Healthcare Insurance support long calls with mixed topics like benefits, billing, and pharmacy?

Modern AI in healthcare insurance uses conversational models that track intent across topic shifts. This helps voice agents provide accurate responses even when a member moves quickly between unrelated questions.

4. What role does AI play in the early identification of high-risk claim patterns?

AI in health insurance claims can surface unusual billing sequences, mismatched codes, or repeated member inquiries. These signals help plans investigate potential issues earlier without waiting for manual audits.

5. How does the AI in the Health Insurance Industry use voice AI for care continuity?

Plans adopt voice AI to support long-term outreach with consistent communication. Voice agents and voice cloning maintain continuity across chronic care check-ins and medication reminders, which is difficult to achieve with rotating staff.