Learn how AI loan processing transforms origination, underwriting, and servicing with real use cases, execution impact, and compliance controls. Read more.

Ranjith M S

Updated on

January 28, 2026 at 2:47 PM

Loan teams rarely start searching for AI loan processing out of curiosity. It usually happens after approval cycles stretch from hours to days, exception queues keep growing, or compliance reviews begin surfacing inconsistencies that manual workflows cannot explain fast enough. When volumes rise, and regulators expect precision, small delays compound into real business risk.

That pressure is only increasing. The AI-driven lending market is projected to reach USD 6.44 billion by 2033, underscoring how quickly banks, NBFCs, and fintech lenders are rethinking the process from application to disbursement. As more institutions adopt AI loan processing, the focus has shifted from experimentation to execution at scale, under strict regulatory control.

In this guide, we break down how AI is reshaping loan processing workflows, where it delivers measurable impact, and what teams need to evaluate before deploying it across origination, underwriting, and servicing.

Key Takeaways

AI Loan Processing Replaces Fragmented Workflows: Modern AI systems unify origination, underwriting, servicing, and collections into a continuous, policy-driven execution rather than isolated automation.

Manual Processing Breaks Under Regulatory Scale: Human-driven loan workflows introduce latency, inconsistency, audit gaps, and compliance risk that compound as application volumes grow.

Decisioning Is Driven by Specialized ML Models: Credit risk, affordability, fraud detection, pricing, and escalation are governed by distinct models operating within deterministic policy controls.

Compliance Is Executed Inline, Not After the Fact: AI embeds regulatory checks, consent capture, explainable decisions, and audit-grade logs directly into loan approval workflows.

Operational Success Depends on Execution Infrastructure: Real-time processing, system integration, governance, and concurrency determine whether AI reduces risk or amplifies it.

How AI Operates Across the Loan Lifecycle in Modern Lending

AI loan processing systems function as embedded execution layers across origination, underwriting, approval, servicing, and collections. Instead of point automation, modern deployments orchestrate data ingestion, risk evaluation, compliance checks, and borrower communication as a single continuous workflow.

Application Intake Automation: AI ingests applications from portals, APIs, and assisted channels, normalizes inputs, validates mandatory fields, and flags missing or inconsistent data before downstream processing begins.

Document Intelligence and Data Extraction: Machine learning models classify financial documents, extract structured fields from unstructured files, and reconcile values across bank statements, income proofs, tax filings, and collateral records.

Credit and Risk Scoring Execution: AI evaluates borrower risk using transactional data, employment signals, repayment behavior, and alternative data sources, producing explainable risk scores tied to underwriting policies.

Automated Underwriting Decisions: Rule engines and ML models jointly assess eligibility, debt-to-income ratios, exposure limits, and policy thresholds, auto-approving low-risk cases while routing exceptions for human review.

Fraud Detection and Identity Verification: Behavioral models detect anomalies in application patterns, identity mismatches, document tampering, and synthetic identity signals during both pre-approval and post-disbursement stages.

Real-Time Compliance Enforcement: AI validates every decision against regulatory constraints, audit rules, consent requirements, and jurisdiction-specific lending guidelines before approvals are finalized.

Disbursement and Servicing Orchestration: Once approved, AI triggers disbursement workflows, updates core banking systems, schedules repayment plans, and monitors servicing events such as restructures or early repayments.

Delinquency Prediction and Collections Optimization: Predictive models identify early default risk, segment borrowers by recovery probability, and activate targeted outreach, reminders, or restructuring options automatically.

AI loan processing replaces fragmented workflows with continuous, policy-driven execution across the full lending lifecycle. The result is faster decisions, lower operational risk, and controlled scalability without manual bottlenecks.

If you are evaluating how to handle real-time voice interactions, secure live transactions, and scale mobile banking conversations without latency, talk to a voice expert and see how Smallest.ai supports enterprise-grade voice AI execution in production.

Why Manual Loan Processing Fails at Scale in Regulated Lending

Manual loan processing relies on human-driven validation, document review, and judgment-heavy workflows that break under volume, regulatory pressure, and real-time decision requirements. At scale, these processes introduce structural risk that cannot be mitigated through staffing alone.

Latency Accumulation Across Approval Stages: Each handoff between intake, underwriting, risk, and compliance adds queue time, making end-to-end approval cycles highly sensitive to volume spikes and staffing constraints.

Inconsistent Policy Interpretation: Human reviewers apply underwriting and compliance rules with natural variance, leading to approval drift, uneven risk exposure, and inconsistent treatment across similar borrower profiles.

High Error Rates in Data Transcription: Manual extraction and re-entry of financial data increase the likelihood of misreported income, incorrect liabilities, and mismatched identifiers, directly impacting credit decisions.

Audit and Traceability Gaps: Manual workflows lack machine-readable decision logs, making it difficult to reconstruct why a loan was approved, declined, or escalated during regulatory audits or internal reviews.

Poor Adaptability to Regulatory Change: Updating manual procedures for new disclosures, thresholds, or reporting standards requires retraining staff and revising SOPs, delaying compliance enforcement across active pipelines.

Manual loan processing creates compounding operational, compliance, and risk exposure as volumes grow. Regulated lending environments require deterministic, auditable systems that human-driven workflows cannot sustain at scale.

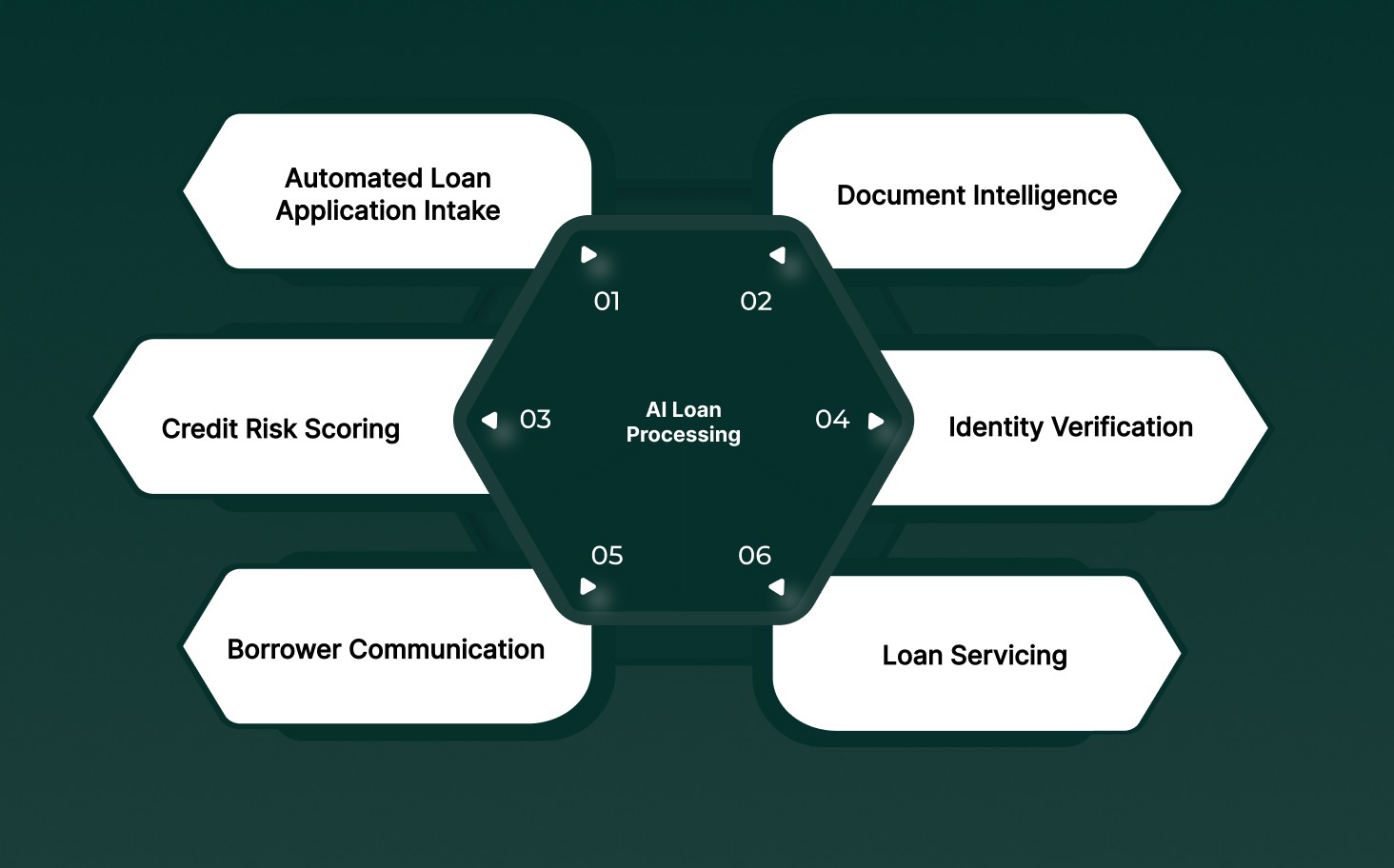

Core AI Loan Processing Use Cases Across Origination, Underwriting, and Servicing

AI loan processing platforms operate as execution layers across loan origination systems, underwriting engines, servicing platforms, and borrower communication channels. Instead of isolated automation, AI coordinates data ingestion, decision-making, policy enforcement, and borrower interaction into a single deterministic workflow.

1. Automated Loan Application Intake and Data Normalization

AI removes bottlenecks in intake by standardizing borrower inputs before they enter underwriting queues.

Multi-Channel Intake Processing: Applications from web, API, and assisted calls enter underwriting in a consistent schema, eliminating manual rework.

Field-Level Validation: Invalid or incomplete submissions are blocked upfront, reducing downstream exception rates.

Early Drop-Off Recovery: Incomplete applications are automatically re-engaged, increasing the application-to-decision conversion rate.

Operational Impact: Faster application readiness, fewer stalled cases, and higher origination throughput without staffing increases.

2. Document Intelligence and Financial Data Reconciliation

AI eliminates manual document review by enforcing data consistency before risk evaluation begins.

Structured Data Extraction: Financial fields are extracted once and reused across underwriting and compliance checks.

Cross-Document Consistency Checks: Conflicting income or liability values are identified early instead of during audit review.

Exception Isolation: Underwriters review only the disputed fields, not the entire file.

Operational Impact: Shorter underwriting cycles, lower review fatigue, and reduced post-approval corrections.

3. Credit Risk Scoring and Policy-Based Decisioning

AI executes credit decisions by jointly evaluating borrower risk signals and policy thresholds, producing real-time approvals, conditions, or declines without manual interpretation.

Rule and Model Hybrid Decisions: Risk exposure is controlled through explicit thresholds rather than subjective judgment.

Explainable Decision Outputs: Declines and conditions are traceable, reducing internal escalation and borrower disputes.

Real-Time Decision Execution: Low-risk cases bypass queues entirely.

Operational Impact: Higher approval consistency, reduced decision variance, and controlled portfolio risk.

4. Identity Verification, Fraud Detection, and Compliance Logging

AI embeds identity verification, fraud detection, and regulatory evidence capture directly into loan decision execution rather than relying on post-approval checks.

Behavioral and Document Fraud Signals: Risky applications are intercepted early, reducing downstream loss.

Consent and Disclosure Capture: Regulatory acknowledgments are captured once and reused across audits.

Audit-Grade Decision Trails: Every approval is defensible without manual reconstruction.

Operational Impact: Lower fraud leakage, faster audits, and reduced regulatory exposure.

5. Borrower Communication and Exception Resolution

AI resolves underwriting exceptions and borrower queries without stalling the processing pipeline.

Automated Clarification Requests: Missing or ambiguous inputs are resolved through structured borrower interactions.

Decision Status Communication: Outcomes and conditions are communicated immediately upon decision.

Human Escalation Control: Only unresolved exceptions are routed to loan officers.

6. Loan Servicing, Repayment Monitoring, and Early Collections

AI governs post-disbursement loan execution by tracking repayment signals, initiating early outreach, and resolving servicing actions before delinquency thresholds are breached.

Automated Clarification Requests: Missing data is resolved without underwriter intervention.

Decision Status Communication: Borrowers receive immediate clarity, reducing inbound support volume.

Human Escalation Control: Only unresolved or high-risk cases are routed to loan officers.

Operational Impact: Reduced underwriter interruptions, faster exception closure, and improved borrower satisfaction.

AI loan processing replaces fragmented, sequential workflows with continuous, policy-driven execution across lending systems. This structure allows faster approvals, controlled risk exposure, and regulator-ready auditability at scale.

Review how AI is being applied across risk, operations, and customer workflows in financial services by reading Top 6 Applications of AI in Financial Services Today

Machine Learning Models Powering Credit, Risk, and Approval Decisions

Loan processing platforms rely on multiple specialized machine learning models, each responsible for a discrete decision surface such as eligibility, fraud exposure, pricing, or approval routing. These models operate within policy constraints and produce explainable outputs required for regulated lending.

Model Type | Decision Scope | Core Inputs | Output Produced | Operational Role |

Credit Risk Scoring Models | Borrower creditworthiness | Transaction history, repayment behavior, income stability, and credit bureau data | Probability of default score | Determines approval eligibility and exposure limits. |

Income and Cash Flow Models | Repayment capacity validation | Bank statements, salary deposits, and expense patterns | Verified net disposable income | Validates affordability thresholds before underwriting. |

Fraud Detection Models | Application legitimacy | Identity attributes, document metadata, behavioral patterns | Fraud likelihood score | Triggers step-up verification or rejection paths. |

Policy Compliance Models | Regulatory and internal rule adherence | Jurisdiction rules, product policies, borrower attributes | Pass or fail flags with reasons | Prevents non-compliant approvals in real time. |

Pricing and Offer Optimization Models | Loan terms and pricing | Risk score, tenure, market rates, borrower profile | Interest rate and tenure recommendations | Aligns risk-adjusted pricing with policy constraints. |

Exception Routing Models | Human escalation decisions | Confidence scores, policy conflicts, anomaly signals | Escalation priority level | Routes only high-uncertainty cases to underwriters. |

Each model governs a specific decision boundary within loan processing. Together, they allow deterministic approvals, controlled risk exposure, and audit-ready decision transparency without manual intervention.

Evaluate which voice AI platforms meet BFSI security, compliance, and scale requirements in 2025 by reviewing Top AI voice agents for BFSI (Banking, Financial Services, and Insurance) in 2025?

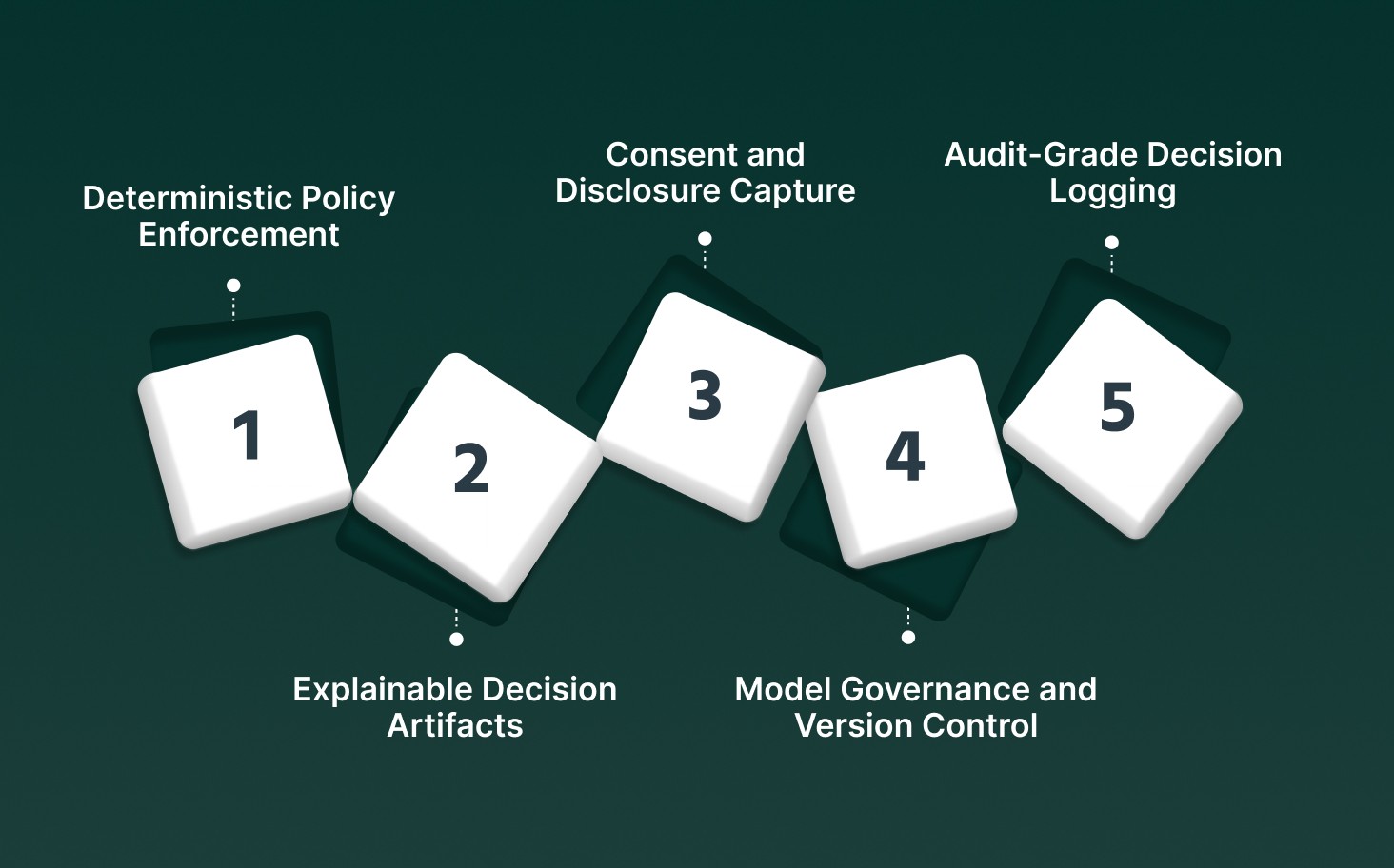

Regulatory and Compliance Controls in AI-Driven Loan Processing

AI-driven loan processing embeds regulatory enforcement directly into decision execution rather than relying on post-approval audits. Compliance controls operate at each decision point to satisfy jurisdictional lending laws, data protection requirements, and model governance standards.

Deterministic Policy Enforcement: Underwriting and approval decisions are executed only when all regulatory thresholds, product constraints, and jurisdiction-specific rules evaluate to true.

Explainable Decision Artifacts: Every approval, decline, or conditional outcome is accompanied by structured reasoning that links input data, model outputs, and policy logic.

Consent and Disclosure Capture: Borrower acknowledgments, disclosures, and opt-ins are recorded with timestamps, interaction context, and immutable evidence tied to the loan record.

Model Governance and Version Control: Active models are tracked with version history, training metadata, approval dates, and rollback capability to satisfy model risk management audits.

Audit-Grade Decision Logging: All data inputs, rule evaluations, model scores, and system actions are logged in sequence to allow regulatory replay and examiner review.

Embedding compliance into AI execution guarantees lending decisions remain transparent, auditable, and regulator-ready while operating at high volume and speed.

Operational and Technical Challenges in Deploying AI for Loan Processing

Deploying AI within loan processing environments introduces execution, integration, and governance challenges that extend beyond model accuracy. These challenges surface at system boundaries where legacy infrastructure, regulatory constraints, and real-time decision requirements intersect.

Legacy System Interoperability: Loan origination, servicing, and core banking platforms often lack real-time APIs, requiring event bridging, batch reconciliation, and data normalization layers.

Data Quality and Signal Reliability: Incomplete documents, inconsistent borrower data, and delayed third-party feeds degrade model confidence and increase exception rates.

Decision Latency Constraints: Synchronous underwriting and borrower-facing interactions demand sub-second response times that many AI stacks struggle to sustain under peak load.

Model Governance and Control: Frequent model updates introduce version drift, requiring strict approval workflows, monitoring, and rollback mechanisms.

Operational Scalability: Handling thousands of concurrent applications stresses inference throughput, orchestration logic, and failure recovery paths.

AI loan processing succeeds only when technical execution, governance, and system integration are engineered together. Without this alignment, scale amplifies risk rather than reducing it.

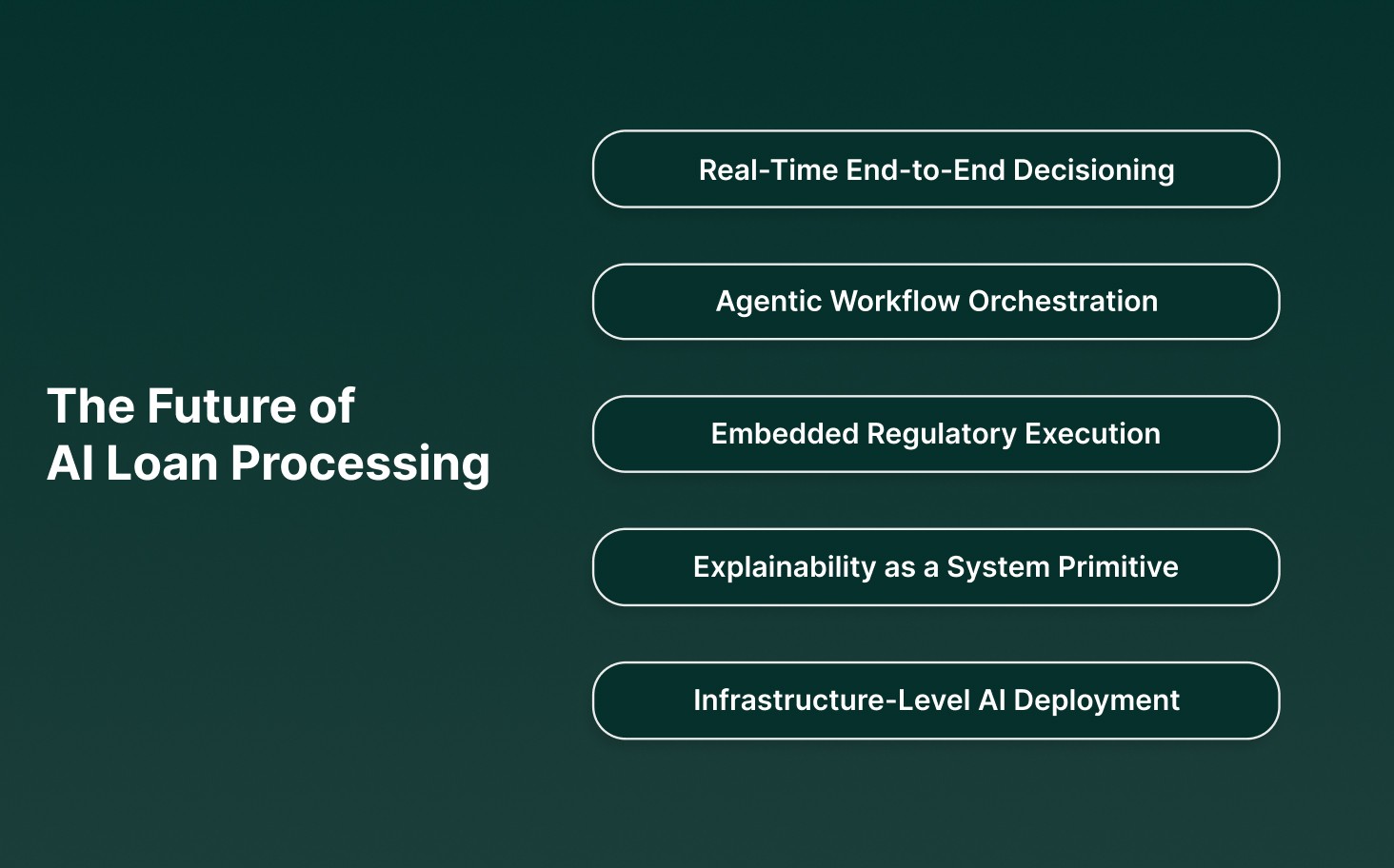

Where AI Loan Processing Is Headed Over the Next Five Years

AI loan processing is shifting from assistive automation toward autonomous, policy-governed execution layers that operate continuously across lending systems. The next phase prioritizes real-time decisioning, tighter regulatory control, and deeper operational integration.

Real-Time End-to-End Decisioning: Loan approvals will move from batch-based workflows to continuous, event-driven execution triggered instantly by data changes.

Agentic Workflow Orchestration: AI agents will coordinate intake, verification, underwriting, and servicing actions without linear handoffs or manual scheduling.

Embedded Regulatory Execution: Compliance logic will run inline with every decision, eliminating post-process audits and reducing regulatory exposure.

Explainability as a System Primitive: Model reasoning, policy paths, and data lineage will be generated by default for examiner review and internal governance.

Infrastructure-Level AI Deployment: AI models will run closer to core banking and data systems to reduce latency, improve reliability, and support higher throughput.

The future of AI loan processing lies in autonomous execution with deterministic control. Institutions that treat AI as infrastructure, not tooling, will scale faster with lower operational and regulatory risk.

How Smallest.ai Powers Real-Time AI Loan Processing at Enterprise Scale

Smallest.ai provides real-time voice AI infrastructure designed for high-volume, regulated financial workflows. Its voice agents and speech models operate as execution layers inside loan processing systems, handling borrower conversations, verifications, and servicing actions with low latency and deterministic control.

Real-Time Voice Execution: Voice agents process live borrower calls with sub-100ms speech generation, allowing synchronous application intake, verification, and servicing without queue-based delays.

Enterprise-Grade Agent Orchestration: Agents are configured with policy-driven workflows, knowledge sources, and escalation logic to handle complex loan SOPs and edge cases reliably.

High-Concurrency Call Handling: The platform supports thousands of parallel calls, allowing lenders to scale origination, servicing, and collections without increasing human agent capacity.

On-Premise and Secure Deployment: Models can run on enterprise-controlled infrastructure, keeping sensitive borrower data within regulated environments while maintaining low latency.

Multilingual Borrower Coverage: Lifelike voices across 16+ languages support geographically diverse borrower bases while maintaining consistent communication quality.

Smallest.ai allows lenders to operationalize AI loan processing through real-time, voice-driven execution. Its infrastructure supports the scale, compliance, and responsiveness required in modern regulated lending environments.

Final Thoughts!

AI loan processing is increasingly defined by how well systems execute under pressure rather than how many features they advertise. As volumes rise, regulations tighten, and borrower expectations shift toward immediacy, lenders are being forced to examine where decisions stall, where risk becomes opaque, and where human effort is still compensating for structural gaps. The competitive edge now comes from removing those bottlenecks without sacrificing control or auditability.

This is where real-time execution infrastructure becomes decisive. When borrower interactions, verifications, follow-ups, and servicing actions run synchronously with lending systems, teams gain predictability instead of firefighting. Decisions move forward, exceptions resolve faster, and operations scale without multiplying headcount or compliance exposure.

Smallest.ai fits into this shift as a real-time voice AI infrastructure for loan operations, allowing high-volume, compliant borrower interactions across origination, servicing, and collections without slowing core decision systems.

Talk to a voice expert to see how Smallest.ai can support AI loan processing workflows at scale.

Answer to all your questions

Have more questions? Contact our sales team to get the answer you’re looking for