Discover how AI copilots for banking improve execution across voice, compliance, and operations, where banks see impact, and how to deploy them safely at scale.

Nityanand Mathur

Updated on

January 28, 2026 at 3:02 PM

Inside most banks, the biggest delays do not come from a lack of technology. They come from handoffs. A service request moves from call center to ops, ops to risk, risk to compliance, each step correct in isolation but slow together. This operating model evolved over decades, long before real-time digital banking became the norm.

Early automation helped individual teams work faster, but coordination still depended on humans. That breakdown in orchestration is what pushed banks toward AI copilots for banking, systems designed to assist across workflows rather than inside a single function.

This shift is now structural, not experimental. The global Finance Automation Copilot market size is expected to reach USD 15.2 billion by 2033, reflecting how quickly banks are funding execution-layer AI. Today, AI copilots for banking represent the next stage in this evolution, moving from task automation to cross-team assistance under regulatory oversight. They are being evaluated not as tools, but as operating capacity.

In this guide, we walk through how this model emerged, where it delivers measurable impact, and what banks must get right to deploy it in production.

Key Takeaways

AI copilots address coordination failures, not tool gaps: Banks deploy copilots to reduce delays caused by handoffs across service, ops, risk, and compliance workflows.

Voice is essential for real-time banking execution: High-risk interactions such as disputes, authentication, and payments still happen over calls, where text-based copilots underperform.

Production copilots require full-stack architecture: Effective deployments span data unification, speech processing, workflow orchestration, security, and monitoring under human oversight.

Governance is a deployment prerequisite: Explainability, privacy controls, bias monitoring, and layered authentication determine whether copilots scale beyond pilots.

Infrastructure quality defines long-term advantage: Banks that invest in low-latency, execution-grade systems move faster and scale safely compared to feature-driven implementations.

Why Banks Are Investing in AI Copilots Now

Banks are accelerating investment in AI copilots because structural pressures across regulation, customer behavior, and operating models converged into a clear execution gap. 2026 marks the point where incremental automation stops working, and real-time AI assistance becomes necessary.

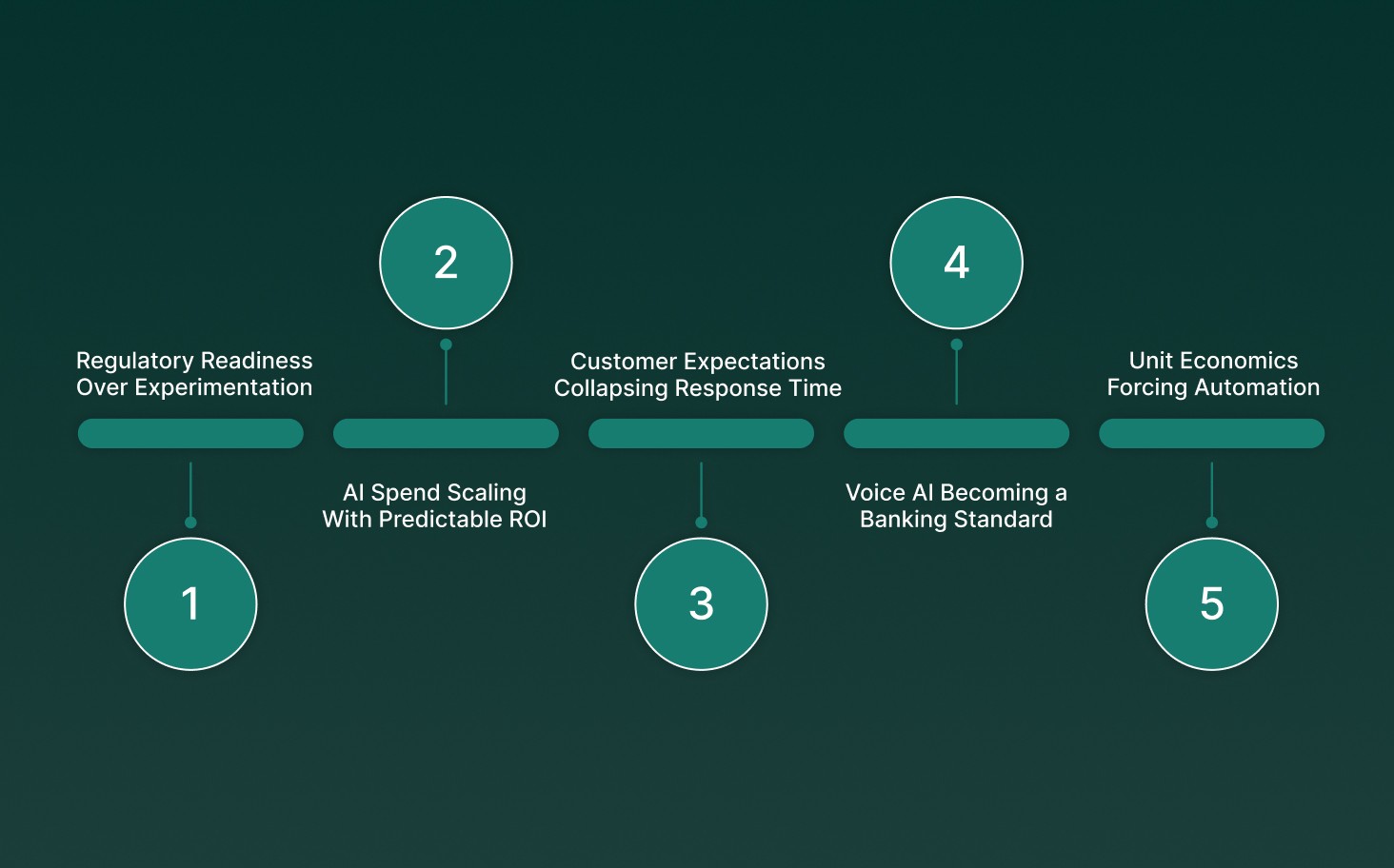

Regulatory Readiness Over Experimentation: Financial regulators are formalizing AI governance rather than resisting adoption. Early adopters gain practical experience aligning copilots with auditability, model oversight, and supervisory expectations before controls harden.

AI Spend Scaling With Predictable ROI: Banking sector spending on AI reached $31.3 billion in 2024, rising from $20.65 billion the year before, with projections to exceed $85 billion by 2028. This growth is driven by verified gains in productivity across servicing, compliance review, and internal engineering workflows.

Customer Expectations Collapsing Response Time: Digital banking compressed tolerance windows from minutes to seconds. Always-on availability, contextual responses, and personalized handling are now baseline expectations that human-only operating models cannot sustain.

Voice AI Becoming a Banking Standard: BFSI leads enterprise voice AI adoption because high-risk interactions still happen over calls. Failed payments, disputes, and account access demand real-time voice handling where text-based copilots fall short.

Unit Economics Forcing Automation: AI-handled voice interactions operate at a fraction of human call costs. At scale, this resets staffing models and reallocates skilled teams toward complex resolution and relationship-driven work.

AI copilots have shifted from experimental tooling to required banking infrastructure. Institutions investing now build execution capacity aligned with regulatory pressure, customer expectations, and long-term cost discipline.

Core Use Cases of AI Copilots for Banking

AI copilots in banking deliver the most value when applied to high-volume, execution-heavy workflows where accuracy, speed, and regulatory compliance intersect. The following use cases reflect where banks are already seeing measurable, production-level impact.

KYC and Customer Onboarding: Copilots conduct voice-guided identity verification, validate documents against compliance databases, and flag inconsistencies for human review. This reduces onboarding from days to minutes while maintaining full regulatory adherence. Axis Bank’s AI assistant (AXAA) manages roughly 100,000 customer queries per day.

Fraud Prevention and Real-Time Alerts: AI copilots continuously analyze transaction patterns, flag anomalies in real time, and trigger verification flows using voice biometrics. These systems create secure voiceprints that support both passive authentication during live conversations and active verification through spoken passphrases, improving fraud detection without disrupting legitimate customer activity.

Customer Support and Query Automation: Routine inquiries such as balance checks, loan payment status, and credential resets make up the majority of contact-center interactions. AI copilots resolve these in seconds, freeing human agents for complex escalations. Bank of America’s Erica supports 42 million users and has processed over 2 billion interactions.

Personalized Advisory, Payments, and Fund Transfers: AI copilots deliver spoken portfolio summaries, read analyst insights, identify market-triggered rebalancing opportunities, and escalate complex cases to human advisors. They also support authenticated voice-initiated payments by combining voice biometrics with MFA, allowing secure transfers in seconds.

See how real-time automation and AI reshape regulated banking operations in Digital Transformation in Banking: Benefits, Tools & Use Cases

How AI Copilots Actually Work Inside a Bank

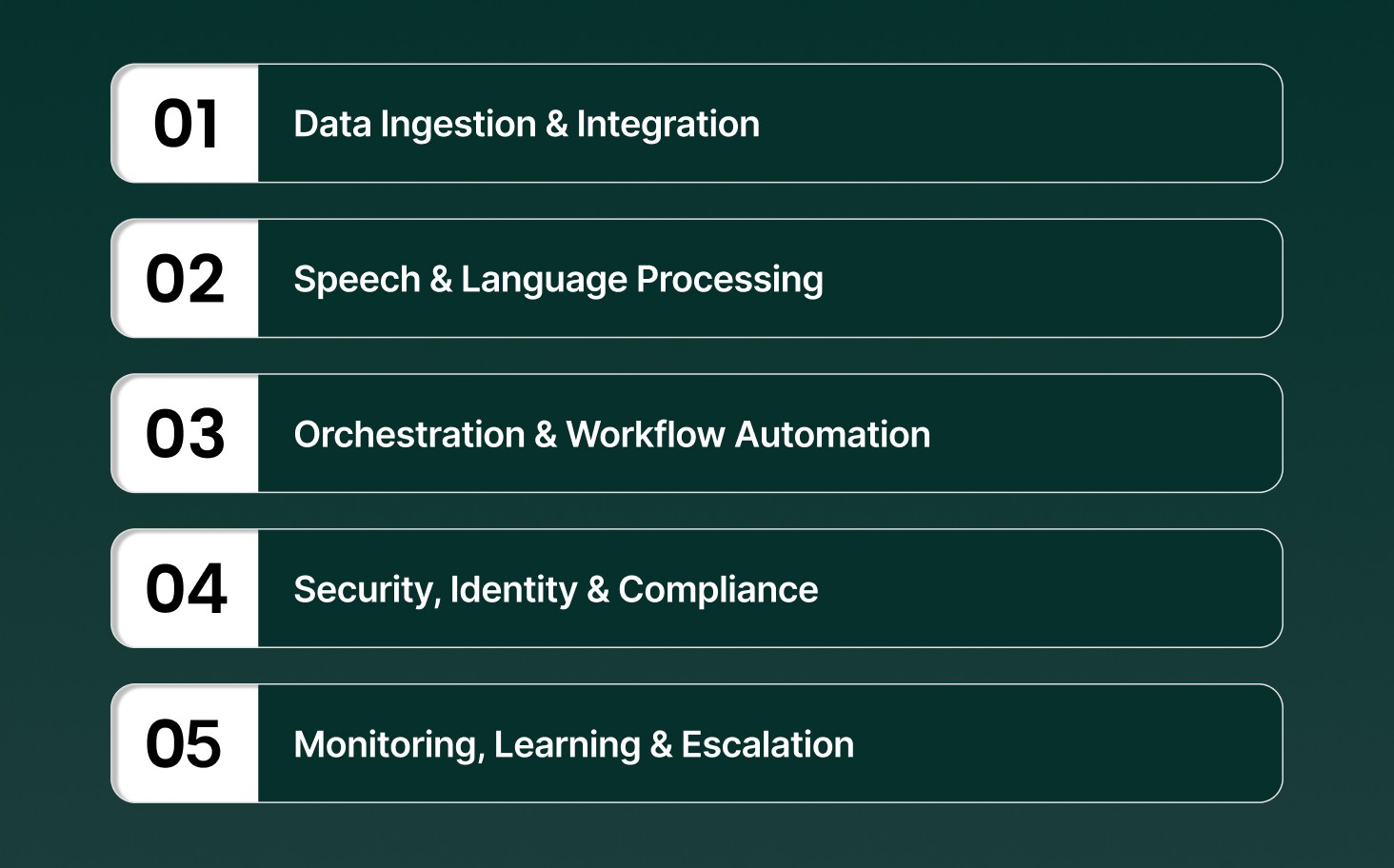

Understanding the architecture behind AI copilots illuminates both their power and their constraints. A production-grade banking AI copilot operates across five interconnected layers.

Layer 1: Data Ingestion & Integration

The foundation is data. AI copilots pull from multiple sources:

Core banking systems (accounts, balances, transactions)

CRM platforms (customer interaction history)

Compliance databases (KYC records, AML flags)

Risk engines (credit scoring, fraud models)

Real-time data streams (market feeds, transaction logs)

The ingestion layer uses tools like Apache Kafka or AWS Kinesis to handle streaming data, guaranteeing the copilot always has current information. For text-based copilots, this is typically batch or near-real-time. For voice copilots, sub-100 millisecond latency is required; any lag breaks the naturalness of conversation.

Key consideration: Data must be unified. Banks running on fragmented legacy systems struggle because the copilot cannot access the complete customer context it needs to make intelligent decisions.

Layer 2: Speech & Language Processing

For voice copilots, this layer is critical. It includes:

Automatic Speech Recognition (ASR): Converts spoken words to text in real time with custom vocabularies for financial terminology (SWIFT, NEFT, ACH).

Natural Language Understanding (NLU): Interprets the customer's intent from their spoken (or written) query. A customer asking "Send five thousand rupees to my savings" and "Transfer 5k to savings" should trigger the same intent.

Large Language Models (LLMs): Generate contextually appropriate, natural responses. Modern LLMs can understand complex, multi-turn conversations, handle follow-ups, and adapt their tone to customer sentiment.

Text-to-Speech (TTS): Converts the copilot's response back to speech with a natural, expressive tone. Voice quality directly impacts customer trust.

Key consideration: Enterprise voice copilots require custom vocabularies, domain-specific training, and continuous refinement. A copilot trained on consumer assistant data will perform poorly in banking contexts.

Layer 3: Orchestration & Workflow Automation

The orchestration layer is where the copilot decides what to do. It routes queries to the right backend system, chains multiple actions together, and escalates to human agents when necessary.

This orchestration requires careful design. The copilot must be able to:

Handle exceptions (insufficient funds, account lockouts, KYC lapses)

Chain workflows together without losing context

Make risk-aware decisions (deny risky transactions, escalate edge cases)

Maintain compliance audit trails for every decision

Layer 4: Security, Identity & Compliance

Banking-grade security operates at multiple levels:

Authentication: Voice biometrics + multi-factor authentication (OTP, device fingerprinting, challenge-response). Voice alone is insufficient; fraudsters can spoof voices using AI. Modern solutions use liveness detection to identify synthetic or recorded voices.

Encryption: All audio and text data is encrypted in transit and at rest. Data residency requirements mean some banks mandate on-premises or VPC deployments.

Explainability: Every copilot decision must be traceable and auditable. Regulators need to understand why a loan was approved or a transaction flagged.

Bias Detection: Training data quality directly impacts fairness. A lending copilot trained on biased historical data will perpetuate unfair lending decisions. Continuous monitoring is essential.

Key consideration: Banks cannot treat voice copilots like consumer chatbots. Data residency laws, PCI-DSS compliance, GDPR requirements, and local regulations require deployments to be configurable for on-premises, hybrid, or private-cloud infrastructure.

Layer 5: Monitoring, Learning & Escalation

Production copilots continuously learn. Every interaction generates data that can improve future responses. But this learning must be governed:

Human-in-the-Loop: Compliance teams review flagged interactions, correct Copilot errors, and continuously refine decision logic.

Model Monitoring: Detect model drift (performance degradation over time as customer behavior or fraud tactics evolve).

Escalation Paths: Define when the copilot should hand off to humans. A customer disputing a fraud flag or a complex loan restructuring request should be routed to an agent with full context immediately.

Sentiment Analysis: Detect frustration, urgency, or distress in customer tone. If a customer sounds increasingly upset, escalate proactively.

Deploy real-time voice AI that executes compliant conversations with sub-second latency, consistent behavior, and production-grade scale using Smallest.ai.

Common Challenges Banks Face When Deploying AI Copilots

Deploying AI copilots in banking introduces measurable risk across regulation, security, and operations. These challenges are not theoretical. They surface during audits, customer disputes, and production rollouts, making disciplined controls mandatory.

Risk Area | Regulatory Exposure | Control Framework |

Model Explainability | Inability to justify AI decisions in lending, fraud, or onboarding creates supervisory, legal, and consumer protection risks. | Use interpretable models where feasible. Apply decision-level explainability for complex models. Maintain immutable audit logs for all AI-driven outcomes. |

Data Privacy and System Integrity | Exposure of customer data and inconsistent controls across legacy platforms increase operational and compliance risk. | Enforce unified data governance. Restrict access via secure APIs. Apply encryption in transit and at rest. Enforce data residency where mandated. |

Bias and Fair Treatment | Biased AI decisions may violate fair-lending and anti-discrimination regulations. | Audit training data. Apply fairness constraints. Monitor outcomes by cohort. Require human review for flagged or borderline cases. |

Authentication and Fraud Risk | Over-reliance on a single biometric signal exposes banks to identity fraud and account takeover. | Enforce layered authentication. Combine voice with behavioral, device, and secondary verification. Monitor for synthetic or anomalous patterns continuously. |

Discover how automation strengthens execution, governance, and scale across banking operations in 10 Ways RPA in Banking Improves Efficiency and Control

Why Voice Is the Missing Layer in Most Banking Copilots

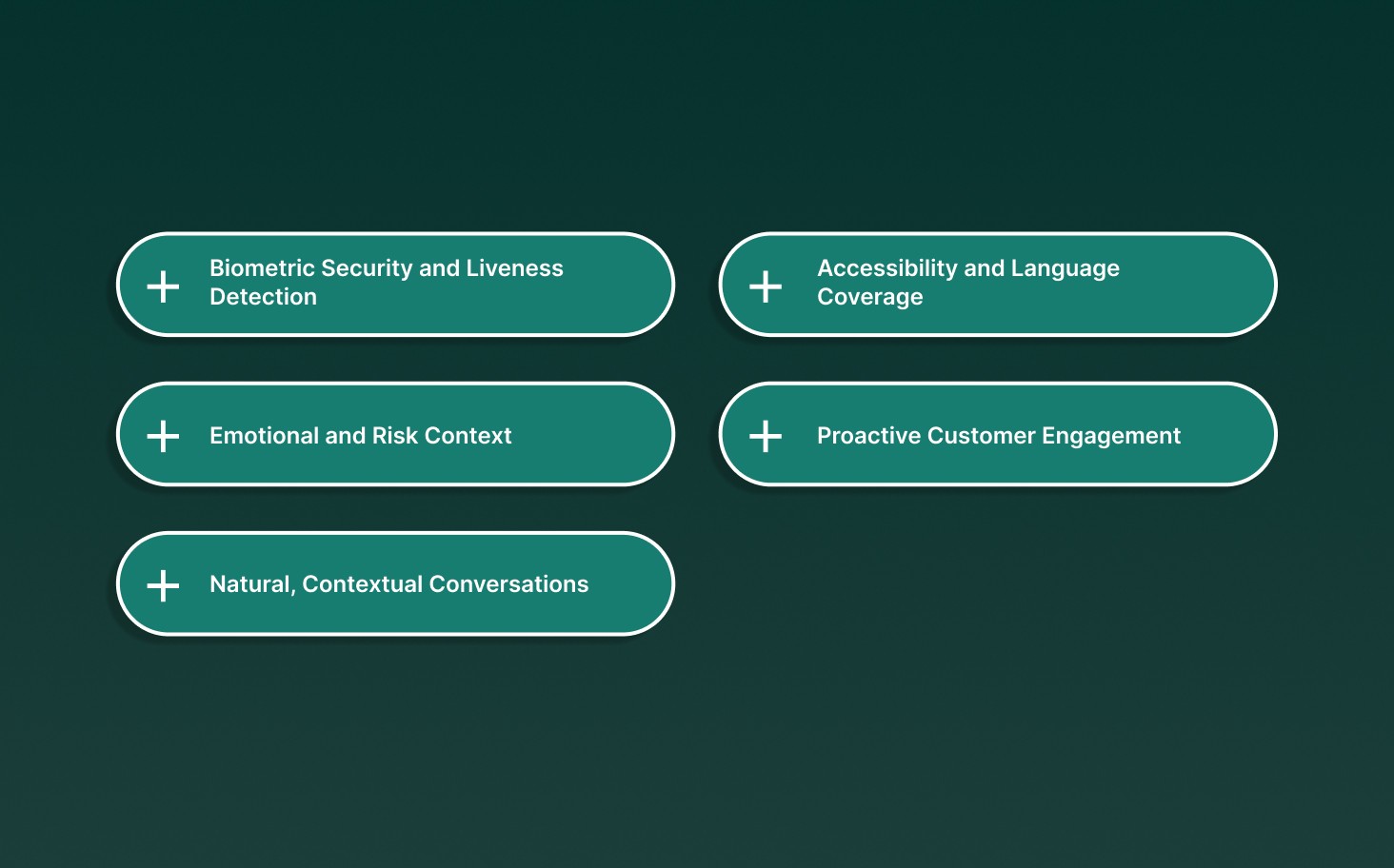

Most banking AI copilots are built on text-based systems. Voice introduces capabilities that fundamentally change security, interaction quality, accessibility, and compliance.

Biometric Security and Liveness Detection: Text-based authentication relies on credentials that can be compromised. Voice copilots authenticate users through biometric voiceprints and apply liveness detection to confirm a real, present speaker, reducing spoofing and account takeover risk.

Emotional and Risk Context: Voice captures tone, pace, and stress in real time, allowing copilots to detect urgency or distress. This allows improved fraud verification and priority routing for frustrated or high-risk customers.

Natural, Contextual Conversations: Voice supports multi-turn dialogue without resets or rigid prompts. Complex workflows, such as loan discussions or advisory interactions, complete faster and feel consultative rather than transactional.

Accessibility and Language Coverage: Voice lowers barriers for customers who prefer speaking over apps and supports local-language banking. Multilingual voice copilots extend access to underserved and non-urban populations.

Proactive Customer Engagement: Voice copilots initiate outbound interactions to alert customers about risks, deadlines, or opportunities, shifting service from reactive response to anticipatory support.

Built-In Compliance Traceability: Voice conversations are recorded and transcribed end to end, creating auditable records of customer intent, system actions, and outcomes for AML, KYC, and dispute review.

How Smallest.ai Powers AI Copilots for Banking

Smallest.ai provides the execution layer required for banking AI copilots to operate in real time, over voice, and under enterprise-grade constraints. Its architecture is built for live calls, strict latency budgets, complex SOPs, and regulated environments where outcomes matter more than recommendations.

Real-Time Voice Execution: Smallest.ai transcribes, analyzes, and responds to live calls in real time. Voice agents operate within milliseconds, allowing copilots to resolve issues, authenticate users, and take actions while the customer is still on the line.

Agentic Workflows for Banking SOPs: The platform supports agentic workflows designed to handle hundreds of edge cases. Banking copilots follow defined SOPs across servicing, collections, onboarding, and escalation, with predictable behavior under high-volume and high-risk scenarios.

Low-Latency Speech Models Built In-House: Lightning Voice AI and Electron SLMs are trained on millions of conversations to accurately handle acronyms, numbers, and financial terminology. This allows precise handling of account numbers, card details, and transaction references without pacing or comprehension errors.

Enterprise Deployment and On-Prem Control: Smallest.ai supports cloud and on-premise deployment, allowing banks to own inference, run on custom hardware, and meet data residency requirements. Models execute under strict security controls aligned with SOC 2 Type II, HIPAA, PCI, and ISO standards.

Smallest.ai enables AI copilots for banking to move from advisory systems to real-time execution engines, delivering voice-led resolution at enterprise scale while meeting regulatory and operational constraints.

The Future of AI Copilots for Banking

AI copilots in banking are moving from assistive tools to agentic systems that execute, coordinate, and learn across the full service lifecycle. By 2026, leading banks will operate fleets of specialized AI agents that collaborate in real time across onboarding, servicing, risk, and operations under human oversight.

Speech-Native Intelligence: Next-generation copilots process speech directly rather than converting voice to text and back. This removes latency, preserves acoustic signals, and improves intent, emotion, and risk detection during live banking interactions.

Continuous Authentication Layers: Authentication evolves from a single checkpoint to a persistent process. Voice analysis combined with behavioral signals verifies identity throughout the interaction and adapts dynamically as risk levels change.

Predictive and Proactive Banking: Agentic copilots anticipate needs rather than waiting for requests. They identify balance erosion, debt concentration, or portfolio drift and initiate timely, contextual recommendations or actions before issues escalate.

Emotion-Driven Fraud and Service Controls: Advanced voice analysis detects stress, coercion, or deception signals during conversations. These signals inform fraud prevention workflows and service escalation paths in real time.

Banks that combine quick execution with disciplined governance will establish durable advantages, while delayed adoption creates structural catch-up risk.

Final Thoughts!

AI copilots are reshaping how banks execute work, not by replacing teams, but by tightening the connection between intent and action. The institutions that see sustained value treat copilots as operating infrastructure rather than surface-level automation. They focus on orchestration, real-time context, and governance from day one, knowing that speed without control creates risk, and control without speed stalls progress.

The competitive gap emerges quietly, through faster resolution, cleaner oversight, and systems that scale without adding friction.

This is where Smallest.ai fits. Its real-time voice AI is built for execution inside live banking workflows, where latency, accuracy, and compliance matter simultaneously. If you are evaluating AI copilots for production use rather than pilots, Smallest.ai provides the infrastructure layer that makes that transition practical.

Talk to a voice expert and see how Smallest.ai powers real-time AI copilots for banking.

Answer to all your questions

Have more questions? Contact our sales team to get the answer you’re looking for